The world is grappling with the effects of the Covid-19 pandemic, but the climate emergency and the crisis of biodiversity is as urgent as ever. Only if we can protect nature and the environment better will we become crisis-proof as society. This has to be the central guideline of the Green Deal.

The “European Green Deal” is a new vision for a sustainable and fair economic system in Europe. Its strength is its cross-sectoral and integrative approach: it includes initiatives in climate protection, biodiversity, nature conservation, agriculture, recycling economy, mobility, and a sustainable financial market.

The declared goal

The declared goal is a climate-friendly, sustainable, and socially just transformation of our economy and society. Even though the devastating Covid-19 pandemic has moved another challenge into focus, the green vision for Europe is as urgent as it ever was: our environmental footprint is by far bigger than is good for our planet.

Despite a short-term decline in emissions, climatically harmful emissions remain in the atmosphere for an extremely long period of time and continue to speed up global warming. The loss of biodiversity is dramatic as well: according to a report from the UN World Biodiversity Council up to one million animal and plant species are threatened with extinction around the world.

At the same time, renowned environmental scientists have warned that “the probability of pandemics rises as a function of the increasing destruction of eco-systems.”

The gigantic dimension of these problems illustrates the fact that we need a fresh economic and societal start on all levels. Instead of trying desperately to return to pre-corona times, our goal should be to transcend the crisis towards a different, better economy, as for example Frans Timmermans, EU Climate Commissioner, demands.

And it is true – we need to switch to a greener version of our current economy. The Paris Climate Agreement, the UN biodiversity goals, and an intelligently implemented “European Green Deal” constitute the right framework for this challenge.

An eco-social reboot

In order to achieve a fair and sustainable economy, all economic stimulus programmes have to be aligned with the goals of a robust Green Deal. Europe has to realign itself without compromise towards its climate and ecological goals.

That is the only way we can prepare ourselves for new, future crises and create a resilient economic system. At this point it is crucial for the public investments that have become necessary in the wake of the pandemic to be allocated to the right causes and to facilitate an eco-social reboot.

For example, the EU Commission has to ensure that its planned recovery package does not support projects or economic sectors that are detrimental to the Green Deal. Environmentally and climatically harmful subsidies such as those for the use of fossil fuels finally have to become a thing of the past. Instead, more funds have to go towards environmentally sustainable activities. This goes hand in hand with the strengthening of environmental standards and the consistent application of the EU Taxonomy for sustainable finance.

More resilience is the order of the day, so we can fight threats more efficiently in the future. If a real Green Deal becomes the core part of rebuilding the economy, we create not only a more sustainable economy, but we also become more crisis-proof as society.

Nature and climate are our essential livelihoods that we have to protect better for our own sake rather than exploit them without thinking twice. In conclusion, the leitmotif of the post-corona times has to be “do the right thing”.

Info box “Green Deal in times of the corona crisis”:

In order to ensure a long-term economic reboot that is in line with our climate and environmental goals, the recovery fund of the EU Commission has to contain the main pillars of the Green Deal. What we still need are compulsory guidelines on how to use the billions of euros the budget provides that take into account climate and nature.

From the perspective of environmental protection, three important criteria have to be recalibrated:

- The EU budget has to fully contain the so-called “do no harm” principle of the Green Deal. This rules out state subsidies and support for environmentally harmful activities such as the fossil fuel industry, nuclear energy, new airports or motorways, landfills, and the incineration of waste.

- At least half of the EU budget has to go towards sustainable activities. The transformation of the economy towards climate neutrality and the recovery of nature have to be supported across all levels.

- The use of the EU Taxonomy has to be made explicitly obligatory because it is already precise, scientifically founded, and based on the goals of the Green Deal.

The “Green Deal” for investors

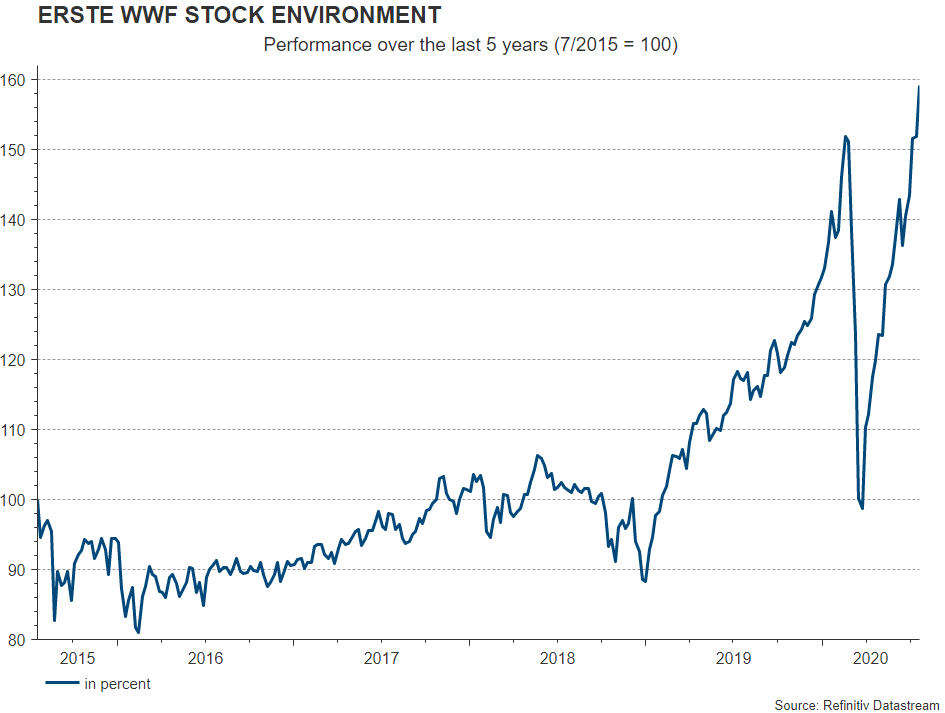

A successful example of the symbiosis of economy and ecology is the equity fund ERSTE WWF STOCK ENVIRONMENT. This fund invests worldwide primarily in companies active in the fields of water treatment and supply, recycling and waste management, renewable energy, energy efficiency and mobility. Erste Asset Management and WWF have been cooperating since October 2006: WWF supports the fund management through an environmental advisory board initiated by WWF. A measurable positive impact on the environment and society is a key factor in investment decisions. At the same time, Erste Asset Management donates part of its management fee to the WWF’s water, climate and nature conservation programme. Over 2 million euros have already benefited nature through this program.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.