Predictions are hard, especially about the future. And even more so about the future far out. But this may not hold true everywhere. In fixed income, for example bonds, forecasting the future return over the next 10 years may be easier than forecasting the return for next year.

Rising yields – falling prices

What may seem counterintuitive at first has a simple mathematical logic behind it. Namely the inverse relationship between yields and prices. Rising yields lead to falling prices, and vice versa: when yields fall, bond prices rise.

How easy it is to predict the return can be illustrated by a simple example: Assume we bought a bond for 100 with a coupon of 4% and a maturity of 10 years. If we simply do nothing over the next 10 years and the bond is redeemed, we would have earned an average return of 4% a year. Pretty easy to forecast the return, right? But it gets a little bit more complicated if we re-invest the coupon payments and even more complicated if we sell the bond and buy another one. It gets even trickier to forecast the return over a 10-year horizon if we hold a bond portfolio. From step to step we get more and more exposed to changes in interest rates.

Higher coupons and redemptions counteract price losses

Assume one has a relatively safe portfolio of bonds with a duration held constant over time. If yields rise the bond portfolio will see a fall in prices. However, we could reinvest the coupons and the redemption received at higher yields. But how good do these two effects offset each other over a 10-year horizon? The surprising answer: pretty good! This is one reason why one of the simplest forecasting models for future fixed income returns for a 10-year period relies solely on the yield.

10-year return higher than yield

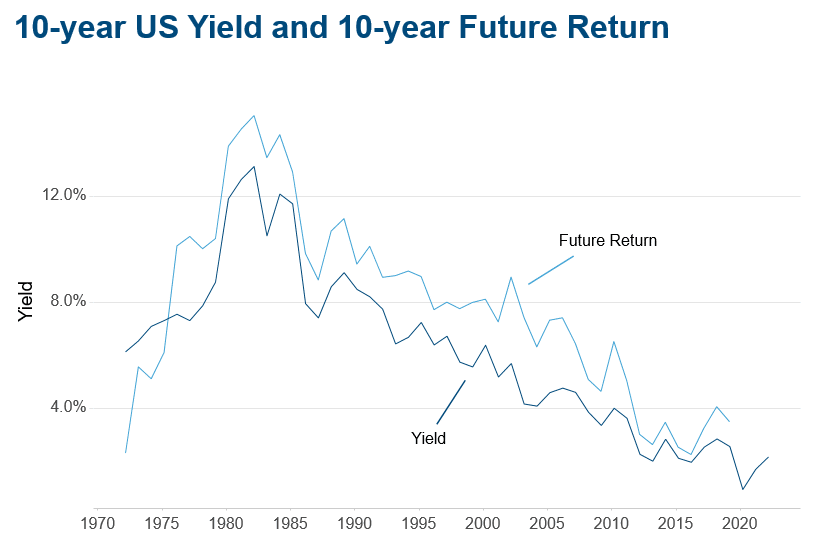

We will start with a short analysis on the 10-year US Treasury. The graph shows the yield and the 10-year future return of it. The plot should be read as follows: Assuming we are in the year 2000, we can observe an interest rate of 6.4%. The 10-year return from 2000-2010 would be the point on the upper line and is around 8%.

Some interesting facts can be observed. First, for nearly the past 40 years, with exception of the most recent past, we have experienced a trend of falling yields. Second, the 10-year rate and the future return move in a very similar way and seem to be highly correlated. Another point worth highlighting is that the 10-year future return has been higher than the 10-year yield. This can be explained by the fact that investors made windfall capital gains from the falling yield trend.

Note: Past performance is not a reliable indicator for future performance of an investment.

Return Components: coupon and price changes

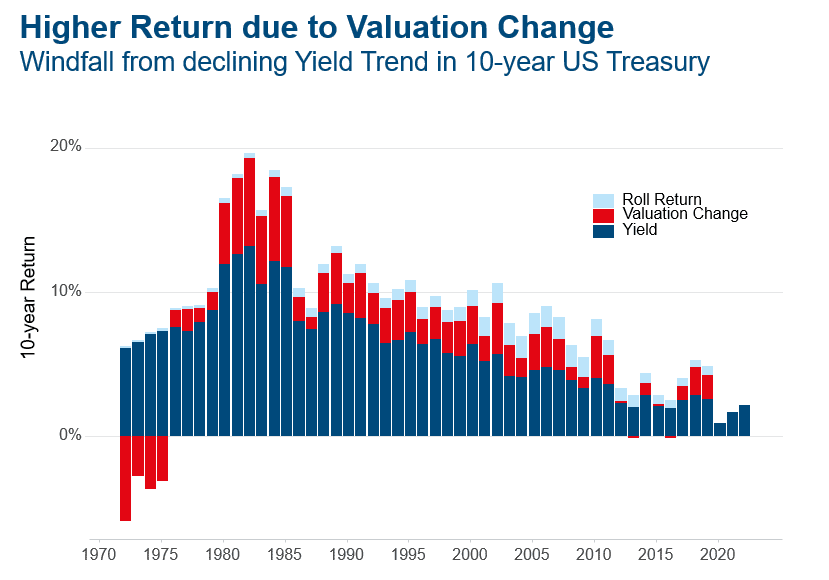

It is interesting to dig a bit deeper into the mechanics of this. In fixed income one has two major sources of return. One is the coupon (cash flows) the instrument is paying, and the other source is price gains of the instrument itself.

Price gains can further be composed. First, into the “roll-down” effect. This describes that, for example, a bond with a maturity of 10 years will only have a maturity of 9 years in one year. The price of the bond changes naturally and this is called “roll-down” effect since one “rolls-down” the yield curve. The other component in the price return source is due to the level change of the yield curve. When yields are falling, prices are rising and vice versa. The graph shows the breakdown of the 10-year return: between 1980 and 2010 the valuation change (capital gains from falling yields) played a prominent role and led to the above 10-year rate return.

Note: Past performance is not a reliable indicator for future performance of an investment.

10-year return compared to yields

Sometimes one must look backwards to understand the future. A model is only as good as the data which it is fed with. Moreover, the explanations given so far put the model into context and give some background on how the results should be interpreted as this model is quite commonly found in research papers.

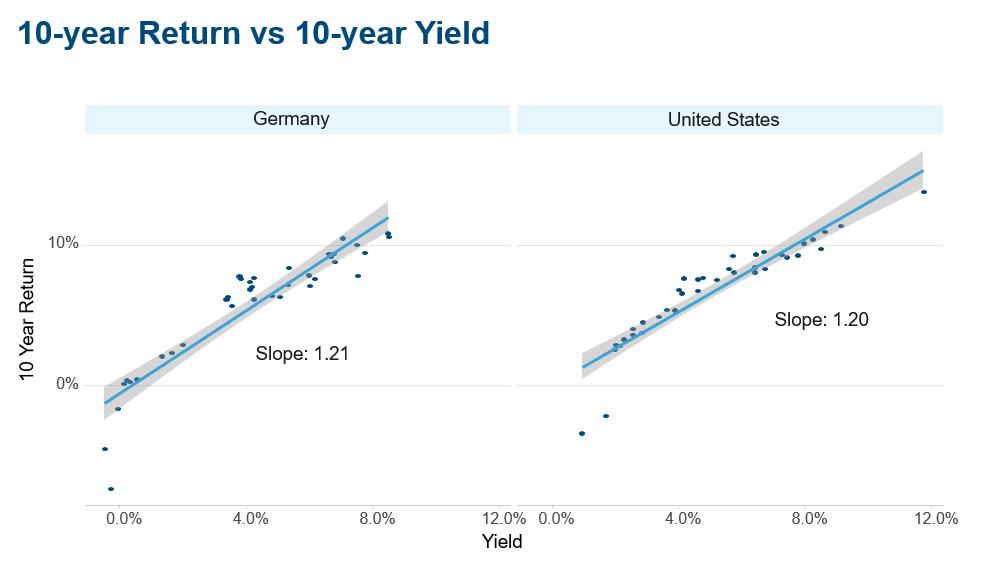

The model is a simple regression model: the future 10-year return is estimated with the current yield. We first apply it to the 10-year US and German Bunds.

The graph below shows the result of such a regression: as expected, the relation is very strong, and the yield can explain more than 95% of the variation of the 10-year future return. The coefficients are around 1.2 for both markets. This tells us that when we observe a yield of 2 percent it expects a 10-year return of 2.4 percent (2 * 1.2). The model expects a return greater than the actual yield because of the bias of falling yields in the data and has already been worked out comprehensively in the paragraphs above.

Note: Past performance is not a reliable indicator for future performance of an investment.

Now that the foundation has been laid, the regression model has been estimated for various market segments of the US and German government bonds. For a market weighted average of US Treasuries as well as for German Bunds the coefficient is a bit lower at around 1.07. This is because capital gains at the lower maturities are less than for bonds which are longer dated. But still, the model expects a slightly higher 10-year future return for the overall Treasuries and Bund market compared to the yield.

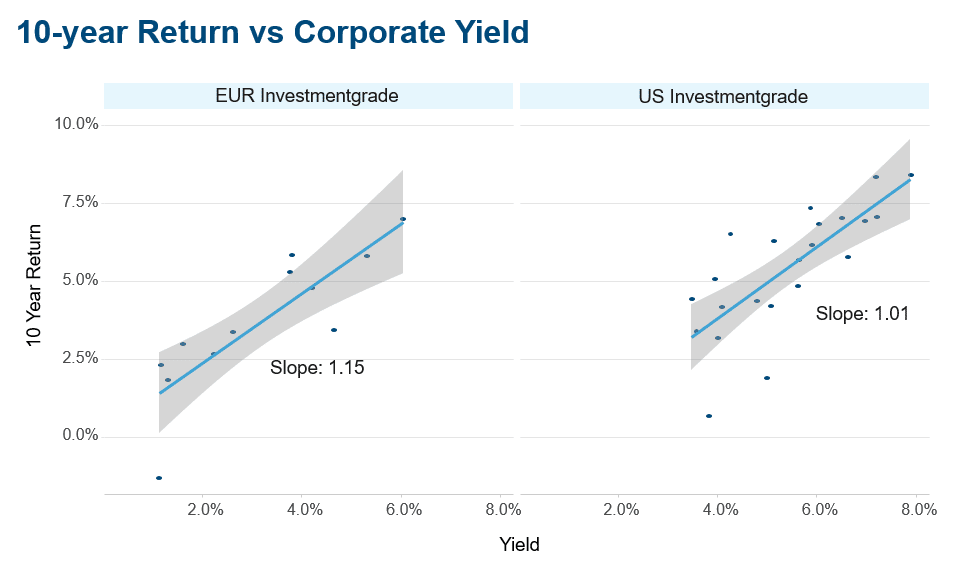

Since we already started exploring different government segments, let us move to the corporate sector. Without going to much into detail, the key findings are: first, the model does not work here as good as for government bonds. This is because the spread component, potential downgrades and defaults play a role in the return calculation. In addition, the data history is not as extensive as for the government segment which leads to possible distortions.

The following graph shows the regression for investment grade in Dollar and Euro. Still, the yield explains around 85% of the future return and the coefficient is slightly above one for both markets. One explanation may be that the rate component for investment grade plays a more important role than the spread component. The picture is different for the high yield segment where the relationship is close to collapsing. This may be because the spread development and defaults are more prominent contributors to the return than the development of general rates levels.

Note: Past performance is not a reliable indicator for future performance of an investment.

Conclusion

Keep it simple! One credo in machine learning is, when faced with multiple models which give equally good results, choose the simplest one. And it is hard to find a simpler model than the one presented above. Moreover, it works extremely well for government bonds, acceptable good for corporate investment grade and only fails for high yield bonds. Besides this, the intuition behind the model and the interpretation of the coefficients are straight forward.

Nevertheless, caution is advised: going forward, the model may be overestimating the future return in the given yield environment. However, the relationship between yield and 10-year future return is strong. So, with good conscience it can be expected to earn the yield over a longer horizon.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note that an investment in securities also entails risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.