11 July 2003 was no extraordinary day on the international stock exchanges. The S&P 500 in New York scratched the 1,000-point mark, closing level at 998.14 points. In Frankfurt the day before, the European Central Bank had decided to leave the key-lending rate at the then historically low level of 2.0%.

Meanwhile, in Vienna the ERSTE RESPONSIBLE STOCK GLOBAL fund was launched that Friday in July 2003. While a lot has happened since then both in the economy and in politics worldwide, the topic of sustainability in investment also enjoys a completely different standing.

Almost twenty years on, ERSTE RESPONSIBLE STOCK GLOBAL is now one of our sustainable flagships. Time, therefore, to take a closer look at the fund and what has changed in the area of sustainable investment since then.

Sustainable investment – then and now

In 2003, sustainable investment had not drawn much attention yet. In its first market report 2005, Forum Nachhaltige Geldanlagen (FNG; Forum of Sustainable Investments) put the volume of sustainable investments in Austria at just EUR 1.4bn.

Today, the sustainability of investments is more than just a fashionable term. This is also highlighted by current statistics: according to FNG, the volume of sustainable investments in Austria had increased to EUR 63bn by the end of 2021. A figure that still seemed a long way off at the beginning of the millennium.

Not only the importance of sustainable investing, but also the range of products and investment processes in this area have developed profoundly. Sustainable investment revolves around three central core themes, on which our sustainable funds also focus:

- Environment

- Social

- Governance

Nowadays, a team of experts within our investment department deals exclusively with the topic of sustainable investments. In our investment process, we analyse environmental and social aspects as well as the type of corporate governance when assessing sustainability and determine our in-house ESGenius score for investment candidates in a comprehensive process.

The investment process consists of both positive and exclusion criteria. For example, investments may not be made in companies that are involved in nuclear energy, arms production, or child labour. In addition, companies whose core business includes the mining of coal and the generation of energy from it are also excluded from our investment universe.

In addition, the best-in-class approach is meant to ensure that investments are made in the most sustainable companies from the respective investable sectors, i.e. those with the highest ESG standards. Another important point is active voting and engagement to encourage companies to operate sustainably. For more information on our responsible approach, please click here.

Focus on sustainable pioneers

As the name suggests, ERSTE RESPONSIBLE STOCK GLOBAL invests globally in shares of selected companies from the developed markets. The emphasis is on investing in shares from companies that are pioneers in terms of environmental, social and governance aspects.

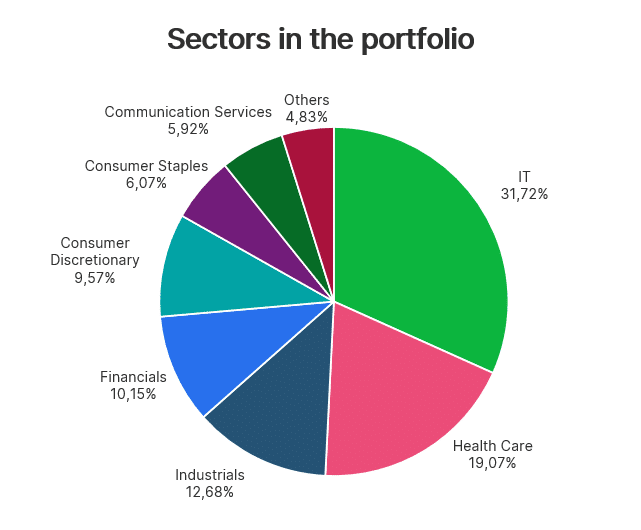

The fund’s portfolio currently contains 166 shares from a wide range of sectors. The most heavily weighted sector in the fund is currently the IT industry, which accounts for almost a third of the portfolio. It is followed by the healthcare sector with a share of just under 19% and the industrial sector at around 13%.

From a regional perspective, North America is by far the most strongly represented one in the fund, accounting for 70% of assets under management. The top positions include some of the largest companies worldwide, such as Apple, Microsoft, Google parent Alphabet or Nvidia.

Crisis-proven over the years

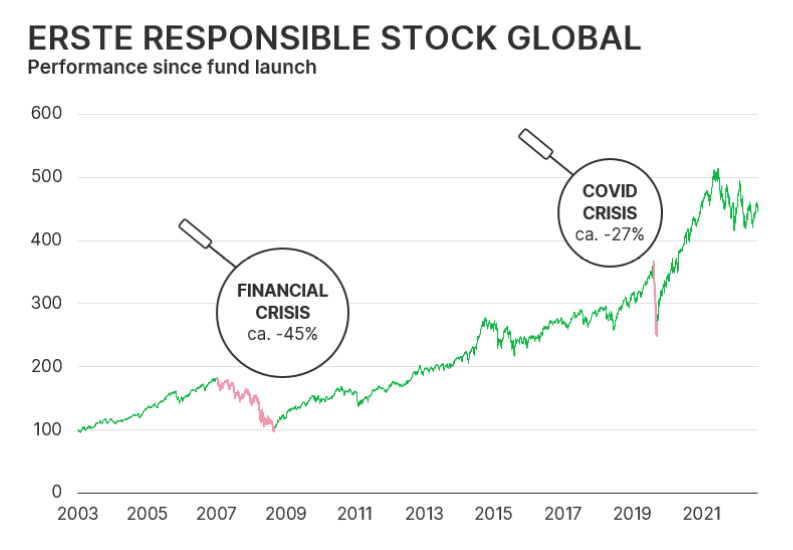

In its roughly twenty-year history, ERSTE STOCK RESPONSIBLE GLOBAL has not only experienced boom phases on the markets. In July 2003, the equity markets had only just absorbed the bursting of the dotcom bubble, in which many technology companies in particular had suffered heavy losses.

About four years later, the global financial crisis was to be followed by the next downturn. During this crisis, the fund lost around 45%. The most recent crash, the Corona crisis in March 2020, caused intermittent losses of around 27%.

Despite these setbacks, which always occur on the equity markets, the fund can look back on an extremely positive performance. If one had invested in ERSTE RESPONSIBLE STOCK GLOBAL at its launch, said investment would have generated a total performance of +347% (as of 28 February 2023), i.e. more than quadrupled. This corresponds to an average increase in value of 7.92% per year. Perseverance and endurance would therefore definitely have paid off over the past 20 years.

Conclusion: well-equipped for the future

A lot has changed in the world of investment since 2003. Sustainability has turned from a fringe topic to a trend that will continue to shape the coming years.

Even almost twenty years after its launch, ERSTE RESPONSIBLE STOCK GLOBAL is well equipped for the future. After all, environmentally and socially responsible investments will be needed in the next twenty years and beyond to support the development towards a more sustainable world.

Benefits for investors

- Broadly diversified investment in equities from the developed markets

- Participation in environmentally, ethically, and socially acting companies

- Active asset selection based on fundamental criteria

- Chance of attractive gains

Risks to bear in mind

- The price of the fund may be subject to significant fluctuations (volatility)

- Foreign exchange fluctuations may affect the value of the fund due to the investment in foreign currency

- Capital loss is possible

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act

For information on technical terms, please refer to our Fund Glossary.

Important legal notice:

Forecasts are no reliable indicator of future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.