The introduction of the euro is a success story. At the same time, there is still the residual risk of the break-up of the currency area due to a deliberately accepted construction flaw. Please find in the following a snapshot of the status quo, the opportunities, and challenges of the euro.

Integration

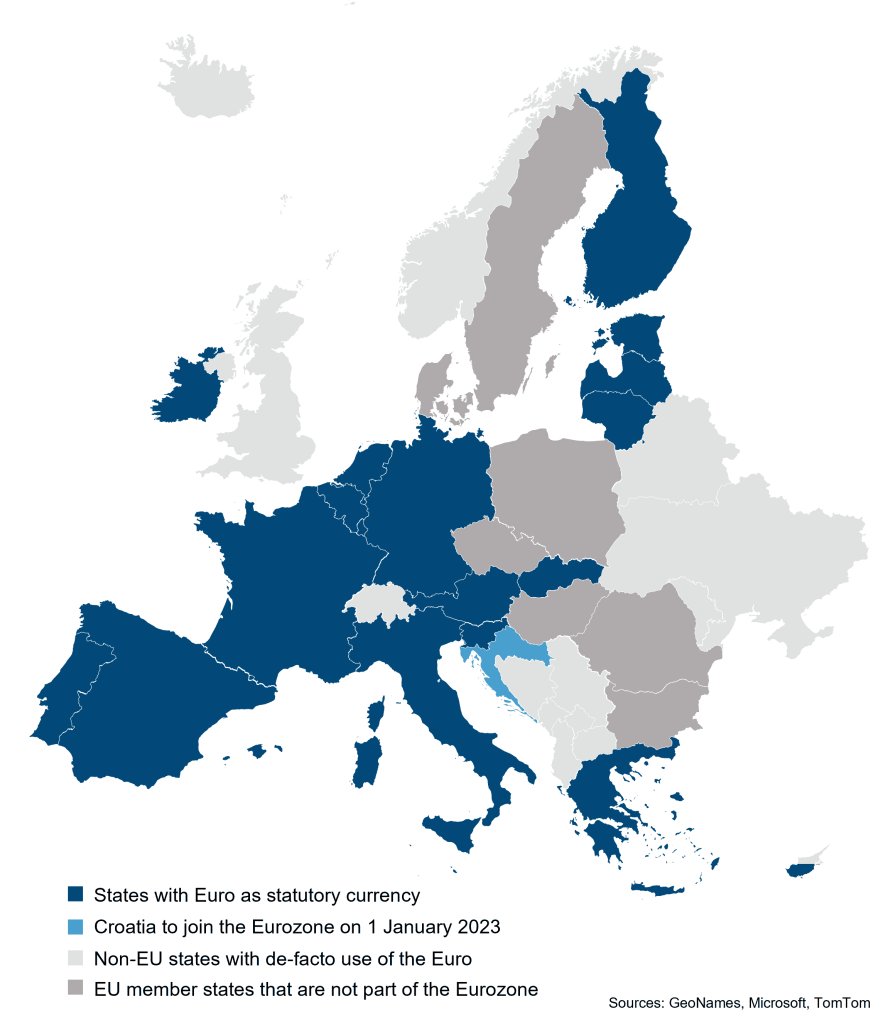

The switch to the euro as common electronic currency in 1999 and its introduction as cash in 2022 was a big step towards the integration of the European Union (EU). Since then, the currency has been the official means of payment in 19 countries with 340 million people. In 2023, Croatia will join the currency union.

The three functions of money

The requirement to exchange currencies within the euro area was eliminated, the foreign exchange risk disappeared as a result, and prices became comparable. And of particular significance, all three functions of money were being fulfilled flawlessly:

- The euro is a medium of exchange that was accepted by the population as means of payment, i.e. currency. Goods and services are paid in euro.

- The euro is a unit of account. The value of goods and services is expressed in euro. This makes them comparable.

- The euro acts as store of value. While prices are not stable, average inflation has been low since the euro was introduced.

Digital central bank money

The central banks are faced with the strategic challenge that the competition between traditional currencies and blockchain-based might increase on the internet platforms in the future. This could lead to, among other things, a partial loss of control for central banks and states over the currency, to technological dependence, and to a lack of choice for users (if no traditional currencies are being offered anymore). It could also compromise access to the (probably) safest form of money, i.e. a claim vis-à-vis a central bank. Therefore, the introduction of a central bank currency based on blockchain technology is being discussed (i.e. so-called Central Bank Digital Currencies, or CBDC). If at one point our avatar buys a mixed fund in a digital 3D bank branch, we will surely be able to pay in euro, either traditionally or in blockchain euro.

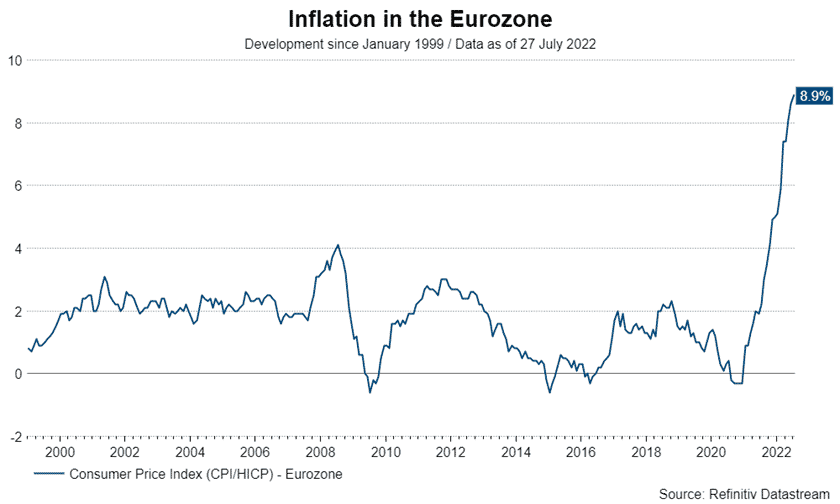

Internal stability

The euro has been a beacon of internal stability since 1999. The average consumer price inflation (CPI) until June 2022 was 1.98% y/y. This is only slightly above the former inflation target of the ECB (i.e. just shy of 2%), which was in use until July 2021. Since then, the ECB has pursued a symmetric inflation target of 2%

High inflation

At the moment, the Eurozone and the global economy are dealing with the impact of the pandemic and the war in Ukraine. The development that stands out the most is the high inflation that has been caused by imbalances between supply and demand. In the OECD area, the CPI was 9.6% y/y in May, while in the Eurozone it was 8.6% y/y in June.

Inflation expectations

Whether the development comes with a long or a short time horizon depends crucially on the path of the inflation expectations. More and more scientific studies suggest that the inflation expectation is decisively influenced by the development of historic inflation. When inflation is low for prolonged periods of time, it is not on people’s minds. However, if inflation is elevated for a longer period, it turns into an important topic. This means inflation expectations can rise permanently in that case, because inflation has increased (adaptive forming of expectations). The current risk, therefore, is that of an inflation spiral.

Increase in key-lending rates

The central banks are trying to prevent the aforementioned inflation spiral by raising key-lending rates. The ECB – somewhat late to the party – has recently also started abandoning its ultra-expansive monetary policy. In July, the ECB increased its three key-lending rates by half a percentage point each. We should like to point out the increase of the discount rate from -0.5% to 0% in particular, which put an end to the negative interest rate policy that had been in place since 2014. The move was more substantial than had been signalled only in June. The ECB signalled further hikes for the future. Higher interest rates are meant to weaken economic growth (i.e. demand) to an extent where inflation pressure starts falling. The central banks want to facilitate a soft landing. However, in the past, rate increases have often set off a recession.

Interest rate policy and inflation

The problem of a restrictive monetary policy is that the relationship between interest rates and inflation is beset by numerous uncertainties:

- How big is the difference between the actual and the potential GDP (output gap)? It is very difficult to assess in advance whether an economy is already overheating. At the moment, the unemployment rates across many countries are low (Eurozone: 6.6% in May).

- By how much does economic growth have to be cut (i.e. by how much does the low unemployment rate have to increase) for inflation to fall by one unit? The relationship between economic growth and inflation is unfortunately not stable.

- What does the inflation momentum look like? Have only the short-term inflation expectations increased or also already the long-term ones? Also, structural factors such as demographics, (de-) globalisation, and external shocks (pandemic, energy and food prices) could affect inflation significantly and the monetary policy could have surprisingly little effect on the development of inflation.

Structurally higher inflation

There are indeed two arguments in particular that suggest structurally higher inflation in the coming ten years than since the introduction of the euro.

- The employable population will decrease in size. The labour market will therefore probably remain tight.

- The tendency towards deglobalisation increases costs.

Increased inflation target?

The currently high rate of inflation will probably fall. The question is on what level inflation will stabilise. Below, at, or above the inflation target of the central bank (2%)? There is a realistic scenario that suggests that inflation might sustainably hover slightly above the inflation target of the central bank of 2%. After all, according to the ECB the inflation estimate by economists has increased to an all-time-high of 2.2% according to the Survey der Professional Forecaster for the 5Y horizon.

In this case, the ECB would be faced with a difficult decision. Either it would then pursue a permanently restrictive policy that harmed economic growth and employment. Or it abandons the inflation target of 2% in favour of a higher one, either explicitly or implicitly.

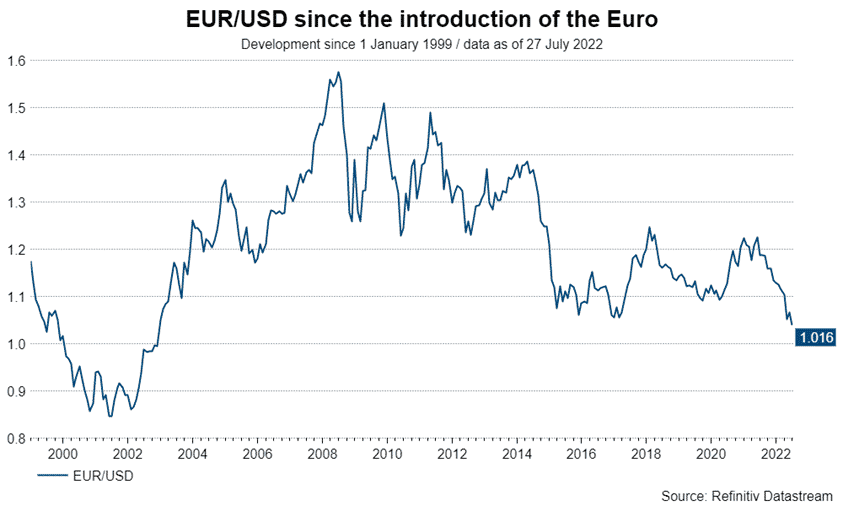

External stability

The external value of the euro appreciated by almost 13% until June 2022 relative to a broad basket of currencies (nominal effective exchange rate; source: BIS). Adjusted for the difference between the inflation of the Eurozone and the currencies of its trading partners, the euro depreciated by almost 12% (real effective exchange rate; source: BIS). This means that the euro was a stable currency and Eurozone inflation was below the inflation in other countries.

Weakening euro

At the moment, the US dollar is strong relative to many currencies, not only the euro. This has several reasons. A crucial factor is that the US central bank has already raised its key-lending rates by a significant degree, whereas the ECB managed its first rate hike only at the beginning of July. The appreciation of the US dollar reduces the inflation pressure in the USA as it dampens import prices. This channel is particularly relevant as a large part of inflation comes from the external front. The stronger the currency, the more it dampens inflation in the medium term, which is why the central bank (Fed) has to raise the key-lending rate to a lower level. Conversely, the weakening of the euro has increased inflation pressure. The ECB raised key-lending rates in July more substantially than had been expected, not the least to support the euro, because this move should indirectly reduce inflation risk.

Structural euro problem

In contrast to other currencies, the euro is also faced with an additional structural problem. Even 23 years after its introduction, the biggest flaw of the common European currency has not been remedied: the economic and fiscal policy of the EU is not integrated on a union level. This means that a residual risk of the currency union breaking up remains alive. The basic issue is that the various states do not want to surrender their (relative) sovereignty. In the past, that has only happened partially during crises (e.g. the euro government debt crisis).

Conflict of goals between price stability and Eurozone cohesion

For ten years, the ECB has de facto also fulfilled the function of a lender of last resort. If the market cannot provide the states with money any longer, the central bank steps into the breach. In theory, that is no problem; rather, it is a desirable state of affairs, as it is the core task of a central bank during a crisis. In recent months during the pandemic, the state deficits have soared massively. These deficits were indirectly financed by the central bank and its purchases of government bonds on the secondary market. However, once central bank money is being printed not only during a crisis, but structurally in order to compensate for the absence of a common economic and fiscal policy, problems can emerge in the medium term. As long as the rate of inflation remained below the central bank target, the highly expansive central bank policy (negative interest rates and government bond purchases) was no real problem. But given the recent drastic increase in inflation, the conflict of goals between price stability and Eurozone cohesion has become more intense. The ECB has started to raise its key-lending rates and has ended the pandemic emergency purchase programme (PEPP). This has contributed to widening spreads for country risk in the Eurozone.

Transmission Protection Instrument

Therefore, the ECB introduced a new instrument in July: the Transmission Protection Instrument (TFP). According to the ECB, the TFP may be activated (i.e. bonds may be purchased) in order to thwart an unjustified, disorderly market momentum that constitutes a serious threat to the transmission of the monetary policy across the entire Eurozone. There are no limits to either the volume or the duration of the purchases. While a few suitability criteria were mentioned for the TFP (largely based on the overall fiscal situation of a country), the operational implementation is unclear. Whether the widening of spreads for country risk is (un)justified, i.e. does not align with any according deterioration of the economy, is ultimately subjective. The most likely case would be where a country (e.g. Spain) experienced a drastic increase in spreads because another country (e.g. Italy) had deteriorated (spill-over effects).

Euro reserve currency

The share of the main reserve currency, the US dollar, has decreased from 70% to 60% since the introduction of the euro. At the same time, the share of the euro has not increased, but rather has remained relatively stable at 20%. The expectation that the euro could gain importance at the expense of the dollar has not been confirmed. The gradual loss in relevance of the US dollar resulted from an increase in the share of non-traditional currencies (i.e. all currencies except US dollar, euro, British pound, and Japanese yen).

Conclusion

The euro fulfils the three functions of money. In addition, it has now comfortably survived three major crises (i.e. the Great Financial Crisis in 2007/09, the euro government debt crisis in 2011/12, and the pandemic from 2020 to 2022). Additional steps towards integration have been taken in response to the crises in order to ensure the continued existence of the Eurozone. The current problems – especially the conflict of goals between the fight against inflation and the interest burden imposed on the various states – will surely be dealt with in a satisfying manner as well. That being said, the lack of a common fiscal and economic policy remains a weakness of the Eurozone.

This article is the start of our new €uro dossier. In the coming months, Erste Asset Management experts from the CEE countries will provide insights on topics related to the euro. The next article will deal with Croatia’s entry into the Eurozone.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.