The world’s largest pharmaceutical companies have recently reported substantial increases in turnover for the past quarter. However, in view of expiring patents and potentially tougher conditions under the next US government, the companies must continue to focus on innovation – through in-house developments, but also increasingly by means of company acquisitions. And while experts see great potential for the industry in the increased use of AI, fears of a potentially pharma-critical new US government dampen positive sentiments.

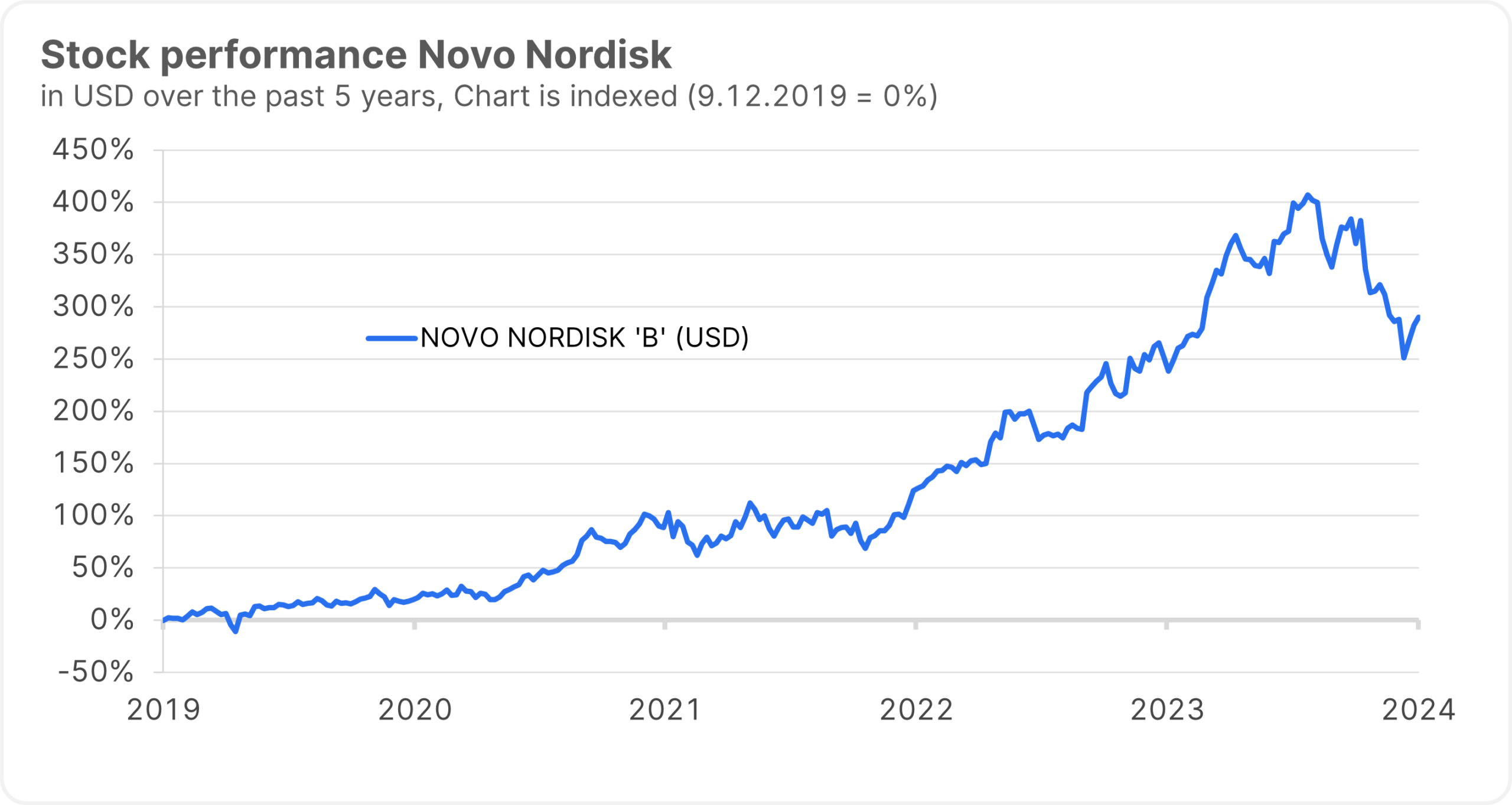

Novo Nordisk posts a jump in profits

Good business with cancer therapies and slimming products, among other things, has recently led to an increase in sales in the sector. Thanks to the continued high demand for diabetes and weight loss drugs, Danish pharmaceutical giant Novo Nordisk reported an increase in its operating profit by 26 percent to DKK 33.8bn, roughly EUR 4.5bn, in Q3. Sales increased by 21 percent to DKK 73.1bn.

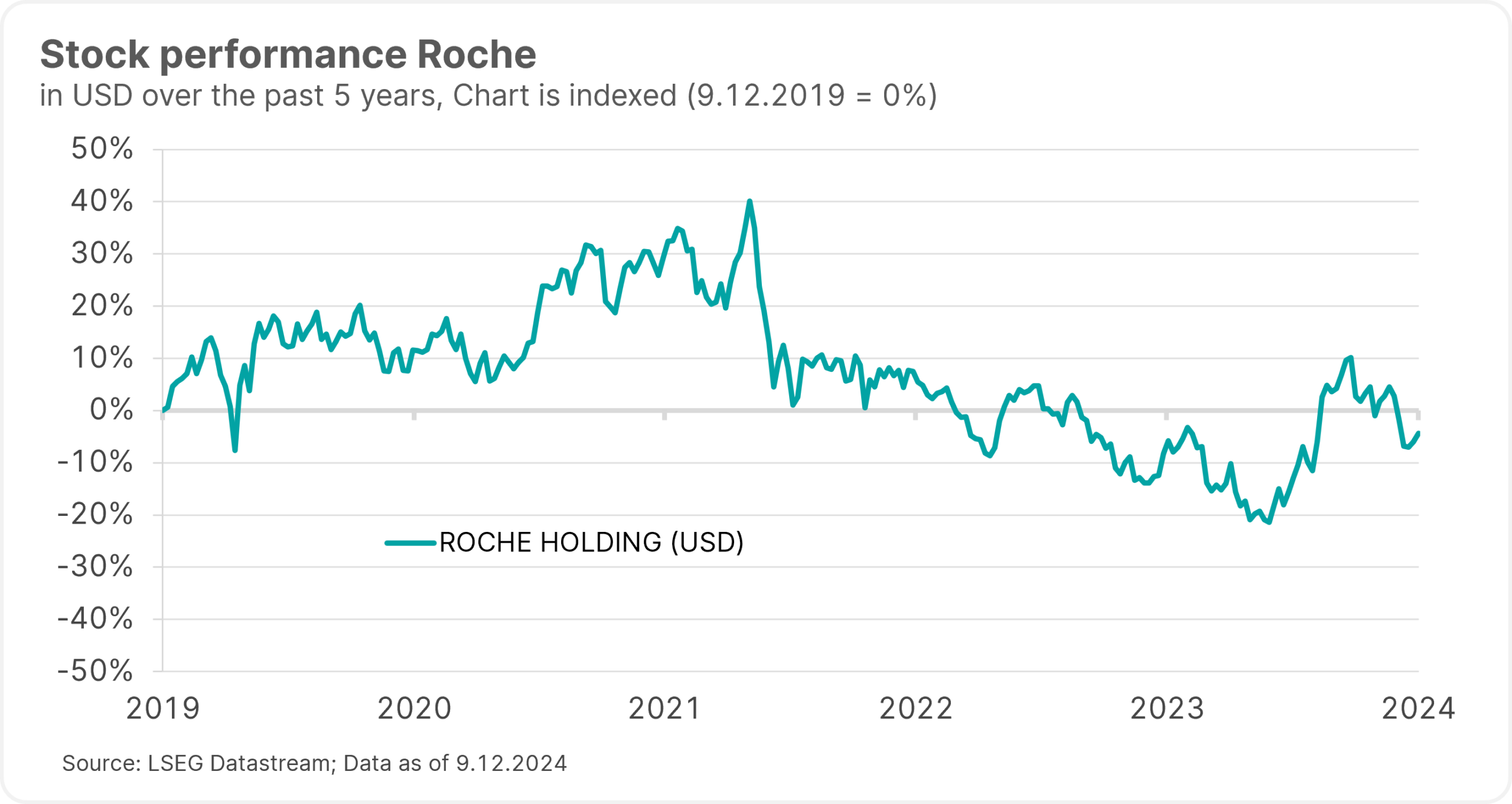

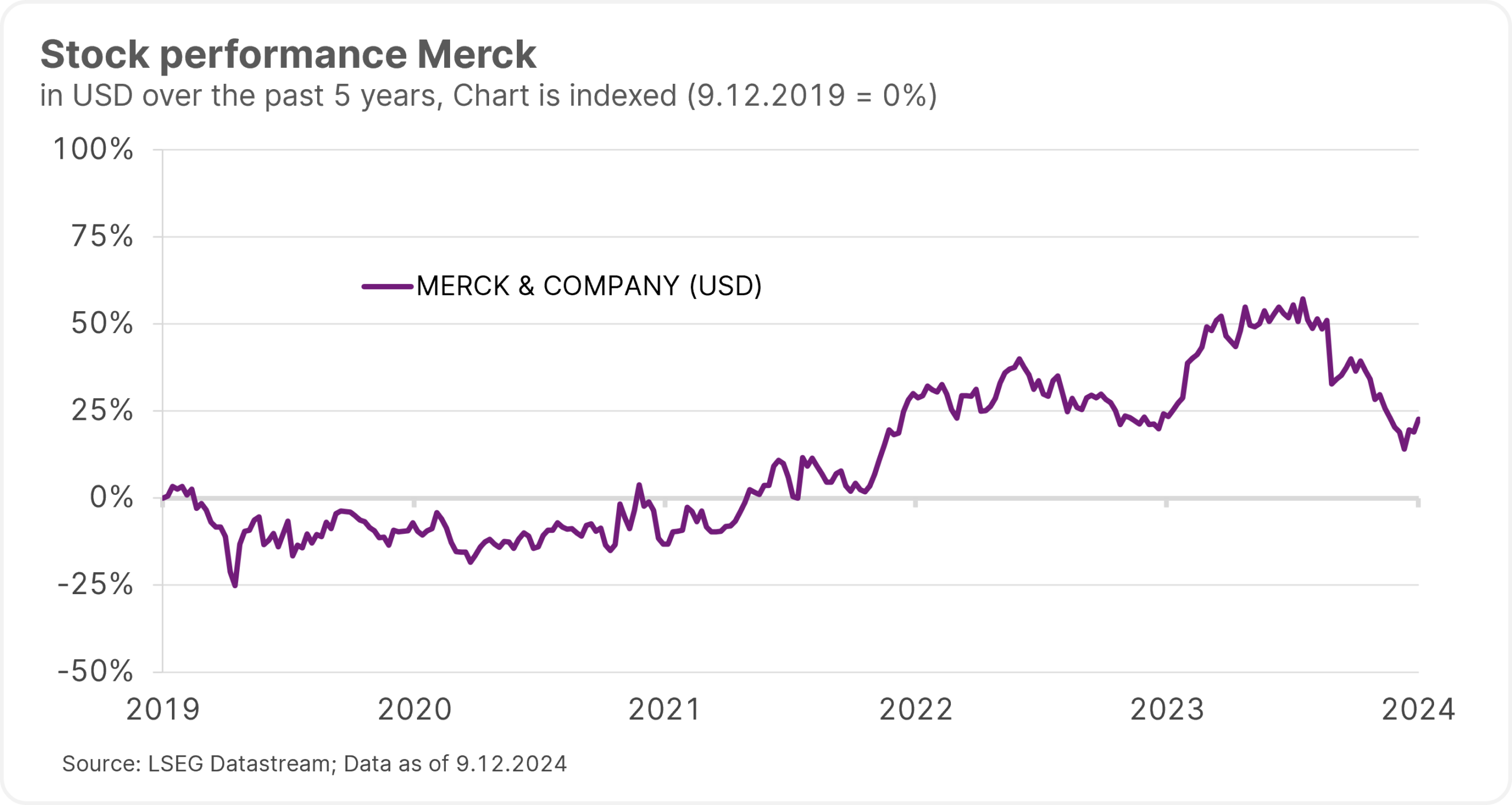

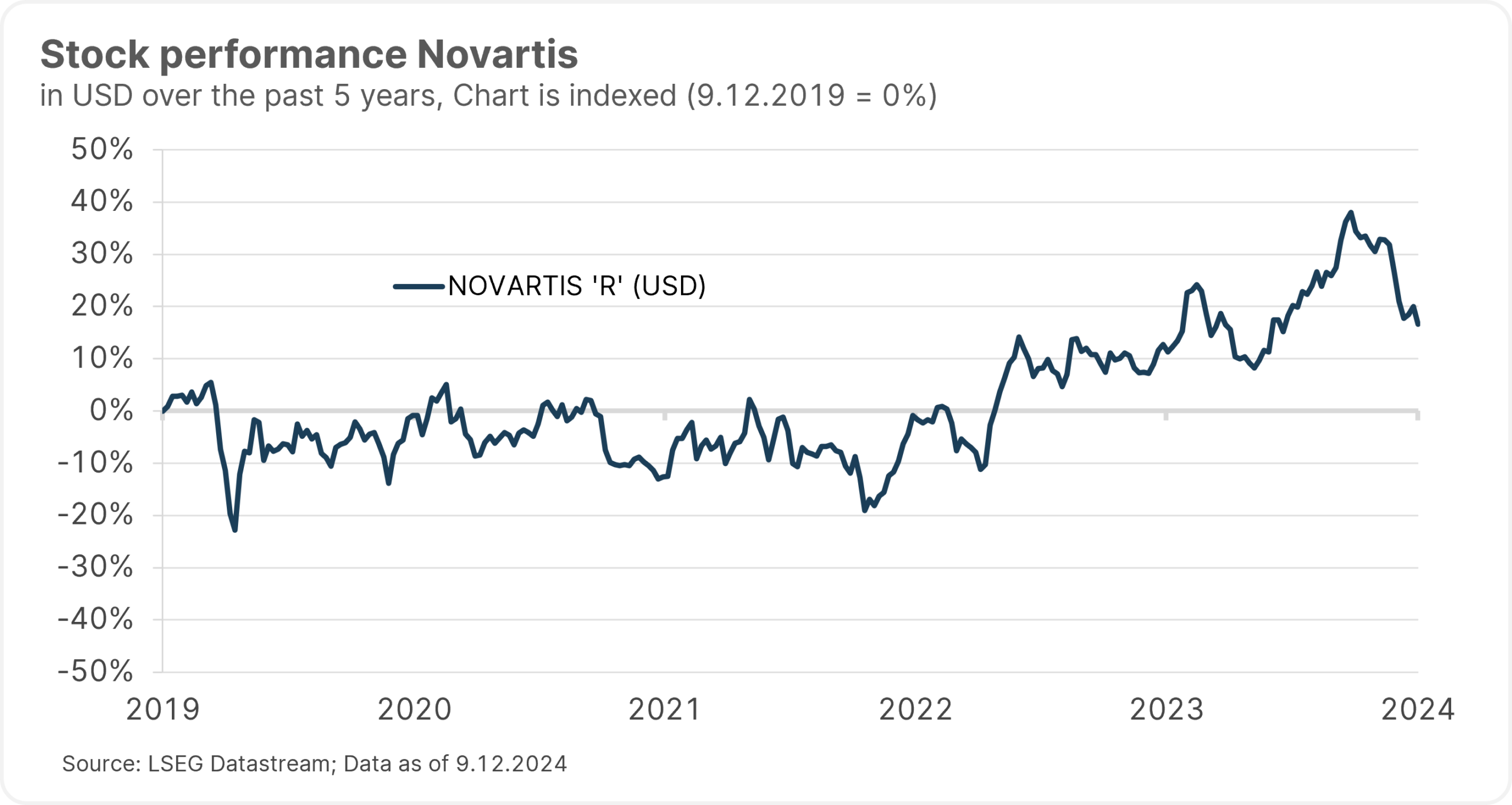

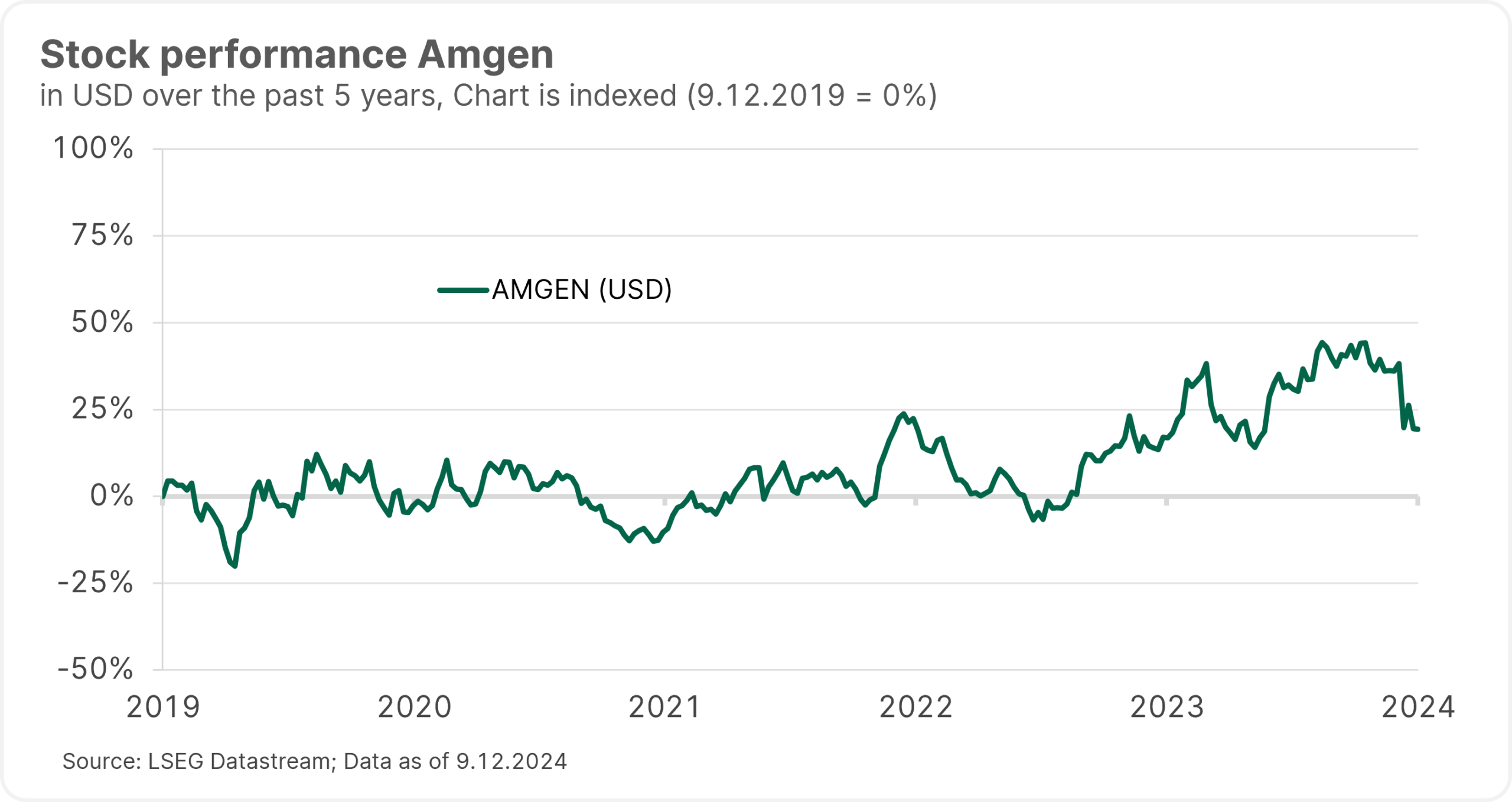

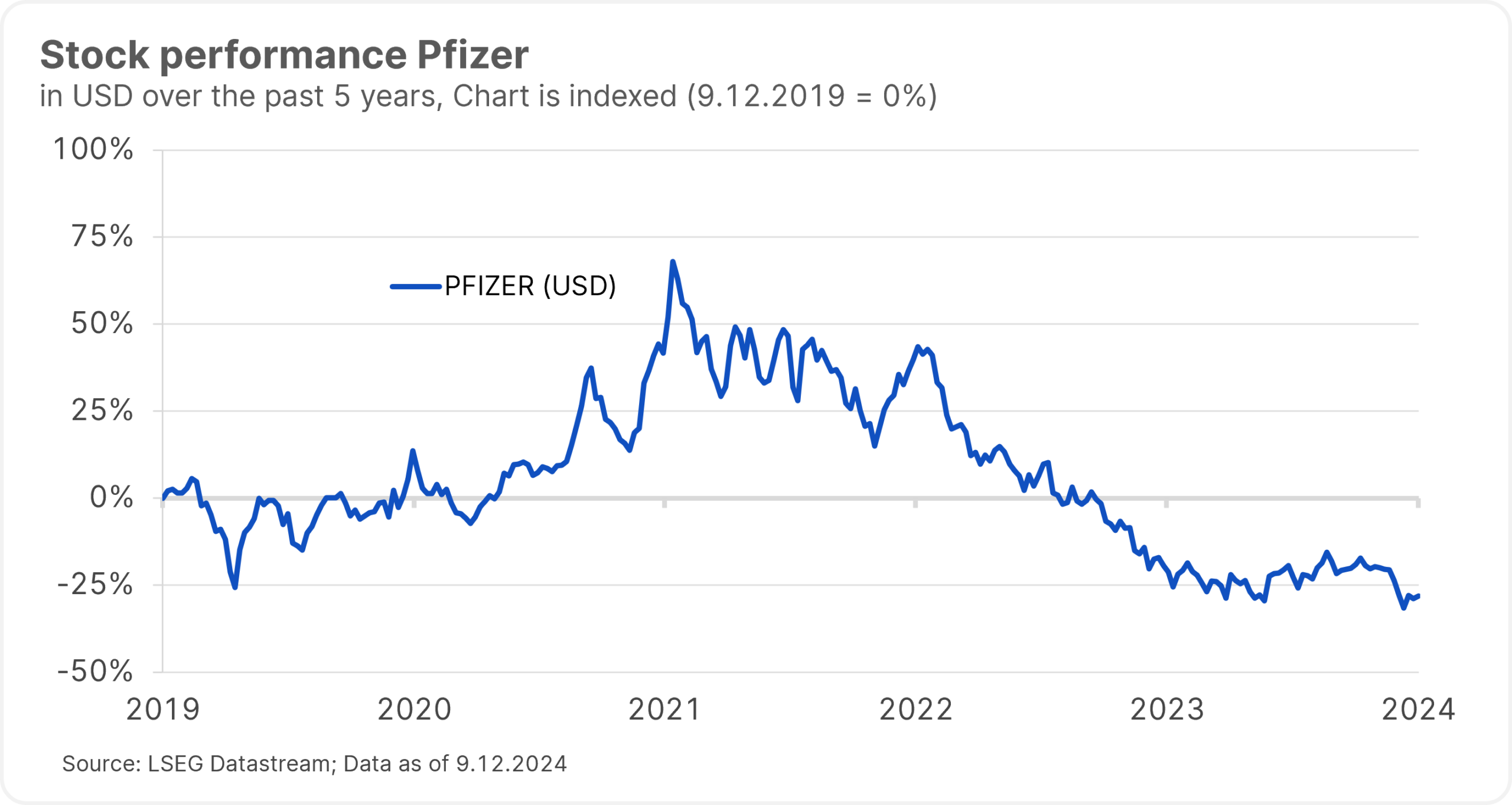

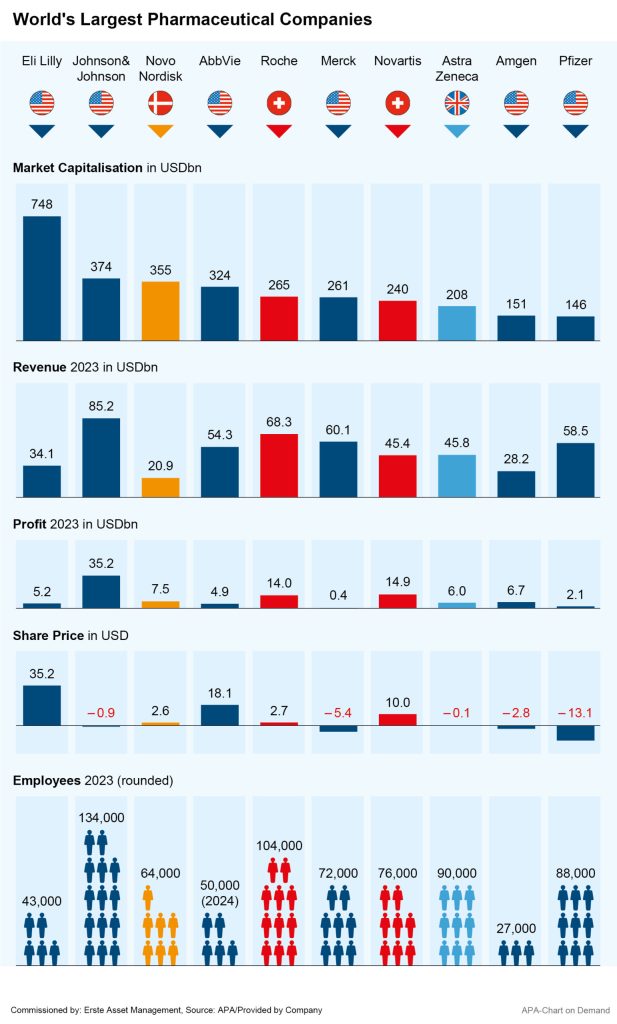

Note: Past performance is not a reliable indicator of future performance of an investment. The companies listed here have been selected as examples and do not constitute an investment recommendation.

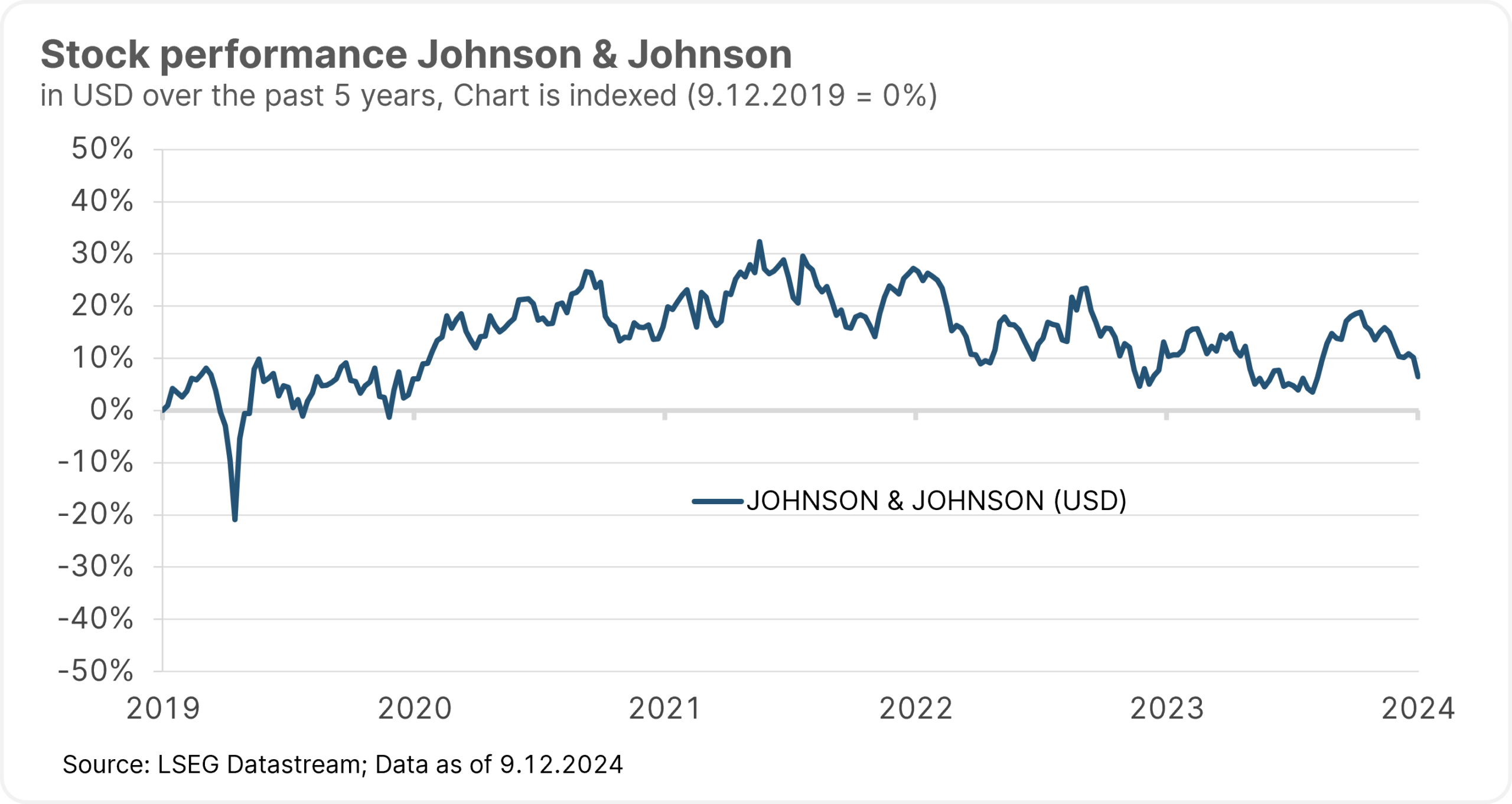

Thanks in large part to the cancer drug Darzalex, Johnson & Johnson performed better than expected in the past quarter. Although the bottom line profit fell by more than a third to USD 2.7bn due to higher costs, sales increased by nearly 5 percent quarter-on-quarter to USD 22.5bn. Meanwhile, competitor Pfizer increased its turnover for the quarter by 31 percent to USD 17.7bn. Pfizer also benefited from higher cancer drug sales, but also from the surprisingly good sales figures for its corona drug Paxlovid. The Group wrote a net profit of nearly USD 6bn, after a USD 968m loss in the previous year.

US pharmaceutical group Merck & Co reported mixed figures, with expenses for acquisitions causing the group’s profits to plummet in Q3. While profits dropped by 27 percent to USD 3.99bn, sales increased by 4 percent to 16.7bn. Merck benefited from strong business with its cancer immunotherapy Keytruda.

Note: Past performance is not a reliable indicator of future performance of an investment.

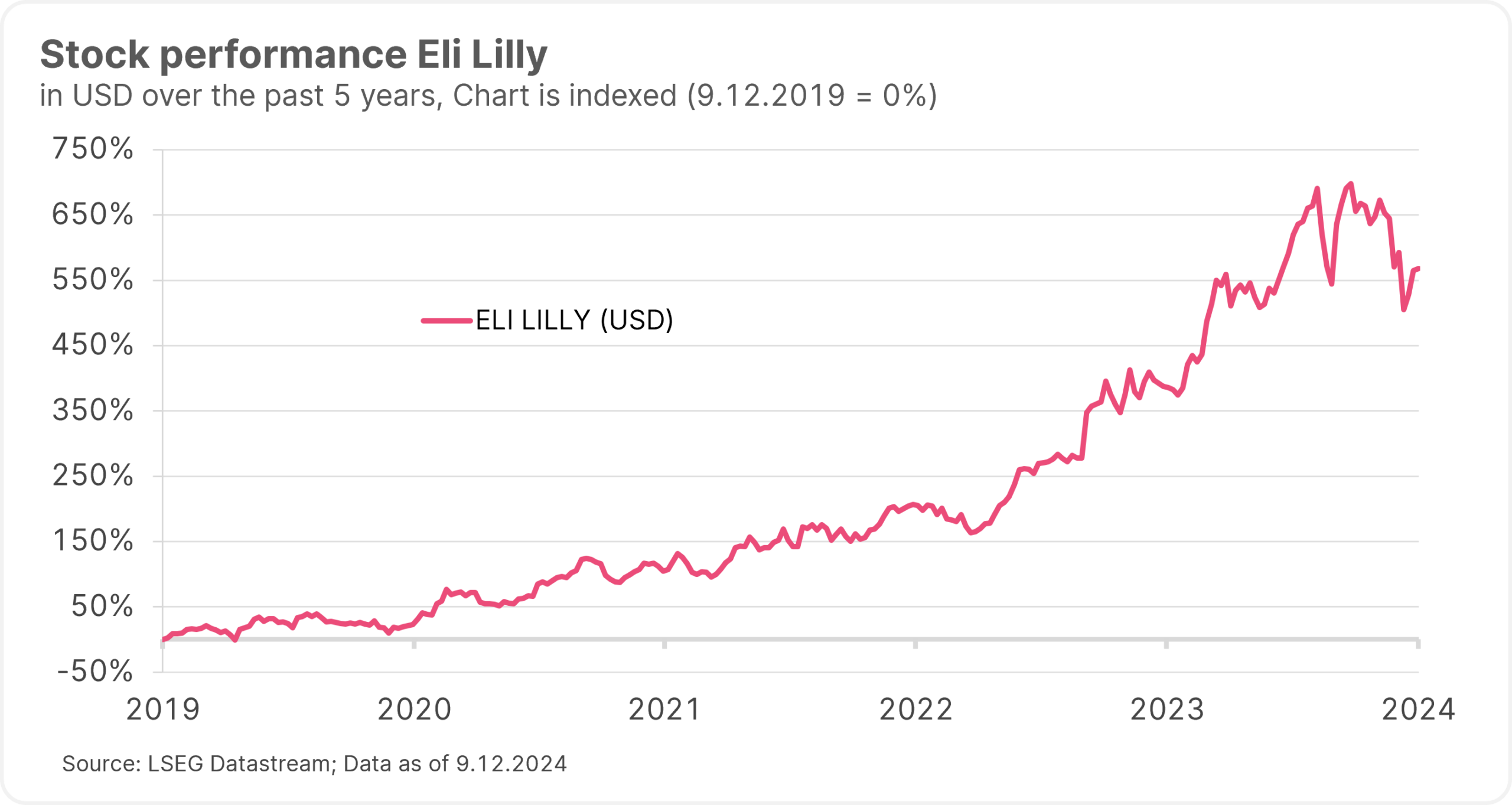

Eli Lilly disappoints with quarterly figures

Swiss group Roche reported an increase in sales of 6 percent to just under CHF 45bn for the first nine months of the year, to which the Group’s pharmaceutical division contributed sales of CHF 34.3bn. For the entire year, the Basel-based group therefore believes it is well on track to achieve its set targets. The development was driven by good demand for drugs like the eye preparation Vabysmo, Phesgo (breast cancer), Ocrevus (multiple sclerosis), Hemlibra (haemophilia) and Polivy (blood cancer).

The Q3 figures reported by pharmaceutical giant Eli Lilly were received with disappointment. The group increased its sales in the third quarter by 20 percent to nearly USD 11.4bn, with a profit of USD 970m, after being in the red in the previous year. However, analysts had expected stronger growth. Eli Lilly’s management is now taking a more cautious view of the sales trend for the entire year while also lowering its profit target.

Continued boom in slimming products

Pharmaceutical companies are still pinning their hopes on the booming business with anti-obesity drugs. According to expert estimates, the market could grow to USD 200bn by 2030, with an initiative by outgoing US President Joe Biden possibly providing an additional boost in demand. Biden plans to make weight-loss medication available to US citizens via Medicare. Until now, health insurance companies have only paid for these products for overweight people with diabetes or heart disease.

At present, Novo Nordisk and Eli Lilly are the only companies that already have such drugs on the market. Accordingly, the high demand for the products is reflected in Novo Nordisk’s figures: Quarterly sales of the Group’s weight loss injection have increased by almost 80 percent year-on-year. In Q3, the drug accounted for nearly a quarter of Novo Nordisk’s total sales. Eli Lilly also made a handy profit with its slimming products, but the moderate sales increase of its weight loss injection was disappointing. While the Group increased sales in Q3 to USD 1.26bn up from 1.24bn in the previous quarter, analysts had expected a much stronger increase.

Experts expect Eli Lilly and Novo Nordisk to continue sharing a large part of this market in the near future thanks to their lead in development. In the medium term, however, more and more pharmaceutical companies will likely enter the market with similar drugs. In addition, the patents for the drugs’ active ingredients will expire in a few years’ time.

Competition is also likely to remain high for other products, with expiring patents enabling copycat products from competitors. The pharmaceutical giants must therefore constantly keep innovating, making sure they have new potential blockbuster drugs in the development pipeline. Aa an additional measure to development in their own research laboratories, the groups are also increasingly relying on takeovers of smaller pharmaceutical companies to acquire new developments.

Acquisitions as key for pharmaceutical giants to strengthen their product portfolio

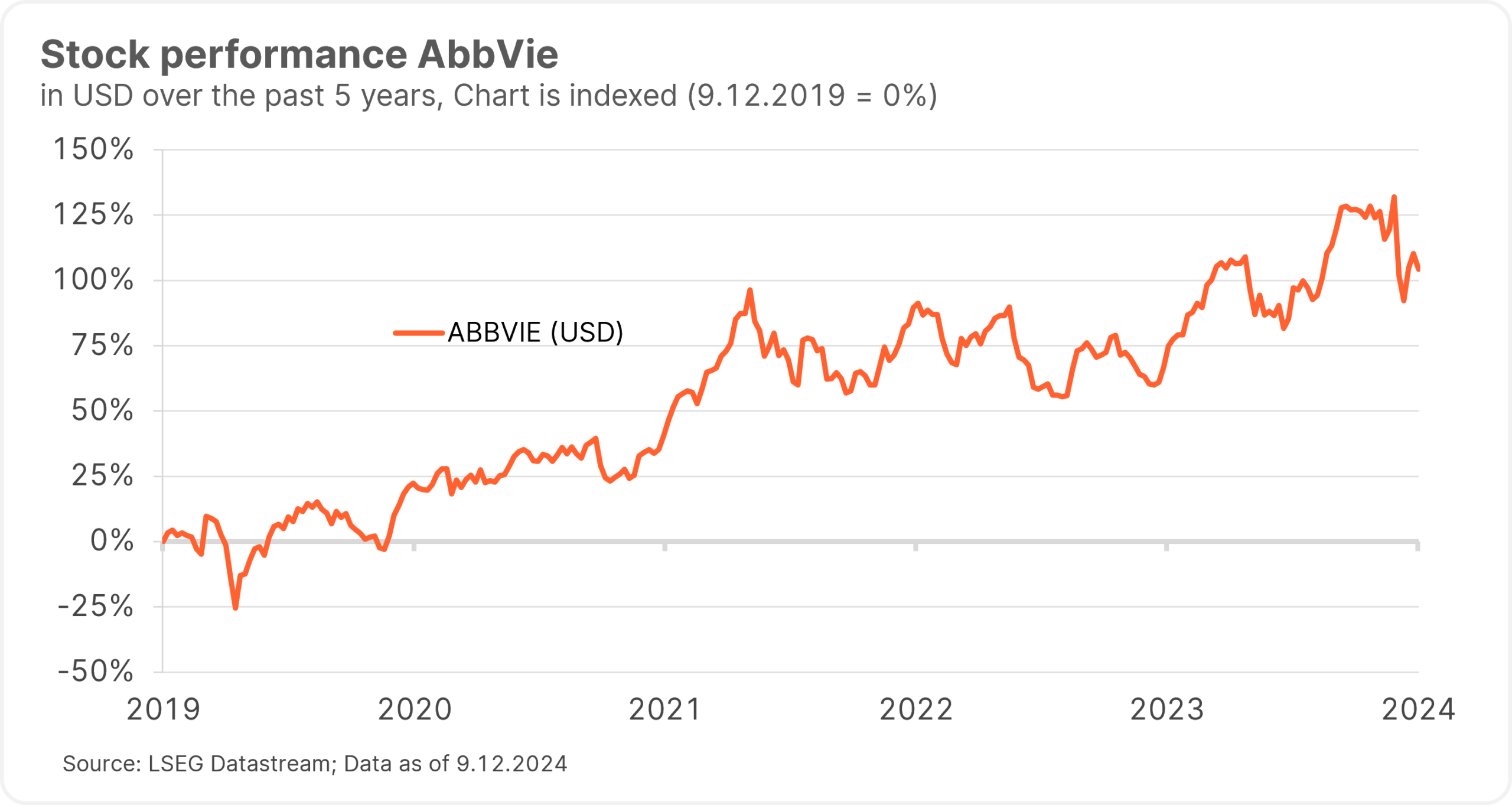

US pharmaceutical group AbbVie recently secured access to a potential Alzheimer’s drug by acquiring the US biotech company Aliada Therapeutics, paying USD 1.4bn in cash for the takeover. Swiss company Roche is expanding its business with cancer and autoimmune diseases therapies by means of acquiring US cell therapy company Poseida Therapeutics for USD 1.5bn. The biotech company is currently working on so-called CAR-T therapies against various tumours.

Merck & Co is also strengthening its position with regards to cancer therapies by buying the privately managed biotech company Modifi Biosciences for up to USD 1.3bn. The company is currently on the lookout for acquisitions because its cancer immunotherapy Keytruda’s patent expires at the end of the decade. Keytruda is the world’s best-selling prescription drug, so a sharp drop in sales looms ahead. Merck declared at the beginning of the year that it was open to takeovers of up to USD 15bn.

AI as future opportunity and concerns about the new US government

In addition to acquisitions, the pharmaceutical giants are also likely to further increase their use of artificial intelligence (AI) in research and development. Industry experts believe that the potential of AI applications in the pharmaceutical industry is far from exhausted. Analysts at Strategy&, a strategy consultancy owned by accounting firm PwC, expect pharmaceutical companies to be able to make profit gains to the tune of USD 254bn by 2030 through increased use of AI.

On the other hand, the industry is facing potential trouble in the US market from the new US government. US President-elect Donald Trump has nominated anti-vaccination campaigner Robert F. Kennedy Jr. as the next government’s Secretary of Health and Human Services. Kennedy is considered a major critic of the big pharmaceutical companies, having made several anti-industry statements in the past. He has called for greater promotion of alternative and preventative health measures and advocated a cap on drug prices.

Invest in healthcare equities with a broad-based fund

It is difficult to say in advance which drug or which development in cancer research, for example, will be successful. And in the sense that the health authorities in the US and Europe will actually approve it at the end of the day. Which means that it can be sold. In view of the large number of promising drugs currently in the approval process, it is important to cover as many of the companies involved as possible when investing.

Two funds of Erste Asset Management focus (among other) on the healthcare sector:

The ERSTE STOCK BIOTEC fund invests primarily in companies in developed markets in the biotechnology sector. The fund’s investment process is based on fundamental company analysis. The majority of companies in this sector are located in the USA. As a result, stocks from the Pacific region and Europe tend to play a subordinate role in the fund. Two of the companies mentioned above, Amgen and Astra Zeneca, are currently in the portfolio.

The ERSTE FUTURE INVEST fund focuses on megatrends that will shape our world for many decades to come. One of these is the aging of society. Megatrends generate growth and thus opportunities for investors who invest in the most exciting companies. In the coming years, we expect groundbreaking advances in healthcare. One company currently in the fund’s portfolio is Novo Nordisk.

Both funds are equity funds that may be subject to higher price fluctuations at times. Please note that investing in securities involves risks as well as the opportunities described.

Risk notes ERSTE STOCK BIOTEC

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

For further information on the sustainable focus of ERSTE STOCK BIOTEC as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK BIOTEC, consideration should be given to any characteristics or objectives of the ERSTE STOCK BIOTEC as described in the Fund Documents.

Risk notes ERSTE FUTURE INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE FUTURE INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE FUTURE INVEST, consideration should be given to any characteristics or objectives of the ERSTE FUTURE INVEST as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.