Amid signs of economic recovery following the lockdowns, inflation expectations among many market participants, and the hunt for yield, bonds have gone a bit “out of focus” this year. Due to the (low) interest rates environment, fixed income funds do not look exciting anymore. Equity funds are being built up and the risk component in portfolios is being raised. Does it still make sense to hold bond funds in the portfolio?

This is what Wolfgang Zemanek, Head of Fixed Income funds, has to say.

How satisfied are you with the performance of bond funds this year?

Fixed income funds are unfortunately not always the “first choice”. Strong earnings from listed companies and in combination with the dividend payouts are currently outpacing interest income. If you look at performance, you have to take a closer look. The trend is twofold: Especially in the developed world, where the government is the borrower, yields have been more modest or in negative territory since the beginning of the year. However, this is not true for all sovereign debt securities. Local Chinese government bonds have performed very well since the beginning of the year, as have high-yield corporate bonds, both in Europe and globally. Behind the good values is, among other things, investors’ hunt for yield. This remains high because there are hardly any alternatives if you include equities into the equation.

What were the reasons for the good performance of corporate bonds?

Some segments of corporate bonds markets are massively supported by central bank policies, the billion-dollar bond-buying programs. And as we now see, the decent corporate earnings, the positive economic growth prospects again and the low default rates, especially in the high-yield segment, justify investments in these funds. This will not change much for the time being, even if the purchase programs are curtailed – possibly starting in the USA. Risk premiums should remain relatively low.

Speaking of which, do you expect any changes in central bank policy in the near future? The annual meeting of the policy-setting U.S. Federal Reserve Bank in Jackson Hole at the end of August could herald the end of programs and thus also point the way to interest rate hikes?

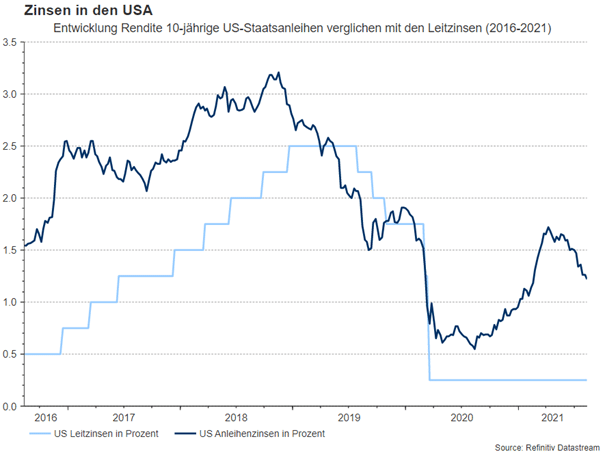

The Fed began “telegraphing” the possible change in its asset purchase program to market participants earlier this year. The recent positive US payrolls report added fuel to these speculations. The next two months will be particularly exciting in this regard. It can be assumed that the Fed will announce a so-called tapering for the end of 2021 or early 2022 in the next 1-3 months. But the Fed will keep interest rates unchanged for the foreseeabel future. The ECB is also still a long way away from possible key interest rates. This means that interest rates will remain low for savers and borrowers.

What sort of development do you expect for bond yields? The 10Y US What are your expectations with regard to the development of bond yields? For 10-year US government bonds, we are currently fluctuating between 1.1% and 1.8%. The US Treasury has trillions in funding needs. Couldn’t the flood of upcoming issuance cause yields at the long end to rise more significantly than anticipated?

The infrastructure package and the additionally proposed programs by the Biden administration will push up the deficit in the state budget. However, the increased financing needs of the U.S. government have been relatively well digested by the market recently. This topic alone could create pressure towards higher yields. Now comes the “but”: other issues, such as the still high uncertainty regarding the pandemic – keyword Delta variant – as well as the expectation that some reasons for the rise in inflation are only temporary, work against this.

Are the risk premiums (spreads) on corporate bonds or the government bonds mentioned earlier still attractive enough? Are investors getting “fair” compensation for the risk they are taking?

To answer this question seriously, you have to watch closely which companies get back on their feet after the pandemic and which ones don’t. Many sectors of the economy have been hit very badly. Nevertheless, there were many fears, fortunately not all of which have been confirmed. Default rates are low and analysts expect them to remain low in the coming year.

Other factors that argue against overshooting yields: Volatility is currently low and real yields are in negative territory in parts of the developed world: currently, German government bonds are yielding in negative territory across most buckets of the yield curve. This means that debtors are still getting money, and liquidity remains high. Because there is little to be gained by investors in the credit-secure segment, demand for higher-yielding asset classes will remain strong. The financing of government debt is favored by negative real yields in the USA.

Are inflation expectations not set too low, given the humming global economy, extremely good corporate results and future prospects. High commodity prices and possibly burgeoning wage pressures from strong labor market data could drive the price spiral?

How the price spiral will turn is incredibly difficult to assess at the moment. We do not know how severe the distortions are. The global pandemic is a factor that has not existed in our lifetime. We completely lack the empirical data! It was an artificially induced recession: the states closed the economy.

After the opening, ramping up the economy is fraught with difficulties, as the supply bottlenecks show. Further lockdowns are less likely currently due to the vaccination programs, expecially as long as the hospitalisation rates remain low, but still cannot be ruled out. The pandemic is not over yet. We can see that the minimum wage has been raised in the USA in some areas, but we still expect some factors of the current inflation spike to remain transitory.

China is currently making headlines because of rigorous approaches to some companies. Why do Chinese government bonds still play a role?

Clearly, there are many question marks in China, which are political in nature. Tensions between the U.S. and China are clearly elevated and will remain so in the medium term. But we also cannot argue away the fact that China is on its way to becoming the world’s largest economic power. This cannot simply be ignored. Especially since there are corresponding opportunities that we would like to take advantage of. Foreign investors are still underinvested on the Chinese bond market. China is entering the international benchmarks (indices) step by step. This mean that there is a constant flow of capital into the Chinese markets.

Currently, the dynamic of the Chinese economy is weakening a bit. The central bank has already hinted that it might continue to pursue a loose monetary policy. This is boosting the Chinese government bond markets (in local currency). The yield on the 10-year government bond has fallen from around 3.1% to 2.8%. The potential to remain stable or fall further is there. Investors would see further price gains from falling yields. The yuan’s currency relation to the euro and U.S. dollar does not signal any major changes.

CONCLUSION:

Even though the upward trend on the equity markets remains unbroken, we recommend a diversified portfolio. It still makes sense to hold bonds as they bring stability to the portfolio. Investors who want to receive a return from bonds could have to look at high-yield corporate bonds. Chinese government bonds are worth a look as well.

Funds containing types of bonds that were discussed above

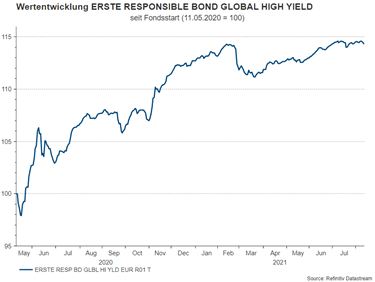

ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

A fixed income fund whose investment universe is based on ethical, sustainable criteria. The fund focuses on high-yield corporate bonds in euro, British pound, and US dollar. Currency risks tend to be hedged strategically. Its rating is currently in the high-yield segment (BB and lower). We integrate environmental, social, and governance factors as part of a wholistic ESG approach into our investment process.

The ERSTE BOND CHINA fund aims at investing in local currency bonds that were issued or are guaranteed by the People’s Republic of China and are traded in Mainland China. In addition, the fund may also hold securities from other issuers. The foreign exchange risk vis-à-vis the euro is usually not hedged.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.