In my last blog post, we clarified the background to the Sahm Rule and looked at how certain a coming recession in the US is after the Sahm Rule was triggered by the US labor market report in August. For the inventor of the Sahm Rule, this time it is not so certain and, moreover, a closer analysis of the data shows that the Sahm Rule was not technically triggered at all.

Beyond this technical nuance, the Sahm Rule primarily pertains to the US labor market. Unfortunately, there is no equivalent standardized indicator for Europe or the Eurozone. However, this article proposes an approach to analyze the diverse European labor market by dividing the Eurozone into two distinct regions: the core and the periphery.

Two regions with many differences

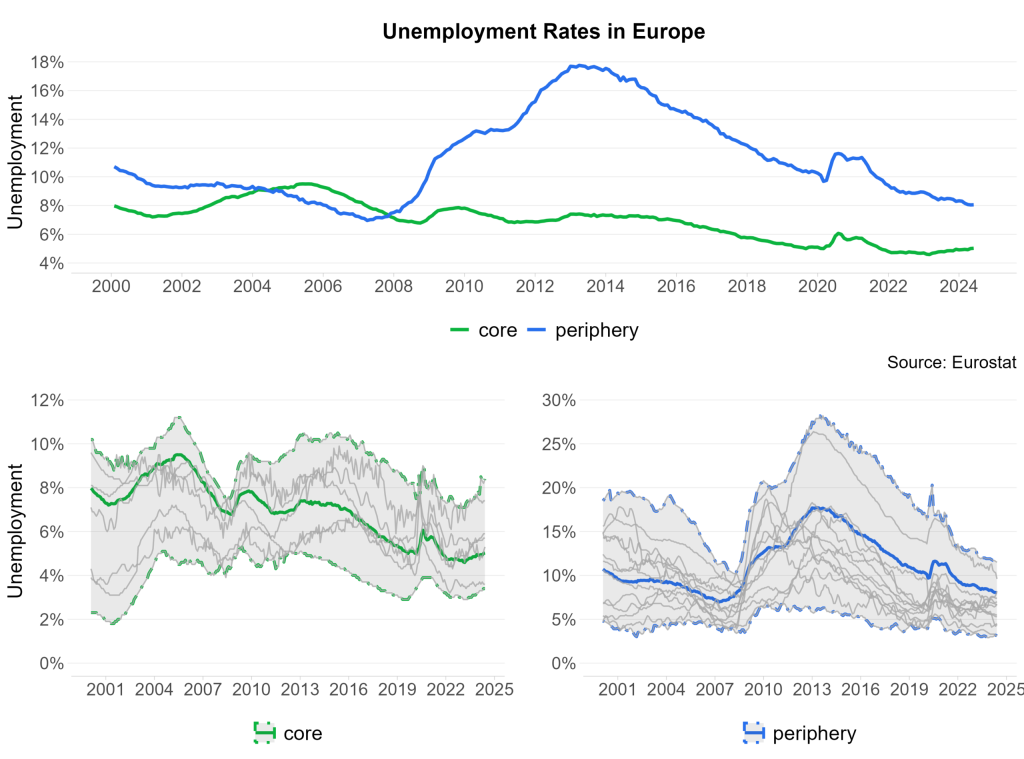

In doing so, the figure below shows what I mean by heterogenous. The core countries represent the stronger manufacturing members of the eurozone, such as Germany, Netherlands, Austria and Finland (among others). Those 4 countries, for instance, also represent the monetary hawks.

On the other side are the periphery members such as Italy, Spain, Greece, and other eastern European countries. Those countries are more service (tourism) or agricultural heavy. Furthermore, they count more to the dovish camp when it comes to monetary policy.

At the top of the chart, we observe the GDP-weighted average for both regions. Following the Great Financial Crisis (GFC), peripheral countries faced a severe economic downturn, while the labor market in core countries remained relatively stable (with a minor disruption in 2009 and 2013). This global shock, followed by the Euro crisis, had a lasting impact on the labor market in peripheral regions.

Furthermore, even within the two regions, there is substantial variation among countries, particularly in the periphery. In 2013, Greece (with an unemployment rate of 28.2%) and Spain (26.4%) experienced the highest unemployment rates, coinciding with the peak of the Euro crisis. In contrast, the core countries had lower rates: France at 10.5% and Finland at 8.9%. Interestingly, the core area faced its highest unemployment rate during spring 2005, when Germany’s rate reached 11.2%, earning it the moniker ‘the sick man of Europe’.

To summarize, the Eurozone exhibits diverse economic characteristics. The core countries emphasize manufacturing, while the periphery includes agricultural or tourism-heavy regions (especially in the south) and less economically developed areas (such as the east). Larger periphery countries have higher debt due to current account deficits with core countries, notably Germany. Interestingly, post-Covid, factors like inflation, labor market demographics, supply chain adjustments, and travel demand have been more favorable for the periphery.

It remains to be seen whether this will continue to be the case and whether European integration and convergence will progress. At this year’s Alpbach Forum, Andreas Teichl emphasized the importance of European determination and unity, as we are falling further and further behind economically and politically, and nobody is waiting for Europe.

Eurozone currently well below threshold

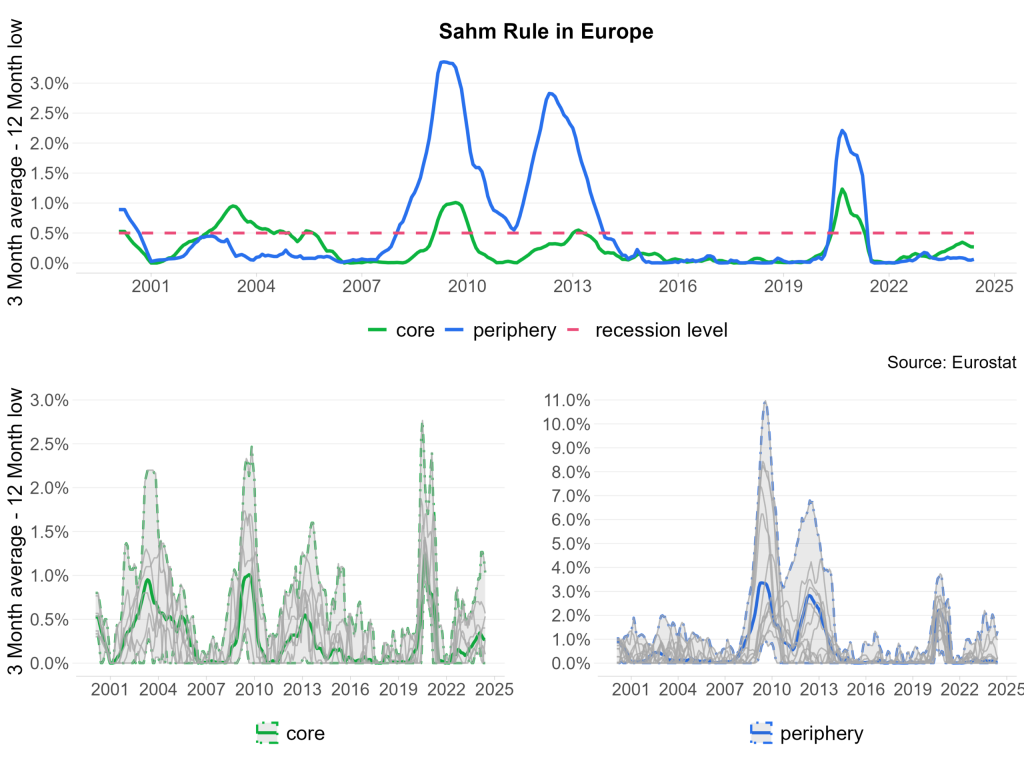

Yet, with all these issues, the question arises as to whether the weakening economy in Europe will also lead to a significant weakening of the labor market and whether the eurozone will therefore face economic turbulence. Using the available unemployment data (first full sample is for January 2000), we can compute the Sahm Rule for the Eurozone. As previously explained, this involves calculating the 3-month moving average and subtracting the 12-month minimum. If this resulting value exceeds 0.5%, it signals a recession, at least according to the US criteria.

The outcomes are depicted in the chart below. Using the same threshold as for the US (0.5 %), both areas of the eurozone are not near the level that indicates a recession.

There are some interesting patterns evolving, however. Traditionally, economic shocks within the Eurozone originated in peripheral areas during events like the Great Financial Crisis, Euro crisis, and Covid Pandemic. However, the current situation deviates from this pattern: the periphery now experiences no “momentum” in the average unemployment rate (0.048%), while the core stands at 0.269%. When you look at the lower left part of the chart, you can see that the range of the core countries is higher than for the periphery. For June, Finland has the highest number in the core area, with 1.067 %. However, several countries have already published their unemployment rates for July, with unemployment in Finland falling again to 7.9% (from 8.3%). The last time such a shift occurred was between 2003 and 2006 due to economic weakness in Germany. Considering the Sahm Rule, it appears unlikely that the Eurozone will enter an economic recession, which is triggered by higher unemployment and its secondary effects.

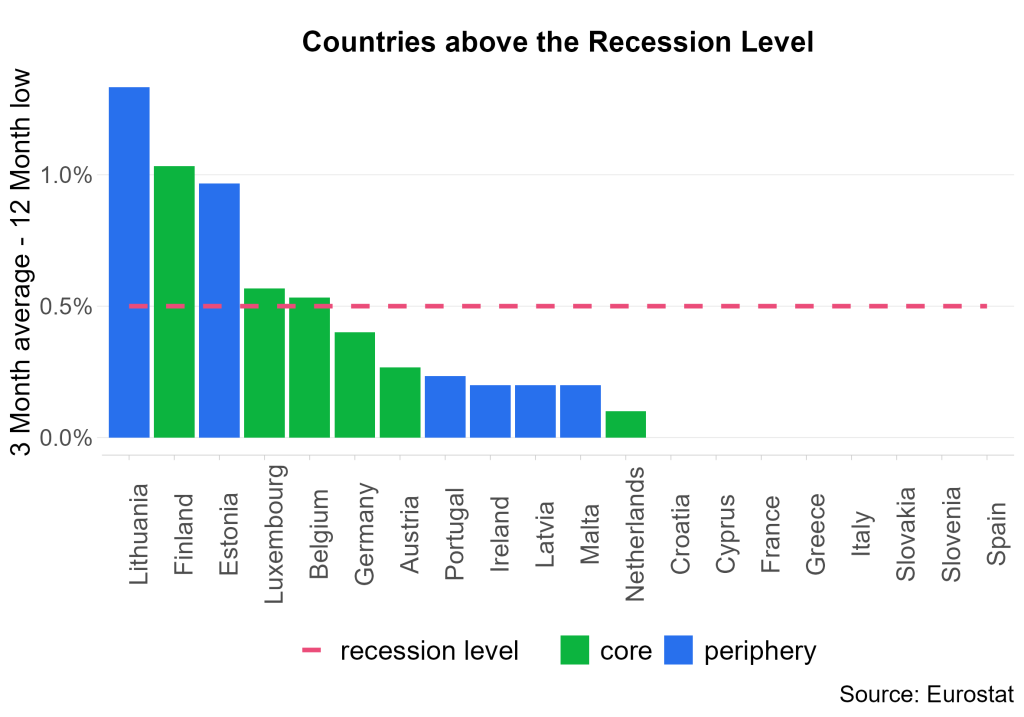

Looking at the latest unemployment data of June, there are 3 Countries that are a lot higher than the recession trigger level and two that are slightly above. These three countries are Lithuania, Estonia and Finland, which are heavily affected by the conflict in Ukraine. However, there are 8 countries with a figure of zero, meaning that the average rate is at the minimum of the last 12 month, indicating that the unemployment rate is flat or even falling. This is a good sign from an historical perspective, as we will see in the next graph.

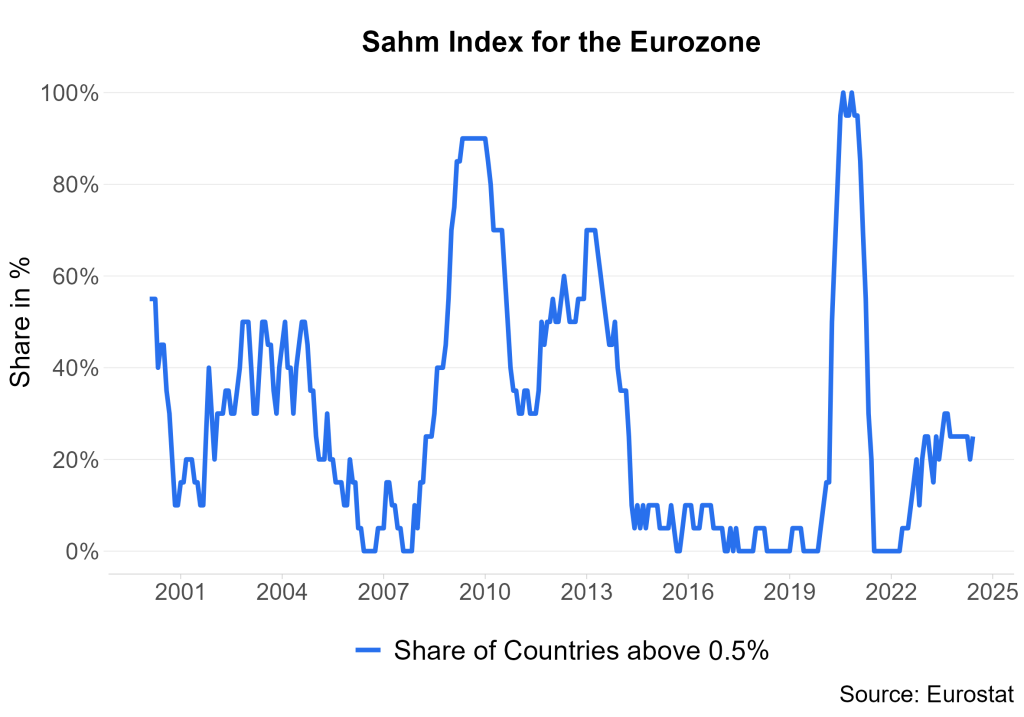

Another important insight is to look at the share of countries that are at or above the threshold of 0.5 %. Year to Date, the share of countries above the threshold was 0.25 % (except for May with 20 %). Looking at the chart below, the last minor spike was in September 2023, with 30 %. In general, not more than one-fourth of the Eurozone countries are above the recession threshold, Finland seems to be rolling over, and the two countries slightly above 0.5 % (Belgium and Luxembourg) could also fall below the threshold of 0.5%. So the recent spike of unemployment could be seen as a normalization rather than a economic weakness. This would reduce the overall share of Eurozone members above the recession threshold to 15%.

Conclusio

Last famous words, the current labor market situation in Europe does not strongly indicate an impending recession, at least according to the Sahm Rule. While Germany’s manufacturing sector faces challenges, and global uncertainties persist, the overall Eurozone data suggests a divergence from historical patterns which is an adjustment to the changing global landscape. Considering the Sahm Rule, it appears unlikely that the Eurozone will enter an economic downturn that is caused by higher unemployment.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.