The rapper Eminem clearly does not think much of diversification – after all, in his song “Lose Yourself“ he says: “You only get one shot, do not miss your chance to blow, this opportunity comes once in a lifetime”.

Fund managers have a different view on diversification. You don’t want to put all your eggs in one basket, because if the basket falls to the ground, all the eggs may break. But if you spread them across more baskets, while it may still hurt when an egg breaks, it does not mean that ALL eggs are lost.

Don’t put all your eggs in one basket

This is why we do not only invest in one share, bond, or asset class for our funds, but instead we spread the risk across more investment vehicles. For a multi asset mandate that means among other things that we mix asset classes that go in different directions in the event of a crisis. In the past, this has been implemented by mixing risky asset classes (e.g. equities, high-yield bonds) and defensive investments (e.g. German or US government bonds).

In order to mitigate the economic impact of the corona crisis, the governments and central banks have resorted to ultra-expansive measures. Large fiscal aid packages have been passed across almost all countries of the developed world. In addition, the central banks have supported the real economy and the financial markets with bond purchase programmes and interest rate cuts. This has led to a status quo where the yields of traditional, conservative investments are either very low or even negative.

10Y yields of government bonds in the developed markets

| Country | 10Y yield of government bonds in % |

| Germany | -0.209 |

| Switzerland | -0.195 |

| Japan | 0.070 |

| France | 0.162 |

| Sweden | 0.383 |

| UK | 0.804 |

| Italy | 0.907 |

| USA | 1.552 |

Source: Bloomberg, as of 9 June 2021

The low level of interest rates leads to accordingly low expected income from conservative government bonds and to the decline of the diversification potential of such instruments. Of course, in the event of a crisis, yields can still fall, but less significantly so than in the past.

China as third pole

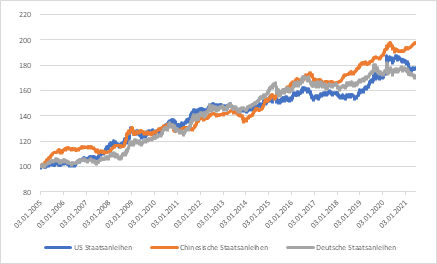

This is why alternatives are needed that provide the aforementioned diversification potential and, in an ideal case, also higher returns. In addition to the two currency blocs in the USA and Europe, a third pole has emerged in the recent decade, i.e. China. Both equity and bond markets have grown substantially in China, but they are still underrepresented in the portfolios of many institutional investors. From our point of view, Chinese government bonds are particularly interesting. The following chart shows a comparison of the performance of government bonds in China, Europe, and the USA (allowing for currency effects).

Long-term performance comparison of the government bond markets in the USA, Germany, and China in euro

Much like government bonds from the USA and Europe, the Chinese market has offered a certain degree of diversification potential vis-à-vis riskier assets in the past. The correlation between global equities and Chinese government bonds in the past ten years has hovered around zero. This was also the case last year, at the beginning of the corona crisis.

Performance of Chinese government bonds and global equities in euro, 31 December 2019 to 29 May 2020 (equities: left scale; government bonds: right scale):

Also, the yield and thus the long-term return expectations of Chinese government bonds are clearly above those of the developed world. 10Y Chinese government bonds are currently traded at a yield of 3.1% (source: Bloomberg, 9 June 2021).

Chinese government bonds bring diversification and yield

In recent months, we have closely scrutinised Chinese government bonds as asset class, in terms of our return expectations and with regard to their diversification potential. In both cases we arrived at the conclusion that in the long run, adding these assets to our existing investment universe would bring advantages.

Therefore, we have added this asset class to our multi-asset funds and asset management mandates. We have allocated different bandwidths in accordance with the risk profile; Chinese government bonds are part of the emerging markets bonds allocation. This means that the maximum ratio of emerging markets bonds in local currency will not change.

This month, we will add Chinese government bonds to our funds and portfolios and will at the same time reduce our emerging markets bonds exposure.

Summary: our portfolios will become more efficient as a result of adding Chinese government bonds to our investment universe. The expected return of this asset class is above that of government bonds of the developed world, while the diversification potential improves.

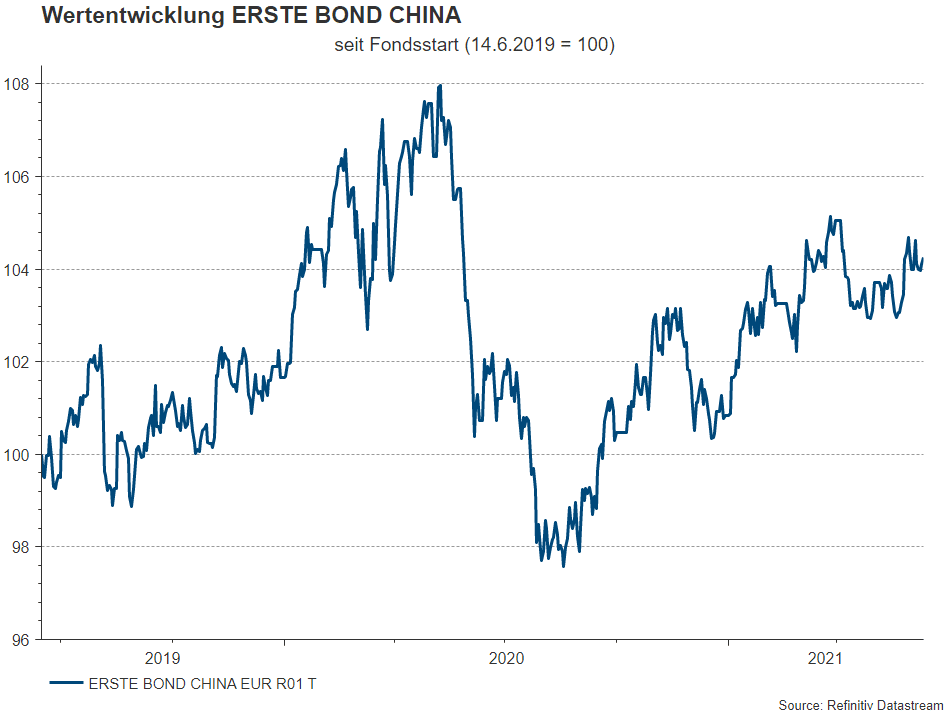

ERSTE BOND CHINA: Chinese bonds in local currency

Investors who want to invest directly in Chinese government bonds can do so with our ERSTE BOND CHINA fund. The fund invests in local currency bonds that are issued and guaranteed by the People’s Republic of China and traded on Mainland China. Please note: currency exchange rate fluctuations affect the fund performance.

ERSTE BOND CHINA performance

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.