At first glance, the second quarter of 2025 seemed almost unspectacular on the global equity markets: the S&P 500 and the MSCI World recorded a slightly positive performance – in the US, we are now trading at an all-time high again.

Anyone who keeps an eye on the markets knows, of course, that the truth is different. Developments in the first six months of the year were sometimes highly volatile – driven by headlines that were mostly dominated by US President Donald Trump. Despite incisive events such as “Liberation Day” and the tariff discussions that have repeatedly flared up since then, or the geopolitical escalation in the Middle East, the stock markets proved resilient on the whole.

The performance of environmental technology stocks was also quite similar in the first half of the year – the slump around Liberation Day was followed by a clear and rapid recovery, resulting in a small gain since the beginning of the year. For investors in the cleantech sector, however, a particular focus in the year to date has not been on the tariff discussions, but on the US government’s new tax law.

One Big Beautiful Bill vs. Inflation Reduction Act

With the Inflation Reduction Act (IRA), Joe Biden, Donald Trump’s predecessor in the White House, introduced a major tax package in 2022 that primarily benefited renewable energy providers. The package, with its billions in tax breaks, has given a powerful boost to the expansion of renewables in the United States in recent years.

However, as soon as he took office, Trump made it clear that his aim was to repeal the IRA. Our opinion was always that there would only be a partial repeal of individual passages, as too many Republican states benefit from the IRA. Texas, for example, is now one of the most important states in the solar sector.

The end product – the “One Big Beautiful Bill” (OBBB), which has now been passed in the House of Representatives – is in line with this assessment. The IRA has indeed been trimmed, but with a scalpel rather than a chainsaw. However, the path to this was a bumpy one with enormous volatility. The various proposals from the Senate and House of Representatives caused many 180-degree turns with corresponding market reactions in equities. In total, there were 5 proposals from the Senate and House of Representatives – and each had a completely different interpretation of the clean tech tax credits from the IRA than the previous proposal.

The final version of the tax law now includes some improvements for renewable energies compared to the previous versions:

- Wind and solar: In the area of large-scale wind and solar projects, the text regarding the start of construction is particularly important – this enables developers to generate tax credits until 2032.

- FEOC / Foreign Entities of Concern: FEOC is basically the anti-China clause, which stipulates that renewable projects should be implemented with as little influence from China as possible – be it in the supply chain or in terms of ownership. In the final text, some FEOC clauses were softened and the entry into force was postponed.

- Made in America: Building on the anti-China stance, producers whose value creation is located in the USA are rewarded – be it in the solar, wind or supplier sectors. These credits remain untouched, which was also in line with our expectations and positioning.

- Residential solar leasing: The final version is significantly better for residential solar, i.e. solar installations in private households, than in the previous drafts. Although the tax credit for the direct sale of solar systems will expire at the end of 2025, sales via leasing contracts – the most common form of sales – have not been affected. The tax credits will continue to be available until 2032.

Now that the uncertainty surrounding the future rules of the game has been put to one side, the focus could shift away from political stock markets and back towards fundamentals. In this respect, the clean tech segment has recently surprised on the upside in some cases.

Reporting season brings better than expected figures

In the utility-scale solar segment, i.e. large-scale solar installations, some companies were able to exceed the low expectations in the current reporting season. Even more important is the outlook for the sector, which remains subject to some political uncertainties (keyword: tariffs), but nevertheless turned out better than expected.

The next few quarters could bring momentum, especially for larger projects. There has been a delay here in recent months due to political uncertainty. Now the opposite is more likely to be the case – developers of solar and wind systems want to install them as quickly as possible in order to be able to access all remaining tax credits.

Companies from the solar segment are hoping for a catch-up effect for large-scale projects. Source: unsplash

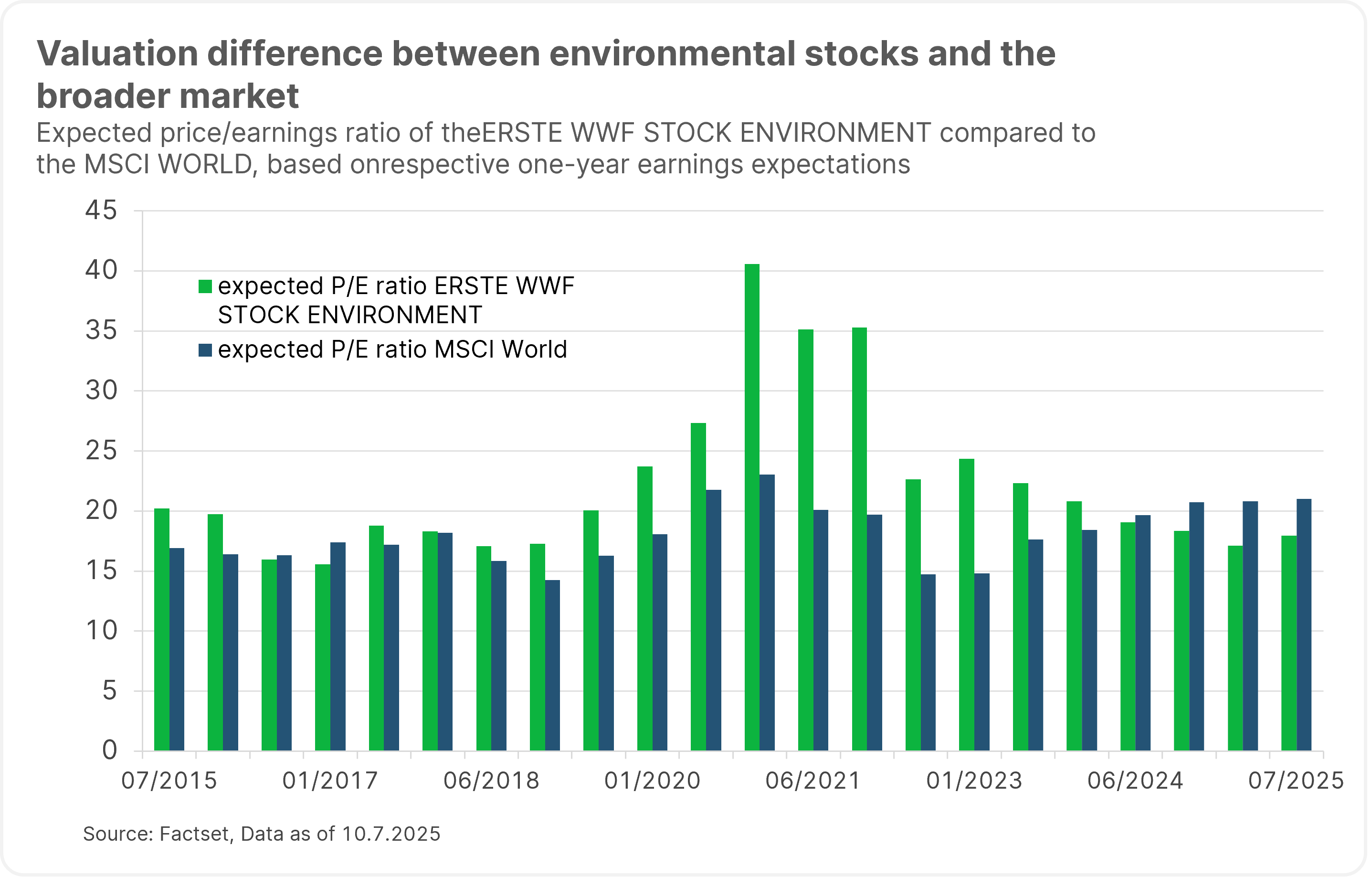

What stands out? Despite recent gains by some players in the renewable energy sector, environmental stocks continue to trade at lower valuations than the broader stock market. The price-earnings ratio in the ERSTE WWF STOCK ENVIRONMENT is currently around 18, while the P/E ratio of the MSCI World is 21. Historically, small and medium-sized companies in a growth industry such as environmental technologies have been valued higher than the broader market. This could therefore be an indication of long-term performance potential in the segment.

Note: Past performance is not a reliable indicator of future performance. Investing in securities involves risks as well as opportunities.

Company in focus: Siemens Energy

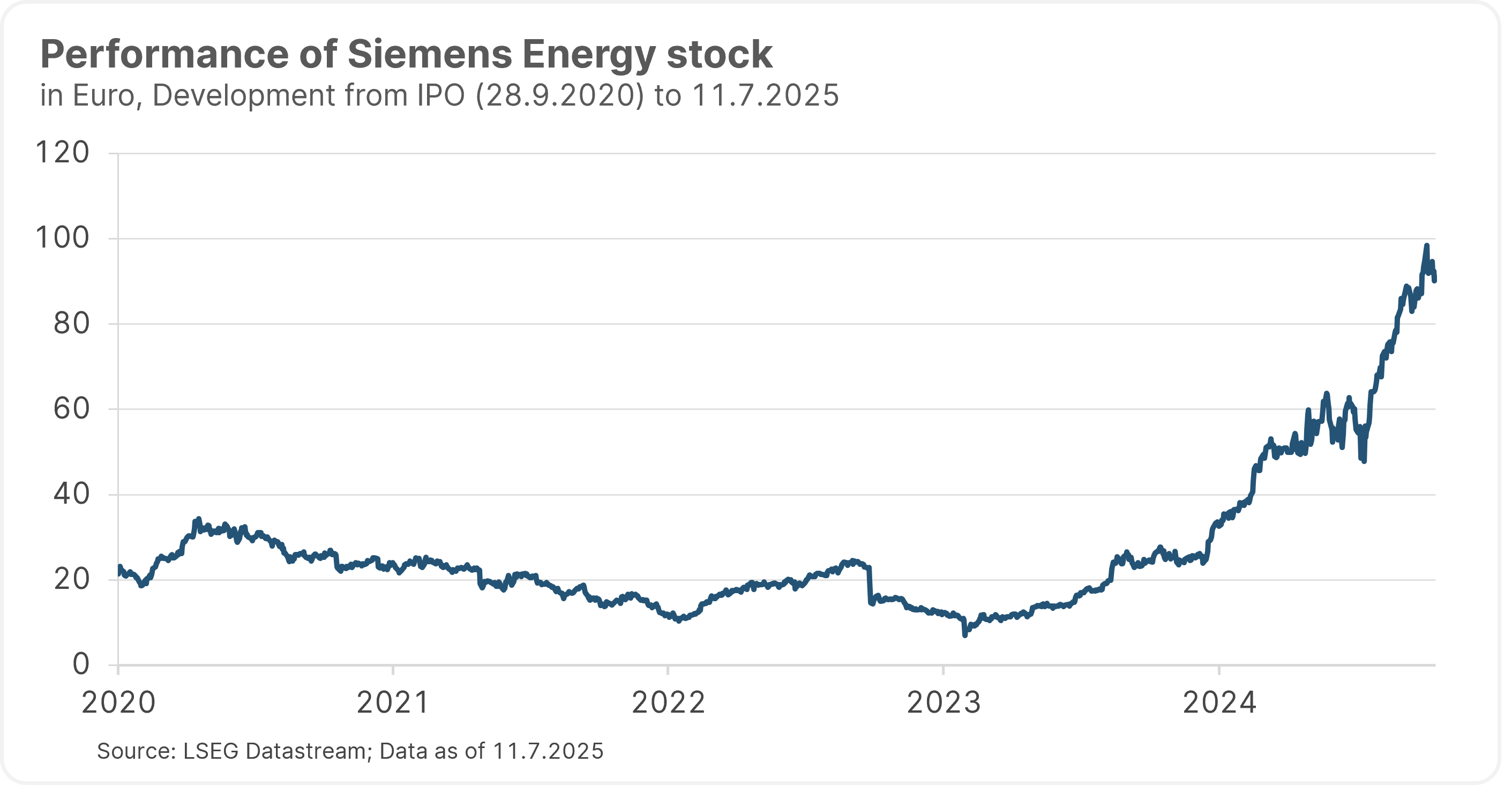

One company from the renewables segment that has performed very well so far this year is Siemens Energy. The share is up 87% since the beginning of the year and has even gained 1,300% since the low in October 2023. What are the reasons for the good performance of the share, which is also part of the ERSTE GREEN INVEST portfolio?

Note: Past performance is not a reliable indicator of future performance. Please note that investing in securities involves risks as well as opportunities. The company mentioned here has been selected as an example and does not constitute an investment recommendation.

The company operates in four segments: traditional power generation, power transmission, wind energy and transformation of industry, and is a prime example of transformation in environmental technologies. Siemens Energy recently won several major orders for grid expansion. The advantage here is that regardless of the type of electricity, grid expansion is essential, and Siemens Energy is one of the few companies worldwide that specialises in this area. The order backlog across the entire company is at a record level, margins and profits have improved significantly, and forecasts are being raised on an ongoing basis. Artificial intelligence and the trend towards electrification are providing further tailwinds.

But there are also risks – because not all segments are doing equally well. For example, the wind power subsidiary Siemens Gamesa has been in crisis for some time, after a necessary guarantee from the German government led to the share price plummeting in 2023.

However, the high order backlog in grid expansion continues to benefit Siemens Energy and supports a positive outlook. The company therefore remains a top pick in our ERSTE GREEN INVEST and ERSTE WWF STOCK ENVIRONMENT clean tech portfolios and one of our largest positions. It is also one of the few European companies that plays a pioneering role in technology – the increased public investment in Germany should also help Siemens Energy.

Note: Please note that investing in securities involves risks as well as opportunities.

Conclusion

The environment for environmental technologies remains very volatile. No sooner has Trump pushed through his tax reform than he turns back to a politically motivated tariff policy, as was recently seen in Brazil and the price of copper. However, purely in terms of the US market and our segment, the legislation passed should provide more planning security for the time being, as demand for electricity continues to rise. Wind and solar can fill this gap as a cost-effective alternative that can be connected to the grid quickly. The basic scenario has not changed – without renewable energies, there will be no expansion of the electricity grids or smart solutions for providing energy in the immediate future. Accordingly, our positioning in ERSTE GREEN INVEST and ERSTE WWF STOCK ENVIRONMENT remains focused on these megatrends.

Further information can be found on our website 👉 Investing in environmental technologies

Risk notes ERSTE GREEN INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Risk notes ERSTE WWF STOCK ENVIRONMENT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE WWF STOCK ENVIRONMENT as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE WWF STOCK ENVIRONMENT, consideration should be given to any characteristics or objectives of the ERSTE WWF STOCK ENVIRONMENT as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.