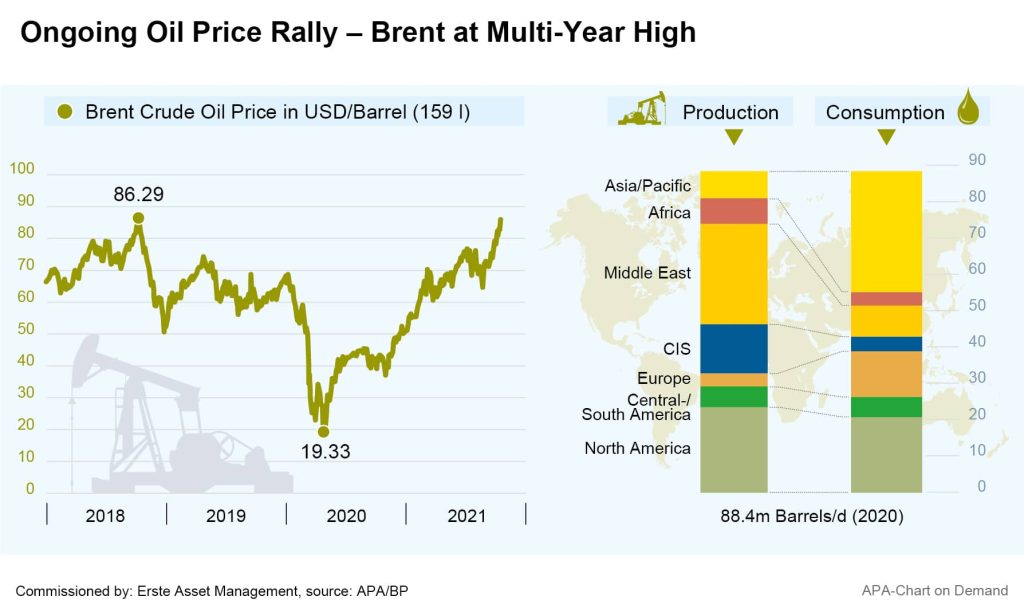

Crude oil prices continued to soar in the past week. The price of North Sea Brent crude, an important reference grade, rose to over 86 USD per barrel (159 liters) on the futures market at times, its highest level in four years. The price of US WTI oil even reached a seven-year high of over 84 dollars per barrel. Oil prices receded again intermittently, but remain just below these multi-year highs.

The background to the oil price increases lies in the rising demand for oil combined with the ongoing economic recovery and fears of tight supply. The price surge in recent days was triggered by a drop in oil reserves reported by the US government on Wednesday. According to the data, inventories of crude oil had decreased by 0.4 million to 426.5 million barrels, which came as a surprise to the market, as previously the interest American Petroleum Institute (API) had reported an increase in inventories.

Oil prices had previously already been pushed up by the outcome of OPEC negotiations in early October. The member states of OPEC+ had agreed to raise their daily production by no more than the already-agreed 400,000 barrels in November despite the shortage on the world market, dashing hopes for a stronger stepping-up of oil production that had been fuelled by media reports.

Gas Prices Continue to new Highs

Gas prices, which are important for the electricity sector, also remain at a very high level. Due to a lack of sufficient reserves, natural gas is currently in short supply in Europe. Many utilities are therefore switching to coal and oil as energy sources, further driving up oil prices. Although Russia signalled willingness to increase natural gas supplies to Europe, it is making this conditional on the approval of the planned Nord Stream 2 pipeline through Germany.

The high prices are already putting some electricity utilities in Europe under considerable pressure, with a number of smaller utilities in Germany already filing for bankruptcy. In the UK, the industry is under particularly heavy pressure: the country holds only small gas reserves, but producers cannot pass on gas price increases directly because private households are protected by a government price cap.

As early as next month, 20 or more more companies in the power sector could go bankrupt, the head of energy company Scottish Power said in an interview with TV channel Sky on Thursday. Companies in other energy-intensive industries, such as steel manufacturing, are also already coming under severe pressure, according to British media reports.

Energy Prices Push Inflation in Europe to Multi-Year Highs

The energy price increases are already noticeably reflected in consumer and producer price data. Producer prices in Germany, for example, rose by 14.2 per cent year-on-year in September. This is the strongest increase since October 1974. The German Institute for Economic Research (DIW) assumes that the high inflation will not last; however, the fear of price increases alone could become a self-fulfilling prophecy.

If consumers and companies assume that prices will continue to rise, „people will bring forward purchases and demand higher wages. Companies, in turn, will raise their prices if they expect to have to pay higher wages and higher producer prices,“ explains DIW economic researcher Kerstin Bernoth. According to the economist, this could set off a wage-price spiral.

In Germany, the inflation rate jumped to 4.1 per cent in September, above the four percent mark for the first time in almost 28 years. In the euro zone as a whole, the inflation rate rose to 3.4 per cent, the highest level in 13 years. The rising inflationary pressure could therefore put a damper on the ongoing recovery from the corona crisis. The inflation data is also giving rise to fears in the markets that the central banks might take countermeasures and abandon their loose monetary policies to support the economy. So far, however, many central bankers have classified the inflation increases as only temporary effects.

Japan and China Hit Particularly Hard by Energy Price Hikes

Energy price hikes are also increasingly becoming a problem in other regions of the world. Natural gas prices in Asia, for example, have increased more than fivefold this year. Japan has been hit particularly hard, as it has to import all but a small fraction of its required energy. Energy prices in the country are not yet reflected in the inflation data, as many companies are reluctant to pass on the prices to their customers in order not to jeopardize the recovery of consumption, which is already weak. But Japan’s Prime Minister Fumio Kishida has already instructed his cabinet to take steps against the high energy costs.

In China, high energy prices are compounded by the recent frequent power outages, which threaten the country’s security of supply. According to media reports, some major Chinese corporations are already negotiating with US exporters for a multi-billion-dollar contract to supply liquefied natural gas. At least five major corporations are said to already be negotiating, according to insiders.

IEA and World Bank Expect no End to Shortages for the Time Being

There is no end in sight to the strong demand for energy. According to recent forecasts by the International Energy Agency (IEA), global oil demand is expected to recover to pre-corona pandemic levels next year. The IEA expects the global energy crisis to boost oil demand by half a million barrels per day. According to a recent forecast, the World Bank also expects energy prices to remain at a high level for the time being. Supply-side bottlenecks, and with them the whole situation, are unlikely to ease until the second half of 2022, the World Bank economists expect.

This also calls for countermeasures on the part of the EU. Accordingly, energy prices were also a major theme of the EU summit that ended on Friday. As expected, however, the 27 EU heads of state and government were unable to agree on a unified approach to the high energy prices. During the discussions, countries such as Spain, Italy and Greece demanded joint gas purchases by the EU states in Brussels on Thursday. However, Germany for one had already rejected this beforehand. The summit declaration refers to the EU Commission’s proposed package of measures and the EU energy ministers’ consultations on October 26.

Conclusion:

The high prices for oil and natural gas are the result of the economic recovery, but also of the political differences surrounding the commissioning of the Nord Stream 2 pipeline. With the ERSTE STOCK COMMODITIES equity fund, you can participate indirectly in the current price level for energy and commodities.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.