At the end of April, the moment had arrived – Donald Trump’s presidency had passed the first 100 days, and unsurprisingly, Trump celebrated them with self-adulation. Considering that there are still more than 1,350 days of Donald Trump in the Oval Office ahead of us (under the premise of two terms in office), it is hard not to feel a little disillusioned.

Trump is unlikely to tone down his rhetoric, but there are already signs of a certain degree of wear or habituation setting in. For example, the recently announced 100% tariffs on foreign films were largely ignored. The massive rebound in the markets following the tariff shock also shows that market participants have (at least for the time being) ticked this issue off their list and expect a timely agreement. After the longest winning streak in 20 years, the US equity markets are now back to the levels seen before the correction triggered by “Liberation Day”.

“Mr. Too Late“ leaves interest rates unchanged

In addition to the postponement of the tariffs issue and the progress signalled in negotiations with a wide range of trading partners (even China), investors are also rewarding the perceived stability surrounding the US Federal Reserve. In April, Trump had exerted massive media pressure on Jay Powell, repeatedly calling him a “big loser” and “Mr. Too Late”. The Fed chairman will remain in office and thus stands for a continued independent and stable monetary policy from the US central bank.

This is another reason why, contrary to Trump’s wishes, the key-lending rate remained unchanged for the time being. Powell and the US interest rate policy will be the focus of particular attention in the coming months – the supposedly higher tariffs will drive up prices, and long-term inflation expectations have also risen noticeably recently. In this context, the Fed will be wary of cutting interest rates too sharply. At the same time, it will be important to monitor economic developments closely – a complicated dilemma.

US economy is shrinking

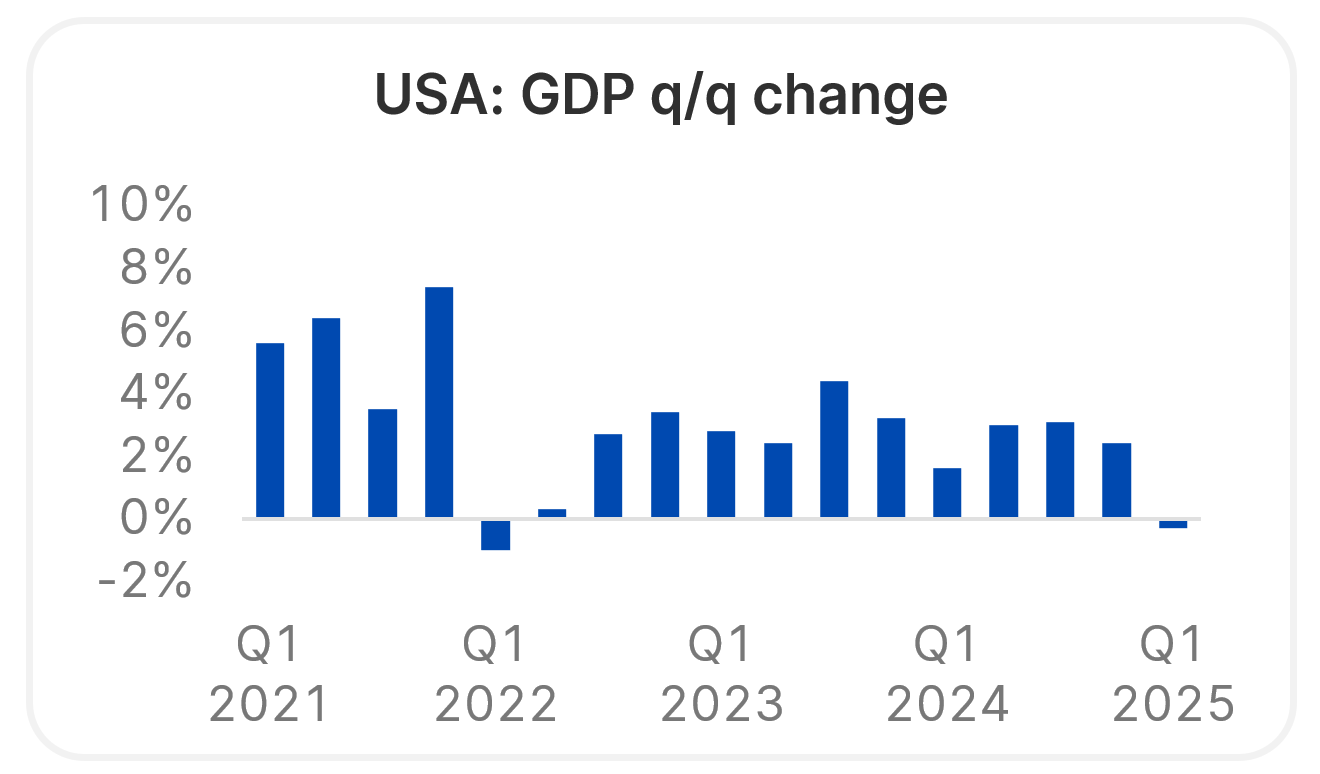

A noticeable slowdown in the US economy seems inevitable. As the chart below shows, the positive growth momentum has already been broken

Please not: Past performance is no reliable indicator of future performance. Source: LSEG Datastream; Data as of 7 May 2025

We should like to point out though that the negative first quarter is primarily attributable to a one-off effect. In anticipation of higher tariffs, US companies have recently increased their imports by a significant degree. Hard economic facts such as the labour market and domestic consumption continue to point to a very robust US economy. The coming months will show how negative the impact of the currently elevated level of uncertainty will actually be.

The results on the corporate side were certainly convincing – more than 75% have reported positive earnings surprises, and the outlook by companies has been generally less negative than expected. The environment remains volatile, but as outgoing stock market legend Warren Buffett said, anyone looking for “risk-free returns is more likely to find return-free risks.”

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.