The outcome of the US election last week, together with the Brexit-vote in June, was the second major political event this year that shook financial markets. In both cases the outcome was different to what pollsters, the media and investors anticipated. Unsurprisingly, markets – across asset-classes and geographies – reacted strongly and in some cases completely different to what was expected before the event. Donald Trump’s win is seen as game-changer, reflecting the next president’s pronounced views on free-trade and immigration, his geo-political positions and his domestic economic agenda including a massive fiscal boost to upgrade the country’s infrastructure, tax cuts and deregulation.

After a very short period of confusion in the early morning hours after the vote, markets started falling in line with the gist of what investors and the wider public assume a Donald Trump-presidency will entail. However, it is important to note that in a number of areas, the election outcome merely accelerated trends that were already evident before. Particularly as far as the “reflation trade” is concerned – the view that equity market will be moved by accommodative macroeconomic policies and rising inflation – Mr. Trump’s success seems to strengthen already existing trends rather than changing the game.

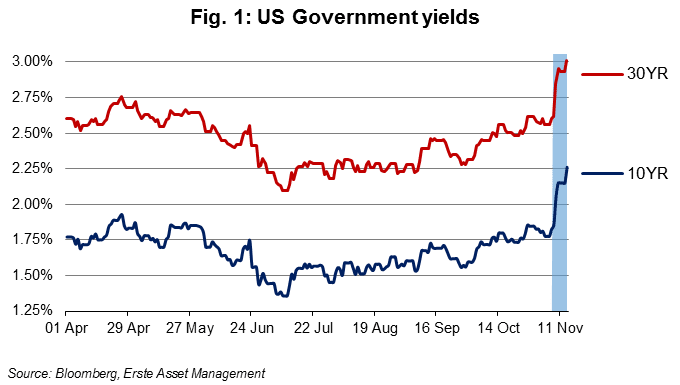

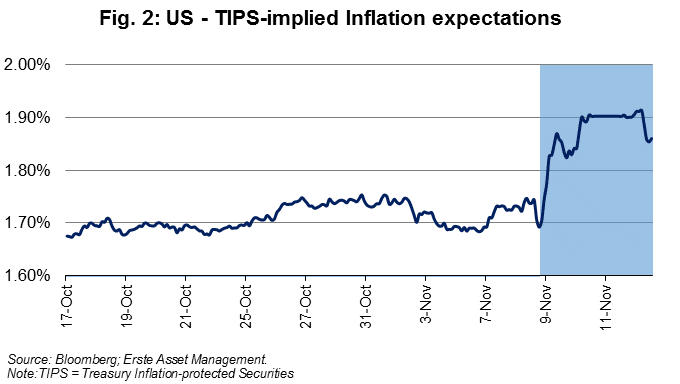

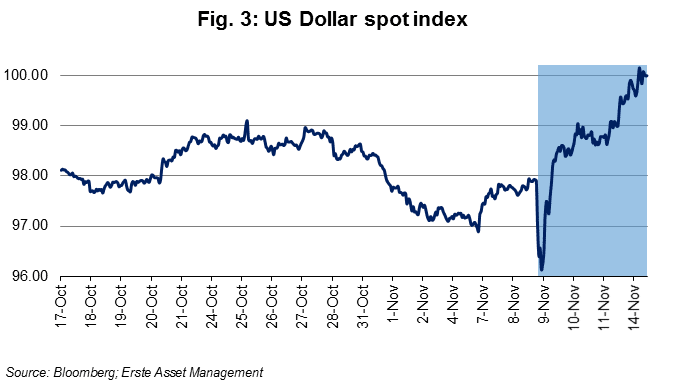

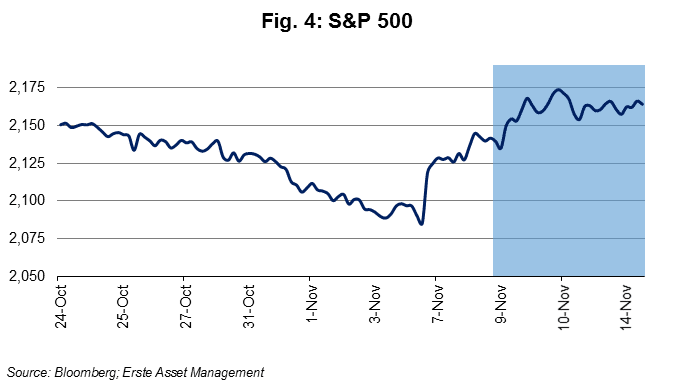

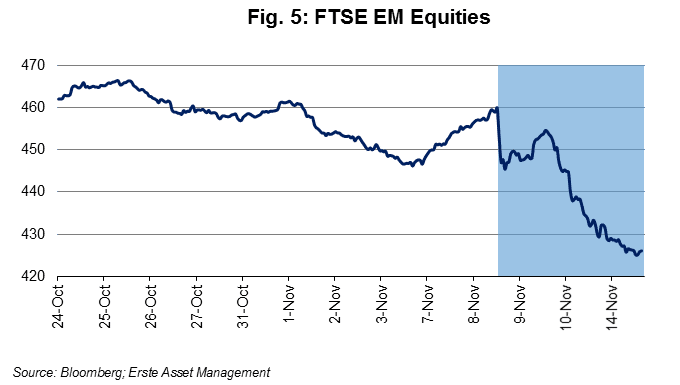

The following charts show in more detail what has happened before and after the election:

- Long-term government yields soared by more than 40 basis points (see Fig. 1), reflecting the incoming president’s announcement of a massive fiscal stimulus. Gavyn Davies, in his blog in the Financial Times, estimates that Trump’s proposed tax cuts and extra spending will lift the US fiscal deficit to 6% of GDP by 2018. Bond investors, apparently, have taken notice.

2. Inflation expectations are gaining momentum. Similarly to bond yields, inflation expectations have been climbing for several months on the back of rising actual inflation rates. Consequently market sentiment shifted, with “deflation fears” fading away and investors starting to focus on the “reflation trade”. Given Mr. Trump’s expansionary intentions, this shift has gained momentum as the jump in inflation expectations last Thursday showed (Fig. 2).

3. The combination of a fiscal stimulus and the Fed’s tightening bias is supporting the Dollar (Fig.3). While the US currency was already strong before the election, since the eve of the election it gained another 2% and is now trading close to its 5-year high (100.5 on Dec 2, 2015). How this will affect the interest rate decisions of the Federal Reserve Bank going forward needs to be seen. A rate hike in December seems to be almost a certainty according to market consensus (92% probability), but if the Dollar continues strengthening, the Fed’s further rate policy will likely to be even more subdued than assumed earlier this year.

4. Equities: Developed markets (DM) benefit from cyclical upside, while emerging markets (EM) suffer from structural threats. Post-election US equities have strengthened (Fig. 4) and a number of cyclical sectors even rallied, whereas EM currencies and equities have corrected. Apparently, equity investors in the US as well as in other developed markets have been buying into the stimulus story while ignoring the risks related to the protectionist ingredients in Donald Trump’s economic agenda.

On the positive side, the fiscal measures announced during Trump’s election campaign (and reiterated since then) could lift US growth by 1% both in 2017 and 2018 according to estimates by Gavyn Davies which would be clearly supportive for equities. It is no surprise that particularly cyclical stocks related to construction, infrastructure and transport massively outperformed the market in recent days.

On the other hand, the other key elements of Mr. Trump’s agenda are definitely not equity friendly: a stricter anti-immigration policy will likely hurt profitability, and the adoption of a widespread protectionist stance will negatively affect productivity in the long run. Together they can be seen as negative supply shocks for the US economy.

While for DM equity investors the cyclical upside in the near term seems to outweigh longer term structural concerns, EM investors immediately reacted to the fallout from the next president’s protectionist agenda. EM equities, which outperformed DM stock markets by more than 10% in the first ten months of the year, lost about two thirds of their relative gains after the election (Fig. 5). International trade and economic growth in emerging markets are closely linked. Therefore, the risk of the world’s largest economy introducing trade obstacles and retreating from international trade arrangements is a serious threat to the EM corporate sector.

Conclusion

Overall, market movements were massive in the first couple of days after the election, although in terms of direction they were mostly in line with pre-election trends. DM equity markets in particular seem to have digested the political shift without major hiccups, with implied volatilities quickly returning to pre-election levels.

The key message implied by the post-election performance of currencies, bond yields and stock indices is: investors believe that President Trump will deliver on what he announced during his election campaign. This is a key difference to the Brexit-referendum, which markets (probably wrongly) apparently considered almost as a non-event. While it is still early days, investors are less relaxed this. What markets are saying is: the Donald Trump-presidency will unlikely turn out to be a non-event.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.