Global equities have made gains. This was due to the agreement of EU leaders on the reconstruction fund and promising results of a vaccine study.

After days of sometimes bitter debate, EU leaders agreed on a EUR 750bn package to finance aid measures. The package includes EUR 390 bn in direct grants and EUR 360 bn in loans. The grants are thus well below the EUR 500 bn initially demanded by Germany and France. In return, the “Thrifty Four” (Austria, Sweden, the Netherlands and Denmark) were able to obtain discounts on their annual EU membership contributions.

The Asian markets therefore grew overnight, for example the Japanese leading index Nikkei rose by 0.7%. The US and European markets were also clearly up yesterday. The S&P 500 and the EuroStoxx 50 closed at +0.8% and +0.7% respectively. Yields on investment grade government bonds changed little. Gold rose to 1822 USD.

What will we see in the coming weeks?

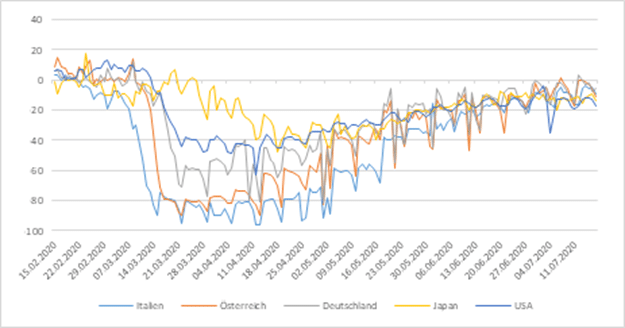

The recovery after the global lockdowns is continuing, but seems to have reached a plateau. This is indicated, for example, by mobility trends, which measure visits to places such as restaurants, cafes, shopping malls, amusement parks, museums, libraries or cinemas.

As a result of the lockdown measures, there was a significant drop in customer frequency in retail and leisure facilities in March and April. With the easing of these measures, a recovery set in from May onwards. This continued into June, but now appears to have reached a level slightly below the starting point. This lower level poses a risk for a rapid, full recovery and may be the trigger for secondary effects, which we have reported on several occasions.

We will continue to closely monitor the development of these “alternative” data in the coming weeks, as well as “classic” indicators. The latter will be in focus this week with the release of the Flash PMIs.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.