Over the past three years (2015-2017) the ATX, Austria’s main equity index, posted an annual return of more than 16%, making the Vienna Stock Exchange the best performing European stock market (or second best, if Eastern Europe is included).

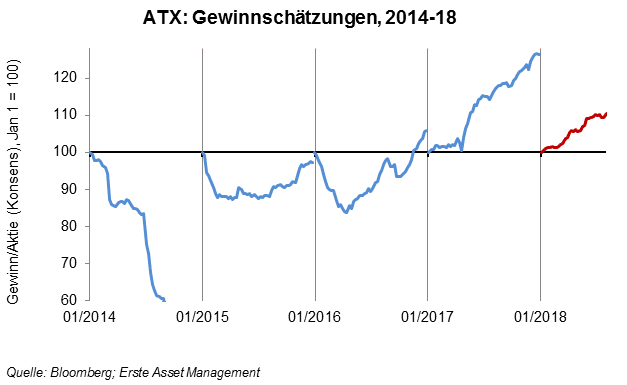

In a way, this stellar performance simply reflected mean-reversion given the ATX’ massive underperformance versus broader European indices over the previous four years. However, the rebound was not purely technical but backed by fundamentals. From 2015 to 2017, earnings of Austria’s listed corporate sector more than doubled, mostly helped by a recovery of profits in the banking sector.

5 reasons why 2018 has been more muted so far

Year-to-date (to July 31), the ATX was flat, similar to the broader European market (Euro Stoxx 600), which posted a small gain of 0.6% over the same period. The weaker performance of the Austrian market in the current year does not come as a surprise. A number of factors that supported the market in recent years have faded:

- Earnings growth has slowed markedly and is expected to reach c.9% in 2018 and c.8% in 2019 according to Factset data, which is just in line with the European average.

- On the growth-versus-value spectrum the Austrian market is tilted toward value relative to the broader European stock universe, reflecting the high share of financial stocks and the lack of technology stocks in the Austrian listed universe. Globally, as well as in Europe, the value-factor has underperformed the growth-factor this year.

- Possibly related to the second point above: the ATX tends to underperform its European peers whenever interest rates are falling. Since February, German 10 year government yields shed more than 30 basis points, which has not helped the ATX.

- Many investors view Austria as a play on Eastern Europe, which is no surprise, given the substantial exposure of many Austrian companies to the region. As a result, the ATX tends to outperform broader European indices whenever Central & East European stock markets do well – which has not been the case in 2018. The main Polish index has lost 6% in the first seven months, Hungary was down almost 9%, and Russia’s RTS-Index (a USD-based index) was flattish.

- For reasons that may have less to do with fundamentals but more with investor sentiment and risk perceptions, the relative performance of Austria’s equity market tends to be negatively correlated with USD strength. The 7%-gain of the USD spot index since February, therefore, has not helped.

Improving near-term outlook

That said, for a number of reasons, the outlook for the remainder of year is encouraging. Austria’s macroeconomic backdrop is sound and political conditions seem more stable than in some of the neighboring countries. Only recently, the central bank lifted its growth forecast for the current year to above 3%, which is well above the European average.

Moreover, while earnings growth has slowed relative to 2017, the earnings forecasts for 2018 have drifted higher during the year. At the beginning of August, the consensus index EPS (ATX) for 2018 was 10% above its initial level at the beginning of the year.

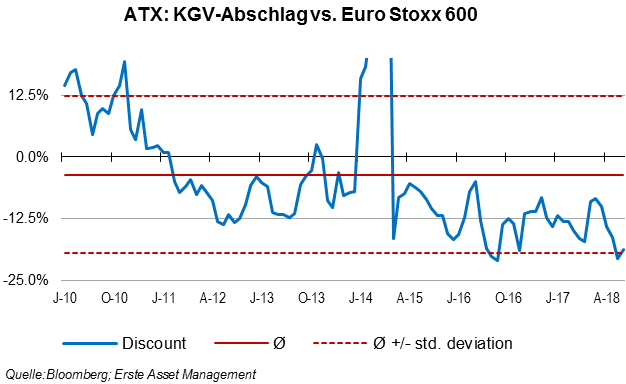

As a result of the market moving sideways, while earnings have been upgraded, valuation has become more attractive for investors. With a forward price-earnings ratio of slightly above 12x, the Austrian market is cheap relative to its peers. To a certain degree, this reflects the fact that the market’s underlying ROE has been the lowest in Europe. However, the current valuation discount (based on the earnings multiple) to the Euro Stoxx 600 universe is close to 20%, which is one standard-deviation below the average discount for the past eight years and stands at the highest level since August 2016.

Bottom-line:

After three outstanding years, the Austrian stock market has fallen in line with its European peers in terms of earnings growth and performance. Sentiment in the first half of year was not supportive for a market with a value and a small-cap bias. However, country fundamentals, earnings revisions and valuation all suggest that Austrian stocks could fare well for the rest of the year – provided the global backdrop for risky assets will not be further hampered by trade wars, accelerating US inflation or Chinese economic woes – just naming the main risks that could derail markets in the near future.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.