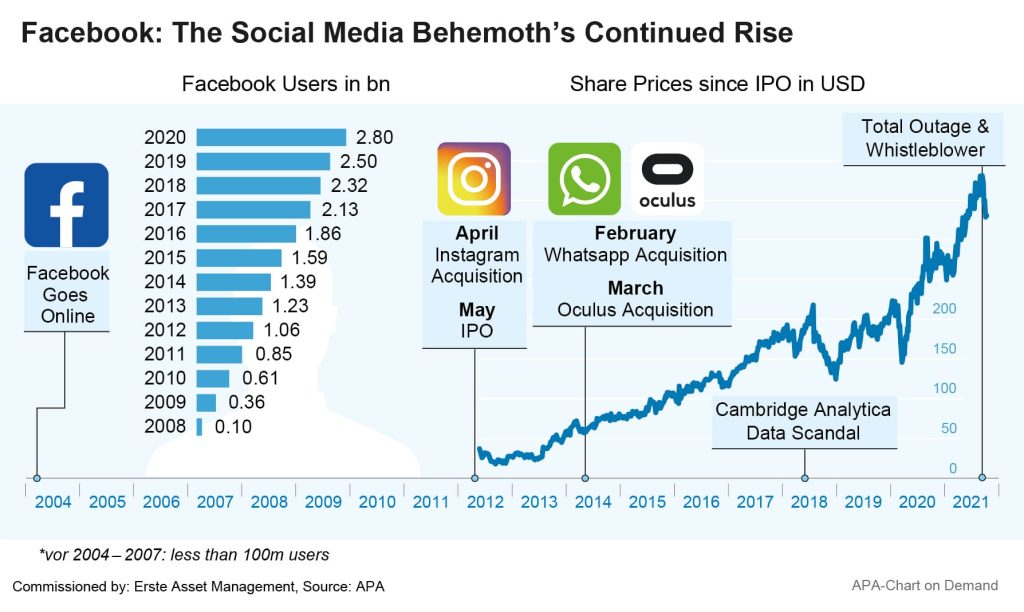

Two nearly simultaneous events surrounding social network behemoth Facebook have recently directed public attention towards the network’s impact and power, giving Facebook critics new momentum: After an outage of the most important Facebook services last Monday that lasted several hours, former Facebook employee and whistleblower Frances Haugen made serious accusations against the company before the US Senate the following day. In doing so, she also provided further fuel for politicians’ calls to stricter regulate Facebook services or even break up the group.

On Monday, Facebook experienced a total outage of its services lasting almost six hours. For the company‘s more than three billion users Facebook itself, as well as the group’s chat platform WhatsApp, the photo service Instagram and the business platform Workplace, were temporarily unavailable. Providers of alternative services recorded rising user numbers as a result.

The chat app Signal recorded millions of new users, with Signal‘s iPhone temporarily climbing from 55th to first place in the download charts. Telegram, the other popular WhatsApp alternative, recorded 70 million new users according to its founder Pawel Durow. Many users also reverted to good old SMS services. Deutsche Telekom recorded eight times more SMS messages than usual that day, while Telefonica (O2) reported a tripling of SMS traffic.

However, not only private users were affected. Many small businesses and self-employed workers rely heavily on Facebook, WhatsApp and Instagram to sell products online and communicate with customers, and, as a consequence of the downtime, suffered considerable economic damage. In addition, Facebook’s Workplace service, a platform for internal communication for corporate customers, was also affected. On the stock market, Facebook shares plummeted by almost 5 per cent on the day of the incident. Facebook founder Mark Zuckerberg’s personal fortune alone thus shrank by more than USD 6bn within a few hours, according to calculations by Bloomberg.

Faulty Configuration Change Paralyzed Facebook Services

According to Facebook, the outage was triggered by a faulty configuration change. According to IT experts, this caused Facebook’s so-called Border Gateway Protocol to „disappear“, which is required for the company’s servers to be found on the Internet in the first place. Troubleshooting was exacerbated by the fact that Facebook’s internal communications were also affected. Even digital door locks reportedly failed in places.

In addition, Facebook network administrators could no longer access their own servers via the Internet to fix the error. Eventually, therefore, Facebook had to send a team to its data center in Santa Clara, California, to perform a manual reset of the servers, according to the New York Times.

Whistleblower Collected Internal Documents about the Services’ Harmful Consequences

The outage brought the impact of Facebook’s services to public attention at the most sensitive time imaginable: The very next day, former Facebook employee Frances Haugen brought her accusations against the corporation before the US Senate. The former Facebook data expert had already collected numerous internal documents and research papers from the company and leaked them to the Wall Street Journal.

At the same time, she filed a complaint with the US Securities and Exchange Commission (SEC), which now entitles her to special legal protection as a whistleblower under US law. According to Haugen, the papers she collected prove that Facebook knew about the harmful effects of its services, and yet put business interests above those of its users.

For example, she said, studies by Facebook’s own researchers show that the Facebook service Instagram increases dissatisfaction with one’s own body and, as a result, a tendency toward eating disorders among many teenage users. In addition, Facebook employs mechanisms that can trigger addictive behaviour, especially among younger users, Haugen said.

According to the data expert, the company also takes too little action against polarizing and hate-fueled postings. Facebook does use algorithms to filter out harmful and misleading content, but they often don’t achieve sufficient results, she said. Internal documents also show that the company has exempted many prominent users from these filters, because they were unable to keep keep up with monitoring those users’ posts.

Facebook is Shaping our Perception of the World, Haugen Says

Overall, Facebook algorithms determine to a large extent what section of the world users get to see. „Facebook is shaping our perception of the world by selecting the information we see,“ the whistleblower said. However, the corporation turns these algorithms into closely guarded corporate secrets and denies researchers and regulators access to them. Haugen therefore calls for greater transparency and regulation of the selection mechanisms.

While Facebook itself does not deny the authenticity of the documents, it generally rejects the accusations. „The argument that we intentionally promote content to make people angry for money is deeply illogical,“ wrote Facebook CEO Zuckerberg. Advertisers, for example, have no interest in seeing their ads next to anger-inducing content.

Top Politicians call for Stronger Regulation or even Breakup of Facebook

For Facebook’s critics, Haugen’s revelations, together with the network outage, nevertheless provided new ammunition. Experts are talking about the biggest PR debacle for Facebook since the scandal surrounding the use of user data by Cambridge Analytica in 2018, when it became known that, years earlier, a data analysis company had been able to access information from millions of users without their knowledge or consent.

US politicians are increasingly calling for stronger regulation of or even breaking up the group, both among Democrats and in the Republican camp. „Break it up now,“ demanded influential Democratic Congresswoman Alexandria Ocasio-Cortez, for example.

Many EU leaders also see the outage and Haugen’s statements as vindication of their plans to regulate companies like Facebook more closely. The network outage showed that there is a need for more competition, wrote Margrethe Vestager, EU Commissioner for Competition and Digital Affairs, on Twitter. „You can’t rely only on a few big players.“ That, she said, is also the goal of the Digital Markets Act (DMA). The new regulations to control large technology groups are currently being developed at EU level, she said.

The stock market continued to fall after Haugen’s appearance before the Senate, but shares recovered somewhat later in the week. The question from an economic point of view is whether the latest incidents can lead to a massive exodus of users and thus, as a consequence, of advertising customers. Some experts doubt that many users will completely turn their backs on Facebook services after the network outage. Facebook profits greatly from the so-called network effect: the service’s great benefit lies in its huge number of users, and it is difficult to find alternatives. The damage for the company could, for the time being, therefore be limited.

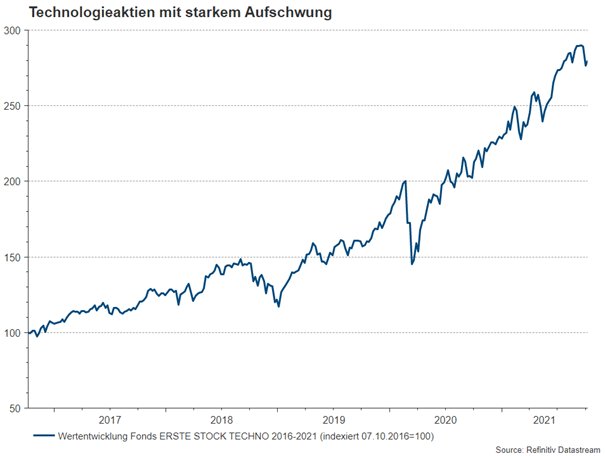

ERSTE STOCK TECHNO: Big Tech Universe in one fund

For those who continue to believe in the strong market position and growth of Facebook shares, ERSTE STOCK TECHNO offers an opportunity to invest in a portfolio of the world’s largest and fastest-growing technology stocks. Over the last 5 years, the fund has shown a disproportionately strong upward movement, see chart below. Price corrections must be expected at any time.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.