The automotive industry, like other sectors, has been hit hard by the corona crisis and experienced a historic drop in sales. The European manufacturers’ association ACEA recently reported dramatic slumps in car registrations: in April, 270,682 new cars were registered in the EU, 76 per cent less than in the previous year. According to ACEA, this is the sharpest monthly decline since records were established.

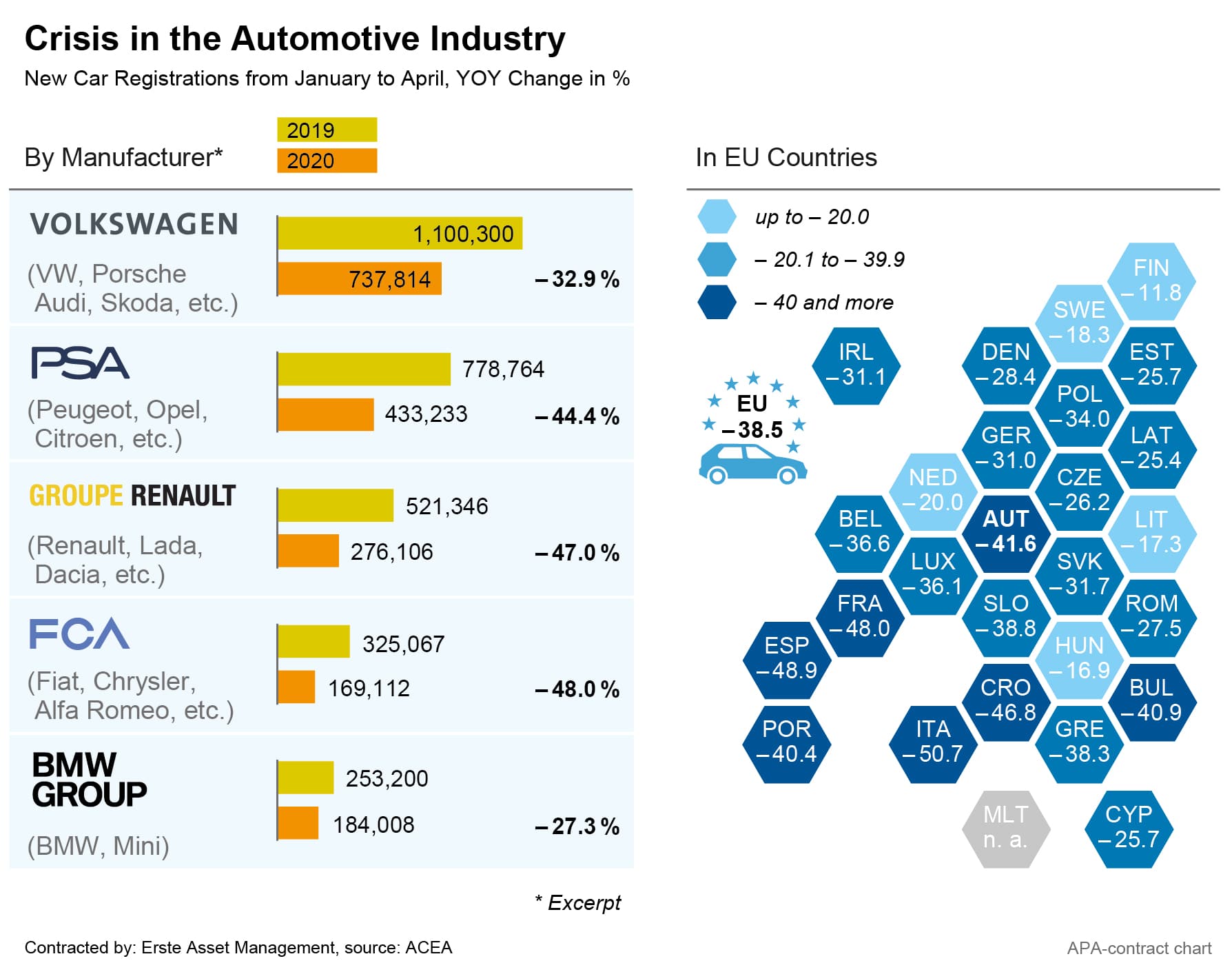

A total of 2.75 million new cars were registered in the EU between January and April, a drop of 39 per cent compared to the same period last year. The reason was the almost complete standstill of both car production and trade as a result of the measures taken to contain the pandemic.

In Austria, the decline in new car registrations in April was somewhat less severe, at just under 65 per cent; however, from January to April the slump in the domestic car market was comparable to the EU average at around 42 per cent.

Sharpest drop in new registrations in Italy and Spain

The decline was most severe in the countries that were hit exceptionally hard by the pandemic: In April, new registrations came to a virtual standstill in Italy with a drop of 98 per cent and in Spain with a drop of 97 percent. From January to April combined, new registrations in both countries dropped to around half of the previous year’s figure. The decline in Great Britain, now no longer part of the EU, is similarly dramatic, with a 97 per cent decline in April and minus 43 per cent from January to April. In Scandinavia, on the other hand, where restrictions on public life were less severe, sales in April dropped by only around a third.

The major European automobile manufacturers were also affected by the slump. Between January and April, new automobile registrations from the groups Fiat Chrysler (48 per cent drop), Renault (47 per cent), Peugeot (44 per cent drop) and Volkswagen (33 per cent drop) declined severely. The drops Japanese manufacturers Mazda (54 per cent) and Honda (51 per cent) experienced were even more dramatic. By comparison, Toyota (24 per cent drop) and Volvo (29 per cent drop) got away with a slap on the wrist.

Europe’s largest car manufacturer, Volkswagen, recently reported a drop in sales in Germany of around two thirds in April. This means that the German domestic market has held up reasonably well compared to other European countries, said VW brand sales director Jürgen Stackmann in a telephone conference with journalists. Across Europe, sales of the VW brand dropped by more than 83 per cent. In the countries most affected by the pandemic – Great Britain, Italy, Spain and France – virtually no cars were sold in the last month.

Despite the crisis, electric cars are still in demand. According to a study by the Center of Automotive Management, the number of newly registered electric vehicles in Germany doubled to 63,000 from January to April compared to the same period in the previous year.

Rapid decline worldwide, but a ray of hope in China

All over the world, car sales are currently falling rapidly. In the USA, where the coronavirus crisis is currently in full swing, sales dropped by 47 per cent in April. In Brazil, where the virus is also rampant, sales slumped by 77 per cent.

The only ray of hope is China, where the car market is now recovering after the corona crisis. Following a collapse of the Chinese car market after the turn of the year, April sales figures allow cautious optimism for the first time since then, especially as the government has taken various measures to revive the car economy.

In February, car sales in China collapsed by almost 80 per cent, in March the decline was still at 40 per cent. In April, however, according to data from the China Passenger Car Association (PCA), sales recovered to only a 5.5 per cent minus. The figures of the China Association of Automobile Manufacturers (CAAM) show a slight decline of only 2.6 per cent for April. The CAAM records the sales of manufacturers to dealers, the PCA counts sales to end customers. China’s largest car manufacturer SAIC now expects car sales to increase in the second quarter thanks to a recovery in demand and government support.

However, the year 2020 as a whole is still likely to yield significantly red figures for China’s car market. The industry association CAAM expects sales in China to drop by up to 25 per cent for this year. If the corona pandemic can be contained, the blow could be cushioned to around 15 per cent, according to CAAM. This would mean that the world’s largest car market would shrink for the third year in a row. The Chinese market already yielded weak results in the past two years due to the tariff dispute with the USA and the sluggish economy.

China’s car market is likely to shrink in 2020 as a whole

This also affects German automotive groups Volkswagen, BMW and Daimler, for whom China is the most important single market. However, in view of the latest sales figures, Volkswagen expects to achieve the previous year’s sales in China again in May.

“It is clear that China will be going through a V-shape,” said Volkswagen’s Head of Sales Stackmann with regards to the recovery curve. This describes a rapid decline at the outbreak of the pandemic, followed by a very rapid increase in passenger car sales. However, Stackmann does not see such a development for Europe.

Recovery is likely to take some time, particularly in Southern Europe.

The situation should ease up in May

In May, the situation in Europe should ease somewhat, as many countries have already relaxed their restrictive corona measures. Nevertheless, industry representatives and consultants believe that an economic stimulus package is necessary to revive demand.

Many people are likely to be cautious in the face of the economic crisis, postponing expensive new purchases. According to experts, the relaxation and reopening of car dealerships will therefore not yet be reflected in higher sales figures.

However, the German auto industry cannot expect immediate economic stimulus packages right now. Manufacturers, dealers and customers will have to wait until June for a decision from the government on whether the state will pay the car purchase bonuses the industry is clamouring for to help it get back on its feet.

Our dossier on coronavirus with analyses: https://blog.en.erste-am.com/dossier/coronavirus/

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.