The environment on the financial markets has become a bit bleaker. Growth rates of industrial output and the survey-based indicators for economic growth are falling, while the trade conflict between the USA and China and the tense geopolitical situation in the Middle East has caused the risk for global growth to increase further.

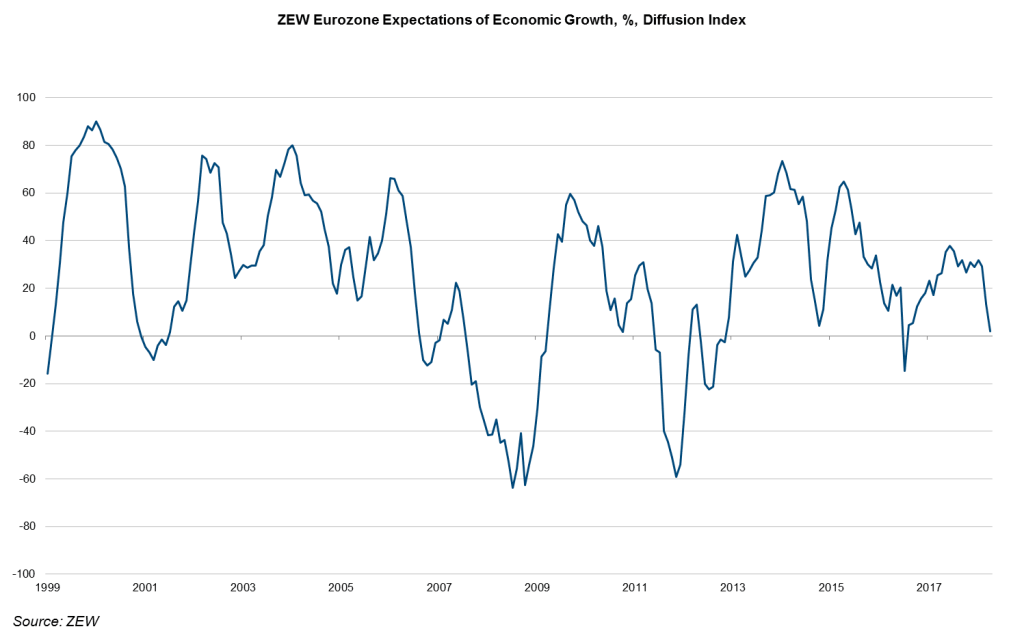

The ZEW economic expectations for the Eurozone, USA, and Japan have decreased again in April. The report has been published by ZEW, the Centre for European Economic Research, which is based on surveys of financial market experts regarding their economic expectations. This indicator is used less to derive future economic developments, and more to assess the current sentiment of market participants.

It currently shows that the sentiment has turned a bit bleaker. Will the environment remain generally supportive to risky asset classes?

Growth “pothole” in Q1

Worries over a sustainable decline in global economic growth have been on the rise since the middle of Q1. The goods sector in particular has recorded a decrease in growth rates. This affects both industrial output and retail sales. However, a range of arguments suggest that we have seen a “pothole” in Q1 rather than a weakening trend. Q4 recorded very strong growth on a global scale. In fact, this constituted the final point of the accelerating growth rates that we had seen from mid-2016 until the end of 2017. A decline in the wake of high growth rates comes as little surprise. Also, the labour market has continued to improve across many developed economies. More and more unemployed people are finding jobs, with unemployment rates falling further. We can also see an increasing number of signals that suggest a slight rise in wage growth. The combination of higher wage growth and more employment will support income and thus consumption. In addition, the leading indicators for capex, such as order intake for long-term capital goods, suggest only a small decline in growth for Q1 after a very strong Q4. In the base case scenario, the stabilisation of private consumption and the strong capex will put a halt to the deceleration of growth in Q2. In this context, the increase in retail sales growth in the important economies USA and China is encouraging.

Mild increase in inflation

The leading indicators for inflation suggest mild upward pressure. The underlying inflation is still too low in the developed economies, i.e. below the central bank target. However, cyclical inflation pressure is on the uptick. Generally speaking, the longer the unemployment rate is below the so-called structural unemployment rate, the more the growth rate of wages increase. In the USA, this has been the case for about a year. The worries cropping up in 2018 about an imminent, significant increase in inflation have not materialised. This has calmed market participants. However, the increase in the prices of goods and in wage inflation indicate a slight increase in the underlying inflation across the important economies in the coming quarters.

Slow exit from expansive monetary policy

The central banks are going through a slow exit from the very supportive monetary policy. The most important central bank, the US Fed, will increase its Fed funds rate two to three time still this year. In the current quarter, the central banks in the UK and in Canada might also continue hiking their rates. In the Eurozone, the signals by the ECB suggest an end of the net bond purchase programme until the end of the year at the latest. Generally speaking, the monetary policies have become less supportive, because economic growth has turned less self-supporting. The market participants are already wondering at what point the monetary policies will switch from increasingly less expansive to restrictive, i.e. at what point they will start dampening economic growth. The Fed has indicated a moderately restrictive level of the Fed funds rate in its projections. It expects its Fed funds rate around 3.4% at the end of 2020. The neutral key-lending rate is estimated to be in the region of 2.8%.

Risk factor politics

The price fluctuations in response to the bleaker situation on numerous political levels would suggest that politics are sometimes more important for pricing on the capital markets than the economic framework. The tariffs announced for Chinese imports to the USA and US imports to China, the sanctions the USA imposed on Russia, and the intensification of the tensions in Syria have trivial effects on the future growth. In all three cases the risk lies in the possible escalation, which could mean a trade war, cyber-attacks, or even a large-scale fire in the Middle East.

Increased spreads

The spreads have increased. Economic growth could experience a weakening trend. Inflation could eventually jump up after all. The central banks could raise key-lending rates too quickly by too much. Central bank liquidity could drop too fast, and the trade and geopolitical conflicts could escalate.

The deterioration of the environment is not sufficiently strong or clear to topple the base case scenario: global boom phase, low inflation, supportive monetary policies. However, the increased risks and the heterogenous economic and political developments have translated into widening spreads and volatility. Generally, the environment remains positive for risky asset classes. But the optimism of investors has been dented.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.