The third quarter of the current year brought a welcome boost to environmental technology equities. While geopolitical tensions and domestic political uncertainties (particularly in the United States) continue to dominate the headlines, the clean tech industry is proving increasingly resistant to short-term disruptions.

Political uncertainty not denting optimism

The political landscape in the United States remains volatile. President Trump regularly causes irritation with his rhetoric – especially in the context of renewable energies and climate protection measures. That being said, a comprehensive legislative package was passed in July with the “One Big Beautiful Bill” (OBBB), which creates better-than-expected conditions for many clean tech companies.

The discrepancy between public rhetoric and actual legislation in the United States is noticeable. Whereas various government agencies and departments are striking a negative tone, many companies in the environmental sector are optimistic behind the scenes. The results of the past two quarters confirm this confidence: sales and earnings development have exceeded expectations by a significant degree, even though companies are publicly cautious in order to avoid political attacks.

Artificial intelligence: driver of energy demand

The rapid development in the field of artificial intelligence (AI) remains a key issue. The expansion of data centres is causing a veritable investment boom – especially among tech giants such as Google, Amazon, and Microsoft. At the moment, there is no indication that said boom should end anytime soon. In a recent interview, Facebook CEO Mark Zuckerberg said that while it would be “unfortunate” if Meta “misinvested a few hundred billion (!) in data centres,” the risk “on the other hand is higher.”

Please note: the companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

These infrastructure projects are extremely energy-intensive and increase the demand for a reliable, scalable power supply. Renewable energies offer a decisive advantage here: they are available at shorter notice than conventional power plants.

The term “speed to power” aptly describes the competition to provide energy as quickly as possible. The shortage of readily available electricity in the United States is now so extreme that old nuclear power plants are being reconnected to the grid to meet demand – but even these are finite in number. It takes over four years to restart a decommissioned nuclear power plant and at least ten years to build a new one. In comparison, wind, solar, and battery power are often operational within a year – an advantage in a race where no one wants to fall behind.

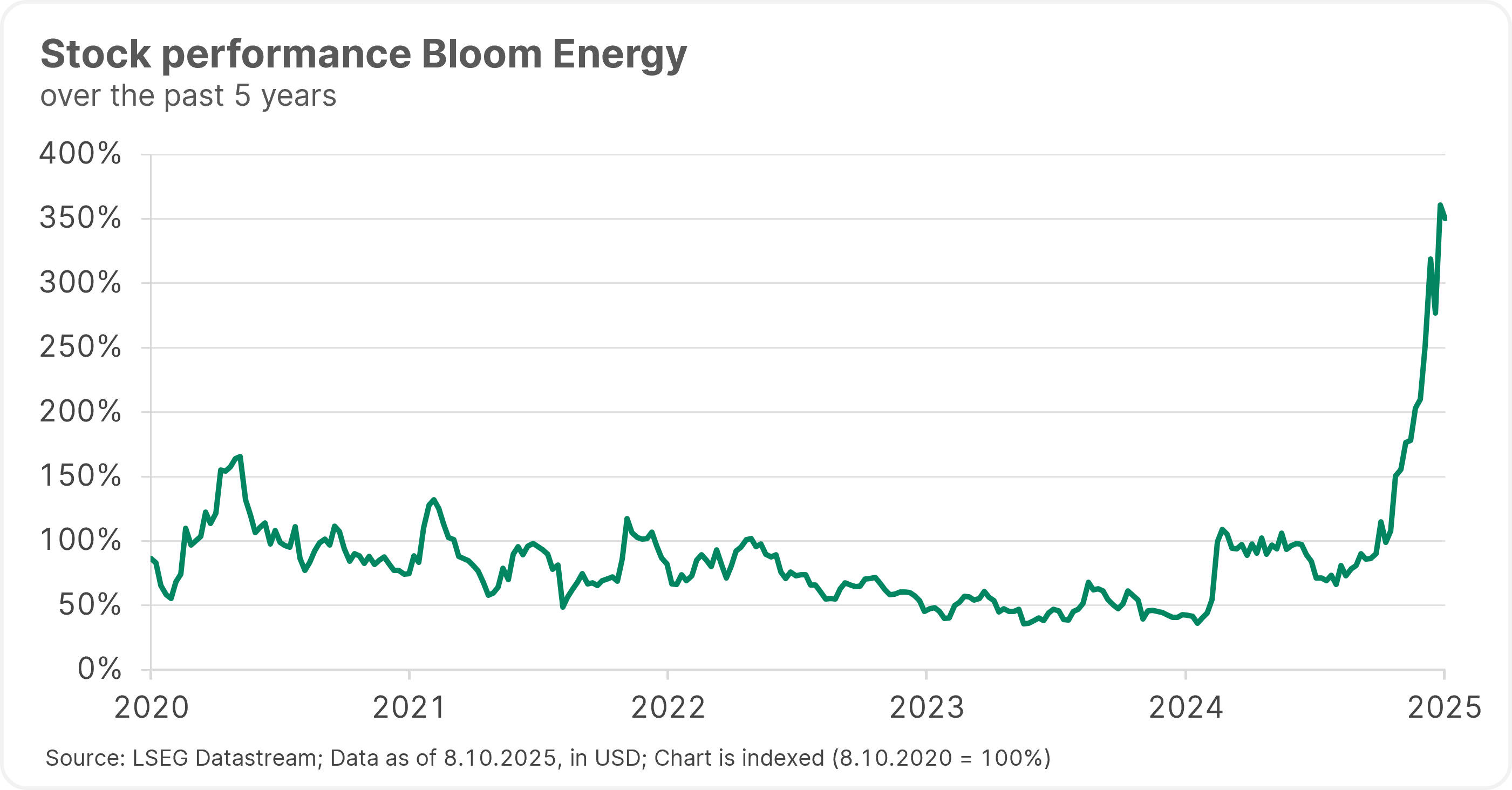

Company focus: Bloom Energy

Bloom Energy provides a special solution in the area of speed to power. The company offers fuel cells that can be powered by hydrogen, biogas, or natural gas. The fuel cells use these fuels to produce electricity by way of an electrochemical process that reduces air pollution by more than 99% compared to combustion and reduces CO2 emissions by up to 45%.

With these fuel cells, data centre operators, for example, can disconnect 100% from the grid and generate their own electricity. This also means that long waiting times for grid connection can be avoided, allowing data centres to become operational more quickly. Compared to the years of lead times for various power sources and the lengthy process of connecting to the grid, Bloom Energy can produce electricity within 90 days from the time of ordering.

In the year to date, Bloom Energy shares have gained about 300%, and over the past year, the increase has been more than 700%. In the ERSTE GREEN INVEST equity fund, we remain invested in Bloom Energy and are optimistic about its long-term prospects.

Please note: Past performance is no reliable indicator of future value development. Please note that an investment in securities entails risks in addition to the opportunities described.

Fund performance: substantial recovery

The two equity funds focusing on environmental technologies, ERSTE GREEN INVEST and ERSTE WWF STOCK ENVIRONMENT, have gained significantly in the wake of Liberation Day in April. The recovery since then has been driven mainly by short covering – generalists are still hardly invested. This opens up further potential should interest from institutional investors increase.

Individual shares such as Array Technologies have more than doubled since April. Despite these gains, valuations remain attractive. We used the third quarter for targeted reallocations by expanding positions in heavily sold-off shares such as Shoals Technologies, Sunrun and Solaredge. At the same time, we took profits in Bloom Energy and Nextracker. The focus remains on the energy segment, which offers the greatest opportunities in structural terms, both in the area of power generation and in storage solutions and grid infrastructure.

Valuation and outlook: fundamental strength as driver

The valuations of our funds remain attractive by historical comparison. The (forward) P/E ratio of ERSTE WWF STOCK ENVIRONMENT is 18.3x, while that of the ERSTE GREEN INVEST is 20.7x – significantly below that of the US technology share index Nasdaq 100 at 30x. At the same time, 87% and 95% of the companies in our funds, respectively, expect to be profitable in 2026, compared to only 64% in the Russell 2000, a US equity index for small-cap companies.

This fundamental strength is a central pillar of our investment strategy. With political uncertainty receding and interest rates looking stable, the focus is shifting back to corporate quality. If the Q3 reporting season comes down on the convincing side again, we expect the momentum to remain positive until the end of the year.

Please note: investing in securities involves risks as well as opportunities. Prognoses are not a reliable indicator of future performance.

Conclusion: sustainability remains a structural mega trend

Despite short-term political noise, the long-term outlook for environmental strategies remains intact. The combination of technological innovation, regulatory clarity, and growing demand – particularly from AI-driven infrastructure projects – creates an attractive environment for sustainable investments.

For investors who focus on long-term trends and regard short-term volatility as an opportunity, environmental strategies continue to offer a compelling risk-return profile.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Risk notes ERSTE GREEN INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Risk notes ERSTE WWF STOCK ENVIRONMENT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE WWF STOCK ENVIRONMENT as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE WWF STOCK ENVIRONMENT, consideration should be given to any characteristics or objectives of the ERSTE WWF STOCK ENVIRONMENT as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.