The end of the coalition government in Germany is exacerbating the uncertainty for the struggling German economy – and at a time when new challenges are emerging for Europe’s largest economy following the US election. However, experts also see the upcoming change of government in Germany as an opportunity for realignment and necessary reforms.

Risky step by the German Chancellor

“The Federal Chancellor’s decision to end this government at this point in time is risky,” said Marcel Fratzscher, President of the German Institute for Economic Research (DIW), according to the Reuters news agency. However, this is likely the lesser evil compared to a continuation of political and economic paralysis, Fratscher pointed out.

“The coalition was barely able to act and the political uncertainty in Germany was already very high. With new elections comes a chance of a liberating fresh start,” Achim Wambach, President of the Leibniz Centre for European Economic Research (ZEW), told the German press agency dpa.

German economy in crisis

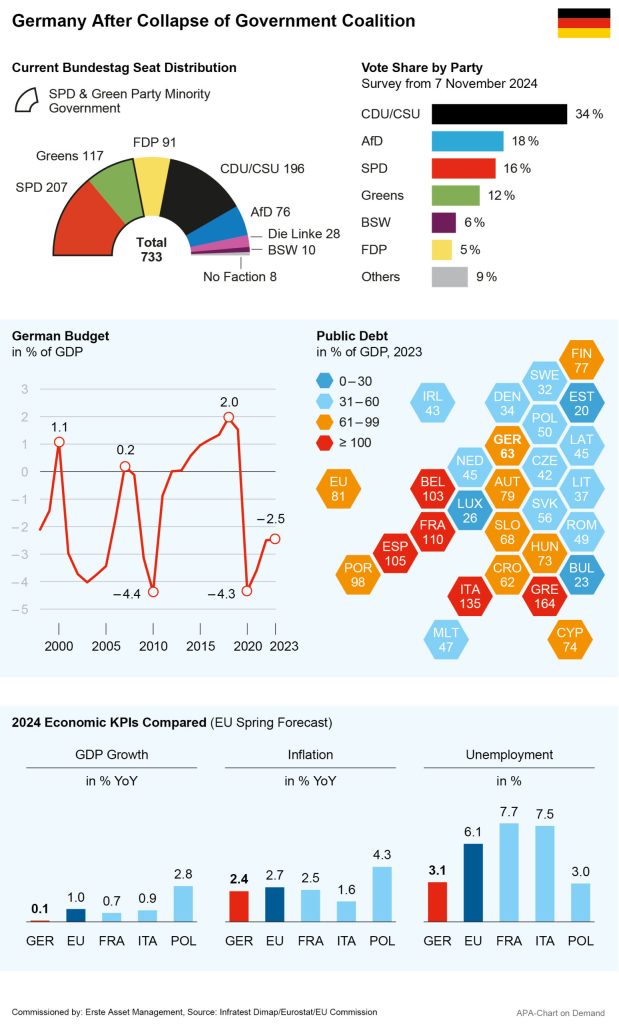

The crisis-ridden German economy grew surprisingly in Q3 due to higher consumer spending. According to an initial estimate by the Federal Statistical Office, the gross domestic product (GDP) increased by 0.2 per cent between July and September compared to the previous quarter. The Ifo business climate index, considered the leading early indicator for German economic development, increased again in October for the first time after four consecutive declines. However, the ailing German economy has recently shown signs of weakness again.

Despite good business in the US, exports of German goods in September were down 1.7 per cent from the previous month at EUR 128.2bn. Growing competition from countries such as China and high energy prices compared to other countries have been causing problems for Germany as an export nation for some time now. In addition, businesses cut back their production significantly due to the weakening automotive sector: industry, construction and energy suppliers together produced 2.5 per cent less than in August.

The uncertainty surrounding the new election could potentially also dampen consumer sentiment. “We are expecting the coalition’s end to have a negative impact on consumer sentiment,” Rolf Bürkl from the Nuremberg Institute for Market Decisions (NIM) told the Reuters news agency.

Trump election fuels concerns about the export economy

German economists are also worried about the recent re-election of Donald Trump, fearing that the US president-elect could instigate a trade war between the EU and the US with his tariff plans. Trump announced his plans for new tariffs of 10 to 20 per cent on imports from Europe and even spoke of 60 per cent for goods from China. While that would give Europe an advantage, the punitive tariffs would likely hit Germany hard. The US is the most important sales market for the German export industry, and the planned tariffs would make German products significantly more expensive – and therefore less attractive – in the US.

The planned tariff hikes could reduce GDP by around 0.3 per cent next year and by up to 1.2 per cent in subsequent years, said Michael Hüther, Director of the German Economic Institute (IW), to the Funke Mediengruppe newspapers. Even if the EU were to take countermeasures in the trade dispute, the negative GDP effects would increase until 2028.

The planned tariff increases of the future US President Donald Trump would hit the German export industry hard. © unsplash

“The US has been Germany’s most important trading partner for nine years. Filling this gap with domestic and European consumption in the single market will be almost impossible,” said Hüther. Experts expect the tariff increases to hit the automotive industry, mechanical engineering, but also the pharmaceutical and chemical sectors particularly hard, as they have above-average export quotas to the US.

Bleak outlook for the automotive industry

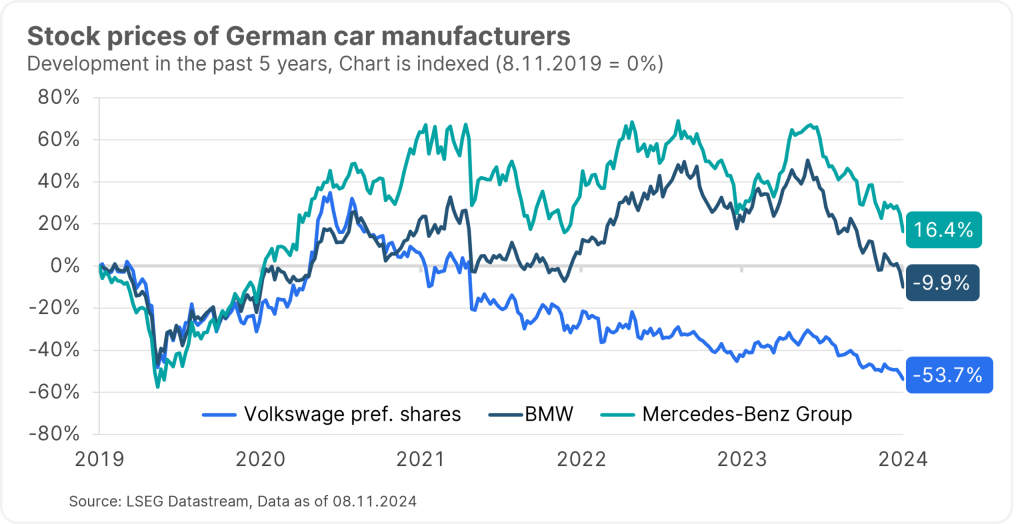

This could cause the already ailing automotive industry to suffer even more. The mood in the German automotive industry already deteriorated significantly before Donald Trump’s election victory. The business climate barometer determined in a company survey by the Ifo Institute fell from minus 23.4 points in the previous month to minus 27.7 points in October.

Note: Past performance is not a reliable indicator of future performance.

The stock prices of the major German carmakers clearly reflected the weakness in the industry in recent months. Source: LSEG Datastream

Export expectations in the German automotive industry deteriorated further in October, with the corresponding indicator dropping to minus 32.8 points. The only time the value was lower was during the first coronavirus wave in early 2020. “The German automotive industry appears to be increasingly affected by the intensifying competition, especially from outside Europe,” Ifo industry expert Anita Wölfl explained the downward trend.

Opportunities for German companies with production sites in the US

For German companies with production sites in the US, however, there could be opportunities under Trump’s presidency. “Trump will probably not only increase tariffs, but also reduce corporate taxes. For some local German companies, Trump’s election is good news,” said ZEW President Wambach. Last year already, companies in the pharmaceutical and chemical industries invested more in the US, attracted by low energy prices and a subsidy programme to the tune of billions, and German car manufacturers have had large plants in the USA for years.

Trump’s re-election should make the USA even more attractive as a business location, says Wambach. “Companies will react to this and produce even more locally.” Germany, on the other hand, runs the risk of losing even more production and research to the USA. Germany therefore needs reforms all the more, not least a reduction in bureaucracy. The EU must also “cast off self-imposed shackles”, urges Wambach with regard to complex regulations such as the EU Supply Chain Act and General Data Protection Regulation.

Experts call for new elections as early as possible and a fresh start with reforms

Top managers are also hoping that the new government will speed up reforms, particularly with regards to reducing bureaucracy and other measures to strengthen business locations. “Every month of missing reforms will later be nothing more than a missing year of growth,” wrote Deutsche Bank CEO Christian Sewing on the LinkedIn platform. “We are convinced that Germany has great potential,” said Sewing, “but we need to act now so that we can catch up and our economy can realise this potential.” The chemical sector, which is important for Germany, also recently called for extensive reforms and a reduction in bureaucracy to strengthen the location via its industry association.

The uncertainty in the already weakening German economy continues to increase after the end of the governing coalition. In addition, the upcoming second period of Donald Trump as US President is likely to weigh particularly on the export sector.

However, business representatives also see opportunities for the world’s fourth-largest economy in the end of the coalition and the result of the US election. New elections also bring the opportunity for urgently needed reforms. To remain competitive, the economy demands a rapid realignment and a reduction in bureaucracy.

However, Germany is facing a period of standstill until the new election, which is currently scheduled for March. For example, Chancellor Olaf Scholz will probably no longer be able to implement the billion-euro package of measures to support the automotive and chemical industries, which he announced in October, to the extent planned due to a lack of a majority. Entrepreneurs and economists are therefore calling for new elections to be held as soon as possible in order to keep the impending standstill until the hoped-for fresh start as short as possible.

Note: Prognoses are not a reliable indicator of future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.