Whether you want to buy a house or buy a car, many private consumers currently deal with soaring prices for materials and unpleasantly long delivery periods.

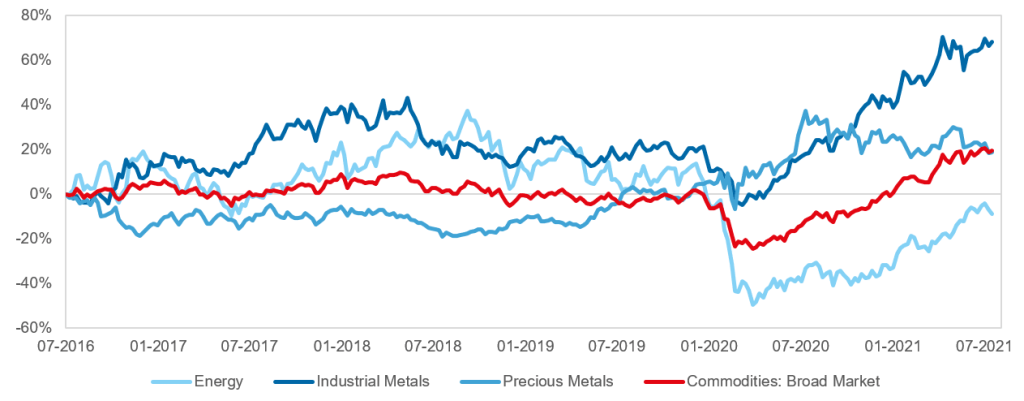

This situation is directly reflected in commodity prices. The following chart illustrates the commodity market with the segments of energy, industrial metals, and precious metals. This is how we should want to interpret the chart: from 2016 to 2019, supply and demand were roughly in equilibrium, and as a result, prices did not change much. After the pandemic in 2020 that affected all commodities but particularly crude oil, prices started to rise significantly. The chart also shows that industrial metals – especially the important copper – are ahead, which should paint a positive picture as far as the global economy is concerned.

Performance of commodities

Indices: Bloomberg Commodity Index Total Return; Bloomberg Energy Subindex Total Return; Bloomberg Industrial Metals Subindex Total Return; Bloomberg Precious Metals Subindex Total Return

Please note: past performance is no reliable indicator for the future development of the fund

How do we measure the performance?

The performance, i.e. the development of prices, of the commodity market is measured by referential indices, with the Bloomberg Commodity Index assuming a crucial role. At the moment, the index contains 23 commodities that are classified and weighted as outlined below:

Daneben gibt es weitere Referenzgrößen, etwa den S&P GSCI Index, der einen größeren Energieanteil aufweist, oder There are additional benchmarks such as the S&P GSCI index, which contains a bigger energy weighting, the CRB index, and the Rogers index.

What is the status quo of gold, copper, and oil?

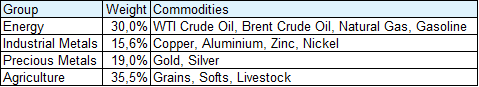

Gold is known to often appreciate in times of crisis as was the case in the financial crisis 2008/2009, the euro crisis 2016, and the pandemic crisis 2020. This feature qualifies it as financial investment. It should be regarded as complementary to a core equity portfolio though, given that equities are indispensable to the portfolio in the long run when it comes to achieving one’s investment goals despite intermittent setbacks. One of the factors driving the gold price is whether national central banks buy gold in order to diversify their portfolios.

The volume of purchases has fluctuated strongly in history. This year, central banks seem to be present in the gold market, and new ones have joined the ranks: Brazil, Hungary, and Thailand. For Russia, which has always been a major player in this field, the higher oil price should have created liquidity with which to become active (again). In other words, central banks as a driving factor should support the lower end of the gold price.

MSCI All Countries World Index; Bloomberg Gold Subindex Total Return

Please note: past performance is no reliable indicator for the future development of the fund

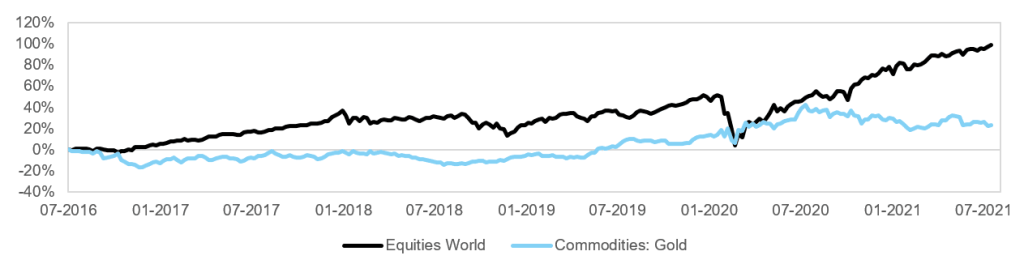

Historically speaking, copper is strongly correlated with global economic growth. Most recently, China has become a relevant player in this area, given that it accounts for a large part of global growth and its industry hinges on commodities. In economies such as Europe and the USA, the service sector and the IT sector have already assumed more important roles.

To China, copper is a strategic metal, as the current five-year plan maintains. This results in the need for high levels of inventory, which caused substantial purchases already last year. The targeted level of inventory has not been achieved yet, which is why China should continue to drive prices, along with general global growth. Also, copper and industrial metals in general are indispensable – both for traditional production and product design (which have to be adjusted due to their high CO2 emissions) and future ecological economies.

MSCI All Countries World Index; Bloomberg Copper Subindex Total Return

Please note: past performance is no reliable indicator for the future development of the fund

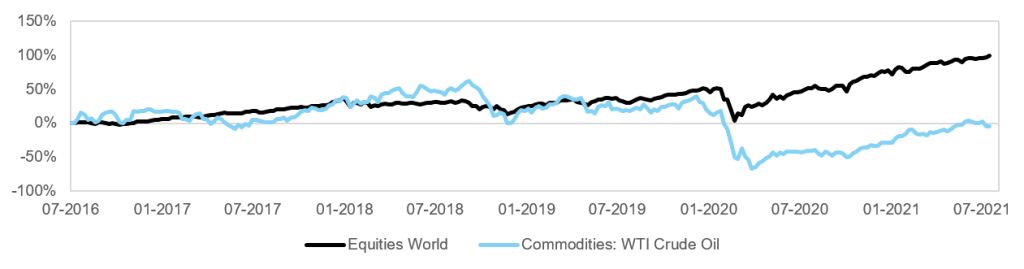

Crude oil has underperformed equities more significantly than copper, as the following chart highlights. This is due to the fact that during the pandemic, not only was industrial production reduced sharply, but supply also clearly outstripped demand. On the one hand, the relevance of oil for the global economy will decline in the long run in order to facilitate a more environmentally friendly approach. On the other hand, this process requires a gradual transition that takes time. Also, oil reserves, once tapped, provide declining revenues; after a while the investments in the development of new reserves fall short of the required volume. This could instil the oil price with temporary upward potential.

MSCI World All Countries Index; Bloomberg WTI Crude Oil Total Return

Please note: past performance is no reliable indicator for the future development of the fund

How do commodity investments work?

Companies that process commodities have to be able to physically buy them. For financial investors, this is not practical for reasons of logistics (storage). Therefore, financial investors access this market via so-called commodity futures. A commodity futures contract obligates the parties to transact a commodity at a predetermined future date and price; the future buyer can thus already participate in the development of the price until the transaction.

Futures contracts are available with a wide range of maturities from very short (a few months or even weeks) to long-term (several years). The contracts with shorter remaining time to maturity tend to reflect the development of the price of the physical commodity (i.e. the so-called spot price) more directly than contracts with end of maturities that are farther off. Therefore, investors tend to buy futures contracts with relatively short remaining time to maturity; once one expires, the end of maturity is pushed back to a new one. This is called “rolling”. As pointed out, financial investors want to participate in the price performance but do not want delivery, because they have no way of storing the goods while trying to sell them on.

An interesting aspect is the ratio of the price of futures contracts with shorter remaining time to maturity and those with longer remaining time to maturity. If the price of the shorter futures contract is higher, this suggests a supply shortage because the industry that processes the commodities needs them right away. It is not possible any longer to order commodities and wait for delivery.

How significant is the current demand overhang?

The conclusion is that the shortage in commodities is the most pronounced one since 2007, as the following chart illustrates as well. The so-called backwardation is the ratio of short-term to long-term futures maturities. 2009 was clearly a phase when the demand for commodities was limited in the wake of the global financial crisis, as was 2020 as a consequence of the pandemic. Since 2021, the “shortage index” has been pointing upwards.

Extent of demand overhang for commodities

Interestingly, this situation makes it easier for investors to invest in commodities, because the mechanism of the frequent switching of futures becomes cheaper. It also makes sense that a phase where demand is outstripping supply is a good time for investing.

Will commodity prices be fuelling inflation in the future?

We have seen unexpectedly high levels of inflation in particular in the USA, which then also affected the financial markets (especially government bonds). Later, the situation relaxed again. Inflation expectations – i.e. the rate which well-informed investors envisage for the future – declined a bit. It is not particularly high by historical standards. The dominant interpretation that we have seen suggests that it was not commodities and wages that were driving inflation, but components that were going through a turbulent yet transitory development in the wake of the pandemic: new and used cars as well as tourism (hotel, flight tickets). The so-called core inflation, on the other hand, has not changed much since the end of 2019.

Conclusion

Dass Demand for commodities exceeding supply is a fact that both business owners and consumers are well aware of at the moment. Whether the commodity prices remain high will depend on whether the global economy continues to grow strongly. Prior to the pandemic, the stage we were in was deemed a low-growth, late stage of the economic cycle. Now, the sharp recession in 2020 may have changed the framework to such a degree that a new growth cycle may be imminent.

Commodity prices affect the following funds in particular:

ERSTE STOCK COMMODITIES

ERSTE STOCK COMMODITIES invests globally with a focus on companies from the commodity sector. The investment process of the fund is based on fundamental company research. The investment strategy hinges on a balanced portfolio from basic materials and energy and on a stronger weighting of companies from the developed markets. As a matter of principle, we tend not to hedge foreign exchange risk, although the terms and condition of the fund would allow it. Environmental, social, and governance factors are integrated into the investment process.

ERSTE REAL ASSETS

ERSTE REAL ASSETS invests mainly in the asset classes of equities, commodities, precious metals, real estate, infrastructure, and inflation-protected bonds, which overall means a focus on real assets. Global equities, and gold, and real estate account for the majority of assets under management. The capital is invested directly or indirectly via investment funds or derivatives. The allocation in precious metals, especially gold (e.g. as exchange-traded commodities, i.e. debentures), is capped at 40% of assets under management. Real estate funds may account for up to 20% of the fund’s assets under managements.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.