Technologies – and, in particular, environmentally friendly ones – were THE big narrative on the stock exchanges last year. The upward trend of these companies continues in view of the clear political cues.

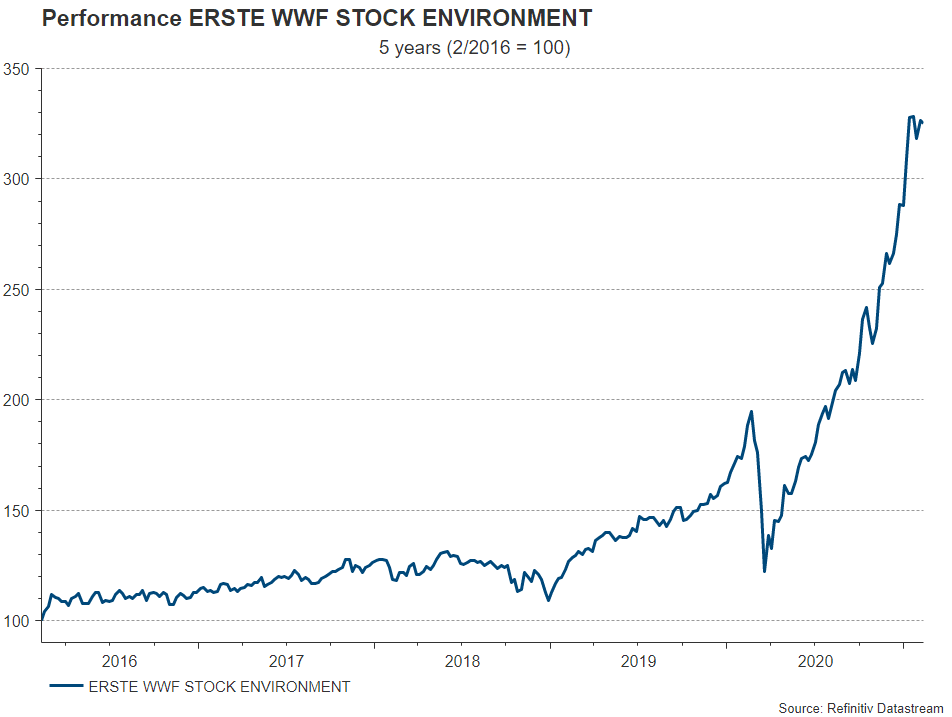

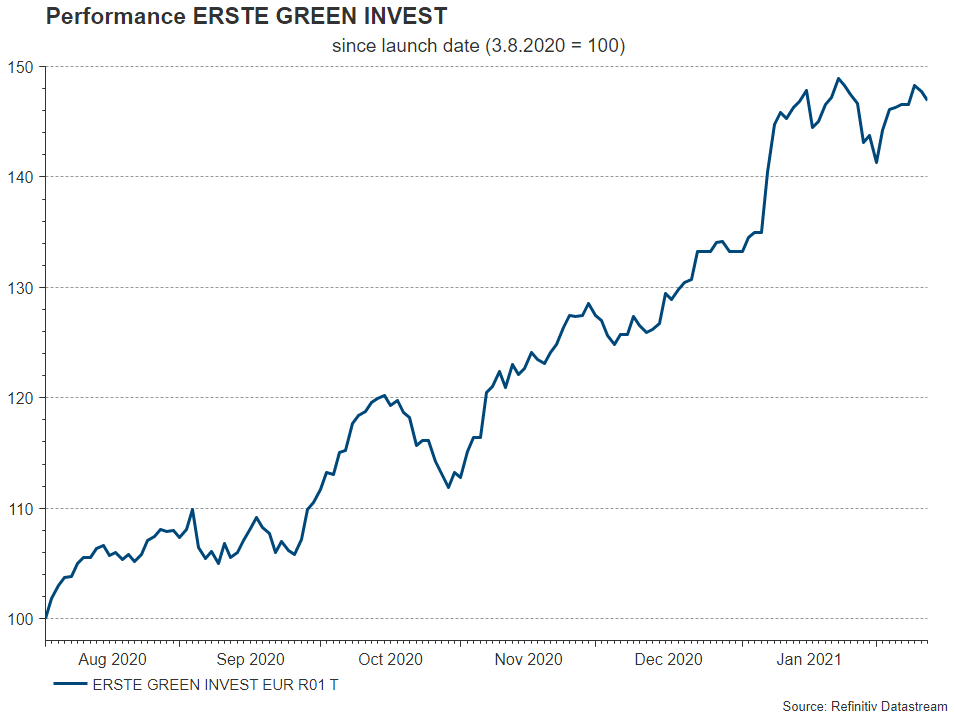

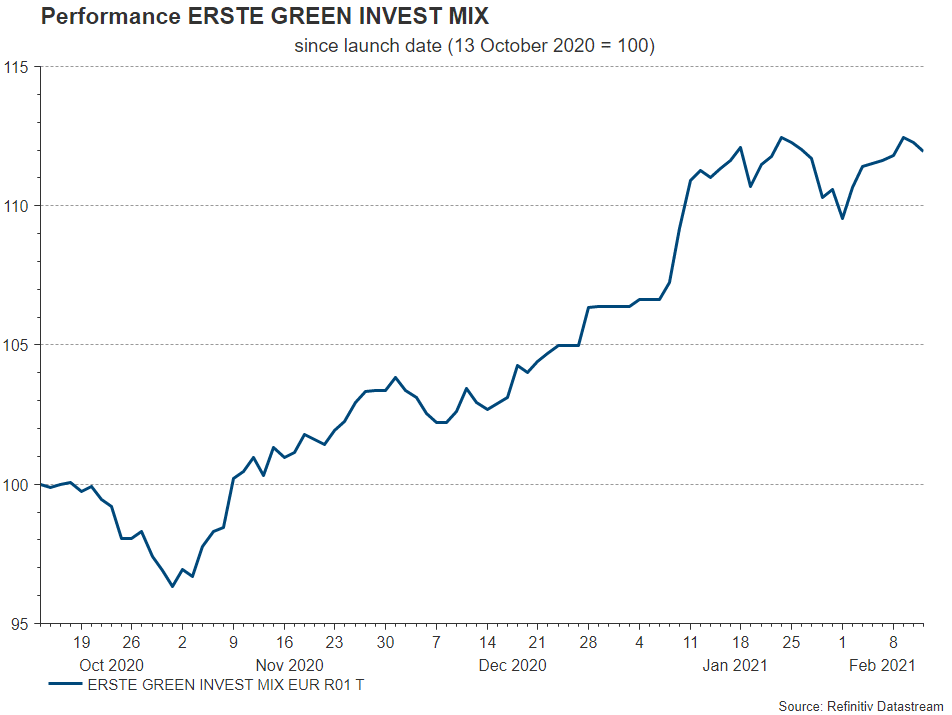

The environmental funds ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST, and ERSTE GREEN INVEST MIX achieved above-average performance for its investors last year (as of 31 December 2020). We spoke with Senior Professional Fund Manager Clemens Klein about 2020, valuations, and the outlook for equities in the environmental technology sector.

2020 was a very positive year for environmental equity funds and sustainable investments in general. What do you think was the basis for these developments?

Investors focused on technology shares. The sub-sector of environmental technology, with its many innovations, took a leading role in this context. In terms of sectors, equities in the solar energy segment topped the rankings. Hydrogen-related investment stories and wind power also recorded a positive year. Mobility was less convincing, and water, in particular, picked up a significant degree of underperformance in 2020.

This means that overall, you couldn’t really go wrong?

Let’s put it this way: the capital flows did not stop because of the pandemic. Investors were relatively unfazed, and they continue to regard environmental technologies as investment for the future. Of course, you can always take a wrong turn, for example if you put all your eggs into one basket. If you want to invest your money in environmental technologies, it pays off to diversify your capital across a large number of companies and sectors. – Which is what we as fund managers excel in. Of course, it is possible to read up on the subject and pick a few shares that one thinks may have upward potential. But among all the investable companies – and we are talking about hundreds of them – there will be a few that cannot meet the high expectations set in them. In a fund, if one company incurs a rapid decline in prices, the other titles can absorb those losses if they perform well. This means a fund also has to be seen from the angle of risk diversification. Apart from that, the performance we have achieved is not exactly meagre.

What companies were the frontrunners in the environmental technology funds?

The selection process – the “golden touch”, if you will – plays a crucial role. We don’t always get there, but we have now repeatedly outperformed the market on the basis of our stock selection for the benefit of our clients. In the solar segment, the company Enphase Energy was the top performer, followed by Sunrun, Sunpower, Daqo and Sunnova, which also contributed significantly to the performance of the fund (source: Bloomberg). In addition, companies in the fuel cell/hydrogen sector (Plug Power, Ceres Power, Nel ASA , Ballard Power) and niche companies in e-mobility (Workhorse,Niu Technologies) and wind power (TPI Composites) recorded substantial gains.

What is the future outlook for the area of environmental technology? Why or how could the shares continue to rise?

The outlook for investments in the areas of ecology and environmental technology remain solidly positive for 2021. The election victory by Joe Biden in the USA will produce additional political tailwind for many segments of the environmental industry, much like the European Green Deal will do. The focus is on themes like electro-mobility, energy efficiency, hydrogen, and renewable energy. For example, plans are in place for the installation of two million charging stations in Europe by 2025 in order to drive the switch to electric cars. In the USA, the climate plan of the new president calls for the restoration of four million buildings, with the focus on lighting, insulation, heating, and air conditioning. In Europe, too, the renovation rate of old buildings is to be doubled. The USA, Europe, and China, in particular, will invest hundreds of billions of euros into building hydrogen infrastructure in the coming years. And of course, renewable energy remains one of the decisive topics in the environmental sector. We have increased our weightings in the aforementioned themes in order to take into account these political measures.

“Solar and wind power will become the cheapest form of electricity production”

Clemens Klein, Senior Professional Fund Manager, Erste Asset Management

But they say that politically driven stock exchanges are short-lived. Ultimately, the bottom-line counts – for the environmental balance, the climate footprint, and the investors. Will all sides benefit?

Political support is of course crucial, but economic reasons have been particularly relevant for the long-term positive perspectives of investments in environmentally friendly technologies. In many parts of the world, solar energy is now one of the cheapest forms of electricity production, which means subsidies have become unnecessary. This is very positive. The drastic decline in battery prices in recent years (minus 80% since 2010, minus 50% since 2015) has not only helped e-mobility break through but will also ensure that solar or wind power and its storage will become the cheapest forms of electricity production in the foreseeable future. This will inevitably cause demand to accelerate further. Other areas such as recycling (plastics in particular) or water are also becoming more important across the world and should therefore generate above-average growth rates for years to come.

Conclusion

The performance of equities in the environmental technology sector in 2021 will again depend on the general development of the international equity markets. If the upbeat environment lasts, ERSTE GREEN INVEST and ERSTE GREEN INVEST MIX should benefit as well. In view of the increased valuations on the stock exchanges, temporary corrections are both possible and healthy. The above-average growth rate of “green companies” should be reflected in better revenue potential for funds with a focus on ecology and environmental technologies in the long run.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.