Last Friday saw the launch of Black Week, which marks the start of the holiday season in the US retail sector. Traditionally, the Black Friday and Cyber Monday sales after Thanksgiving are regarded as a prelude to the high-turnover weeks towards the close of the year. However, while the annual retail tradition provides buyers a wealth of offers and discounts, it is above all a benchmark for the US economy’s most important pillar.

Underestimated economic driver

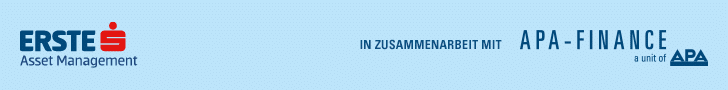

Consumer spending by private households accounts for around two-thirds of the US’s total GDP, according to data from the Bureau of Economic Analysis, as much as 68.1 per cent in Q3 of 2019. This figure has remained consistently high over the past few years and is regarded as a reliable pillar of economic performance, particularly in times of otherwise less pronounced economic growth.

Apart from the macroeconomic view, this time is particularly important for investors in large retail groups. High turnover favours attractive dividend opportunities, and so investors are also looking forward to holiday season. This year, however, the landscape is showing mixed results.

Varying baselines for retail shares

In view of the tough competition, Amazon, the world’s largest online retailer, is expecting significantly weaker business in the important last quarter than stock market experts project. For the quarter that includes Thanksgiving and Christmas, the Group expects net revenues of between USD 80bn and 86.5bn. Analysts’ expectations have been lying at USD 87.37bn.

On the other hand, Wal-Mart, the largest US retailer, performed better than expected in Q3 thanks to booming online sales. Between August and October, profits increased more than 90 per cent to USD 3.3bn year-on-year.

Indicators point to solid consumer spending

According to the latest data from the Washington Department of Commerce, US retailers were able to increase their sales slightly in October, with revenues increasing 0.3 per cent month-on-month – slightly higher than economists’ expectations. In previous months, sales had been significantly stronger, in some cases surprisingly.

However, according to the Conference Board research institute, the mood among US consumers unexpectedly deteriorated in November. The corresponding barometer fell from 126.1 points in October to 125.5 points – experts had expected an increase.

Nevertheless, the Federal Reserve’s (Fed) economists remain confident overall: “At this point in the long expansion, I see the glass as much more than half full,” said Fed chairman Jerome Powell recently. This can also partly be attributed to private consumption, which rose by 2.9 per cent in Q3 – which means that everything should be set for a holiday season that is not only enjoyable fo consumers and economists, but also for investors.

Note: Past performance is not indicative of future development. Date: 29th of November

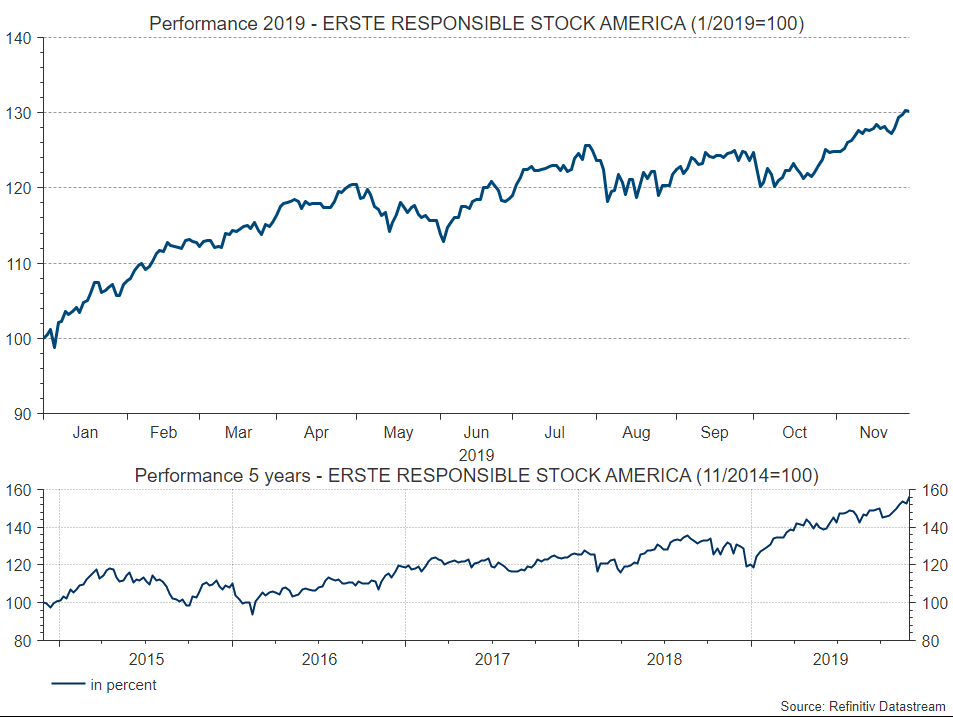

ERSTE RESPONSIBLE STOCK AMERICA: “good conscience” on US equities with good opportunities

Consumer stocks also play a role in ERSTE RESPONSIBLE STOCK AMERICA. This fund, which focuses on US and Canadian equities, is invested in listed companies of all sizes. The selection of shares eligible for the fund is based on the sustainable criteria of Erste Asset Management. Stocks such as Procter & Gamble, Pepsi or the payment company VISA are currently prominently represented in the portfolio. The ERSTE RESPONSIBLE STOCK AMERICA offers the opportunity for high increases in value as this year and in the last 5 years. As an investor, you have to be aware of the fact that stock prices can fluctuate strongly at any time and that a loss of capital is also possible. A longer holding period of at least 6 years is therefore recommended.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.