There currently seems to be a number of changes to the usual world order – keyword: US trade war. We are still assuming that the “no landing” scenario is the most likely scenario for the current year. However, the uncertainty surrounding the policies of the new US government, higher than expected inflation rates and disappointing growth figures are currently putting this assumption to the test.

👉 What you read in this blog

Structural change

The all-dominant factor influencing the markets at the moment is US policy. The changes brought about by the new Trump administration are so far-reaching that there is talk of structural change. Many areas are affected:

- Trade (tariff increases)

- Immigration (more restrictive approach)

- Taxes (permanent tax cuts)

- Regulation (facilitations)

- Governance (job cuts at state level and closure of federal agencies)

- Energy (relief for fossil fuels)

- Foreign policy (unilateralism, weakening of international organizations)

The last point in particular could mean the end of the world order as we have known it since the end of the Second World War. In any case, the fragmentation of the global economy is being driven forward. But how can this insight be applied to current market developments?

US unilateralism meets defense…

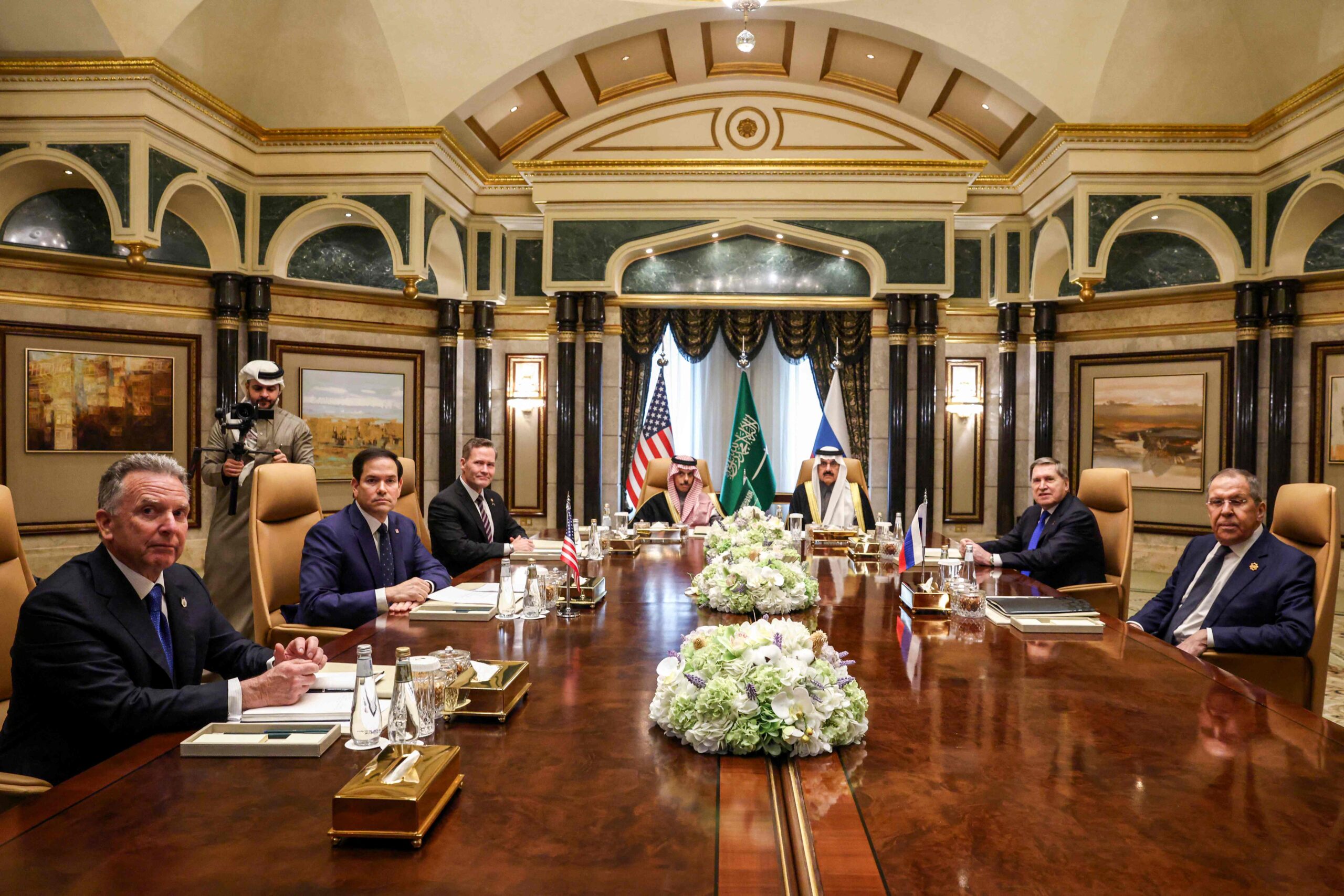

The headlines are currently dominated by the negotiations between the USA and Russia on a ceasefire in Ukraine. The Europeans are merely onlookers. One effect of this is that the incentive for a significant increase in defense spending in Europe has increased.

The USA and Russia are currently negotiating a possible ceasefire in the Ukraine war in Saudi Arabia – but in the absence of Ukraine and Europe. Image source: EVELYN HOCKSTEIN / AFP / picturedesk.com

For comparison: according to the World Bank, military spending in the USA amounted to 3.4% of gross domestic product in 2023 and 1.5% in Germany. The EU Commission has already proposed excluding defense spending from the calculation of new government debt. To put it cautiously, the chances of a reduction in budget deficits against this backdrop are low.

This has three implications:

- The tailwind for companies in the defense sector has increased further.

- The “fair” yield level for government bond yields shifts upwards due to the higher level of government debt.

- Coordination of defense spending at EU level is becoming more necessary. Now that the anti-EU parties have gained strength in recent years, this necessity could benefit the pro-EU forces.

…and trade

There is also currently some uncertainty regarding US trade policy. Is Trump stepping up the pace of tariff increases and targeting several countries at the same time, or will he take more moderate steps?

In any case, the USA is also pursuing non-trade-related goals with its customs policy: For example, pressure has been exerted on Mexico and Canada to better secure their respective borders. Colombia quickly agreed to deportations under the threat of tariff increases. Substantial tariff increases of 25% have so far only been announced for the subordinate areas of steel and aluminum.

The USA recently mentioned the principle of reciprocity in its trade policy. According to the motto “tit-for-tat”, this would mean US tariff increases if a certain country imposes higher tariffs on US imports. Against this backdrop, the risk of a full-blown trade war is not too high, but a trade conflict cannot be ruled out.

In any case, Europe already seems to be preparing for the threat of higher US tariffs. Proposals such as higher spending on liquefied natural gas (LNG) and defense from the US have recently been making the rounds.

Europe could also be targeted even more by US President Trump’s tariffs. The EU wants to prepare for this by making concessions on higher spending in the US. Image source: unsplash

Slight rise in sentiment indicators

Uncertainty about future US trade policy can be seen most quickly in market prices. Generally speaking, US tariff increases strengthen the US dollar. The dollar has weakened since mid-January, which from a market perspective has reduced the likelihood of a trade war.

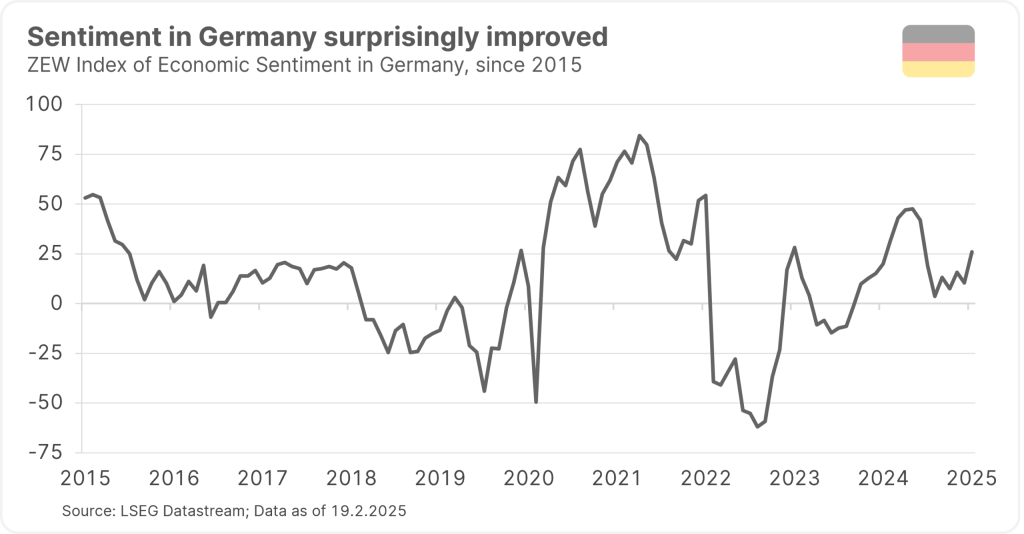

Economic sentiment indicators also give a good sense of the level of uncertainty on the market. In the USA, sentiment among companies has risen significantly since November. Sentiment in the manufacturing sector has also improved both in Europe and globally. Even in Germany, the outlook has surprisingly improved. According to the ZEW (Center for European Economic Studies), the economic expectations of financial analysts for Germany rose considerably in February.

It remains to be seen how the situation in Germany will develop after the general election. In any case, Germany’s leading index, the DAX, is likely to start trading higher today. According to market observers, investors are hoping for new momentum for the German economy as a result of a change of government following the CDU/CSU election victory.

Economic expectations in Germany have recently improved surprisingly. Nevertheless, the ZEW index remains below the important mark of 50 points, which signals growth.

Inflation picks up surprisingly, growth weaker

However, the latest US inflation figures came as a negative surprise. In January, prices rose by 3.0% compared to the previous year, exceeding expectations. The usual explanation for the high figure is that there were strong upward price adjustments at the beginning of the year, which do not reflect the seasonal adjustment factors. Even if inflation falls again in the coming months: In what we see as the most likely “no landing” scenario, inflation is expected to reach 2.9% by the end of 2025. This would leave inflation well above the central bank’s target of around 2%

With regard to economic growth, a number of indicators have recently been disappointing. First and foremost, the 0.8% month-on-month decline in US retail sales in January was surprising. Indicators on US consumption are particularly important because the strong US economic growth is driven by consumption. To date, however, with GDP growth of over two percent, the assumption of strong economic growth in the US continues to hold.

In Europe, on the other hand, the sharp decline in industrial production in December stands out. In fact, the manufacturing sector in the eurozone has been on a downward trend since 2023. One small ray of hope here is the aforementioned upturn in sentiment in industry.

Risk inflation-fighting Fed

Which brings us to the next important question: What’s next for interest rate policy? Since September 2024, the Fed has already reduced the key interest rate by one percentage point from 5.5% to 4.5%. As long as there are few signs of inflation falling further and the economy is booming, the central bank has little argument for further interest rate cuts.

The latest statements from Fed representatives indicate a wait-and-see attitude, but also a tendency towards further interest rate cuts in the medium term. The major risk for the markets lies in a possible trend reversal: if inflation actually rises again, the wind could quickly shift back in the direction of interest rate hikes.

Short-term scenario: “No landing”

In view of the current economic data and the political environment, we believe that a “no landing” scenario is the most likely scenario for the current year. What would such a scenario entail?

1) Inflation in the industrialized nations remains above the central banks’ 2% target with an expected value of 2.6% in the fourth quarter of 2025

2) Inflation-adjusted economic growth in the developed economies remains on trend (2025: 1.7% year-on-year).

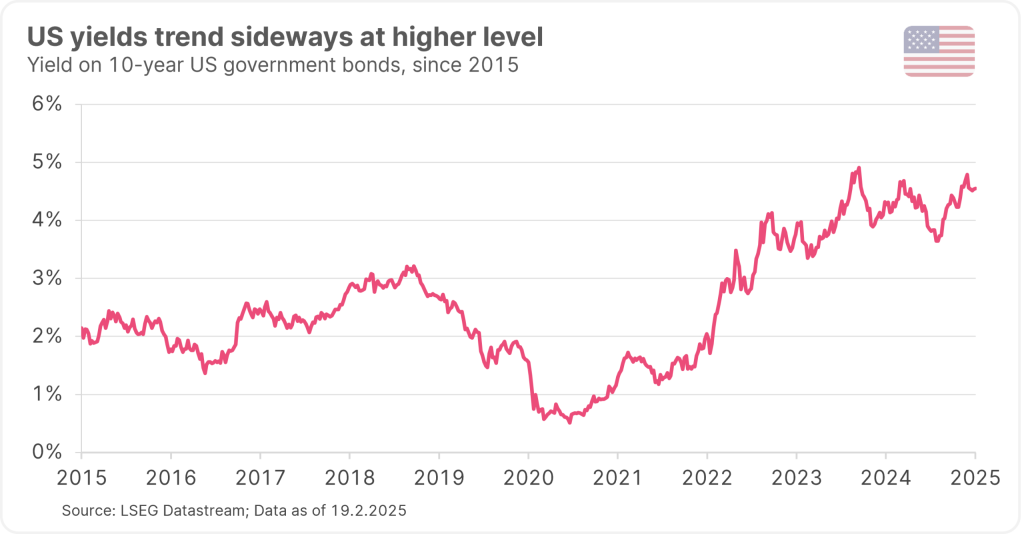

3) Yields on government bonds are trending sideways to higher (10-year bond in the USA currently at 4.5%, 10-year German bond currently at 2.5%)

4) The central banks cut key interest rates only slightly.

For investors, this means that price gains can be expected that are in line with long-term expectations. However, the big downside risk remains high.

Long-term scenario: “Inflationary growth”

In the long term, higher investment spending, e.g. on digitalization, defence, climate or integration, will also support economic growth. Growth in the industrialized countries could be around 1.5% in the long term. In this scenario, inflation stabilizes above the 2% target in the long term. However, the decline in the working-age population, more frequent supply shocks, a stronger industrial policy and a looser fiscal policy will have an inflationary effect.

In this case, the monetary policy stance of the central banks is likely to be set to neutral. Assuming a real neutral key interest rate of 1%, this would mean an average key interest rate of 3.5% for developed countries.

Note: Past performance is not a reliable indicator of future performance.

Yields on US government bonds have risen significantly again since the end of 2024. The market has priced in higher government debt and a possible return of inflation. Higher yields would fit the “no landing” scenario.

Conclusion

In both the most likely short-term and long-term scenarios, nominal economic growth is 4% or slightly higher. This value provides a rough estimate of the “fair” yield level for government bonds in industrialized countries (USA: 4.5%) – at least as long as the risk premium for rising government debt remains low.

The environment for risky asset classes such as equities remains fundamentally positive. However, the structural change being driven by the new US administration brings uncertainty with it. Risks such as the fragmentation of the global economy, including the financial system, have increased.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.