Autumn is always a time of numerous events on the capital markets. It is not without reason that, historically, October is the month with the highest volatility on the equity markets. 2024 will be no exception to history in this respect, given the sheer volume of relevant data and topics that are currently or will be occupying the markets in the coming weeks.

There is the geopolitical situation: the Russia-Ukraine conflict seems far from an imminent solution and the fuse on the Middle East powder keg has recently been noticeably shortened with Iran’s entry into the conflict. The already tense situation could become even more explosive depending on the outcome of the US elections on 5 November. A second presidency of Donald Trump is unlikely to simplify the global situation.

Turnaround finally!

Speculation about the US Federal Reserve’s first interest rate cut has been going on for months, but the data available to date did not suggest that a turnaround in interest rates was opportune. On the one hand, inflation had remained extremely persistent for longer than expected, and the US labour market in particular showed no signs of weakness despite interest rates being at their highest level in over 20 years.

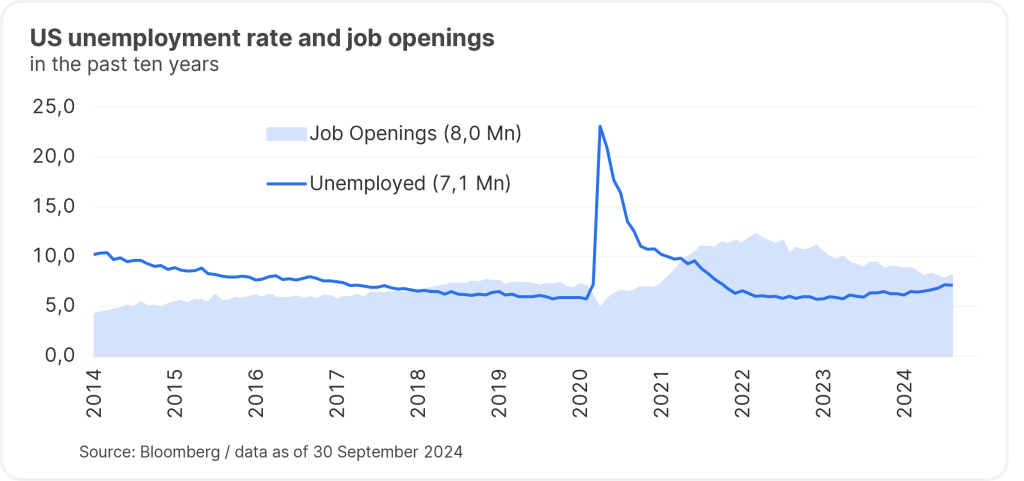

On 18 September, however, the time had come, and Jerome Powell surprised the markets by cutting the Fed funds rate by 50bps. Normally, interest rates are adjusted by a quarter of a percentage point, which is why the move came as a surprise to market participants. The slight weakening of the labour market over the summer months prompted the central bankers to take this step. As you can see from the chart below, the number of unemployed Americans has risen noticeably of late, while the number of openings has fallen. As a result, the unemployment rate rose from 3.4% in January 2023 to 4.2% in August 2024.

You would think that this should not really be a cause for concern, as the USA is thus still close to full employment. That being said, history shows that a slight increase in unemployment has always been followed by a sharp increase. Unlike the ECB, the Fed has a dual mandate. In addition to price stability, the Fed must also ensure full employment. Jerome Powell’s interest rate move therefore signals that the future interest rate path will be increasingly characterised by labour market risks and that the Fed wants to guard against a possible stronger economic slowdown.

It should still be noted that the US economy remains in an extremely robust state. The latest revisions to US income growth attest to the good shape of US consumption, which is important for the economy as a whole. Falling interest rates should provide further impetus, so we continue to expect a soft landing for the US economy.

Complaints from a comfortable situation?

Interest rates will (have to) continue to fall in Europe as well. Unlike in the past, the ECB responded relatively quickly this year, cutting key-lending rates twice in June and September. Recently, however, the ECB has been keen to convey a more restrictive stance. This is likely to change in view of the situation in the USA and the disappointing growth indicators in the meantime. The market is currently expecting two further interest rate hikes by the end of the year.

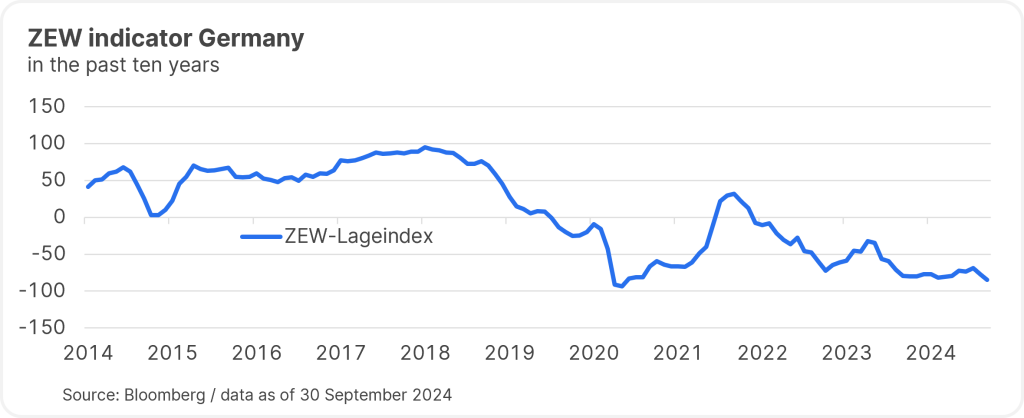

Lower interest rates are sorely needed in both Austria and Germany in particular. Both countries are in recession, and without the Southern member states such as Spain or Italy, which are benefiting from a booming services sector, the entire Eurozone would probably be in an economic contraction phase. The chart below shows that the German ZEW indicator fell to -84.5 in September, a similarly low level to that seen at the peak of the coronavirus pandemic in 2020.

At that time, however, the entire country was in lockdown, unlike today. Political frustration with the paralysing coalition government of Social Democrats, the Free Democratic Party, and the Greens and the latest bad news from Volkswagen, for example, are obviously leaving their mark. The world’s largest carmaker in terms of sales is considering plant closures in Germany for the first time in the company’s history, which would put up to 30,000 jobs at risk. This development certainly shows that the German automotive industry and indeed the country’s entire economic and industrial policy have missed important trends in recent years. However, it is doubtful whether the current situation can be compared to the beginning of the coronavirus pandemic.

Not everything bad

With such negative news coming out of our home region, it is very easy to project the negative development onto the whole of Europe. However, we should like to point out that the economic development of the Eurozone exceeded initial expectations, especially in the first half of the year. Also, at 6.4%, the unemployment rate in the Eurozone is lower than ever before, while at the same time savings rates are extremely high. The current economic situation should certainly not be sugar-coated, but it is definitely positive from a fundamental perspective. This is because falling interest rates should also significantly reduce the savings rate again, which in turn should lead to a noticeable revival in consumption and thus also in the economy as a whole.

China’s massive stimulus package, which was approved at the end of September, also offers further potential for growth. The media even referred to the “Chinese bazooka”. Ongoing deflation concerns and increasingly weak economic indicators, which made it increasingly unrealistic to achieve the annual growth target of 5%, apparently prompted the Chinese leadership to take this decisive step. Whether the current cuts in the key-lending rate, the reduction of the minimum reserve rate for banks, and the support for the ailing real estate and equity markets will be enough remains to be seen. Either way, the government has indicated an increasing willingness to implement further support measures.

Too close to call

It is no secret that American election campaigns revolve to a large extent around show and staging – but even the best Hollywood scriptwriters could not have come up with what this year’s election campaign has to offer. First, an incumbent president who, despite cognitive lapses, did not want to withdraw from the race – until he did. Followed by a former president who only just escaped an assassination attempt and polarised in his usual manner. And a sitting vice president who was able to quickly gain the upper hand and now has a good chance of becoming the first female president ever – and with African-American and Indian roots at that.

The race for the White House

Useful information and insights on the

US election 2024 on our blog.

However, as explained in the introductory article, three weeks before the election there is no clear favourite for the presidency. Kamala Harris’ campaign has noticeably lost momentum compared to the first few weeks – Trump has already proven that he is an election campaigner in the race against Hillary Clinton. It will therefore be a close neck-and-neck race with an uncertain outcome.

From a European perspective, the incumbent vice president would probably be the preferred winner – Harris’s foreign policy orientation would be comparable to that of Joe Biden and therefore the direct effects on Europe would also be marginal. In the long run, the direct effect of the presidency on the capital markets and the local economy is negligible anyway, despite the massive media coverage. Regardless of who resides in the White House in January 2025, a congressional majority is needed to push through far-reaching domestic policy changes, and from today’s perspective, both Harris and Trump would likely govern under a divided Congress.

Diversification remains top priority

Even if the long-term effect is negligible, the capital markets will still be focusing on the upcoming presidential election in the coming weeks. Uncertainty is toxic for the capital markets, and any post-election ambiguity or potential non-recognition of the result would pose a sensitive residual risk. Regardless of the election, the aforementioned economic slowdown and, above all, the escalating conflict in the Middle East remain the dominant sources of uncertainty.

The density of events is enormous and therefore fluctuations would be unsurprising – diversification remains important. However, we are still entering the final quarter of the year in a positive mood.

Please note: Investing in securities involves risks as well as opportunities.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.