The first earnings season of 2020 is dominated by the corona crisis. While, barring China, the lung disease caused by the virus did not turn into a massive problem in most countries until March, the last month of Q1, the economic restrictions imposed by the pandemic are already having a considerable impact. Not only have already-published results been significantly weakened; investors and analysts also expect lower profits medium-term due to the consequences of the global fight against the virus.

Lowered expectations

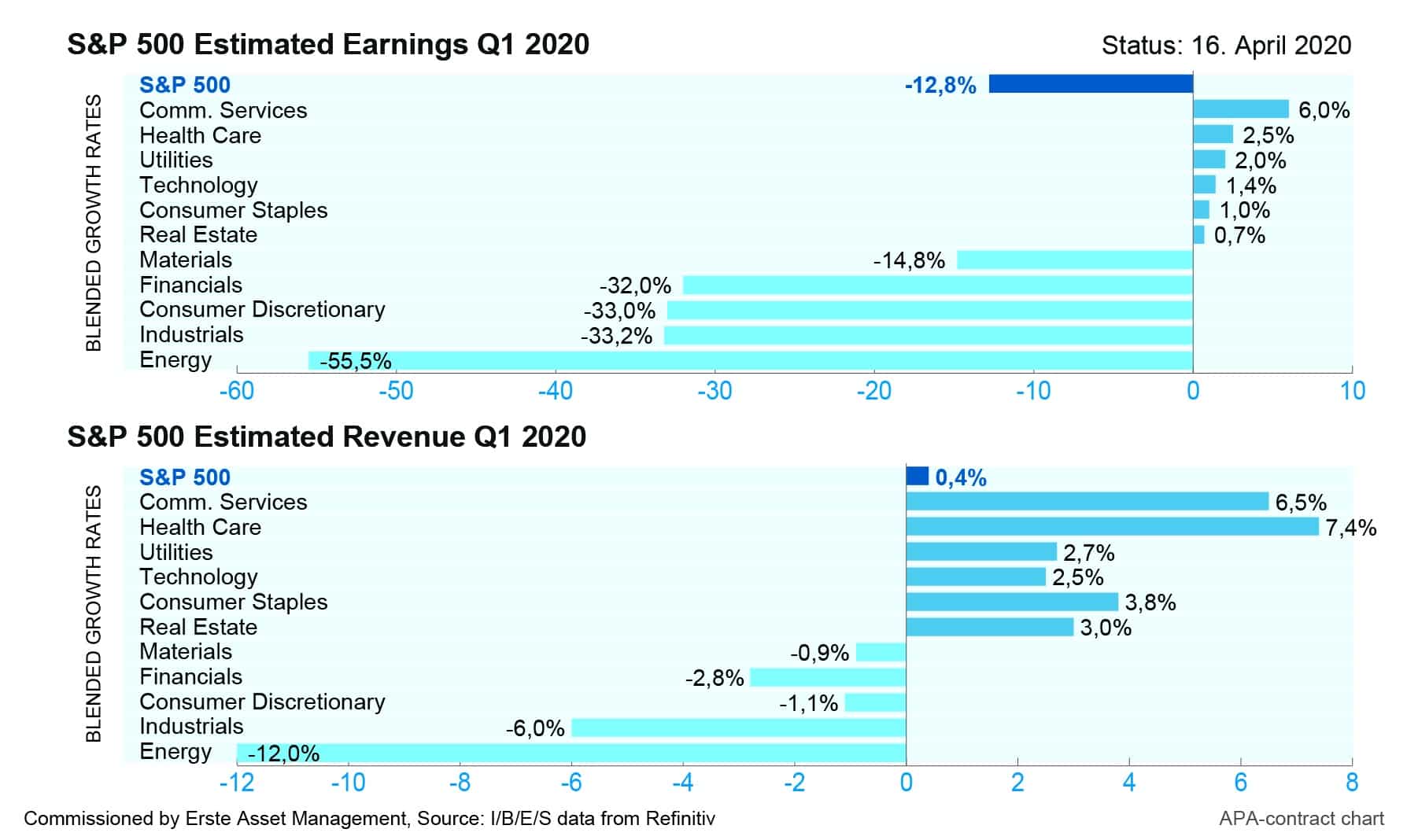

Shortly before the first presentation of figures in the USA, signs of a sharp decline in profits were already becoming apparent. Data from Refinitiv from mid-April shows that companies in the US leading index S&P 500 were expected to post an average of almost 13 per cent lower profits in the first quarter of the year compared to the same period last year. Particularly large drops in profit were expected in the energy sector (-55 per cent), while industrial, consumer goods and financial groups were estimated to post around one-third less profit.

Precautionary measures affecting the figures

In the USA, the big banks traditionally open the quarterly earnings season with their figures: Goldman Sachs, Bank of America and Citigroup faced a 50-per-cent decline in profits in Q1. Industry leader JPMorgan saw its profits drop by more than two thirds, Wells Fargo by almost 90 per cent. Morgan Stanley shows the best performance in the industry with a mere 30-per-cent drop in profits to USD 1.7bn. At first glance, this makes the first round of annual reports even more devastating than expected. However, the lower profits are still mainly due to precautionary measures taken by the banks, who set aside reserves to be prepared for possible loan defaults triggered by the economic consequences of the Corona crisis.

Even in this gloomy environment, winners exist

In addition to companies, rough waters also loom ahead for private households in particular. In the US, more than 26 million Americans lost their jobs in the first five weeks of the pandemic. This in turn will have a negative impact on the sales of consumer-dependent corporations. However, despite the bleak outlook, other companies have so far even benefited from the current situation. Curfews and contact restrictions, for example, have favored communications service providers’ businesses, one shining example being video streaming provider Netflix. The company reported 15.8 million new paying customers in the previous week, almost twice as many new customers as analysts had expected. Quarterly revenues rose from USD 4.5bn in Q1 2019 to USD 5.8bn. Net income was 709 million, more than twice as high as in the previous quarter.

In view of the challenges caused by the corona crisis, attention is also very much focused on pharmaceutical companies and healthcare groups: stockpiling by consumers benefitted pharmaceutical manufacturer Eli Lilly, whose sales increased by over 15 per cent to USD 5.86bn. In the case of French competitor in the sector, Sanofi, sales at the turn of the year rose by around 7 per cent to almost EUR 9bn, the group announced before the weekend. Adjusted earnings per share excluding exchange rate effects increased by almost 16 per cent to 1.63 euros. Net profit increased by 48 per cent to EUR 1.7bn. About half of this growth was attributable to the inventory increase in the wake of the Covid 19 crisis.

While governments around the world are attempting to contain the economic consequences of the Corona crisis as quickly as possible with aid packages and economic stimulus packages, further prominent stock corporations on both sides of the Atlantic will be publishing their quarterly reports in the coming days, among which might well be one or two positive surprises. According to the Refinitiv data, these might be found not only in the communications and healthcare sectors, but also among utilities and technology stocks.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.