The emergence of DeepSeek, the new AI model developed by a Chinese start-up, caused quite a stir in the tech world two weeks ago. While DeepSeek may fundamentally change some of the key premises for the AI world as portfolio manager Markus Auer describes in his blog post, the most important AI players on the equity market could also feel the consequences of the new AI miracle model.

What is DeepSeek?

DeepSeek’s R1 model has a performance comparable to leading models like those from OpenAI, but it comes with two key differences: first, DeepSeek is open source and can be run on personal computers. This move challenges the current business model of companies like OpenAI, which relies on expensive infrastructure and subscription fees to access their most advanced models.

The new DeepSeek AI model triggered significant (albeit short-lived) losses in large tech shares. Image source: Dado Ruvic / REUTERS / picturedesk.com

Second, technical superiority and cost efficiency. DeepSeek uses a “chain of thought” method (CoT), similar to some advanced OpenAI models, to break complex questions into intermediate steps before providing a final answer. This process is transparent to the user and allows for greater confidence and understanding of the AI’s reasoning. What makes DeepSeek stand out is its efficiency. The model is designed to be substantially smaller and less resource-intensive, allowing it to run on personal devices and dramatically reducing the cost of computing infrastructure.

Effects on Big Tech

DeepSeek has not only caused a stir in the tech world, but the new AI model has also left its mark on the equity market. Which of the well-known tech giants on the stock market could be affected by DeepSeek, and how are they reacting to it? Let’s take a look at the most important companies:

Please note: the companies listed in this article have been selected as examples and do not constitute an investment recommendation.

Nvidia

The potential for lower computing power requirements due to efficient models such as DeepSeek could have a negative impact on Nvidia, previously the AI profiteer par excellence. Customers may need fewer or less expensive chips, which could bring Nvidia’s high margins under pressure. Analysts had already partially anticipated this – the current market forecasts assume a decline in gross margins for this year and next.

While Nvidia is developing more efficient and better chips to counter this trend, the shift from training to inference in AI processing could also have an impact.

- Training an AI model is the first phase of its development. This can be done by a process of trial and error or by showing the model examples of the desired input and output.

- Inference, on the other hand, is the process that follows training. The better a model is trained and the more finely tuned it is, the better the inferences will be.

For inference, other chips, known as application-specific integrated circuits (ASICs), are better suited, while graphics processing units (GPUs) are used for training. The problem with this is that Nvidia does not produce ASICs, only GPUs. The former are manufactured by other chip companies, such as Broadcom or Marvel.

Bernhard Ruttenstorfer, fund manager of the technology equity fund ERSTE STOCK TECHNO, believes that the latest developments and advances in the field of AI could be less positive for the chip industry: “Of course, forecasts should always be treated with caution, but there are certain downside risks in this area in particular if the demand for computing power for newer AI models were to decline.”

Please note: past performance is no reliable indicator of future value developments.

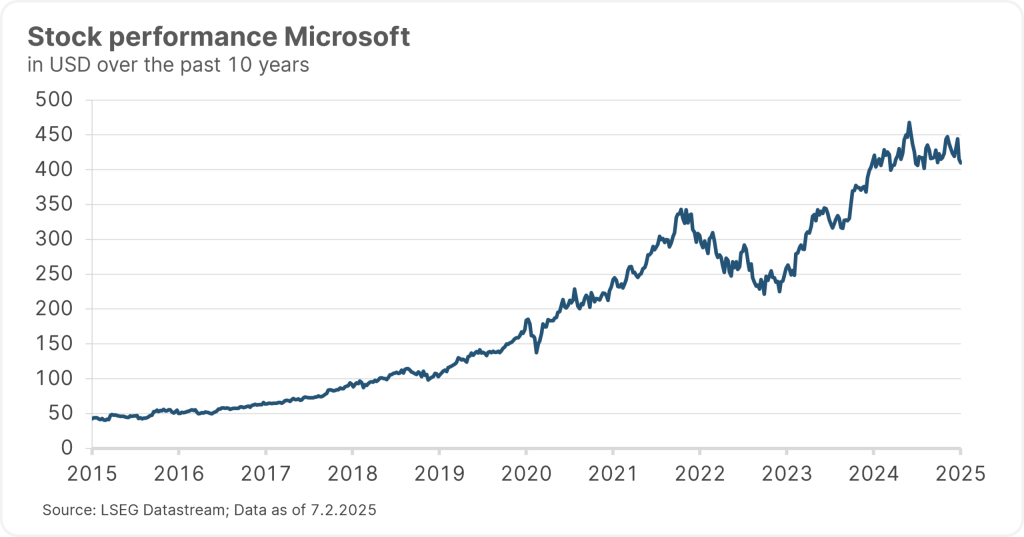

Microsoft

OpenAI, the company that developed ChatGPT, the first AI chatbot to become known to a broad public, is coming under pressure from DeepSeek. This is also indirectly negative for Microsoft, as the company holds a multi-billion dollar investment in OpenAI.

DeepSeek poses a threat to OpenAI and its business model. So far, OpenAI has made money from its subscription model for the use of its AI. The fact that the open-source DeepSeek model allows private users and companies to build their own AI is therefore, of course, negative for OpenAI.

Apart from OpenAI, Microsoft’s focus is on making its infrastructure available for inference applications, i.e. for the everyday use of AI. For example, the company is gradually integrating its own AI “Copilot” into Microsoft applications.

Please note: past performance is no reliable indicator of future value developments.

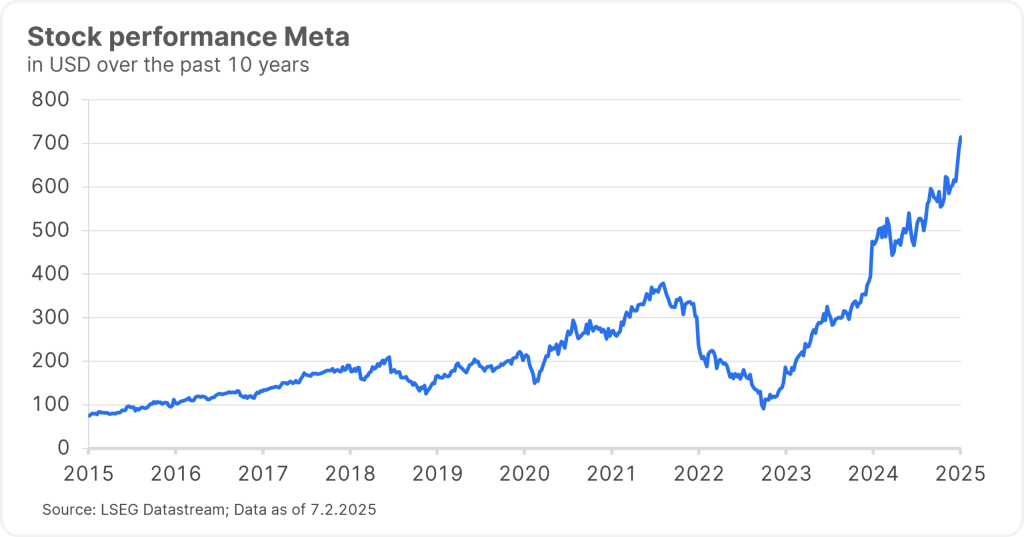

Meta

In general, without Meta there would be no DeepSeek, as fund manager Ruttenstorfer notes: “DeepSeek built its model on that of Meta. Without Meta’s work, DeepSeek would not exist. However, the Chinese have developed the LLM[1] very efficiently.”

However, the facebook parent company views DeepSeek’s progress positively and announced at its earnings presentation two weeks ago that it would like to integrate the new techniques into its own AI models in order to further develop and improve them. The company is adhering to its investment plans in its own infrastructure so as to continue to play a leading role in AI development.

Please note: past performance is no reliable indicator of future value developments.

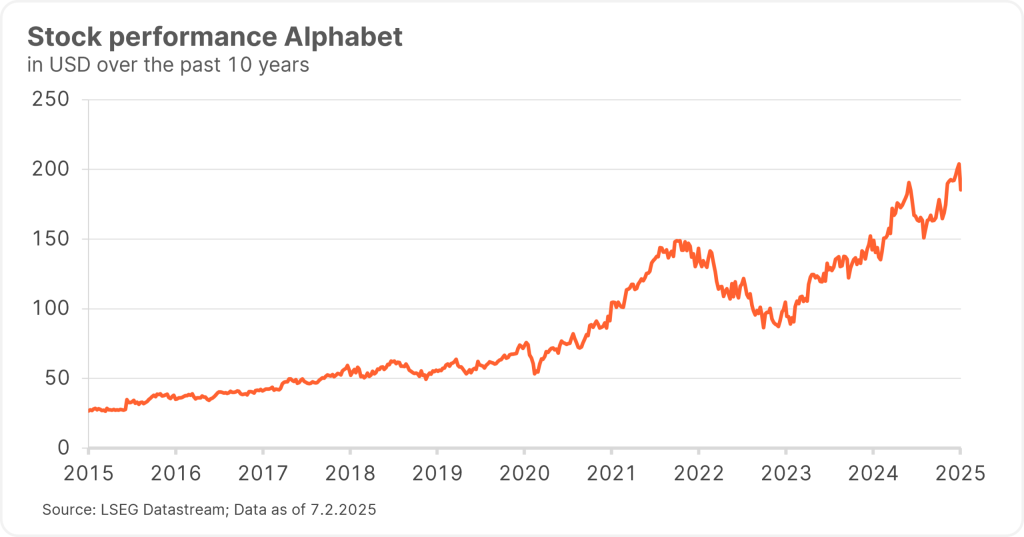

Alphabet (Google)

Alphabet has already demonstrated its ability to significantly reduce operating costs by slashing them within a few months of ChatGPT’s release. At the same time, the Google parent company remains under pressure to deliver good-quality answers to user questions while keeping costs under control.

For cloud infrastructure providers, i.e. Alphabet, but also Microsoft, Meta, and Amazon, Ruttenstorfer sees the developments through DeepSeek in a positive light overall: “They may be able to offer their service more cheaply in the future, which could lead to increased use of AI applications. The other possibility is that they will have to invest less in their offering, which should have a positive effect on margins.”

Please note: past performance is no reliable indicator of future value developments.

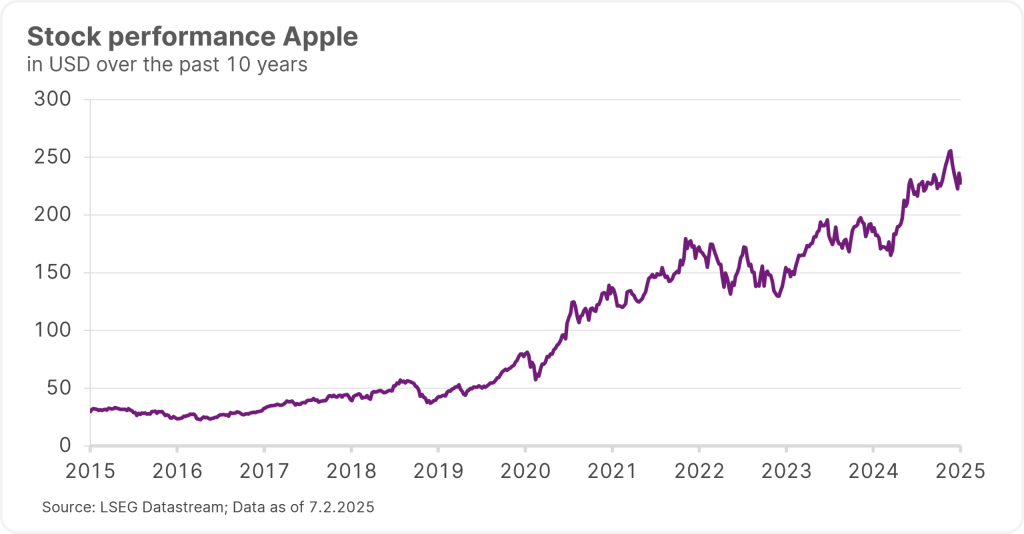

Apple

So far, the iPhone company has not invested as heavily in AI data centres as Meta or Microsoft. At Apple, the focus is on using smaller AI models that run directly on the devices with Apple Intelligence. Only when this smaller model does not provide good answers does it access a a cloud-based AI model.

Apple’s strategy of using smaller models on devices and only moving to the cloud when necessary is in line with the trend towards more efficient AI models. This approach could reduce data centre costs by allowing much of the computing to be done locally on users’ devices.

Please note: past performance is no reliable indicator of future value developments.

Shift towards software

The emergence of DeepSeek and similar technologies points to a shift from hardware to software, as tech stock expert Ruttenstorfer points out: “Software companies that are already successfully integrating AI applications into their services are likely to be among the beneficiaries.” He mentions companies such as Salesforce, SAP, and ServiceNow for reference.

These companies could offer AI-based products at lower prices, which would increase customer acceptance and support their margins. Cybersecurity could also be among the beneficiaries, as could IT service and cloud infrastructure companies.

From a global perspective, cheaper AI could also benefit Europe and emerging markets. These have not yet invested in AI infrastructure on the same scale as China or the USA.

Conclusion

The long-term effects of DeepSeek are not yet clear. While some expect a profound change in the hyped AI industry, others see the effects as less drastic. “In my view, the emergence of the DeepSeek model is positive for the market,” summarises Bernhard Ruttenstorfer. On the one hand, company margins are likely to normalise in the long run, and on the other hand, lower costs could lead to increased use of AI applications.

With DeepSeek and the significantly lower costs of the model compared to those of previous models on the market, software companies that successfully integrate AI into their offerings could come back into focus. For these companies, better AI applications at lower prices could mean higher revenues on the one hand and lower operating costs on the other – so, they would have killed two birds with one stone. At the same time, the further development in the semiconductor industry must be monitored closely in view of the likely lower computing power required.

Investing in technologies of the future

Tech trends such as cybersecurity, cloud computing, and, of course, artificial intelligence are the central themes of the ERSTE STOCK TECHNO equity fund. Investors can invest in exciting future technologies and promising companies in the technology industry either through a one-off investment or with a monthly fund savings plan.

For further information on ERSTE STOCK TECHNO, please visit our website 👉

It should be noted that investing in securities always involves risks as well as opportunities. For example, the value of the fund may fluctuate considerably over time. The average cost effect decreases as the term of the savings plan increases, as the assets saved behave more and more as if the total amount had been invested once. Depending on market developments, a one-off investment can also prove to be more favourable. Investing in securities harbours risks as well as opportunities.

Risk notes ERSTE STOCK TECHNO

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.