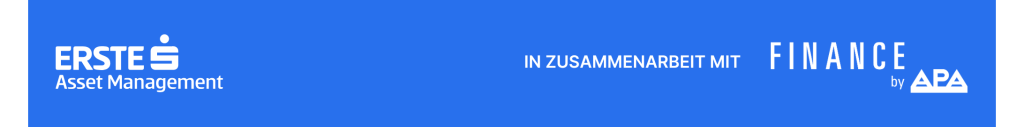

The real estate crisis and lack of private investment have been a drag on the Chinese stock market in recent years. Compared to other important markets, the performance was rather poor for a long time. This year, however, the stock markets of the world’s second largest economy are showing a different side: the Chinese leading index CSI 300 recently reached its highest level since last fall. Since the beginning of the year, it has already gained around 20%.

The Shanghai Composite, which comprises all shares listed on the important Shanghai stock exchange, has also climbed almost uninterruptedly over the course of the year to date and has recently reached its highest level in ten years. Despite the smouldering trade conflicts, Chinese shares therefore appear to be back in fashion. Meanwhile, Beijing is increasingly focusing on foreign policy partners outside the western world.

Note: Investments in securities entail risks as well as opportunities. Past performance is not a reliable indicator of future performance. Representation of indices, no direct investment possible.

Domestic investors return

One of the reasons for the renewed strength of Chinese equities is likely to be its own population. “The recent recovery phase on the Chinese stock markets is an expression of renewed investor confidence in the country’s economic and structural development,” says Gabriela Tinti, fund manager at Erste Asset Management, describing the upswing in China.

The assets of private households in the People’s Republic are increasingly being shifted into equity investments. In addition, the Chinese government has introduced extensive monetary easing and targeted measures to promote private consumption. Last year, the government presented an economic stimulus package to stabilize the economy. It included measures such as lowering the minimum reserve ratio for banks and mortgage interest rates as well as aid for the real estate and financial markets. To further support the economy, the People’s Bank of China’s monetary policy was set to “moderately loose” at the end of 2024 – for the first time since the 2008 financial crisis.

Reforms on the capital market are also having an effect, according to Tinti. Since 2020, Chinese households have accumulated over 7.2 trillion renminbi (around 862.5 billion euros) in excess savings. These funds are increasingly being shifted away from stable but low-interest products such as bonds and towards the stock market.

Further postponement in the customs conflict

Even if the smouldering trade conflict with the USA continues to pose a risk, at least the recent extension of the transition period has eased the situation somewhat. In mid-August, US President Donald Trump postponed the planned tariff measures against China for a further 90 days. Without an extension of the tariff pause, reciprocal punitive tariffs of more than 100 percent would have been imposed. Despite the agreement, high additional tariffs of 30 percent on Chinese imports into the USA remain in place. Previously adopted punitive tariffs, such as the 100 percent levy on e-cars from China, also remain in place. China in turn imposes a 10 percent tariff on US imports.

The USA remains an important trading partner for China; after all, the United States was the most important sales market for products from the People’s Republic last year, accounting for around 15% of China’s total exports. Conversely, China was the second most important import country for the USA in 2024 after Mexico (source: statista.com).

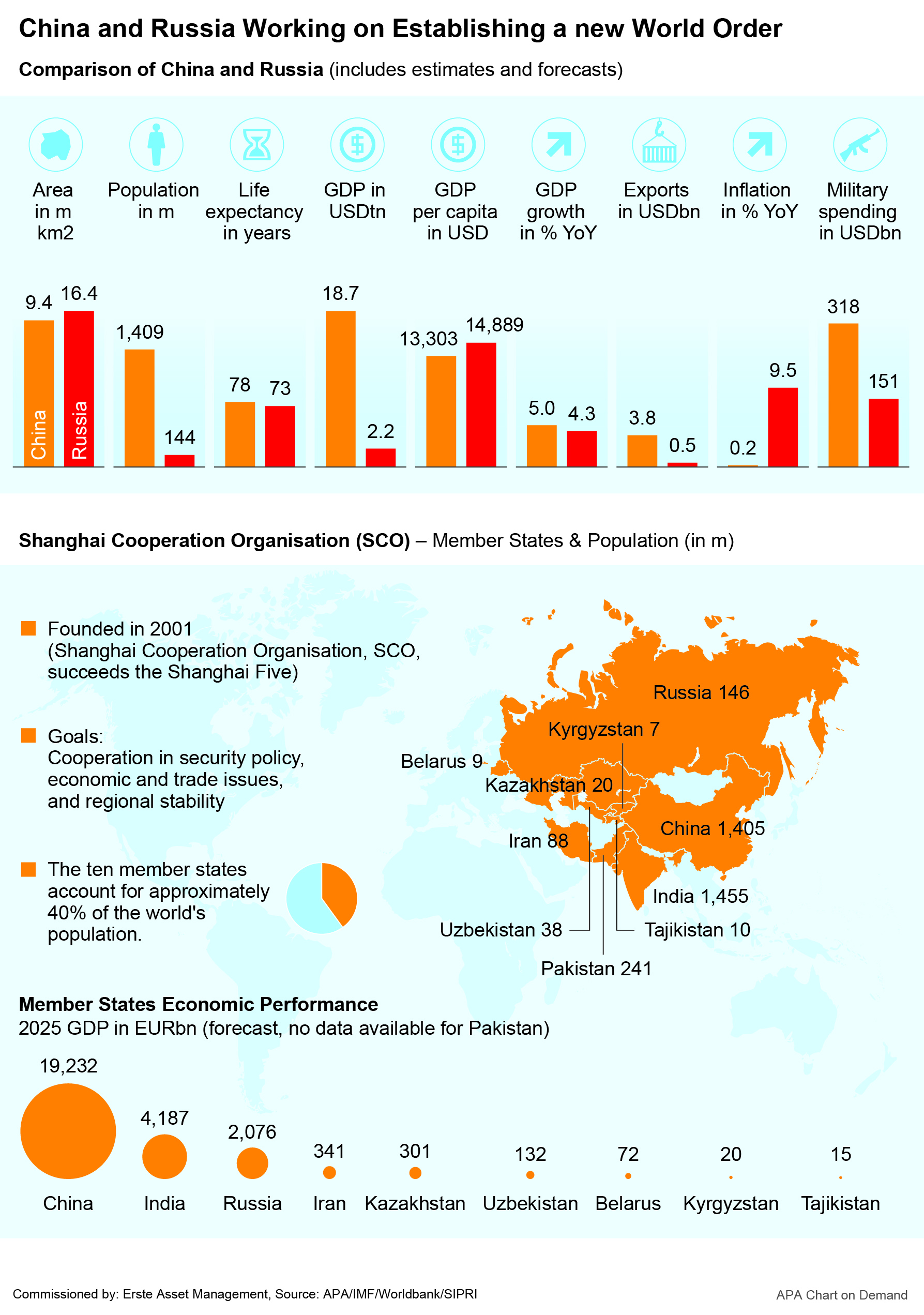

The trade conflict with the United States is probably also a reason why China is increasingly moving closer to other partners such as Russia and India in terms of foreign and economic policy. At the most recent summit of the Shanghai Cooperation Organization (SCO), China’s President Xi Jinping and Russia’s head of state Vladimir Putin pushed ahead with their vision of a new global security and economic order. The SCO is a security policy bloc that includes Russia and China as well as other countries such as India, Iran and Kazakhstan.

The “global South” should be at the center of this multipolar world order, the heads of state declared at the SCO summit in Tianjin in northern China. This is also intended to create a counterweight to the economic and geopolitical dominance of the West and the USA in particular. The goal of developing an alternative payment system or a common currency that bypasses the US dollar has been pursued for some time.

Note: Forecasts are not a reliable indicator of future performance.

Beijing wants to strengthen cooperation on AI

According to Xi, China wants to play a more important role in the SCO area in the future and provide greater support to the countries of the alliance with loans and grants. In addition, the government in Beijing will establish a cooperation center for artificial intelligence (AI) for the SCO nations, which are also invited to participate in China’s lunar research station, Xi added.

AI is also a major future topic for the Chinese market at company level. “Innovative companies such as Deepseek play an important role for China, as they not only embody technological progress, but also strengthen the confidence of local investors and companies. The strategic positioning of Chinese companies in the AI sector creates new prospects for sustainable growth,” equity expert Gabriela Tinti is convinced.

Please note: The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

China and Russia conclude cooperation agreement

Following the SCO summit, Putin and Xi further deepened their countries’ relations at a bilateral meeting in Beijing. According to the official news agency Xinhua, the two sides signed more than 20 cooperation agreements, including in the fields of energy, aviation and artificial intelligence.

China has now become the most important trading partner for Russia, which has been sanctioned and isolated by the West. Chinese trade with Russia reached a record level last year. Imports and exports totaled 1.74 trillion yuan (230 billion euros).

Chinese President Xi Jinping and Russian President Vladimir Putin at the SCO summit in Tianjin. Beijing is repeatedly criticized for supporting the Russian war economy. Source: (c) SUO TAKEKUMA / AFP / picturedesk.com

The People’s Republic supplies industrial plants and consumer goods that help Russia to survive the Western sanctions. The country is also suspected in the West of supplying Russia with important goods for the defense industry. China is also an important sales market for Russian export goods such as oil, gas and agricultural products.

In the West, China’s increasing rapprochement with Russia is sometimes viewed critically. At Beijing’s military parade following the SCO summit to mark the 80th anniversary of Japan’s surrender in the Second World War, Putin was invited alongside North Korea’s ruler Kim Jong-Un. US President Donald Trump was less than pleased about the meeting and wrote to Xi on his social network Truth Social: “Please extend my warmest regards to Vladimir Putin and Kim Jong-Un while you are plotting against the United States of America”. An accusation that was denied by Russia.

Conclusion

So while the government in Beijing is putting out feelers for other partners in the midst of the tariff conflict with the US, causing controversy, the Chinese stock market has put in a clearly positive performance so far this year. What are the chances that the latest rally will last longer? “The combination of structural reforms, technological momentum and growing optimism has the potential to carry the positive market sentiment beyond the end of the year,” comments Gabriela Tinti.

However, this only applies provided that the numerous risks remain under control. This is because the real estate crisis in the country is still ongoing and geopolitical tensions – above all the sword of Damocles of US tariffs – could quickly weigh more heavily on the market environment again.

Interested and risk-conscious investors can invest in the equity fund FIRST STOCK EM GLOBAL equity fund to invest in the Chinese market, among others.

Around a third of the portfolio is currently invested in companies from the People’s Republic, including well-known corporations such as the internet group Tencent and the e-commerce giant Alibaba. The advantage: the fund invests in a broadly diversified manner in several companies from different sectors in countries that are classified as emerging markets. However, it should be noted that investing in emerging markets entails a higher risk potential than in developed markets.

Risk information ERSTE STOCK EM GLOBAL

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.