The interest rates, or coupons, that bonds pay differ due to a variety of parameters. If bond A pays a higher interest rate than bond B, this premium is referred to as spread.

In part 3 of this blog series, “Peaks and troughs”, we were looking at the interest rate differential arising from the difference in the remaining time to maturity (i.e. the so-called term spread). In this article, we want to analyse the spread between euro government bonds of equal remaining time to maturity. In case of equal maturity, different yields are usually due to different ratings (i.e. the so-called credit spread).

German vs. French government bonds

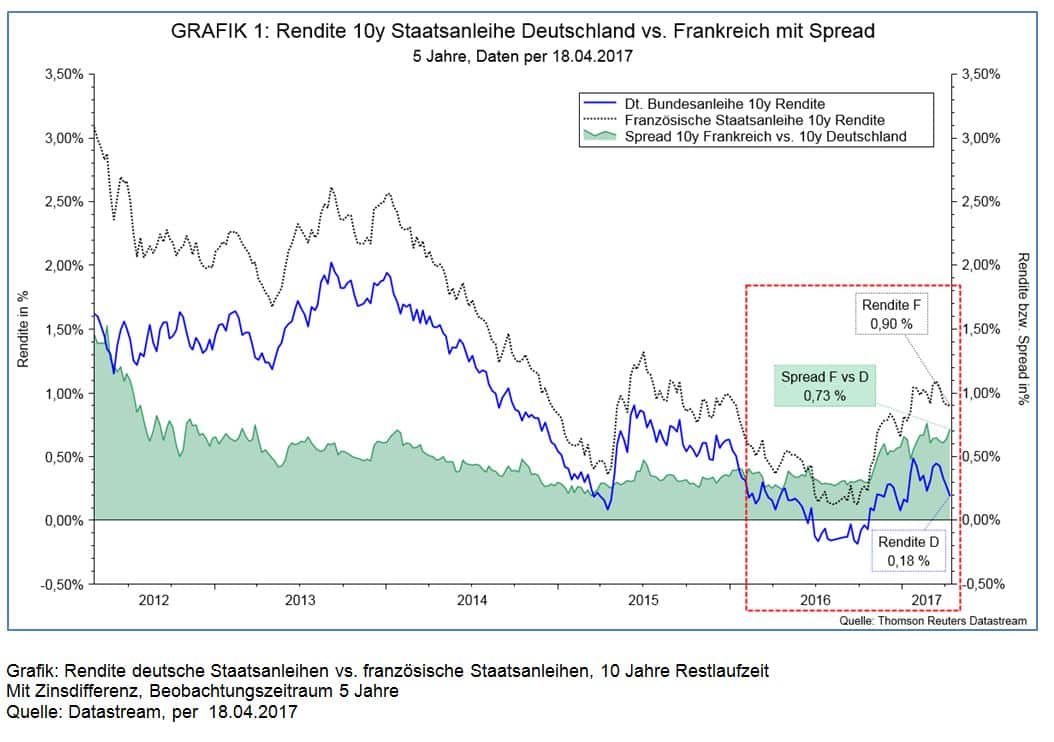

The chart shows the yield for German government bonds with a remaining time to maturity of 10Y (blue) as compared to the yield for their French peers with equal remaining time to maturity (black, dotted). We are not interested in the absolute yield, but in the difference between both bonds (credit spread).

The German bond clearly pays a lower yield than the French one. It is also apparent that the yields move pretty much in sync and parallel to each other. But the interest rate differential (i.e. the green area) illustrates the real difference between both issuers:

- The interest rate differential fluctuates over time, i.e. it is not fixed.

- There are periods when the spread is narrowing and others when it is widening.

- Whereas Germany commands the top rating of AAA, France’s rating is AA. The connection is obvious: a lower rating means higher interest rates!

The effect of changes in spreads

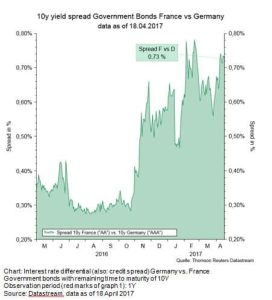

A zoom into the change in spreads over the past 12M in the chart above reveals the following interesting picture:

During the observation period, the interest rate differential widened from 0.27% (as of 19 April 2016) to 0.73% (as of 18 April 2017).

During the observation period, the interest rate differential widened from 0.27% (as of 19 April 2016) to 0.73% (as of 18 April 2017).

This means that the interest rates (i.e. yields) of French bonds increased relative to those of German bonds. Rising interest rates translate into a negative performance for existing investors (i.e. bondholders).

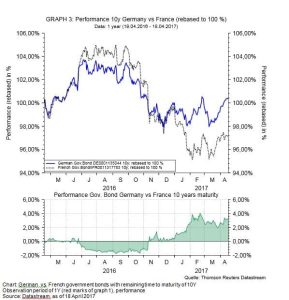

In order to establish the difference in performance, we need two bonds with remaining time to maturity of 10Y. We have chosen the 6.50% Federal Republic of Germany (1997/27) and the 2.75 % France (2012/27). Both come with the same remaining time to maturity.

In order to simplify the illustration and to make the two investments comparable, we have standardised the initial value for both bonds at 100% and taken into account coupon payments. This means that the chart shows the total return. The lower part (green area) indicates the development of both investments (including interest rates) relative to each other.

The interest rates (i.e. yield) of the French bond increased relative to those of the German bond (by close to 0.5%). As a result, the performance of the French bond was almost 3.5% worse.

Why do investors need this information?

We compared two European government bonds with the same remaining time to maturity and high, but different ratings (AAA vs. AA). Interest rate differentials (spreads) fluctuate over time. This results in different developments of bond prices on account of widening or narrowing credit spreads. During the observation period, issuer ratings (as awarded by external rating agencies) remained constant. The widening of spreads reflects the higher risk associated with the French bond, which investors may have seen. A possible and plausible explanation for this development that we saw in particular over the last three months of the observation period could be the presidential elections that were held in France during that time and the risks associated with it.

Conclusion:

When it comes to bond investments, the interest rate differential (or credit spread) and its development over time is crucial for the performance during the observation period. There may be times when it can pay off to rely on lower ratings (i.e. higher yields). And there may be times, as shown above, when investing in higher ratings yields the higher rate of return.

In our example, the return on the investment in a German government bonds was superior to that on a comparable French government bond. But this can easily change into the opposite, given that credit spreads are volatile.

Credit spread management is part of the active management of the funds of Erste Asset Management.

For more information on the product range of Erste Asset Management, please visit our homepage at www.erste-am.com

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.