The interest rates reversal also affected corporate bonds from emerging markets, but most recently this asset class has been able to make up some ground. ERSTE RESPONSIBLE BOND EM COPORATE, a fund that invests specifically in corporate bonds from emerging markets, has just celebrated its tenth anniversary.

In an interview with fund manager Thomas Oposich, we therefore discuss the prospects in the emerging markets and currently interesting sectors and companies.

The world today is different than it was ten years ago, when the fund was launched. To what extent has the outlook for the emerging markets changed since then?

The emerging markets have undergone a remarkable transformation over the past ten years and have become significant players on the global stage.

The rise began in the early 1990s. After the end of the Cold War, the globalisation boom paved the way for a new era of economic cooperation. The second boom phase then began at the start of the new millennium. It was then that the foundations were laid for some of the key events and trends that have driven the development of emerging markets over the past ten years.

Today, emerging markets are more diverse and dynamic than ever. Over the past ten years, real growth in gross domestic product (GDP) in the emerging markets has averaged an annual 4.1%, well above the 1.5% growth of the industrialised countries – a trend that we expect to continue.

5 Trends that have driven the emerging markets in the past years

▶ Commodity boom

The demand for commodities such as oil, metals, and agricultural products increased rapidly. Countries such as Brazil, Russia, and South Africa benefited from their rich natural resources.

▶ Trend towards outsourcing

In the course of globalisation, many Western companies relocated their production and services to emerging markets. India became the centre for IT outsourcing, while China dominated the manufacturing industry.

▶ Technological progress

The rapid development of technologies such as mobile telephony, the Internet, and renewable energies created new opportunities for the emerging markets. South Korea and Taiwan became technology hubs.

▶ Infrastructure and urbanisation

Countries such as Vietnam and Indonesia invested heavily in infrastructure projects and urban development. New airports, roads, and harbours were built to meet the growing demand.

▶ Financial sector and capital markets

The emerging markets continued to develop the structure of their financial markets.

Why would you invest in companies from the emerging markets at the moment?

Over time, emerging markets corporate bonds have decoupled from their national states and have turned into an asset class in their own right. The corporate sector in emerging markets is developing rapidly, and the underlying fundamentals as well as technical ratios speak for themselves.

Compared to emerging markets government bonds, corporate bonds offer higher spreads and lower volatility. Also, and despite some challenges, we believe that they are not only more resilient but also better positioned to weather the current economic realities. This is also demonstrated by the current yield in this asset class of just over 5% p.a. in euro terms (Please note: investing in securities involves risks as well as opportunities).

Are there any countries or companies that are currently of particular interest and that you are looking at?

The diversity of emerging markets plays an important role in the global economy. Each country has a unique set of characteristics that affect its economic development. Whether they are energy exporters or energy importers, whether the economy is based on manufacturing or services – these differences drive the prospects of the individual countries.

In terms of sectors, we are particularly interested in the energy sector at the moment, especially the renewable energy sector. ERSTE RESPONSIBLE BOND EM CORPORATE is one of our sustainable funds, which means that the entire fossil energy segment (coal, oil, and gas) is not investable.

Greenko is an outstanding example of sustainable energy projects. The company develops and operates clean energy projects in India, including solar, wind, and hydropower plants. The energy generated is sold to state utilities, private customers, and other electricity transmission and trading companies. This makes Greenko a pioneer in the field of energy transition and decarbonisation.

We are also optimistic about the Latin American automotive supply industry, where electric vehicles could drive the growth of products with higher profit margins. And, we are positive vis-à-vis the Asian technology sector. We expect fundamentals to improve here. Companies such as Tencent, a leading Chinese technology group, the e-commerce giant Alibaba, and Baidu, often referred to as the “Google of China”, are known for their diverse online services and platforms (Please note: The aforementioned companies have been selected as examples and do not constitute an investment recommendation).

Speaking about China: what are the growth prospects there after the pandemic years and in the midst of the real estate crisis?

Despite some negative headlines, China continues to deserve our attention as the world’s second largest economy. Hopes of a strong upturn following the end of the lockdowns were initially dented, but the recovery is gradually taking hold.

However, there are key challenges, particularly in the real estate sector. Sales of new homes in key Chinese cities remain sluggish. The fate of this sector will have a major impact on China’s growth trajectory. Failure to avert this crisis could cause considerable damage.

Policy makers have increased support, but with limited effect: the housing market continues to slide, negatively impacting incomes, job security, and equity tied up in homes. The fundamental problem is that housing supply is outstripping demand and it will take years to close this gap. The government will probably try to further smooth the adjustment rather than create another price boom.

In the super election year of 2024, new elections will also be held in some emerging economies (e.g. India and Mexico). What could be in store for investors and how do fund managers prepare for such political decisions?

2024 promises to be a politically charged year. In addition to the elections in the USA, important political decisions are also due in some of the largest emerging markets. India (April/May, parliamentary elections) and Mexico (2 June, parliamentary elections) are two such countries that will be in the spotlight. As a fund manager, it is crucial for me to prepare for these events in order to understand the impact on the financial markets and react accordingly.

Ahead of the Indian elections, political analysts suggest that a victory for the current Prime Minister Modi is the most likely outcome. His popularity is undisputed.

What exactly a third term in office for Modi would mean for India, especially if it were to be another absolute majority, is not yet entirely clear. Some see economic success and India’s rise to become the third largest economy in the world as likely outcome. Others fear a continued erosion of democracy and of the rights of the Muslim minority, which accounts for over 200 million people.

We continue to see India as one of the best structural growth opportunities in the emerging markets, if not worldwide. This is why we have positioned ERSTE RESPONSIBLE BOND EM CORPORATE in this direction. India has the world’s largest youth population, with 65% of people under the age of 35. This young population is highly educated and represents the third largest group of scientists and technicians in the world. They are poised to help shape the future of the country.

Geldtipp: Investieren in Schwellenländer-Anleihen

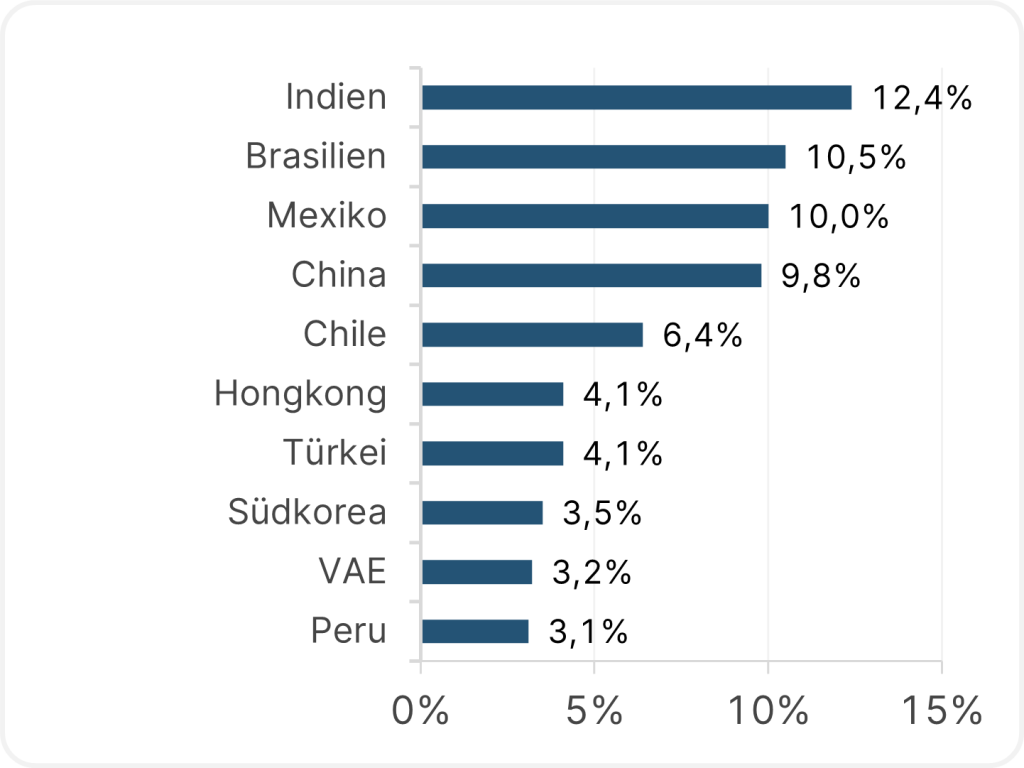

With ERSTE RESPONSIBLE BOND EM COPORATE, investors can invest in corporate bonds from emerging markets. Companies from high-growth emerging markets such as India, Brazil, Mexico, and China command a large weighting in the fund.

As part of Erste Asset Management’s Responsible Funds, the fund also invests in accordance with sustainable environmental, social, and governance criteria. You can find out exactly what this means, and what exclusion criteria are associated with it here.

Please note: Past performance is not indicative of future value development.

How has the fund performed?

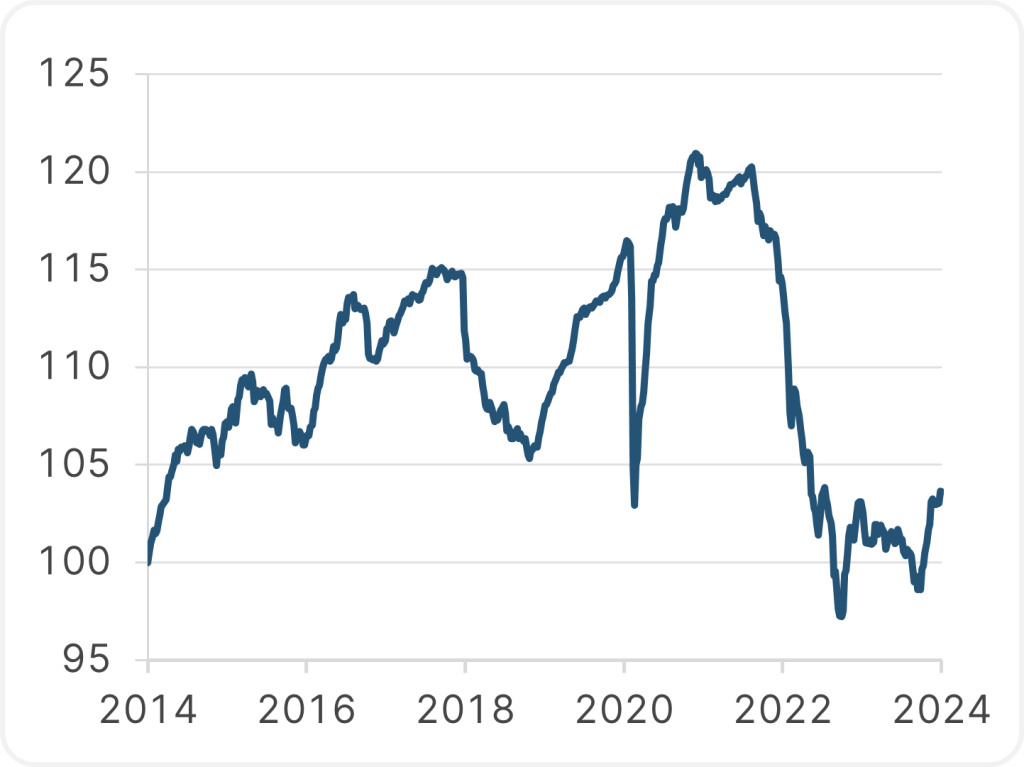

Development over the past 10 years

What’s inside?

Fund assets under management by country (Top 10)

Note: Charts are indexed (6.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Opportunities and risks at one glance

Advantages for the investor

- Opportunities for additional earnings through interesting corporate bonds from emerging markets.

- Investments are made in companies that meet sustainability criteria.

- Foreign currencies are mostly hedged against the euro.

- Risk diversification through broad diversification in bonds from various issuers.

Risks to be considered

- Rising interest rates can lead to price losses.

- Deterioration in credit ratings can lead to price declines.

- Increased risk due to medium to low debtor credit rating of the participating companies.

- Foreign currency fluctuations can affect the fund price development.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE RESPONSIBLE BOND EM CORPORATE

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part.

For further details on the sustainable strategy of ERSTE RESPONSIBLE BOND EM CORPORATE and on the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852) please refer to the current prospectus, section 12 and the appendix, “Sustainability principles”. When deciding to invest in ERSTE RESPONSIBLE BOND EM CORPORATE, please take into account all features and goals of ERSTE RESPONSIBLE BOND EM CORPORATE as described in the fund documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.