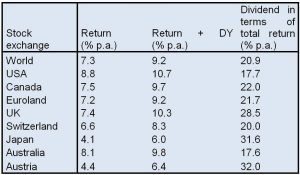

To most people, the notion of the performance of shares relates to changes in the share price. This does not take into account the second component of return, i.e. the dividend. Simply looking at the share price development seems too one-sided to me. After all, dividends may account for up to a third of total return, as is the case for example for the shares listed on the Vienna stock exchange. However, shares with strong dividends do not generate the highest total return in every phase of the market.

Dividends are more important in a bear market

Globally speaking, dividends account for about a fifth of total return. Over time, this share has remained relatively stable. In difficult phases on the stock exchange, dividends may constitute the only return when share prices are not increasing.

Dividend income plays an important role on all stock exchanges

Source: Thomson Reuters Datastream

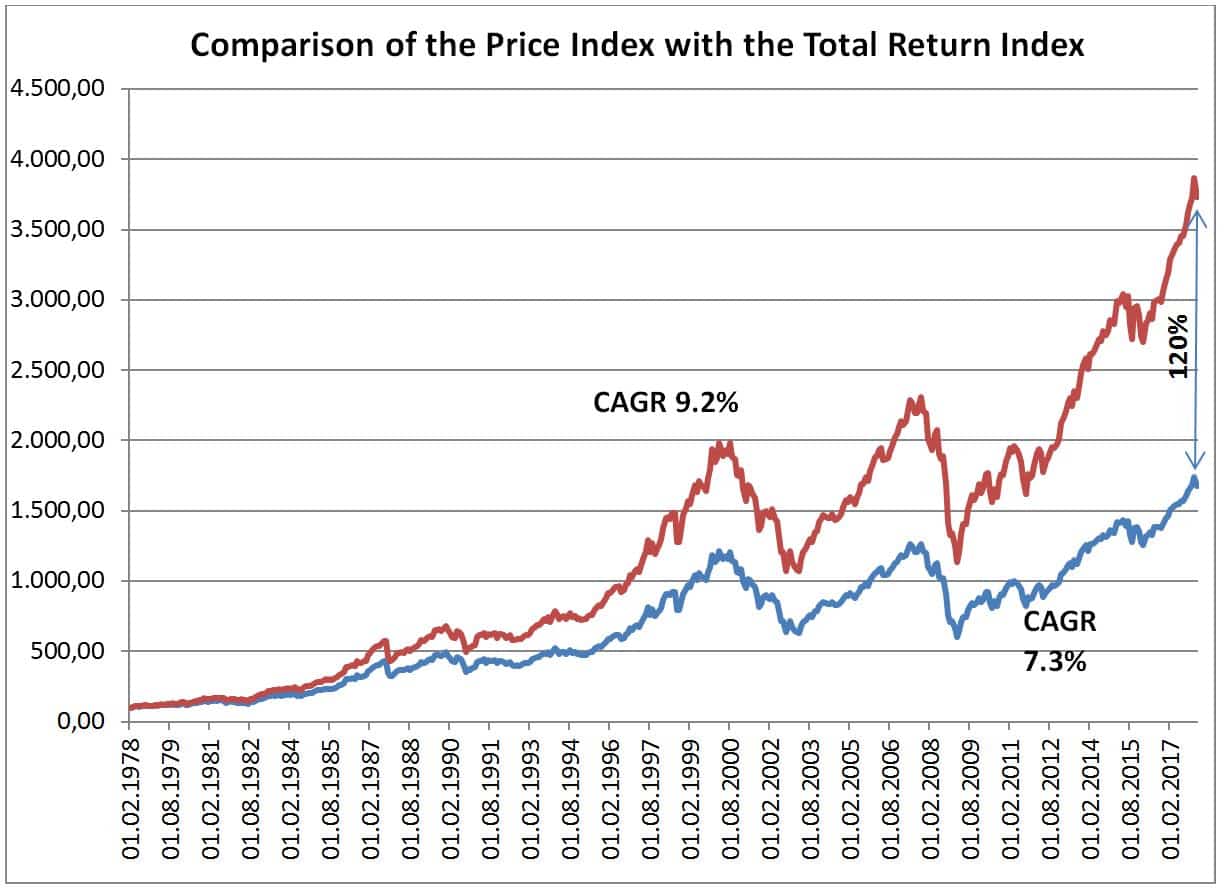

Total return including dividends twice as high as share price performance alone in the long run

In a long-term comparison, dividends are of great importance. In the past 40 years, total return has been more than twice that of share price gains alone – provided of course that dividends are re-invested.

The performance is calculated in accordance with the OeKB method. It does not include fees or taxes (except 28% tax on dividend yields). However, the illustration is net of the one-off load, which falls due at the time of purchase, and of other fees that reduce the return as well as of the individual account and deposit fees. Past performance is not a reliable indicator of the future performance of a fund.

Cost-average effect on the basis of re-invested dividends

Investors benefit from anti-cyclical strategies especially in phases of strongly fluctuating prices with heavy corrections or setbacks. When prices are falling, the reinvested dividends buy you more shares. Investors fully benefit from this so-called cost-average effect. This of course requires investors to re-invest their dividends immediately without waiting.

Depending on the performance of the investment fund, the performance of an s Fund Plan will differ from that of a one-off investment (higher or lower). A loss of capital is possible in both cases.

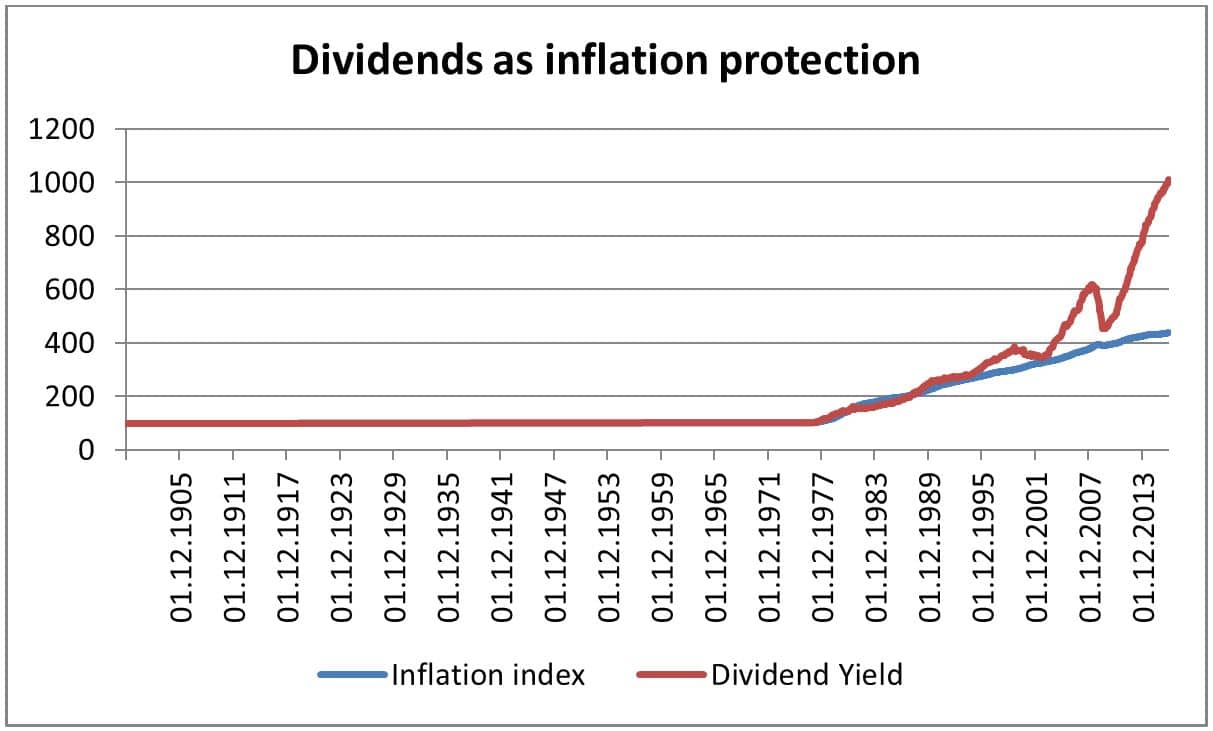

Dividends as inflation protection

In contrast to coupon payments by bonds, dividend payments rise continuously. On average, the companies in the MSCI World Equity index have stepped up their dividends by 5.2% per year. This means that dividends have increased by a factor of 10 over a period of 40 years. From the 1970s to far into the 2000s, dividends offered excellent protection against inflation. Since the financial crisis, dividends have increased even more significantly than inflation.

Source: Thomson Reuters DatastreamThe performance is calculated in accordance with the OeKB method. It does not include fees or taxes (except 28% tax on dividend yields). However, the illustration is net of the one-off load, which falls due at the time of purchase, and of other fees that reduce the return as well as of the individual account and deposit fees. Past performance is not a reliable indicator of the future performance of a fund.

High-dividend shares – a question of style?

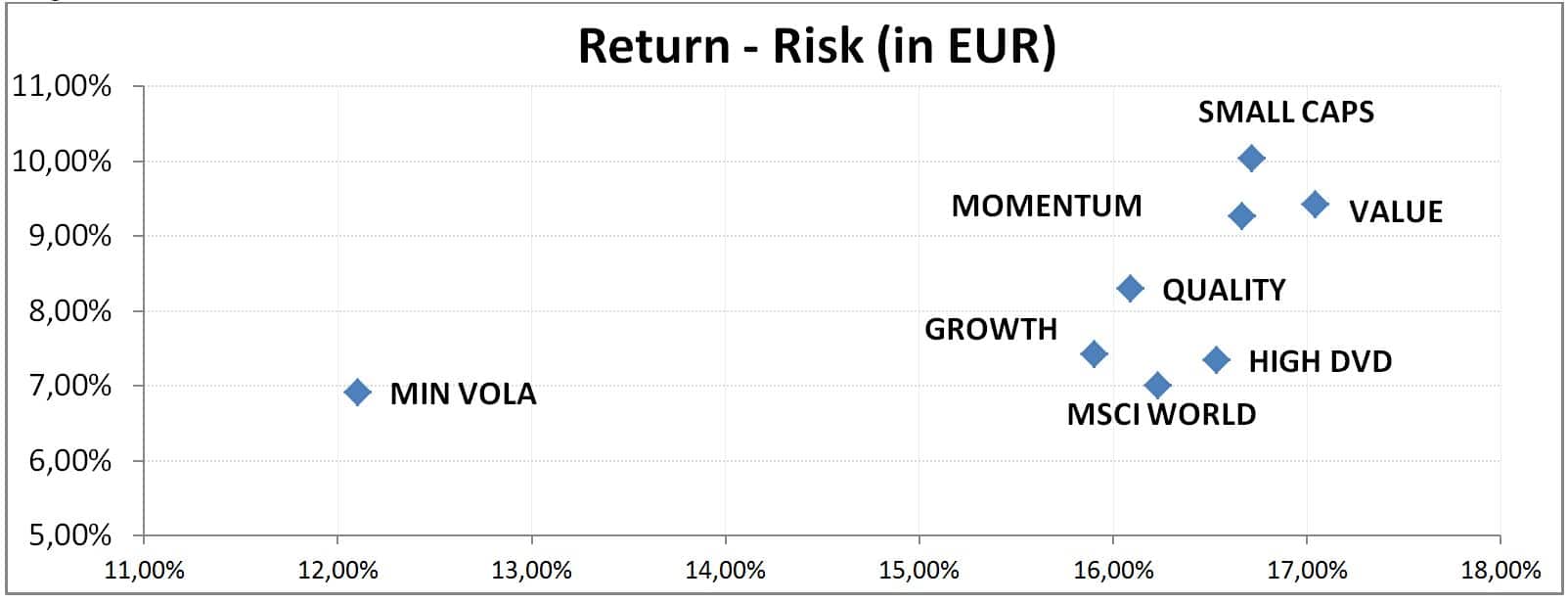

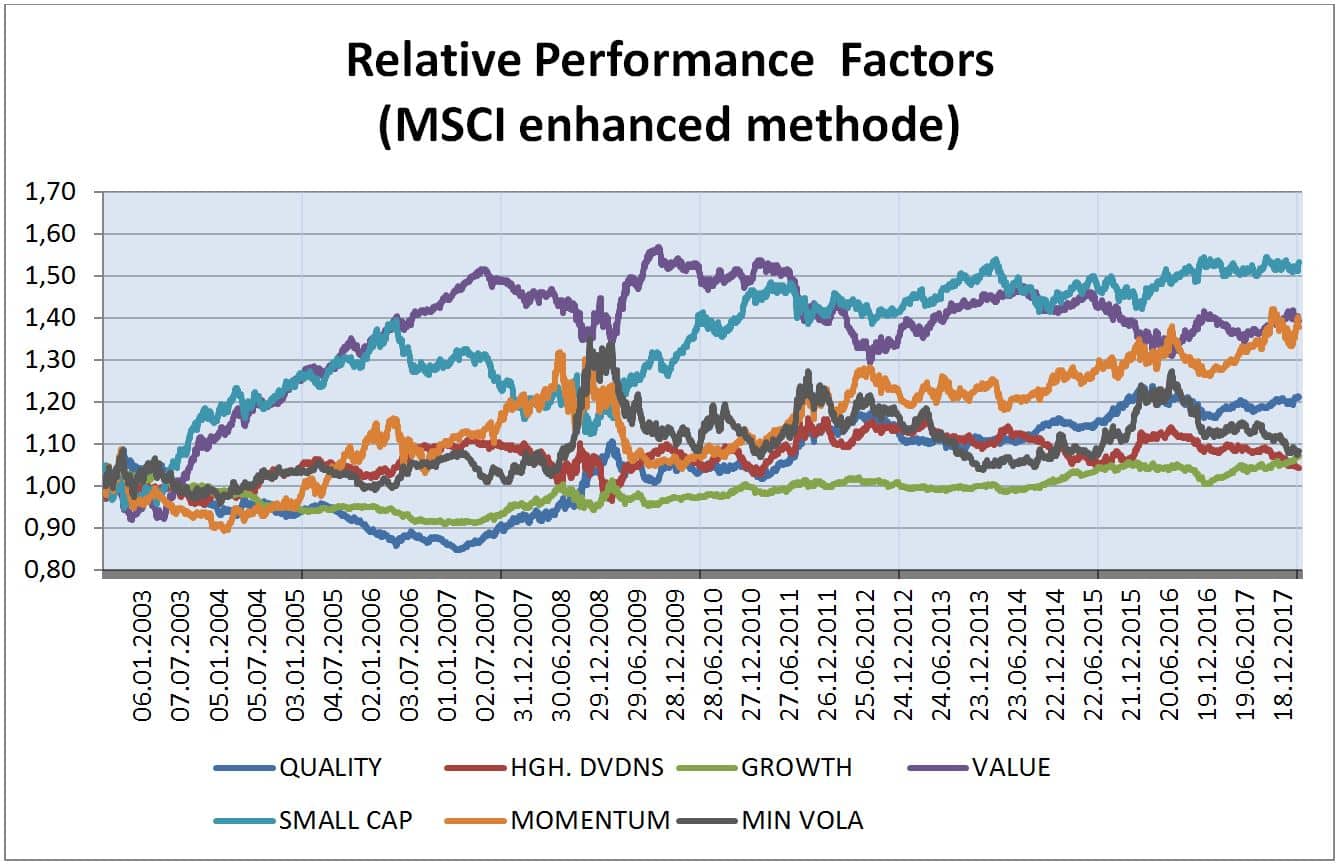

The importance of factors/styles has increased drastically in the past years again. In addition to “high dividend” (i.e. shares with high dividend yields), “value” (shares with low valuation metrics), “quality” (shares with features of high quality), “momentum” (shares that have outperformed the market in the past) and “small caps” have become popular among investors.

I am not happy with the term “high dividend” as style. The group of such dividend shares is very heterogeneous: some belong to the value category, some to quality.

The risk/return profile yields the following picture:

Source: Bloomberg

Quality shares improve the risk/return ratio

High-dividend shares have slightly outperformed the MSCI World Equity index in the past 15 years. However, the risk was higher. If one wanted to improve the risk/return ratio over the past years, one would have had to focus on quality shares, i.e. companies with high profitability, low gearing, and stable earnings development. Some high-dividend shares belong to this category, but not all of them. In particular, financials and commodity shares tend to not fulfil these criteria.

Lower risk does not mean lower return

The performance of the “minimum volatility strategy” in the past 15 years is interesting. It refutes the academic assumption that the reduction of risk entails lower returns. If as an investor you are considering investing in funds that pursue a high-dividend strategy, you will want to look carefully at what the fund management team does: does it focus on quality shares with stable dividends? Or do cyclical companies, i.e. those with strongly fluctuating earnings, also play a role? Or is the fund management team indeed trying to embed a minimum-volatility component into the fund?

This, for example, is the case for ERSTE RESPONSIBLE STOCK DIVIDEND, a sustainable dividend share fund from ERSTE-SPARINVEST’s range of funds. The fund focuses on companies with strong dividends, high quality, and below-average volatility. This means the fund is defensively structured. In phases of downturns, this fund focuses on cutting losses. In bull markets such as we have seen in recent years, it underperforms funds that focus on growth (such as the ESPA STOCK GLOBAL). This feature is supported by the analysis of the investment style.

Differences in performance: before or after the financial crisis

While high-dividend shares have outperformed the market slightly in the past years, they have failed to match the performance of the other popular styles, particularly in the past five years. Since the financial crisis in 2008, mainly quality and momentum shares have outperformed the market significantly. Prior to the financial crisis, value shares were the top performers. A dividend strategy could have been successful across the entire observation period of 15 years. However, this kind of investors would have had to focus on commodity shares with high yields prior to the crisis. After the financial crisis, defensive consumer goods or healthcare shares would have been better. It is easy to see that the minimum-volatility strategy works best during times of crises on the markets. Given that there was little in the way of crisis on the equity markets from 2016 to 2018, the minimum-volatility strategy could not match market performance during that time.

Source: Bloomberg

In summary, investors focus on different segments of high-dividend shares during different market phases: in a difficult phase (weak economy), dividend shares from the consumer goods and healthcare segments will perform better. When the economy is strong and interest rates are rising, financial and commodity shares will have the edge. It is this heterogeneous composition of the high-dividend segment that makes it difficult to treat it as one group.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.