In around one week, Germany will elect a new Bundestag. A change of power is currently looming in the new elections that have been brought forward following the collapse of the ‘Ampel’ coalition. The future government will face a number of challenges, particularly in economic terms. After years of stagnation, the former engine of growth in the European Union (EU) needs to get back on track. These are the parties’ plans.

Polls point to a change of power

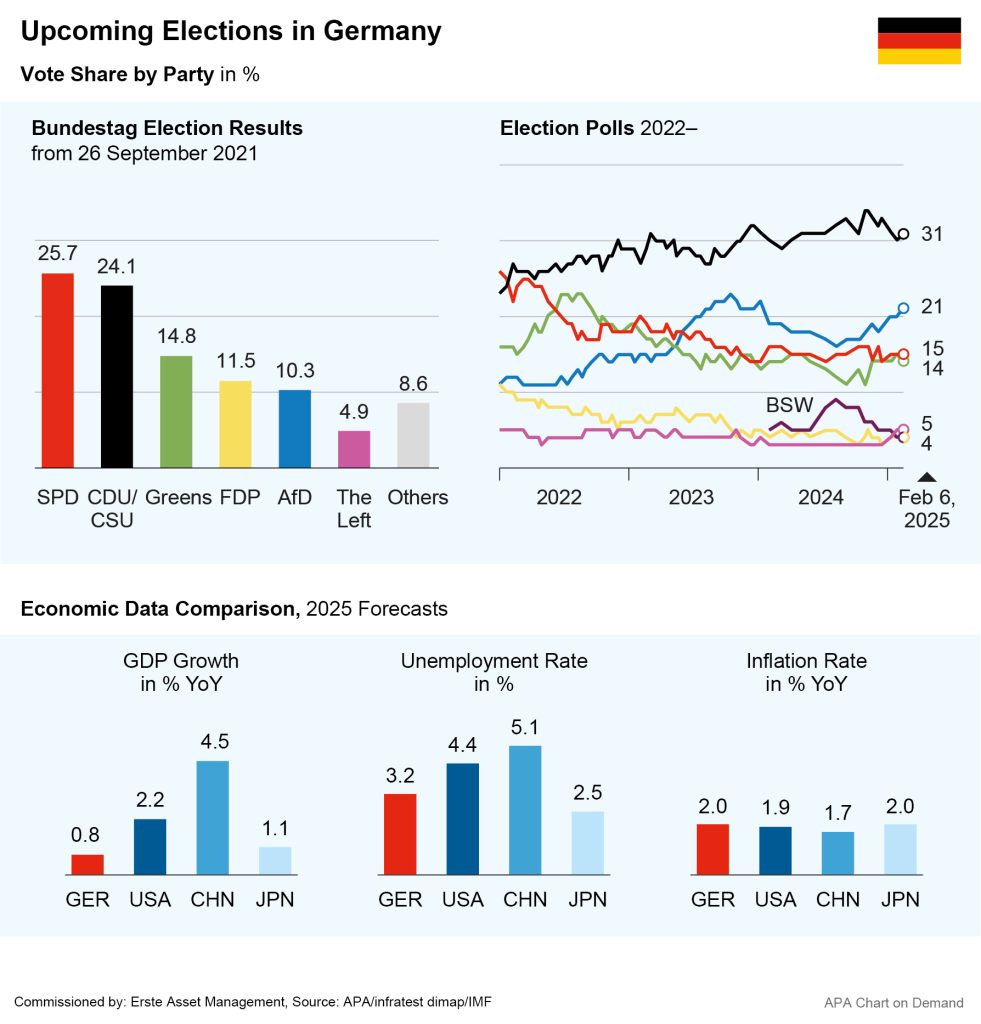

The CDU/CSU made gains in the latest polls and now lies in first place with figures around 30 per cent. A Forsa poll recently put the Christian Democrats at 29 per cent, the AfD at 20 per cent, the SPD at 16 per cent, the Greens at 14 per cent, and the FDP and BSW at four per cent respectively. Experts currently consider a CDU-led coalition with the SPD or the Greens to be the most likely government options. The new government will face the major challenge of bringing the German economy back to growth after two years of recession.

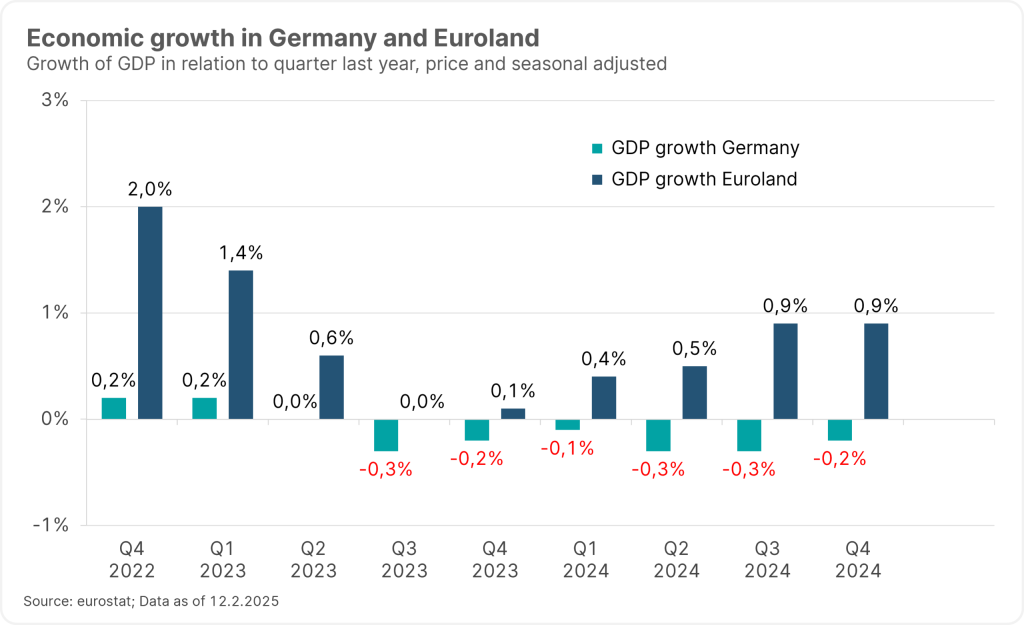

Last year, Germany’s economy shrank for the second year in a row and continues to stagnate for the time being. In Q4 of last year, Europe’s largest economy contracted by 0.2 per cent compared to the previous quarter, more than analysts had expected. At 0.3 per cent, the German government expects barely any growth for 2025, as reported by Handelsblatt citing government circles.

Economic data remains weak

This estimate closely matches the figures given by the ifo Institute in its Economic Experts Survey, in which 1,400 experts were surveyed, and which predicts a minute increase of 0.4 per cent on average. Meanwhile, the Federation of German Industries (BDI) expects a decline of 0.1 per cent in 2025. For the next two years, many economists expect only slightly higher growth rates of just over one per cent, well below the average of other industrialised countries.

Other economic indicators also paint a bleak picture. The number of unemployed in Germany has recently risen to almost 3 million, the highest level in almost ten years; however, German industry has recently shown a surprising increase in orders, after German exports shrank again last year. Although the trend pointed upwards again in December, the consequences of US President Donald Trump’s customs policy are still unclear.

Note: Past performance is not a reliable indicator of future performance.

CDU and FDP favor tax relief for companies, SPD and the Greens want redistribution

Unsurprisingly, economic policy was a key election issue. The parties’ plans for economic recovery diverge significantly. While the CDU and FDP are primarily advocating broad-based tax relief worth billions, the SPD and the Greens are focusing on huge investment programmes.

The CDU and FDP want to reduce the corporate tax burden to a maximum of 25 per cent. The CDU and CSU also want to lower income tax for people with low and middle incomes. The SPD is also calling for relief for low and mid-level earners, but like the Greens they want to raise taxes for top-level earners and the super-rich.

Government programmes would have varying degrees of impact on the budget

Experts at the ZEW Mannheim research institute have calculated the tax effects of the election programmes for private households and the national budget. According to a ZEW study published in January, the tax cuts proposed by the FDP, CDU/CSU and AfD would significantly reduce the tax burden on higher-income earners, while the programmes of the SPD, the Greens, the Left Party and the BDW would mean an increase in income particularly for lower- and mid-level-income earners.

All in all, the ZEW experts expect the FDP programme to provide the greatest relief for private households and, conversely, the greatest reduction in tax revenue: According to ZEW calculations, this would mean a EUR 116bn relief for private households in 2025, which would then miss in the federal budget. The AfD and CDU/CSU programmes are expected to reduce the burden on households by EUR 97bn and EUR 47bn respectively. By comparison, the plans of the Left Party would mean a significant additional burden of EUR 46bn. Although the SPD’s, BSW’s and the Greens’ election programmes mean a redistribution, according to the ZEW calculations they yield almost neutral results, putting an additional burden on households to the tune of EUR 1bn (BSW) and EUR 4bn SPD and Greens).

SPD and Greens want to revamp the debt limit for Billion-Euro Investments

Instead of taxes, the SPD and the Greens are counting on billions in investments to stimulate the economy. To this end, the two parties want to reform the debt brake laid down in the constitution. This limits the federal government’s new debt to a maximum of 0.35 per cent of nominal GDP. According to the SPD’s election manifesto, the debt brake prevents investments needed to optimise the infrastructure and stimulate the economy. However, a two-thirds majority in the Bundestag is required to reform the debt brake, and, according to their election programme, the CDU/CSU wants to retain the current debt brake model. The FDP is also against a reform, which was one of the main reasons for the former coalition’s collapse to begin with.

The CDU, SPD, Greens, FDP, AfD and BSW are united in their intention to lower the high energy costs. The proposed measures include in particular a reduction in network fees and electricity tax. This would make Germany more attractive as a business location but would also mean relief for private households. Reducing bureaucracy is also a common goal of all parties.

More business-friendly course probable

The actual economic programme will now greatly depend on the coalition formed after the election. Although the CDU/CSU were clearly ahead in the polls for the 23 February election, it is still unclear who the CDU might partner with to form the government. Many experts see a coalition between the CDU/CSU and SPD as the most likely scenario. The Greens are also considered a possible coalition partner, although CSU leader Markus Söder has reservations about this.

Should a two-party coalition not be sufficient to achieve a majority, a three-way coalition could follow, making the change of power somewhat less of a change. This would by definition necessitate compromise, but according to many experts, it should mean a change for the country to a more business-friendly course.

DAX very strong recently

The stock market is also keeping a keen eye on the future course of the eurozone’s largest economy. There has been little evidence of poor sentiment or weak growth on the European markets recently. While the DAX & Co. have lagged behind their US counterparts in recent years, the European indices have recently outperformed their US counterparts. Germany’s leading index, the DAX, has gained 25% in the past six months, while the S&P 500 has only gained around 13%.

Like other important stock market indices in Europe, Germany’s leading index, the DAX, has shown its friendly side so far this year. Source: Boris Roessler / dpa / picturedesk.com

According to the economic barometer of the sentix analysis institute, the economic outlook in the eurozone has also improved recently. Expectations were clearly exceeded with an improvement in sentiment of five points to minus 12.7 in February. Investors can also benefit from investment funds

Many investors are therefore apparently betting on a comeback in Europe, which is also possible with an equity fund such as ERSTE RESPONSIBLE STOCK EUROPE, either via a one-off investment or a monthly savings plan. As an investor, the fund currently invests in globally active companies that are among the market leaders in their respective sectors, such as the German software company SAP, the Danish pharmaceutical group Novo-Nordisk and the Dutch semiconductor company ASML.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. Portfolio positioning can change at any time as part of active management.

Risk notes ERSTE RESPONSIBLE STOCK EUROPE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK EUROPE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK EUROPE as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.