In a world that is stumbling from one crisis to the next, for many safety-oriented investors there is no way around the oldest currency in the world: gold. This is also reflected in the price of the precious metal: it has doubled in less than two years and broke through the historic mark of 4,000 dollars per ounce for the first time at the beginning of October. Even though the rally has recently taken a breather, the markets are still keeping a close eye on the gold price.

What are the further prospects for the gold market and what opportunities do investors have to participate in its development? Daniel Feix, Managing Director of Impact Asset Management, and Andreas Böger, Fund Manager of ERSTE STOCK GOLD, recently gave their assessment during a capital market background discussion.

Gold is traditionally considered a safe haven for institutional investors: it is not tied to any particular currency or nation and has steadily increased in value over time. Although, unlike securities, this coveted precious metal does not offer any returns, its low risk has secured it a place in many investment portfolios

Note: The opportunities and risks of investing in gold and other securities must be taken into account.

Rising gold price despite higher interest rates

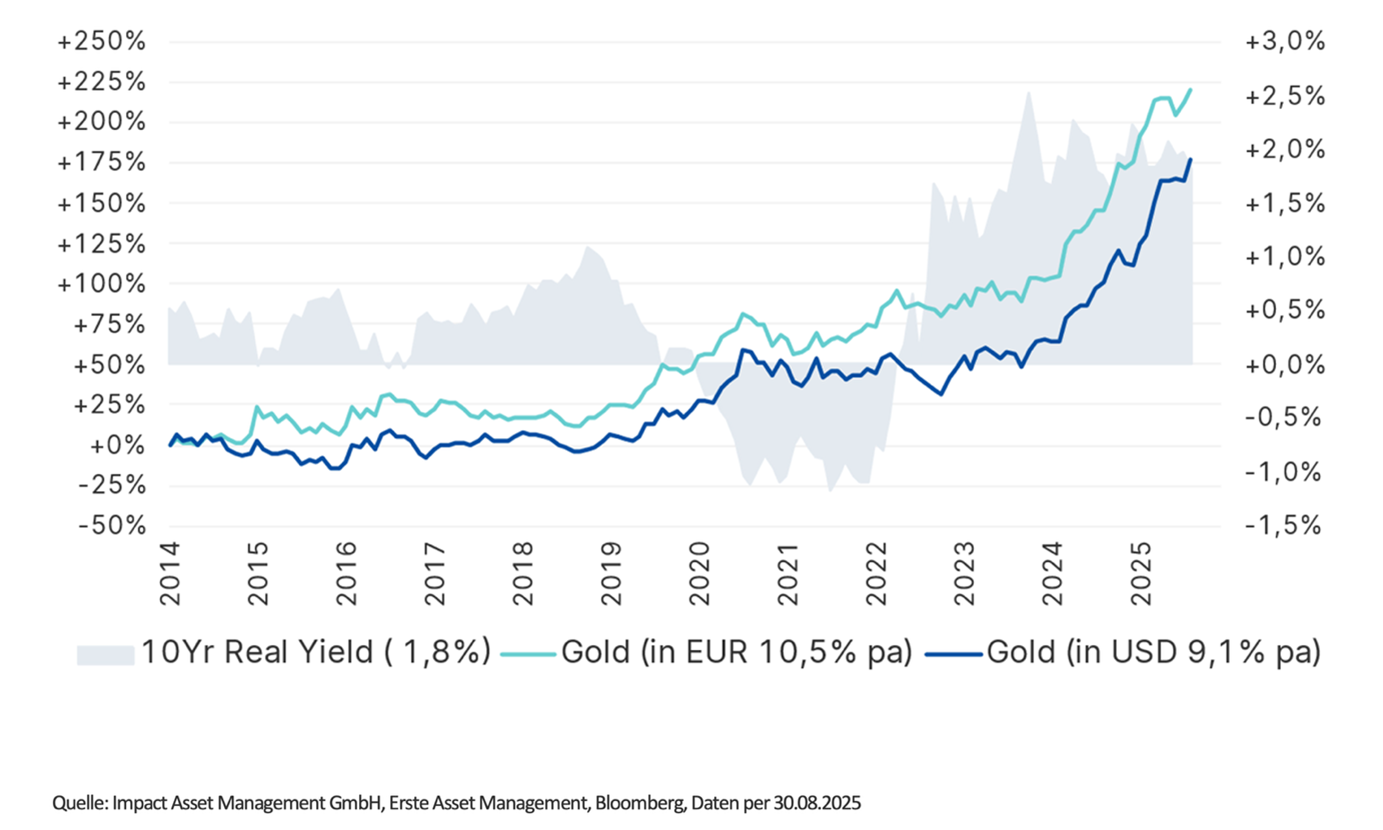

In an environment of falling interest rates and geopolitical uncertainty, gold has always been particularly sought after as an alternative investment. However, Daniel Feix emphasises that the current development has some peculiarities. In the past, the gold price would regularly rise when real interest rates were low. However, it would then fall again when interest rates were high. “Since 2022, this formula no longer applies,” as Feix analyses the situation. “Despite rising interest rates, the gold price continued to rise.” Most recently, it has – metaphorically speaking – exploded, gaining more than 50% in the year to date alone.

Note: Past performance does not allow any reliable conclusions to be drawn about future performance.

Correlation between interest rate levels and gold price

- Low real interest rates -> rising gold prices (historically)

- High real interest rates -> falling gold prices (historically)

The reasons for the gold rush

Economists around the world are concerned about the debt levels of industrialised nations. While France and the United Kingdom stand out negatively in Europe, many are particularly concerned about the financial development of the United States. The USA currently has debt outstanding of USD 37.8 trillion, which corresponds to a debt ratio of 125%. As a consequence of this development, central banks have significantly increased their gold reserves in recent years in order to reduce their counterparty risk and diversify their reserves – a sign of the growing role of the precious metal as a store of value and protection against inflation. However, investing in gold also comes with risks.

Another reason for the sharp increase in the gold price lies in the US sanctions against Russian foreign exchange reserves following the attack on Ukraine. These sanctions had little effect, as Russia was able to draw on its extensive gold reserves. Other countries, including China, drew their own conclusions and also increased their gold purchases – with noticeable consequences for the gold price.

Most recently, a psychological factor has also come into play as a price driver: many investors have jumped on the bandwagon so as not to miss out and to participate in the current gold rush.

For the time being, there is no end in sight to this development. Many experts and analysts believe that the gold rally could continue. Daniel Feix also shares this view. In times of rising government debt, declining confidence in national currencies, and a world full of multi-pronged crises, the precious metal remains an attractive safe haven, he believes.

Note: Investing in gold involves risks as well as opportunities.

Why gold companies are shining now

An interesting aspect for institutional investors: in the shadow of the rapid gold price rally, companies operating along the supply chain of the world’s oldest currency are also benefiting from the current gold rush.

Andreas Böger, fund manager of ERSTE STOCK GOLD, points out a special “gold nugget effect” for the shareholders of these companies in this context: “While the price of gold has risen from about USD 1,100 to over USD 4,000 per ounce over the past ten years, production costs have only increased moderately from about USD 1,000 to USD 1,600. As a result, the industry’s operating margin has soared to a record level.”

In addition to investing in physical gold, such as gold bars, gold coins, or jewellery, investors may also want to consider gold shares as an alternative. “Gold shares offer access to various segments of the value chain and can serve as leverage when prices rise,” Böger emphasises. Please note: investing in securities involves both opportunities and risks.

Note: Please note the opportunities and risks when investing in securities.

The leverage effect of gold mining equities is that rising gold prices can have a disproportionate impact on profit margins, depending on the development of production costs. “Recently, these factors have led to a significant increase in profit margins,” Böger explains. However, this leverage effect can also have a negative effect if the gold price falls or production costs rise.

The entire gold sector as investment universe

ERSTE STOCK GOLD offers the opportunity to invest in the entire supply chain of this shining classic with a flexible capital allocation. Global gold production in 2024 totalled approximately 3,300 tonnes, dominated by countries such as China, Russia, Australia, and Canada. The equity fund focuses on the various areas of companies involved in gold production:

• Producers: companies that mine gold and participate directly in the gold price.

• Developers: companies that develop mines and are about to start production.

• Explorers: companies that search for new gold deposits

• Royalty/streamers: mining financiers who participate in the revenues and profits of mines without mining themselves.

Focus on medium-sized producers

Many analysts are focusing on medium-sized producers in particular, as they are often more agile and experience stronger growth than large index heavyweights. The valuation for these “gold nuggets” is historically attractive: the average price-earnings ratio (P/E) for the sector has fallen from 25–35x (2014) to 10–15x (2025) (source: Bloomberg).

The ERSTE STOCK GOLD fund pursues an active allocation strategy across various segments of the gold sector and adapts to the market phase prevalent at the time. The focus is on medium-sized gold producers. The portfolio is complemented by the addition of developers, explorers, and royalty/streaming mining companies. The weighting is currently about 80% gold and 20% silver.

When asked about the fund’s investment focus, fund manager Andreas Böger highlights companies with strong management, good growth prospects, and solid fundamentals. “At the same time, we avoid investments in large index heavyweights, companies with very high gold production and problematic growth prospects,” he explains.

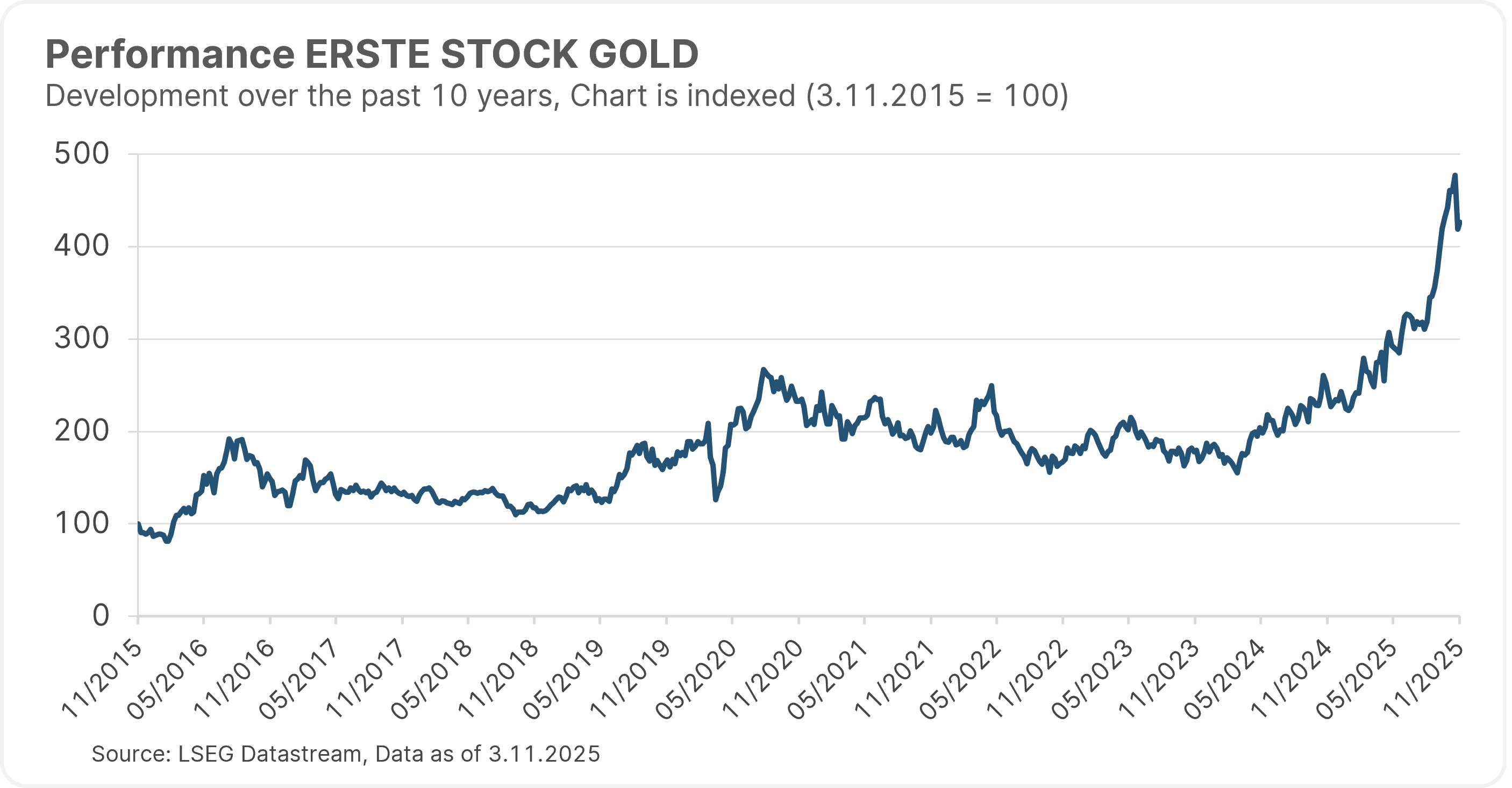

A look at the fund’s performance over the past ten years shows that this strategy has yielded positive results in the long term. However, past performance is no reliable indicator of the fund’s future performance.

Note: Past performance is not a reliable indicator of future performance.

The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation.

Risks that need to be considered

In addition to the opportunities, it is also important to be aware of possible risks. Investments in the gold sector can be subject to considerable fluctuations in value. In addition to the sectoral risk, there are issuer risks, exchange rate risks for foreign currency exposures and operational risks. A loss of capital cannot be ruled out.

Conclusion

Gold remains an exciting topic for investors seeking diversification and inflation protection. Current market dynamics – particularly the gap between the gold price and production costs – favour investments along the entire supply chain.

Risk notes ERSTE STOCK GOLD

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.