China’s state and party leader Xi Jinping’s recent re-election for another term, together with weak economic data, led China’s stock markets and the national currency, the yuan, into a downward trend last week. Concerns about China’s economy are now compounded by fears that Xi could use the consolidation of his position of power to strengthen state power and turn away from his pro-business course.

As expected, the Central Committee of the Communist Party voted the 69-year-old head of state into his third term a week ago. At the same time, the party congress also embedded Xi’s ideology and his permanent leadership role in the constitution more firmly. The head of state is thus defying previously respected age and term limits. Observers now expect Xi to use his strengthened position of power to turn away from a liberal course geared to economic growth and to pursue a more ideologically oriented policy.

According to experts, this is also supported by the personnel decisions for the new term in office. Politicians who were considered liberal, such as the previous prime minister Li Keqiang, were deprived of their power. The new leadership now consists exclusively of politicians who are considered loyal followers of Xi.

Chinese Technology Shares Under Pressure

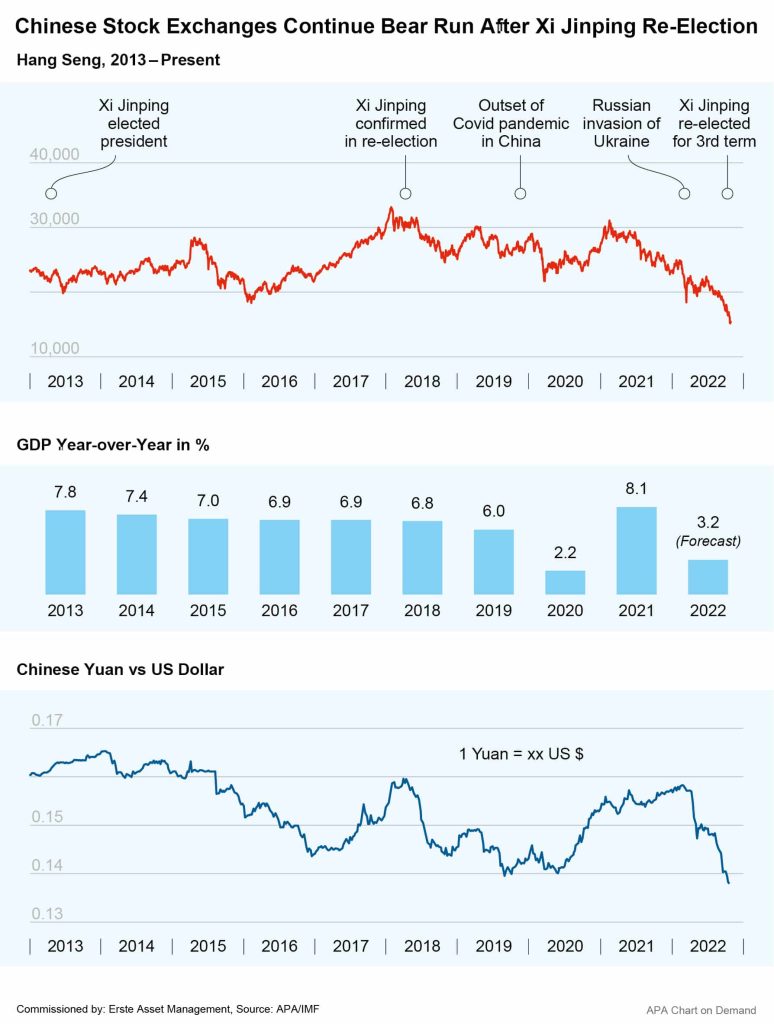

This development was received negatively on the stock markets. Last week on Monday, one day after the plenary session of the Central Committee, the Shanghai Composite fell by 2.0 per cent. The Hang Seng of the Hong Kong Stock Exchange fell even by nearly 6 per cent. During the course of the week, this downward trend continued.

Since the beginning of the year, the Shanghai Composite has lost close to 20 per cent (10 years: +46 per cent) and the Hang Seng around 37 per cent (10 years: -31 per cent). Going by key figures such as the price-earnings ratio, Chinese shares are now calculatively cheaper than they have been for years, according to Bloomberg data, writes German finance Paper Handelsblatt.

Technology stocks such as Alibaba and JD.com came under particular pressure and intermittently dropped by more than 10 per cent. Many investors fear that the new powers of the head of state will also lead to stronger regulation of the Chinese technology sector.

National Currency Yuan Drops to Yearly Low

Xi’s re-election also made waves on the foreign exchange market. The Chinese currency yuan temporarily fell to this year’s lowest price, while the US dollar rose to nearly 7.3 yuan. According to insiders, Chinese state banks have sold US dollars in reaction to the yen crash in order to support their own national currency, news agency Reuters reported.

This political news comes at a time when the economy is already struggling. The world’s second-largest economy grew by 3.9 per cent in Q3, a marked acceleration from the previous quarter. However, China is expected to clearly miss its original growth target of around 5.5 per cent for this year. Experts polled by the Reuters agency see an average growth of only 3.2 per cent.

Purchasing Managers’ Indices Drop Just Below Growth Threshold

Current leading indicators are already pointing downwards. For example, the official Purchasing Managers’ Index for the manufacturing sector published on Monday stands at 49.2 points. Before that, its counterpart for the non-manufacturing sector had already slipped below the important threshold of 50 points that separates contraction from growth.

The country’s strict zero-covid strategy with hard lockdowns is putting a particularly heavy toll on the economy. At the end of October, rising infection numbers triggered a new wave of lockdowns. Entire districts with millions of inhabitants were rigorously sealed off to stop the coronavirus spread. Around 232 million people are currently affected by Corona restrictions, according to the financial services provider Nomura.

In addition, there is a severe housing crisis, high debt and weak domestic demand. Finally, declining global demand is also slowing the country’s export growth. Exports in September grew by only 5.7 per cent year-on-year in US dollar terms, according to the latest report from China Customs. High inflation and rising interest rates in many countries are likely to further curb demand for Chinese products.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.