Investing in the bond market means being able to

- at a certain point in time

- decide on a certain investment duration (maturity of the bond).

But when should one invest one’s capital in the bond market and which maturity would be preferable at that time? These questions are not so easy to answer and depend, among other things, on the preferences of the respective investor. In this article we would like to look at the current market environment for bonds and explain which maturity is currently preferred – and whether there are perhaps aspects that should be considered that are not immediately obvious at first glance.

The initial situation – from the point of view of a private investor

The following situation may sound familiar to many. In recent quarters, interest rates have risen and there is again the possibility to subscribe to individual new issues with a short maturity (often 2 to 3 years) and a fixed interest rate (coupon). Due to a lack of alternatives, investors often have no way of assessing whether this offer is attractive or not in the current environment. Private investors often use the issues of the recent past for comparison.

And even if there were several bonds with different maturities to choose from: Due to a lack of background knowledge, many investors tend to go for the bond with the shortest maturity. This is often based on the desire for security, which is “perceived” to be higher if the capital invested is returned quickly.

The bond market has more to offer than just a single bond

If you want to get an overview, you should proceed systematically. That means:

- start with the highest quality and look …

- … what yields can be achieved here for a spectrum of different maturities.

German Bunds represent the highest quality in the Eurozone, but also offer the lowest yields. Other government and corporate bonds have to pay a corresponding yield premium (spread) due to their lower quality.

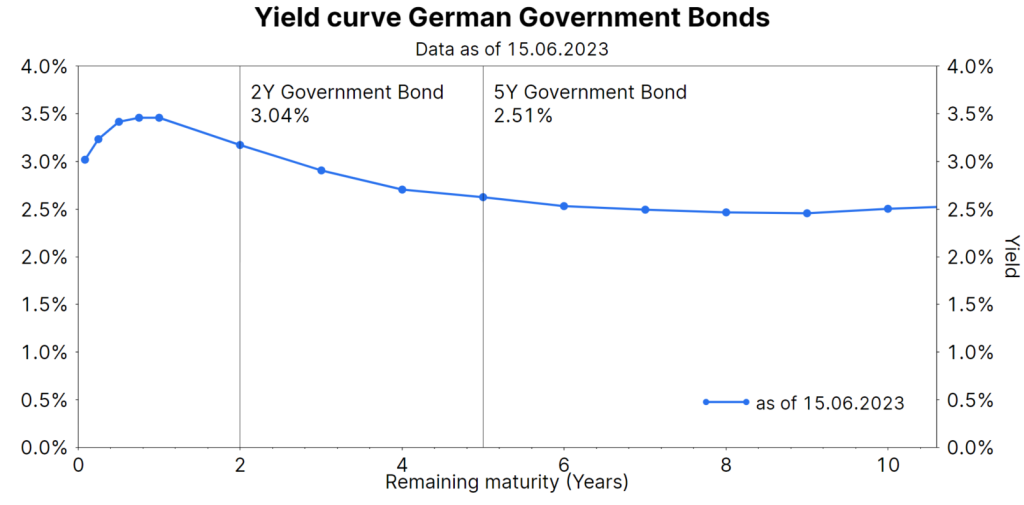

Let us therefore take a look at the current yield (as of 15.06.2023) of German government bonds with different remaining maturities. This information can be viewed as a table, or better (because it is easier at first glance) as a chart. The chart on which the yield is plotted on one axis and the maturity on the other is called the yield curve.

The following chart shows the current yield curve starting with a few months up to 10 years to maturity.

Chart: Yield curve of German government bonds with up to 10 years to maturity; Source: Refinitiv Datastream, as of 15.06.2023; Note: Representation of an index, no direct investment possible. Past performance does not allow reliable conclusions to be drawn about future developments.

Each point on the chart represents a bond with the corresponding remaining term to maturity (x-axis) and the associated yield (y-axis). In the chart we have highlighted 2 maturities as examples. The first bond has two years to maturity and offers a yield of 3.04%. The second has 5 years to maturity and a yield of 2.51%.

We thus currently have an unusual but interesting market environment. For the shorter maturity, investors:inside receive a higher yield than for a longer maturity. One would expect a correspondingly higher yield for a longer commitment.

We have connected the points with a line and thus plotted a curve – the so-called yield curve. In technical jargon, the current situation is called an “inverse yield curve”. The opposite would be a “normal yield curve”, where a longer maturity would also have a higher yield.

Can an investment decision be made now?

Let us assume that there are currently only the following two investment options: Bond (A) is the one with a 2-year maturity and approx. 3% yield and bond (B) has a 5-year maturity and approx. 2.5% yield.

At first glance, bond (A) offers the more attractive alternative. In practice, most investors will therefore opt for this bond.

But we ask an interesting question at this point:

- “Is 2 times 3% (in total 6%) really better than

- 5 times 2.5%?” (in sum 12.5 %)

If you choose the first bond with a 2-year maturity, you need a bond with a total return of 6.5% for the following 3 years, i.e. about 2.2% per year.

The crucial question is thus:

- “Where will interest rates be in 2 years?”

Such an assessment is very difficult, because the interest rate market can change very quickly. How quickly, we would like to show in the following.

How quickly can the interest rate market change?

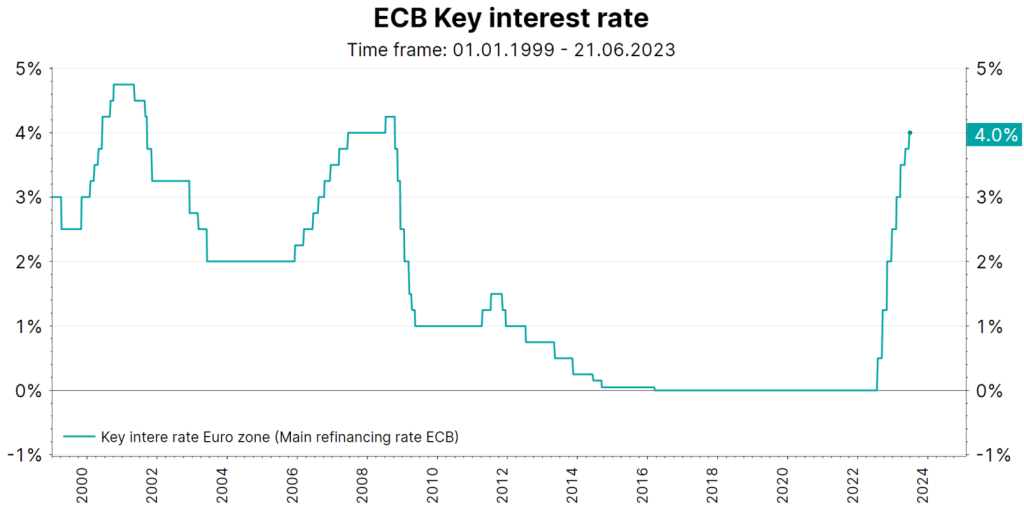

The central banks have a very high influence on the development of the bond markets with their decisions regarding the key interest rates. The following chart shows the development of the key interest rate in the Eurozone, which is set by the European Central Bank (ECB).

Source: Refinitiv Datastream, as of 21.06.2023; Note: Representation of an index, no direct investment possible. Past performance does not allow reliable conclusions to be drawn about future developments.

The chart shows very well how quickly significant changes can occur. As recently as June 2022, the key interest rate was 0% and was raised in several steps to 4% in June 2023 – i.e. within a year.

As interest rates have risen, they can also fall again at the same pace, as can be seen in the chart based on the years 2008/09. The yield of bonds with a short remaining term to maturity is very closely aligned with the current key interest rates.

Summary: The special charm of bonds with short residual maturities

In the last few years, with key interest rates around the zero line, there were hardly any attractive offers for investors in short-dated bonds. After the interest rate hikes of the last quarters, there are always issues with interesting conditions in the current environment.

For private investors, every investment decision in the bond market is associated with a certain degree of uncertainty, because:

- Should one prefer a shorter or longer maturity? In order to be able to make such a decision (with a given investment horizon), not only the current interest rate level is relevant. Rather, investors should also have an assessment of the development in the coming years.

- An assessment of where interest rates might be in 2 or 3 years’ time, given an interest rate market that can change very rapidly in a very short time, is certainly not an easy thing to do!

- However, bond investments with a short investment period are an excellent way to take the first steps from saving to investing, to gain experience and “learn” to make investment decisions.

Note: Please note that investing in securities also involves risks in addition to the opportunities described.

Legal note:

Prognoses are no reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.