Fears of rising interest rates are back. Was the recent 9% correction in global equities just a market blip, amplified by technical factors related to the trading of volatility products? Or something more serious – a regime shift signalling the end of the equity bull market as many have argued?

Regardless of what exactly has caused the mayhem, there seems to be a consensus that surging bond yields have played a role in it. US 10Y treasury yields added 30 basis points in January alone, climbing to the highest level for more than four years.

Interest rates and stock market performance

Higher interest rates will definitely have an impact on risky assets, particularly on equities. Stocks are priced on what investors are prepared to pay today for uncertain cash flows in the future. Higher interest rates will lift the discount factors used in this process and – everything else equal – reduce current stock prices. However, “everything else equal” is a feature of economic models, not of the real world. Whether the impact will be negative, as often feared, depends on specific circumstances, particularly on investors’ expectations about economic growth, inflation and economic policy. If rising rates are the consequence of an economic boom, then the anticipation of higher future cash flows may be sufficient or even more than sufficient to compensate for the impact of higher real rates.

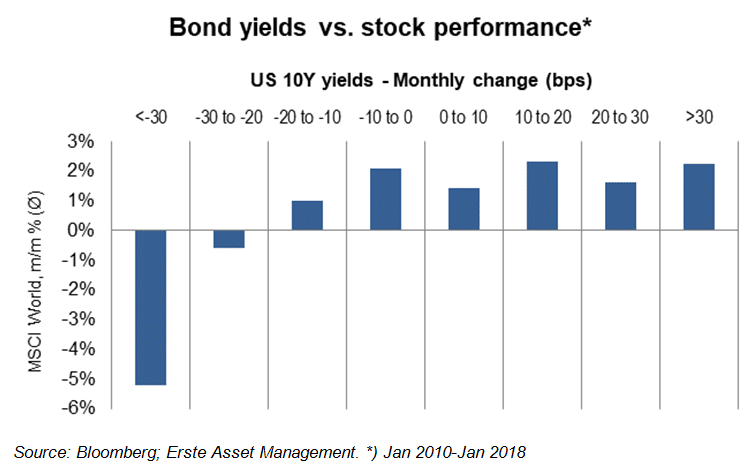

Empirical evidence does not support the notion that rising interest rates tend to be accompanied by depressed stock prices. In fact, monthly data since 2010 more or less point in the opposite direction, as shown in the following chart of average monthly changes of the MSCI World versus changes in US bond yields. In more than 90% of the months, when 10Y yields fell by more than 30 basis points, the global equity index moved down, while in four out of five months with interest rates climbing by more than 30 basis points, stock prices went up as well.[i]

This is a blog and not a comprehensive empirical study, but is worth noting that one gets similar patterns when a) the time horizon is extended back to the 1980s, b) nominal rates are replaced by real rates, and c) the MSCI World index is replaced by single country indices like the S&P 500 or the Euro Stoxx 600.

The key message here is not that investors should be complacent. Rising bond yields could quickly turn into a problem for equity markets if the economic backdrop were different. However, as long as the economic data flow remains robust, earnings growth is decidedly positive with revisions pointing up, and monetary authorities do not move ahead of investors’ expectations in their tightening moves, equity markets will likely remain firm.

Rising interest will affect sector und style performance

Even if equity markets should turn out to be resilient in the face of rising interest rates, equity investors will need to adjust to the new environment. Rising bond yields may not end the bull market, but they will impact the relative performance of sectors and investment styles. It is well beyond the scope of this comment to analyse the full impact of interest rates on the various sub-asset classes in the equity space[ii], but three of the more relevant relative performance effects of rising rates are worth noting: the impact on financials, on emerging markets, and on growth versus value stocks.

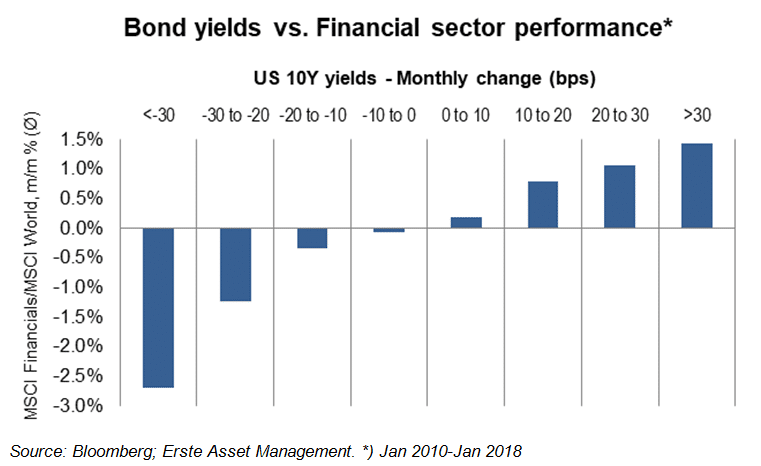

Financials benefit from rising interest rates

Financials will most certainly be among the winners, particularly banks and life insurers. The main channel, how banks will benefit is through a widening of their net interest margin[iii], while life insurers will probably enjoy stronger demand for longer-term savings products and will find it easier to cope with products featuring profit guarantees.

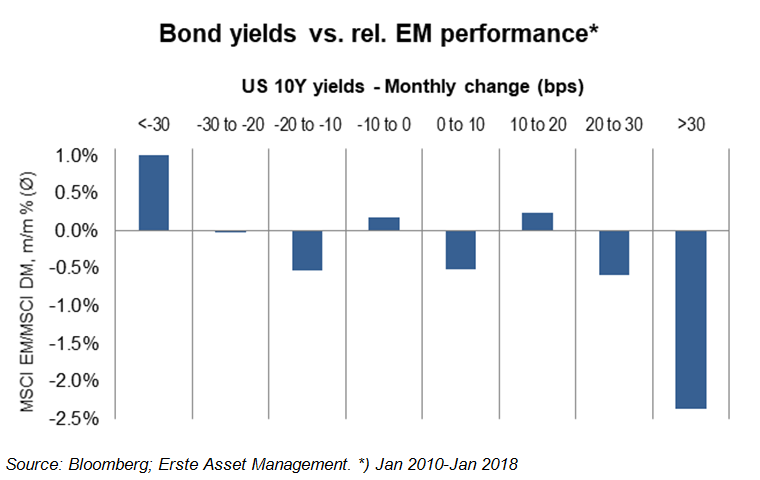

Threats to emerging markets

In contrast, for emerging market equities rising interest US rates will be challenging. This is shown by data since 2010, but also longer-term the same pattern prevails. During times of rapidly falling rates, emerging market equities gain relative to developed markets, while they tend to underperform when rates go rapidly up. There are probably two channels at work here: First, relative to their developed market peers, emerging markets stocks are priced like growth stocks with a longer duration of underlying cash flows; second, there is probably a macro-channel related to the significant USD-debt of many emerging markets. However, even in the case of emerging markets, modest changes in bond yield seem to have little impact.

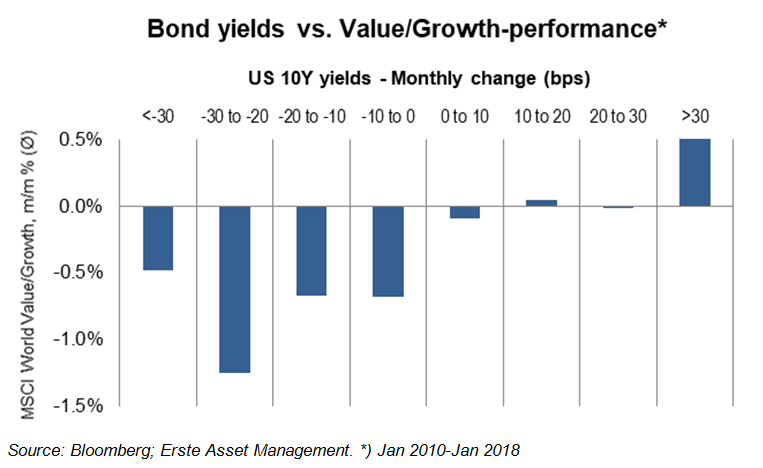

Value or Growth? Has little to do with interest rate cycles

Finally, as far as the performance of the value factor relative to the growth factor is concerned, the picture is less clear than one would tend to think. Given that growth stocks are characterised by higher valuations based on anticipated future cash flows, they should be more sensitive to interest rates (=discount rates). However, the evidence is only partially supportive. In fact, only when rates go up rapidly, value stocks tend to outperform their growth peers, whereas when the rise of bond yields is more muted both factors move broadly in line. Extending the period back to 1990 makes the relationship between interest rates and the relative value/growth performance even more spurious. It seems that value/growth and interest cycles have little in common.

A new regime maybe, but still no stumble block for equities

The secular decline in global interest rates that started more than three decades seems to be over. It has provided a massive tailwind for equity markets, as John Cochrane has cogently pointed out in a recent blog[iv]. In that sense, the global economy is moving towards new regime.

However, there have been little signs yet suggesting that the US economy or even the global economy is entering a new era of accelerating inflation and rapidly rising interest rates, which would threaten equity markets. There is a (rather slow) normalization going on, eliminating some of the distortions that developed during and after the great financial crisis. And there are risks that US policy makers could move faster than markets expect and than the economy can digest. Thus, a moderate rise in risk premiums should not be a surprise, but none of the recent data flow and economic developments suggest that interest rates have reached a level where they would start hurting equities.

[i] During the period since 2010 the general level of interest rates fluctuated in a relatively narrow range. We therefore used basis points as the metrics to distinguish between different phases of interest rates movement. For a longer-term analysis using percentage changes of interest rates would be more appropriate.

[iii] See for example Claessens, S., Coleman, N., and Donnelly, M., “Low-For-Long” Interest Rates and Banks’ Interest Margins and Profitability: Cross-Country Evidence, International Finance Discussion Papers 1197, February 2017, https://www.federalreserve.gov/econresdata/ifdp/2017/files/ifdp1197.pdf

[iv] Cochrane, J.H., Stock Gyrations, Feb 7, 2018, https://johnhcochrane.blogspot.co.at/2018/02/stock-gyrations.html

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.