Climate change is back in the limelight. Not a day passes without someone pointing out the consequences of global warming and possible solutions being discussed on an economic and political level. Is climate change just a fashionable buzzword, or is there more behind it? The changes can be felt across numerous business sectors already. The financial industry and its investments provide leverage to drive the decarbonisation of the economy and a turn towards renewable energy.

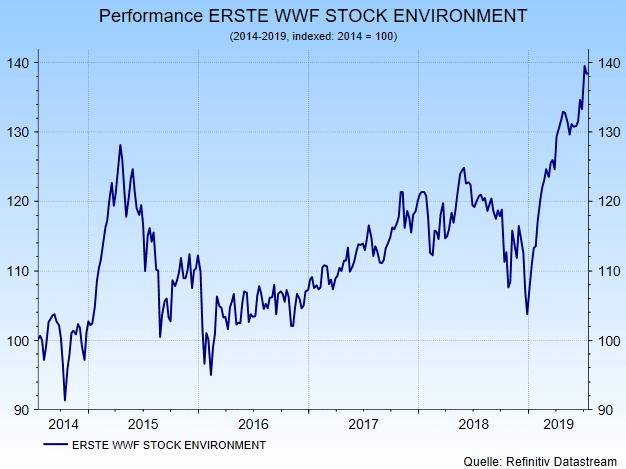

Erste Asset Management has been focused on today’s and tomorrow’s environmental technology for almost two decades. Investors can participate in the most exciting companies and at the same time contribute to the protection of the environment and the fight against climate change by buying shares in the ERSTE WWF STOCK ENVIRONMENT fund. In this Erste AM blog interview, fund manager Clemens Klein describes the consequences of the demographic development, what new environmental technologies look promising in terms of their possible applications, and how investing in the most promising technologies supports the environment.

Is climate change a fashionable term or a reality we have to face?

Clemens Klein: You don’t have to exhaust your imagination to see that our climate has been changing. Floods, droughts, the devastation caused by hurricanes, air pollution in the big cities – the natural disasters have been piling up in recent years. They remind us how important it is to contain the emission of greenhouse gases and to engage in sustainable economies.

Have the Paris Climate Summit and its insight that the maximum temperature increase has to be below 1.5 degrees Celsius for us to be able to prevent a climate catastrophe been nearly forgotten?

Clemens Klein: No, these learning points haven’t been forgotten. The mere fact that in many countries climate protection has become a central issue in political discourse shows that things are shifting. The Paris Agreement was an important guidepost and has laid down the basis and the regulatory framework for the necessary measures. What we are still missing is the swift implementation on the level of individual countries. But the pressure on politics to implement the Agreement is growing continuously among the population. And ultimately, there is no way around it: the global population will be growing to about 10 billion people by 2050, and to about 11 billion by 2100 (currently: 7.7 billion).

Africa and Asia, which will jointly account for about 80% of global population around the next turn of the century, are the drivers of this population growth. There is also the trend towards urbanisation and the resulting increase in income: today, 55% of people live in cities. By 2050, this share will increase to 70%. The people living in the cities need power, water, transportation, and their consumption is increasingly following Western patterns, causing mountains of waste. We therefore need new technologies to deal with those challenges.

How credible are you as asset manager when it comes to cutting carbon dioxide? What aspects do you take into consideration in your investment decision?

Clemens Klein: Erste Asset Management was the first investment company in Austria to sign the Montréal Carbon Pledge in 2015. This international investor initiative was launched at the end of 2014 with the goal of contributing to the reduction of greenhouse gases in the long run by measuring and publishing the CO2 emissions of the companies held in equity funds. Meanwhile, this initiative has grown to more than 120 investors who manage assets worth more than USD 10,000 bn.

How does ERSTE WWF STOCK ENVIRONMENT differ from other sustainable funds in your company?

Clemens Klein: ERSTE WWF STOCK ENVIRONMENT is a theme fund that focuses exclusively on companies with a business model that is connected to environmental and climate protection. It is our philosophy to identify companies whose products and services are crucial to dealing with the effects of mega trends such as population growth, urbanisation, and middle-class growth and the effects such as greenhouse emissions, climate change, scarce resources, and increased volumes of waste.

Past performance is not indicative of future development.

Just so our readers can picture this: can you tell us the most important themes that are reflected in ERSTE STOCK WWF ENVORNMENT?

Renewable forms of energy:

Renewable forms of energy:

Clemens Klein: Solar and wind power are already the cheapest technologies for power generation across many countries. As a result, the rapid growth of recent years is set to continue, regardless of subsidies. In addition, new markets such as India, South America, and Africa will become key markets for the solar and wind power industry. The share of solar power in total global power production will increase from currently 3% towards 30% by 2050. We envisage a similar development for wind power. In the long run, global electricity will become clean.

Mobility:

Mobility:

New drive technologies such as electric vehicles, hydrogen cars, and third-generation bio fuel will continue to gain relevance. Here, too, falling costs in addition to environmental aspects will lead to above-average growth rates. Nowhere else will the technological progress be monitored with as much suspense as in the next generation of vehicles. According to Bloomberg New Energy Finance, 60% of all new cars bought in 2040 will be electric. The 2016 estimates were at 35%. In Europe, Norway is the leader with more than half of new cars being electric: along with tax incentives, it is possible to use the bus lane, and you do not need a tax disc on the motorway when driving an electric car. But we cannot turn a blind eye to the problems: we need safe, affordable batteries with sufficient range. And we have to sort out where the raw materials for production will come from and what happens to the batteries at the end of their useful lives. Companies have to certify that their suppliers do not use cobalt from the Congo. That would not agree with us as sustainable investors.

Energy efficiency and energy storage:

Energy efficiency and energy storage:

Themes such as the optimisation of energy transport, smart grid, smart metering, energy storage in battery systems, and hydrogen (“power to gas”) are becoming increasingly important on the back of the gradual market penetration of wind and solar power and of the expected strong growth of electromobility.

Water supply and water supply technology:

Water supply and water supply technology:

Global water demand will increase by more than 50% by the year 2050 due to the aforementioned mega trends. Urbanisation and rising income have caused a shift in consumer behaviour. Therefore, new investments in infrastructure, in the reduction of consumption and costs, hygiene, water treatment, and sea water desalination are necessary.

Waste collection and separation

Waste collection and separation

The volume of global waste will have doubled from 2014 to 2025 to 6mn tonnes per day and could rise further to 11mn tonnes per day by 2100. Even now, 8mn tonnes of plastic make it into the oceans every year. This is tantamount to 16 Burj Chalifas, i.e. the highest building in the world, or 32,000 Giant Wheels in the Vienna Prater. Without steps against this enormous explosion of waste, we are facing a situation where by 2050 there will be more plastic than fish in the sea, going by weight. The avoidance, the separation, the collection of waste, recycling, and new packaging technologies will be central issues in the environmental sector.

What criteria does a company have to fulfil to make it on your watchlist? And what has to happen for an asset to be taken into ERSTE WWF STOCK ENVIRONMENT ?

Clemens Klein: It is important to us that the business model of a company benefit largely from the developments we have discussed. New technologies that contribute to the solution of the effects from the aforementioned mega trends are under constant scrutiny and admitted into the portfolio. It comes with the territory that the portfolio also contains many younger and smaller or medium-sized companies.

What is our investment process? At first, we identify companies on an ongoing basis that fulfil the strict criteria of the defined fund strategy. New ideas are presented to an environmental advisory board for admission into the investable universe upon examination by the WWF and an external research partner.

The investable universe is the basis for the decision-making process about admission into the portfolio upon diligent qualitative and quantitative analysis by us as fund manager. One goal (and thus part) of the strategy is to hold the company in the portfolio for long periods of time in accordance with the long trends that they serve with their products or services. Some companies have been continuously in the portfolio of the fund since the launch of ERSTE WWF STOCK ENVIRONMENT 2001.

Themes and weightings are primarily adjusted in the fund in dependence of short- and medium-term developments, macroeconomic factors, and the general market environment. At the moment, the investment focus is on renewable energy, energy efficiency, and e-mobility, which jointly account for more than 60% of the portfolio structure. We can see the biggest growth potential over the coming years in renewable energy and e-mobility. This also includes complementary technologies such as energy storage, autonomous cars, and smart grid, which will benefit from the expected developments.

Can you tell us about some companies in the fund that handle the environment sustainably and whose business processes are environmentally/climate-friendly?

Clemens Klein: Among the biggest positions is for example First Solar, one of the leading companies in the solar industry, TPI Composites, a specialised producer of rotor blades for wind power, Xylem, a leader in water infrastructure, water analysis, and water treatment, and Tomra Systems, the world market leader in waste separation, waste sorting, and recycling.

What other (environmental) technologies play an important role in the fund?

Clemens Klein: Hydrogen and fuel cells, desalination, insulation, and efficient lighting systems. NEL ASA, for example, is an interesting company in power to gas energy storage.

One more thing: high chances of profits come with higher risk. Generally speaking, it is also true for the investment in environmental shares that you need to have a certain willingness to take risks and you should also be able to bear stronger fluctuations.

Info:

Investing in climate protection

The environmental organisation WWF and Erste Asset Management have been in an alliance to fight for climate and environmental protection. ERSTE WWF STOCK ENVIRONMENT, whose investment policy WWF also supports, takes into account economic, social, and environmental criteria. Only companies that take their responsibility seriously when it comes to carbon dioxide emissions and water consumption are eligible for admission into the fund. An investment advisory board with the WWF examines whether the respective company is in compliance with the strict environmental criteria and criteria of exclusion. This alliance also includes the support of the WWF river maintenance and climate protection projects. About EUR 2mn have gone towards environmental protection so far this way.

For more details on our alliance with the WWF please refer to our website:

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.