[klapptext headline=”Longterm Outlook”]

You need a mixture of history, economics and politics to hear through the everyday noise and recognize the big trends of the future. In our new series, Erste AM’s investment team identifies those factors that will determine the next 10 years.

First Text: the next 10 years[/klapptext]

Digitalization and its impact on economy or how to invest in the world of Industry 4.0

Industry 4.0 [i]is a term first time used by Klaus Schwab, head of World Economic Forum, during annual summit in 2015. Represents a combination of traditional manufacturing industrial platforms and practices using smart technologies. Primarily focuses is on Large scale machine to machine (M2M) communication and Internet of things.

Fourth industrial revolution, as it refers to, uses Internet of things and Cyber – physical systems such as sensor to collect vast amount of data that can be used by manufacturers and producers to analyze an and improve their work.

KPMG has estimated that the components market of industry 4.0 are estimated to $4 trillion in 2020. What we can expect over next decade is

- Impact on business, anticipated disruption on traditional business, new technologies create new way of serving existing needs

- Impact on government, enable citizens to engage with government, voice opinions, coordinate effort

- Impact on people, replacement rather than displacement, it will affect identity of people, notions of ownership, consumption patterns.

ECB survey on Digitalization and its impact on the economy[ii] describes digitalization as a technology/supply shock which affects economy aggregates, notably competition, productivity and employment. Outcome from 74 leading non-financial companies representing 3.7% of EU output and 1.7% employment is clear.

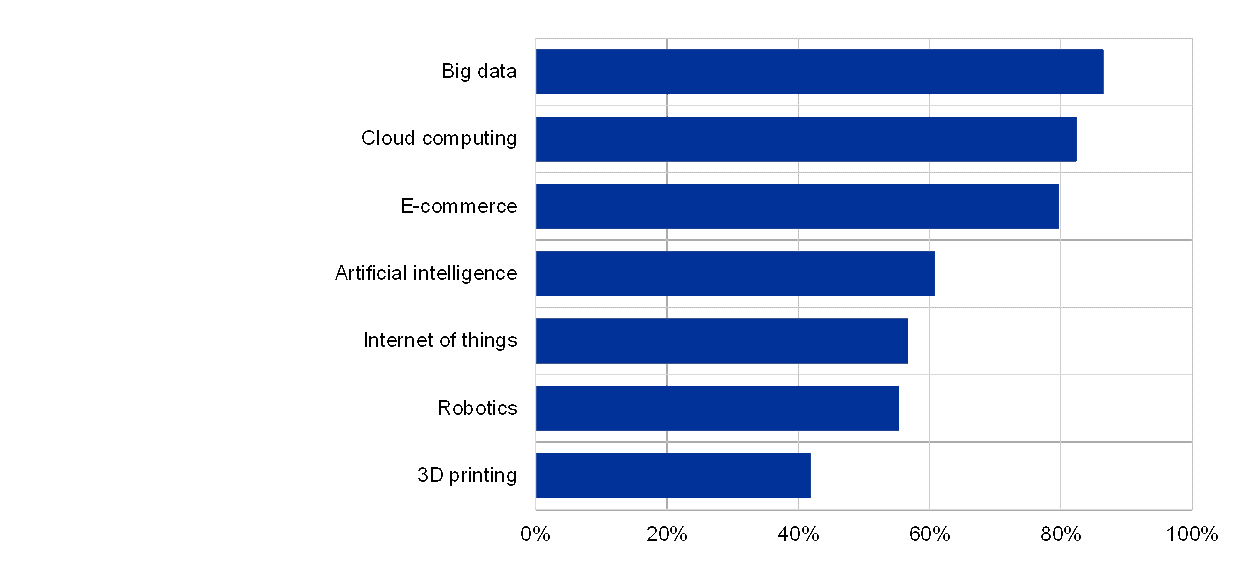

Big data and Cloud computing employ more than 80% of companies. There is positive impact on sales. Digitalization gives price flexibility, ability to differentiate prices across markets. Easier sharing of knowledge in/out of a company and more efficient production will increase productivity.

Surprisingly, effect on employment is rather on replacement not displacement of people with strong focus on development of critical skills.

Picture: Take-up of digital technologies

Source: Elding, Morris: Digitalisation and its impact on the economy: insights from a survey of large companies

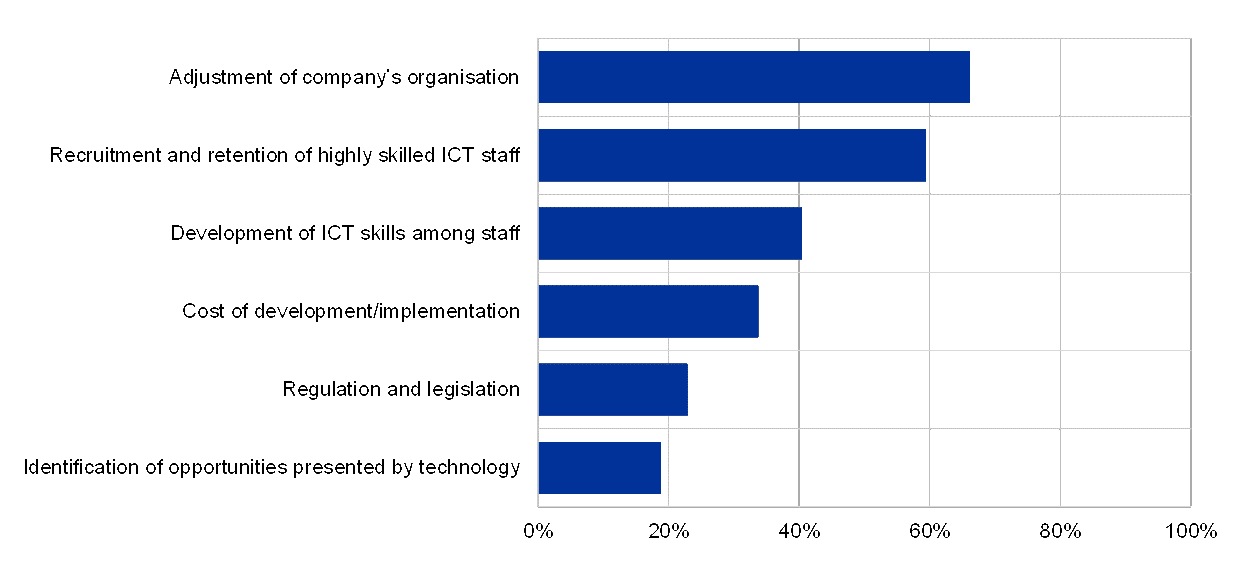

Moreover, in order to take reasonable action (buy or sell a company), we should analyze in detail obstacles of digitalization. Once a company is open to communicate difficulties to implement digital technologies it is a proof of digitalization progress within a company.

Necessity to adjust company organization, recruiting of highly skilled staffs, troubles to align with regulation due to changes taken could be a sign of future profitability. Vague reporting of digitalization and simple reporting on increased R&D cost might be sign of zombie company that do not have a positive prospect.

Picture: Obstacles to the adoption of digital technologies

Source: Elding, Morris: Digitalisation and its impact on the economy: insights from a survey of large companies

I intentionally avoid FinTech and BigTech companies which are on one hand in the focus of investment community and public, on the other hand they are only a part of the story. Many times, progress in digitalization is roughly measured by market capitalization of FAANG stock, that is misleading.

Special case of digitalization represents crypto-currencies. There is evidence that Bitcoin[iii] is probably mean of payment for illegal activities and not complaint with ESG criteria. But blockchain as a distributed ledger technology is very promising in the future due to ability to digitalize of real assets.

Key takeways:

-

Industry 4.0 will provide better efficiency for companies in all sectors of economy and successful companies will pay higher returns on investments.

-

Fintech and Bigtech companies are only part of the Industry 4.0 story.

-

We must define metrics to identify winners. The proof of success is not in positive headlines, the proof is in ability of the company to change org chart if necessary, hiring skilled people, fighting against regulator, because there is no gain without a pain.

[i] https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-to-respond/

[ii] Elding, Morris: Digitalisation and its impact on the economy: insights from a survey of large companies

[iii] Foley,Karlsen, Putniņš: Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed Through Cryptocurrencies?

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.