Climate risks are a sticky issue. Not necessarily because some activist groups elect to physically glue themselves to various public spaces, much to the chagrin of an entirely different group of concerned citizens, who dislike the casual inconvenience this might cause them. However, this blog entry won’t discuss the finer points of whether such glue-y activism is really furthering the cause. I merely wanted to open with a pun!

Are we missing something?

At Erste AM we have recently had our annual internal long-term outlook event, where we shed light on various issues which are driving the markets and will continue to do so in the future. The overarching theme was perceived scarcity, and naturally climate risks was among them. Lack of intention, ideas, profits, regulation, and rationality can all to some extent be attributed to the public discourse around climate change and its plethora of risks.

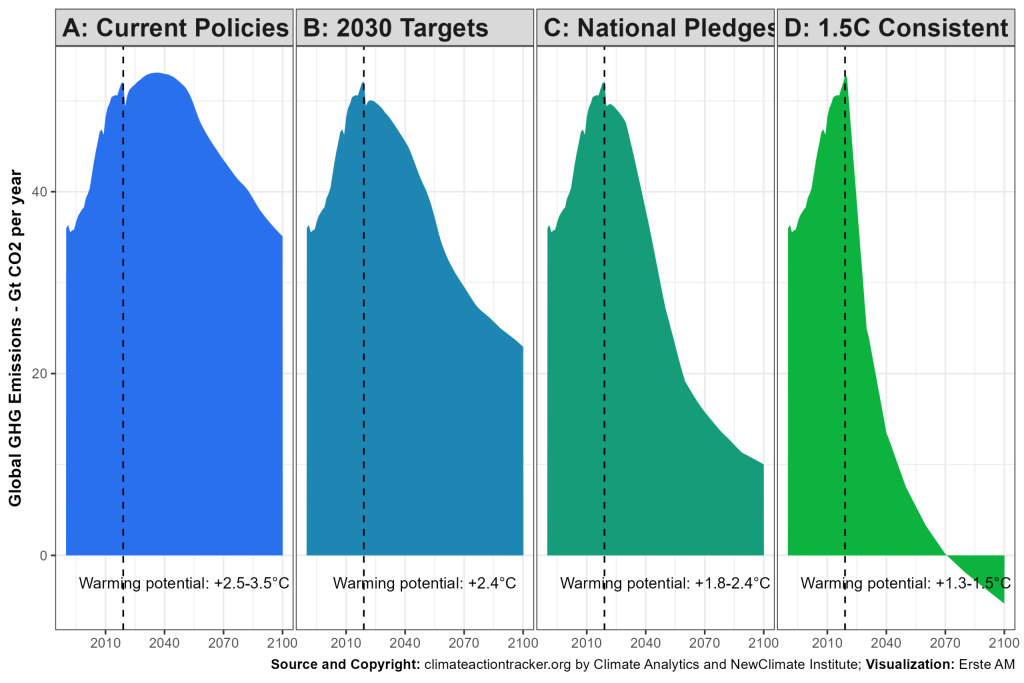

The only thing that is not lacking, is evidence of climate risks itself. The visualization below summarizes the conundrum we are facing. Current policies and lacklustre 2030 targets will put us on a warming trajectory somewhere between 2.4 °C to 3.5 °C. There is much uncertainty with regard to the actual warming potential, but climate scientists (the real ones) are unequivocal in calling this a major disaster[1].

To be precise: image D on the right of the graph highlights the actions necessary to have a chance of meeting 1.5 °C-consistent targets. Not only would this require massive decarbonisation already today, but scientists have estimated that the probability of staying within that range is approx. 50%[2]

So how are we dealing with this dire reality?

Apart from seriously starting to listen to climate scientists, if you are investing your money with a long-term horizon, you ideally want to have a better understanding how to avoid certain risk factors, which could potentially render your investments less valuable. So, as an investor you might want to ask some inconvenient questions to companies. In German you could paraphrase the famous Gretchenfrage and ask your favourite corporate counterpart: “Nun sag, wie hast Du’s mit der Dekarbonisation?”, which roughly translates to “How do you feel about decarbonisation?”. Ideally, companies feel great about it and show their devotion by having third-party approved stringent net-zero targets in place. At Erste AM we routinely ask about this aspect in the course of engaging with companies.

Wishful thinking or not?

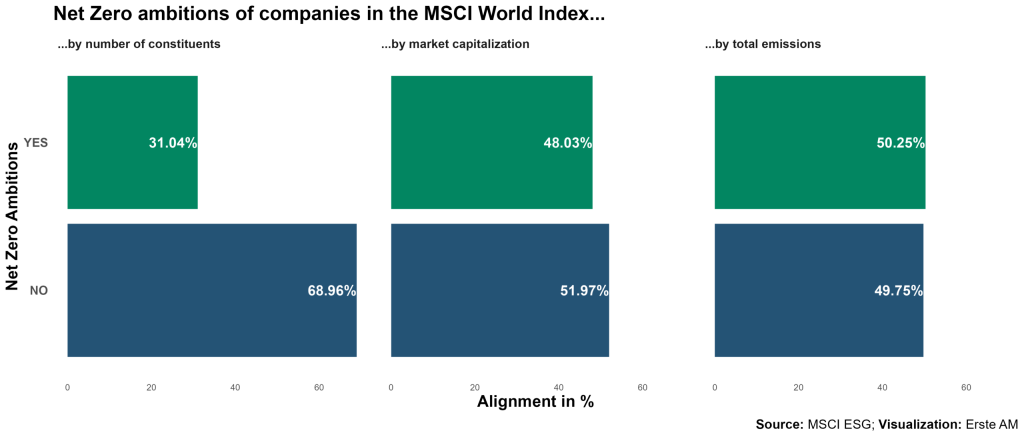

In reality, the current state of decarbonisation might be out of its infancy, but certainly still lacks the maturity needed to take swift action. Research conducted on a broader market index about its constituents reveals a mixed picture:

By pure number of companies, only roughly one in three companies has net-zero targets. Going by market capitalisation, the picture becomes a bit better: here, it is roughly half the index. And if you look at it by emissions, a very slim majority of emissions is pledged away until 2050. The flip side of this is that we are currently still stuck with an unpledged 50%. These laggards might cause major headaches to climate-savvy investors, but also to those who do not like their capital squandered by investing in companies that face legal challenges, rising tallies for carbon emissions via taxes and emissions trading systems, rising costs of capital, asset write-downs and impairments, to name but a few challenges. These risk factors can be mitigated, though. Looking at the climate-readiness of companies might therefore be prudent. In essence: yes, please, let’s look at another ESG factor.

[1] See what three degrees of global warming looks like – YouTube

[2] IPCC_AR6_SYR_SPM.pdf

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.