The corona pandemic has hit China hard. Worse still, the country with the world’s second-largest GDP is regarded as the ground zero of the virus and has had to impose another set of lockdowns for fear of a second wave of infections, as recent images from the capital city of Beijing have shown.

That being said, one has to remember that China has navigated the crisis quite well so far and that the growth rate of industrial production has picked up, too. In spite of numerous relief measures and tax breaks, government debt has also remained within reason. All this in an environment where investors are looking for suitable investment opportunities. The Chinese bond market may just be what they are looking for.

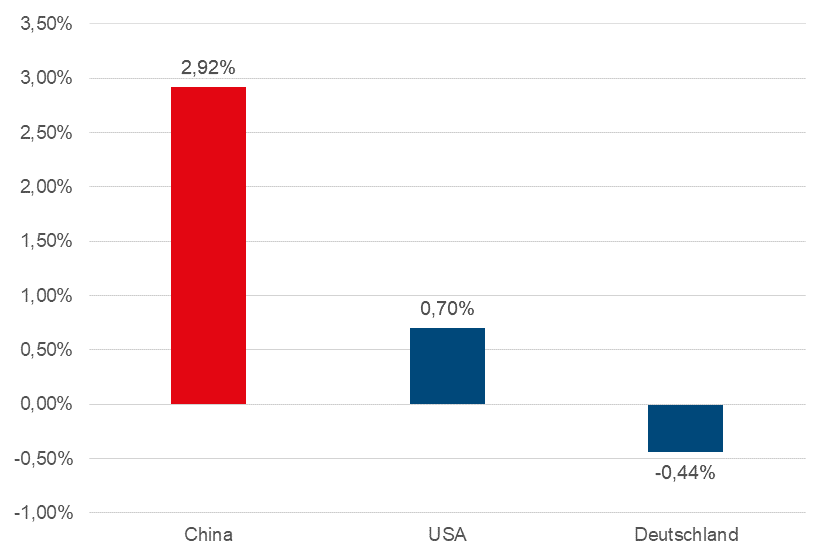

Respectable yield

Ranked by size, the Chinese bond market is already in third place – behind the USA and Japan. As Mario Kaudela, expert in Product Management with Erste Asset Management, explains, among its peer group of large government bonds markets, China is pretty much the only one where the term “yield” is justified. While 10Y US Treasury bonds pay an annual yield of 0.70% and the yield of German government bonds is even negative at -0.44%, Chinese government bonds are currently traded at a yield of 2.92% (source: Refinitiv Datastream, 23 June 2020).

10Y government bond yields

Source: Refinitiv Datastream; As of 23 June 2020

Chinese economy showing improvement after corona

The global pandemic that originated in the Chinese provincial city of Wuhan has had a dire effect on the Chinese economy in Q1. The GDP shrank by 6.8% and was negative for the first time since 1992. Analysts still expect a growth rate of 1% for the Chinese economy this year.

In 2021, the growth rate should accelerate to 7.1%. The decline caused by the shutdown has to be put into perspective: the Chinese economy is shut down every year around Chinese New Year. A shutdown of a different kind is therefore nothing extraordinary.

The pandemic basically just extended the period. In fact, after the massive slump industrial production was up 4.4% in May as compared to the same month of 2019. Retail sales, however, are still below their 2019 values.

Government and central bank providing cash injections

Meanwhile we have seen clear initiatives from the government and the central bank aimed at starting up the economy again. The 2020 National People’s Congress of the Communist Party that convened at the end of March set itself three main goals:

- Economic recovery

- Stable job market

- Opening of the economy and the financial markets

No explicit growth target was formulated. The commitment to the opening and strengthening of the financial markets in particular can be regarded as positive signal for international investors.

The government wants to protect the economy from the effects of the pandemic as quickly as possible and set a course for revival. The set of measures initiated by the People’s Congress is comprehensive and has gravitas.

Here are the most important items:

- Reduction of VAT on exports (except goods that cause a high degree of air pollution or that require a high volume of resource input)

- Tax breaks until the end of 2020 to the tune of USD 500bn

- Increased investments in the healthcare system

- Designated Covid-19 bonds

- Investments in infrastructure and in the healthcare system at the volume of 6.5% of GDP

Those are the main pillars. Further measures include the following ones:

- Taxes on products aimed at curbing the pandemic are to be scrapped

- Small and micro businesses can have their taxes deferred until March 2021

- Renovation of urban council buildings as part of the stimulus programme

- Consumer vouchers

- Electricity tariff cuts for companies of 5%

Mario Kaudela, expert with Erste Asset Management: “Interesting price level for investing, given the attractive yield and upward potential of the yuan”

In order for the job market to pick up momentum again especially in the urban areas, plans have been made for the creation of more than 9 million jobs and for the implementation of training schemes.

In addition to the government, the Chinese central bank has also implemented rather noteworthy initiatives.

- Liquidity injections of USD 420bn in February and USD 3bn in March

- Deferral of loans granted to SMEs until March 2021

- Commercial banks should step up their lending volumes to small and micro businesses by 40%

- The exchange rate is to be kept as stable as possible relative to the currency basket

- Cut of minimum reserve rate for banks, resulting in more capital available for lending

- Cut of short- and medium-term interest rates

Trade conflicts not yet overcome

The Sword of Damocles in the shape of the ongoing trade conflict between China and the USA is still hanging above us. The mutual sabre-rattling has become more intense lately. The presidential election campaign in the USA could affect the climate over the coming months. Also, the fight for autonomy in Hong Kong has triggered tensions between the superpowers.

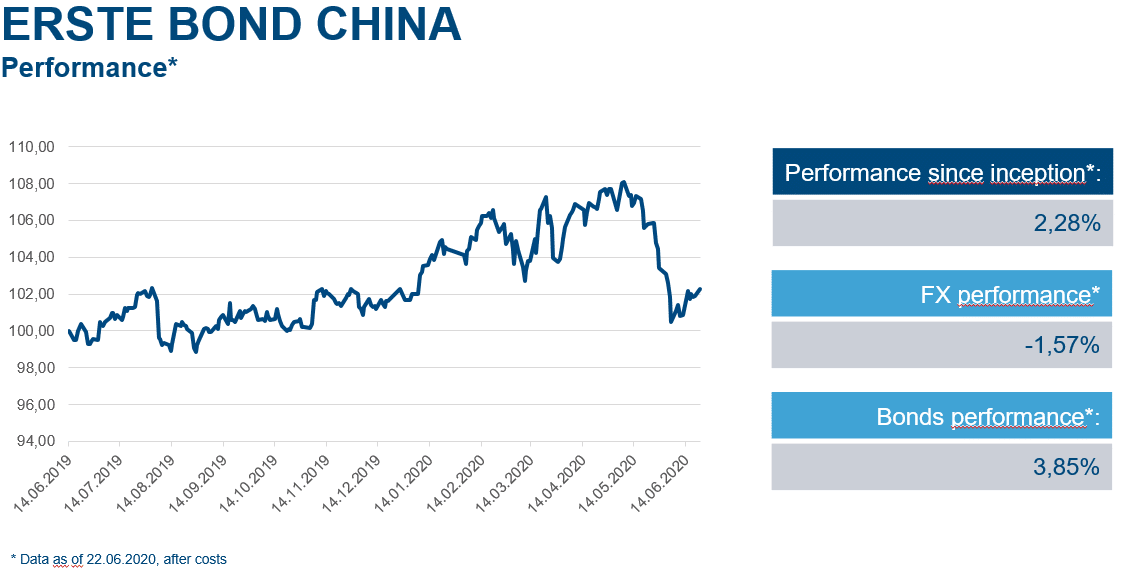

ERSTE BOND CHINA: modular diversification

In the past, Chinese government bonds have exhibited very low correlation with traditional bond markets such as for example European government or corporate bonds. The same is true for their correlation with equity markets, which is why they constitute an intriguing asset class to add to a portfolio. Investors believing in the revival of the Chinese economy who are looking for a way to diversify their portfolio may therefore be interested in the fixed income fund ERSTE BOND CHINA. Its goal is to invest in bonds traded in Mainland China, issued by the People’s Republic of China, or guaranteed bonds in local currency. ERSTE BOND CHINA celebrates its first anniversary these days.

Due to the only very short term, this presentation of the performance is not very meaningful

Investors can participate in the possible appreciation of the Chinese currency in addition to benefiting from the, by international standards, attractive yield. “Especially in the past weeks the euro has appreciated against the yuan, which has eaten into the performance of the fund a bit,” explains the expert Kaudela.

If China were to re-embark on the growth track, the current exchange rate and the yield of 2.9% could constitute a tempting level to buy. In the event of the pandemic having a negative effect, we would probably be looking at falling yields and thus rising bond prices. A further weakening of the yuan would affect the performance of the fund. Generally speaking, investors should plan on a holding period of at least six years.

Benefits for the investor

- The third-largest bond market of the world becomes accessible

- Possible appreciation of the currency

- Chance of long-term attractive return and high annual dividends

Risks to be aware of

- Rating downgrades may cause the fund share price to fall

- Capital market constraints

- Due to the investment in foreign currency, the share price of the fund may be affected by currency fluctuations

- Capital loss is possible

Until full authorisation by the local authorities, our goal is to achieve a comparable risk/return profile via the exposure to offshore bonds on the international market in Hong Kong

Warning notices pursuant to the Austrian Investment Fund Act of 2011

As laid down in the fund terms and conditions approved by the Austrian Financial Market Authority Austria, ERSTE BOND CHINA intends to invest more than 35% of assets under management in securities and/or money market instruments from public issuers. For a detailed list of these issuers, please refer to section II, item 12 of the prospectus.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.