Gold has played an important role in the financial and economic system for centuries. While it initially served as a means of payment, the role of the precious metal increasingly changed over the course of history to become a crisis currency and a store of wealth in uncertain times. How did this come about, and how did this precious metal actually manage to prevail as the safe haven for saved assets over the decades?

Gold and its beginnings as means of payment

The history of gold as a currency and means of payment dates back to the 3rd century BC. The precious metal was already bartered for goods in Ancient Egypt. Later, other peoples and civilisations such as the Romans, the Greeks, and the Chinese used gold coins as a means of payment. By the Middle Ages, silver and gold coins had developed into the lead currency and the main means of payment.

Gold flood causes inflation

The important role of gold for our payment system first became apparent in the 14th and 15th century, respectively. The mines were suffering from an increasing labour shortage due to the decline in population, which also led to a sharp drop in coin production. The demand for a means of payment began to exceed the supply of coins. Gold coins were scarce and therefore valuable, which is why they were being hoarded. The gold coins in circulation gained more and more in value, and deflation set in.

It was probably not until the discovery of America that the permanent deflation came to an end. The precious metal was brought to Europe in large quantities from the mines of South America, which led to a flood of new gold coins and fuelled inflation.

From the gold standard to Bretton-Woods

The introduction of the gold standard was a first milestone in the recent history of gold. The standard had become established worldwide by the year 1870. In most countries, the currency was thus backed by a physical gold reserve. Gold coins and banknotes could be exchanged for gold at the central bank without limit. During the Great Depression in the late 1920s, however, the gold standard made it difficult to take targeted measures to revive the economy and combat the crisis. In the 1930s, more and more countries abandoned the gold standard in order to be able to expand the money supply.

After the end of World War II, the precious metal again played an important role in the international payment system. With the introduction of the Bretton Woods system in 1944, the US dollar was used as a reserve currency for international transactions and was backed by gold at the rate of 35 USD per ounce. The other currencies, in turn, were pegged at a fixed exchange rate to the US dollar.

In the 1960s, however, inflation rose in the USA, which caused the gold price to increase. At the same time, more and more countries wanted to exchange their US dollar foreign exchange reserves for gold, which led to a decline in US gold reserves. In 1971, the Bretton Woods system was abandoned under President Richard Nixon because the USA could no longer maintain the gold standard. Since then, gold has been freely tradable again, and its price is set by supply and demand.

Store of value and crisis currency

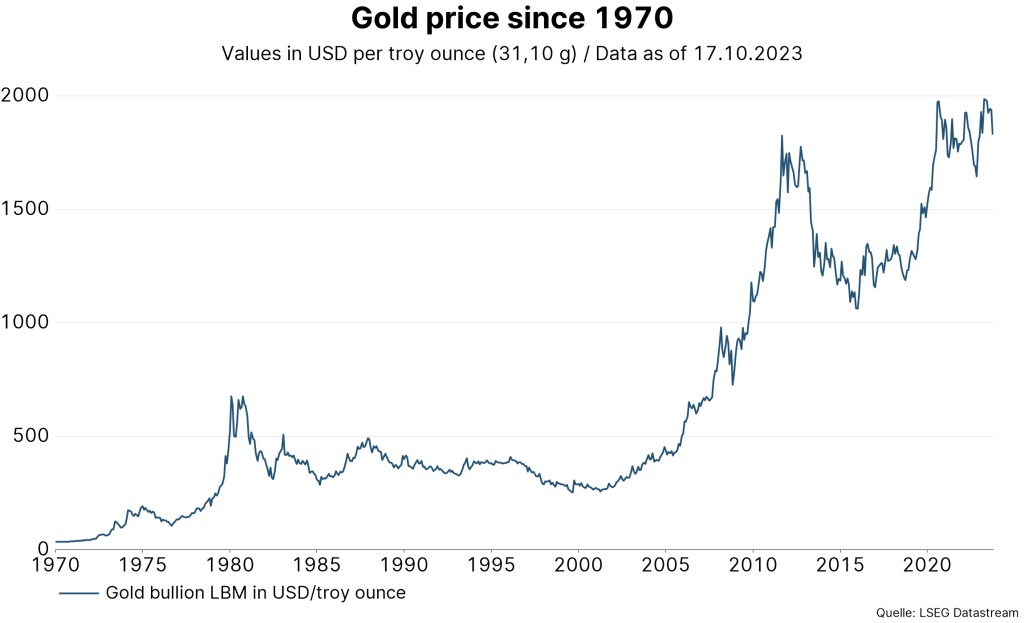

The chart of the gold price since 1970 substantiates the reputation of gold as a long-term store of value. An investment in the yellow precious metal has brought an average annual return of 7.7% since 1970.

Note: Past performance is not a reliable indicator for future performance.

Since the end of the Bretton Woods system, it is mainly geopolitical crises and economically uncertain times that drive the development of the gold price. Many investors use gold to hedge their portfolio because it usually retains or even increases its value in times of crisis, as a look at the past confirms:

- In the early 1980s, the second oil price shock triggered a sharp increase in inflation, which also caused the price of gold to quickly climb to new all-time highs.

- In 2008, the global financial crisis spread from the USA to the rest of the world. The uncertainty drove investors into the safe haven of gold and pushed the price of the precious metal above USD 1,000 for the first time.

- At the beginning of the 2010s, the government debt crisis in Europe and the loose monetary policy by the US Federal Reserve caused further record highs in the price of gold.

- In 2020, the Corona pandemic broke out and increasingly pulled investors into gold as a safe haven. The subsequent easing of central bank policy proved to be an additional driver for the precious metal.

Conclusion

From its beginnings as a means of payment to the gold standard and to a store of value in times of crisis: gold comes with a long history and has retained its firm place in daily market activity to this day. Over the past decades, the precious metal has largely fulfilled its role as a long-term store of value. In turbulent times, investors will therefore probably continue to move into gold as a safe haven.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.