At a time when Covid-19 is ravaging the global economy, 15 Asia-Pacific countries signed the Regional Comprehensive Economic Partnership (RCEP) at a virtual Summit on November 15. The RCEP is a meaningful achievement for regional cooperation and a historic milestone in the globalization process. The RCEP is expected to come into force in the second half of 2021.

Who is involved?

The RCEP is made up of 10 Southeast Asian countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam), as well as China, Japan, South Korea, Australia and New Zealand.

India was involved in early negotiations but chose to withdraw last year. There was a fear in India that its industries would be unable to compete with China and lower tariffs could hurt local producers. As one of the original negotiation partners, India can join the RCEP at any time once the deal comes into effect.

The Regional Comprehensive Economic Partnership (RCEP)

Source: World Bank

Why is the RCEP important?

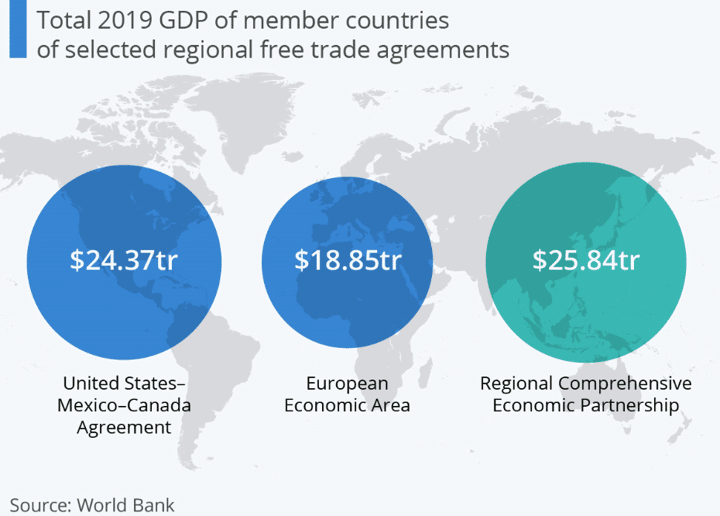

The RCEP marks the world’s largest Free Trade Agreement (FTA), covering a market of 2,3 billion people with a combined size of US$25,8 trillion or 30% of the world’s GDP. It will form a single goods and services trading market in the Asia-Pacific region with tariff elimination of at least 92% of goods traded amongst participating countries. More than 65% of services sectors will be fully open with increased foreign shareholding limits including in Professional Services, Telecommunications, Financial Services, Computer, Distribution and Logistics Services. The pact’s rules of origin set common standards for how much of a product must be produced within the region for the final product to qualify for duty-free treatment. It will make business more predictable for companies to set up supply chains that span several countries and encourage companies to invest more in the region.

Beyond its economic value, the RECP is an indication of Asian region’s political mindset toward closer regional relationships and less dependent on outside assistance. The RCEP brings together countries that have sensitive diplomatic relationships. China, South Korea and Japan, for example, are for the first time under one trade agreement.

Who is likely to benefit, who not?

The RCEP will significantly boost trade and economy in the Asia-Pacific region. According to a research of the Peterson Institute for International Economics, a think-tank in Washington, the RCEP will add $186 billion to the world economy and 0.2% to its members’ GDP on a permanent basis. These benefits will go largely to China, Japan, and Korea, with gains of $85 billion, $48 billion, and $23 billion, respectively. Other significant RCEP winners will include Indonesia, Malaysia, Thailand, and Vietnam.

RCEP – World’s largest trade bloc

The RCEP also offers a win for China politically, because it enabled China successfully positions itself at the center of the Asia-Pacific region’s trade and investment networks.

The United States bailed on the Trans-Pacific Partnership (TPP), a major trade deal that would have enhanced relationships with several countries in the Asia-Pacific region, including Japan, Australia, Malaysia, Singapore and Vietnam, when Trump took office. The withdrawal significantly diminished US influence in Asia-Pacific economic diplomacy. It is likely that the Biden administration will change Trump’s policies in dealing with Asia, but it is still not clear if the US will join any trade agreement again in the region.

The pact does not include Taiwan, another important economic player in the region. Trade represents 62% of GDP in Taiwan. And RCEP member nations’ trade with Taiwan accounts for 58% of Taiwan’s total trade. Taiwan will face increasing competition in its important export markets such as China and South Korea. More Taiwanese companies may have to relocate their production facilities from Taiwan to Southeast Asian countries.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.