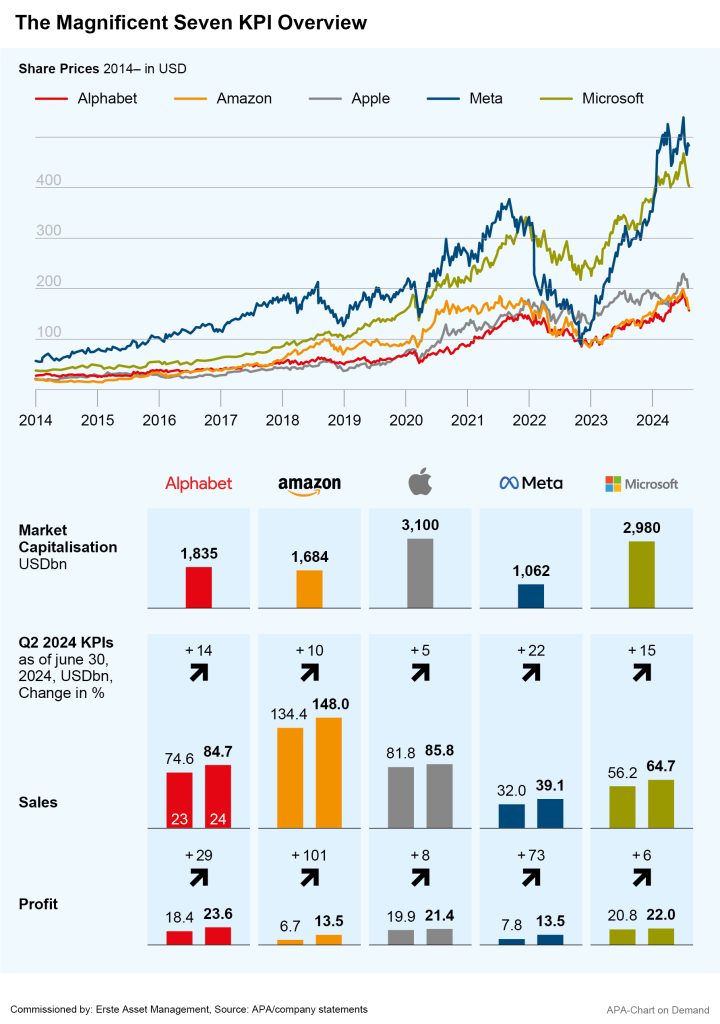

Once again, Artificial intelligence dominated the quarterly figures presented last week by the Big Five, the leading US technology corporations Alphabet, Amazon, Apple, Meta, and Microsoft. However, expectations that the AI boom will be reflected in matching earnings or positive business outlooks for the tech companies are rising accordingly.

Expectations largely met – hardly any increases in profit forecasts

The bottom line is that the Big Five have reported further increases in sales and earnings for the second quarter. The figures partially exceeded expectations, but in some areas investors had hoped for even better figures. As a result of the presentation of the figures and in the wake of the general losses on the markets, some of the tech stocks that had previously performed well also fell sharply.

Bernhard Ruttenstorfer, fund manager of the technology equity fund ERSTE STOCK TECHNO, also emphasizes that the expectations for the half-year results in the technology sector were largely met. “However, there were hardly any increases in profit expectations for the second half of the year,” he explains. In general, he also sees a certain sector rotation out of big tech and into cyclical companies as one of the reasons for the recent correction. “The outlook for falling interest rates should help companies that are more dependent on economic growth, i.e. companies with traditionally cyclical business models,” summarizes the equity fund manager.

Note: Prognoses and past performance are not a reliable indicator of future performance.

Billions in AI investments

Regardless of the market situation, the so-called “Big Five” are investing ever greater sums in the data centers required for AI applications. For Microsoft, the costs for expanding data centres soared by 78% to USD 19bn in the past quarter alone. Google’s parent company Alphabet announced that they will almost double their investments to USD 12bn. Alphabet CEO Sundar Pichai justified the expenditure with the enormous future potential of AI offerings. “The risk of underinvesting is dramatically greater than the risk of overinvesting,” said the Alphabet CEO.

Meta CEO Mark Zuckerberg is also convinced that these investments are urgently needed in view of the long lead times of AI projects. “At this point, I’d rather risk building capacity before it is needed rather than too late,” said Zuckerberg when presenting Meta’s figures.

The AI boom is already causing rapidly increasing demand for the tech giants’ cloud services. Both Alphabet’s and Microsoft’s cloud divisions grew by 29 per cent respectively in the past quarter. However, while Alphabet thus exceeded forecasts, investors had expected even stronger growth in this area from Microsoft.

Alphabet And Meta Planning To Dethrone ChatGTP With Their Own AI

But the big corporations are also competing fiercely with each other with AI applications. For a long time, Microsoft lay ahead in this regard, benefitting from its partnership with ChatGTP developer OpenAI. However, the other tech corporations have now also invested heavily in AI developments and are massively expanding their respective offerings.

Google is competing with ChatGTP with its proprietary AI, Gemini. Facebook’s parent company Meta hopes to give ChatGTP a run for its money by integrating its own AI, Llama, into its platforms such as Instagram or WhatsApp. Unlike OpenAI or Google, Meta offers its own AI as freely accessible open-source software. This is intended to create a software ecosystem that binds users more closely to the company’s services.

Alphabet and Meta want to overthrow the industry leader ChatGPT from OpenAI with their own AI applications

Strong Advertising Income Drove Meta’s Sales

The markets reacted positively to the results reported by Meta. Facebook’s parent company increased its sales by 22% to USD 39.1bn, thanks in particular to surprisingly good advertising income. Profits rose by 73% to USD 13.5bn. The Reality Labs division remains a problem child, and the Metaverse continues to generate losses for the foreseeable future. On the other hand, the group’s AI plans were well received.

Both Alphabet and Microsoft slightly exceeded expectations. The booming cloud business and robust advertising income resulted in a 14% increase in revenue to USD 84.7bn for Alphabet. Microsoft increased its sales by 15% to USD 64.7bn. However, despite the solid figures, disappointment over cloud growth prevailed on the stock market, and Microsoft shares reacted to the results with significant losses.

Amazon shares also dropped sharply after the online retailer’s results were presented. The group’s Q2 sales increased by 10% to USD 148bn YoY, but analysts had expected somewhat more. However, the group exceeded forecasts in its important cloud division Amazon Web Services (AWS), where sales rose by early 20% to USD26.3bn.

Apple Increases its Quarterly Revenue Despite weak iPhone sales

While Apple earned slightly less with its iPhones in Q3, iPad tablets and Mac computers more than made up for this. Group sales rose by 5% YoY to USD85.5bn. At the bottom line, a profit of around USD21.5bn remained, an increase of around 8% compared to Q3 of last year.

iPhone sales fell by 1% year-on-year to around $39.3 billion, with Apple currently particularly losing market share in the important Chinese smartphone market. However, this still exceeded analysts’ expectations. In addition, Apple plans to introduce new AI-based features on its devices starting in autumn. In a conference call, Apple CEO Tim Cook emphasised that this could give customers a reason to buy new iPhones.

Apart from the earnings figures, star investor Warren Buffett caused quite a stir with Apple shares. His holding company Berkshire Hathaway has held a large stake in Apple for years. However, as was announced last weekend, he sold a package of Apple shares worth around 76 billion dollars in the last quarter, which hit the share price hard after the weekend.

US star investor Warren Buffett caused selling pressure on the iPhone manufacturer’s shares with a billion-euro sale of Apple shares © JOHANNES EISELE / AFP / picturedesk.com

Nvidia Figures Eagerly Awaited, Intel Disappoints With Recent Figures

Chip manufacturer Nvidia’s quarterly figures, which will be released in August, are now eagerly awaited. Nvidia produces the majority of special processors used for AI applications and is therefore considered to be the AI boom’s main beneficiary. Reports of a possible delay in the next generation of Nvidia GPU chips (“Graphic Processor Unit”) caused a subdued mood in the run-up to the company’s figures. However, fund manager Ruttenstorfer emphasized the continued good prospects in the segment: “AMD and Nvidia recently confirmed the demand for their AI products.”

Note: Prognoses are not a reliable indicator of future performance.

Share price quake at Intel

The figures reported by industry rival Intel were received with disappointment. Intel has yet to develop its own AI chip with which the company could hope to compete with Nvidia. By contrast, demand for processors for traditional servers has been sluggish of late. In Q2, Intel’s profits dropped more than expected to USD 0.02 per share. “Investments are being made in chips that are important for AI applications, such as GPUs. Investments in CPUs (“Central Processor Unit”; main processor in computers), on the other hand, are being reduced. This trend is likely to continue for years to come. Intel, which primarily offers CPUs, will unfortunately suffer directly,” says Ruttenstorfer, summarizing the less than rosy prospects for Intel.

In view of the slump in traditional chips, Intel also announced a tough austerity programme at its earnings presentation, with more than 15% of jobs to be cut. In response to the figures, Intel shares temporarily lost around a third of their value on the stock market.

Outlook remains positive

Looking at the segment as a whole, Ruttenstorfer continues to see the situation as positive in the medium to long term. “We see the current correction for what it is – a correction in an upward trend,” emphasizes the fund manager. Demand for machines for the semiconductor industry remains good, demand and supply for AI applications is broadening and the software industry is also increasingly stabilizing. “Cybersecurity, autonomous driving and the Internet of Things are also long-term themes,” he continues to see upward momentum for the themes in ERSTE STOCK TECHNO.

Money tip: Investing in future technologies

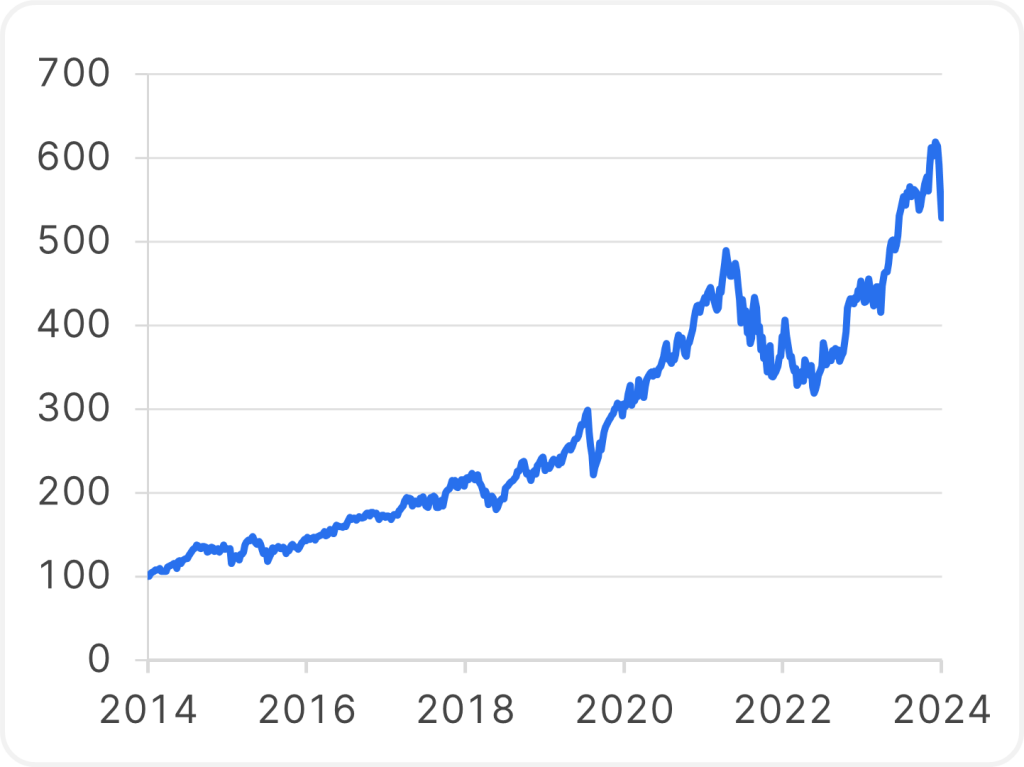

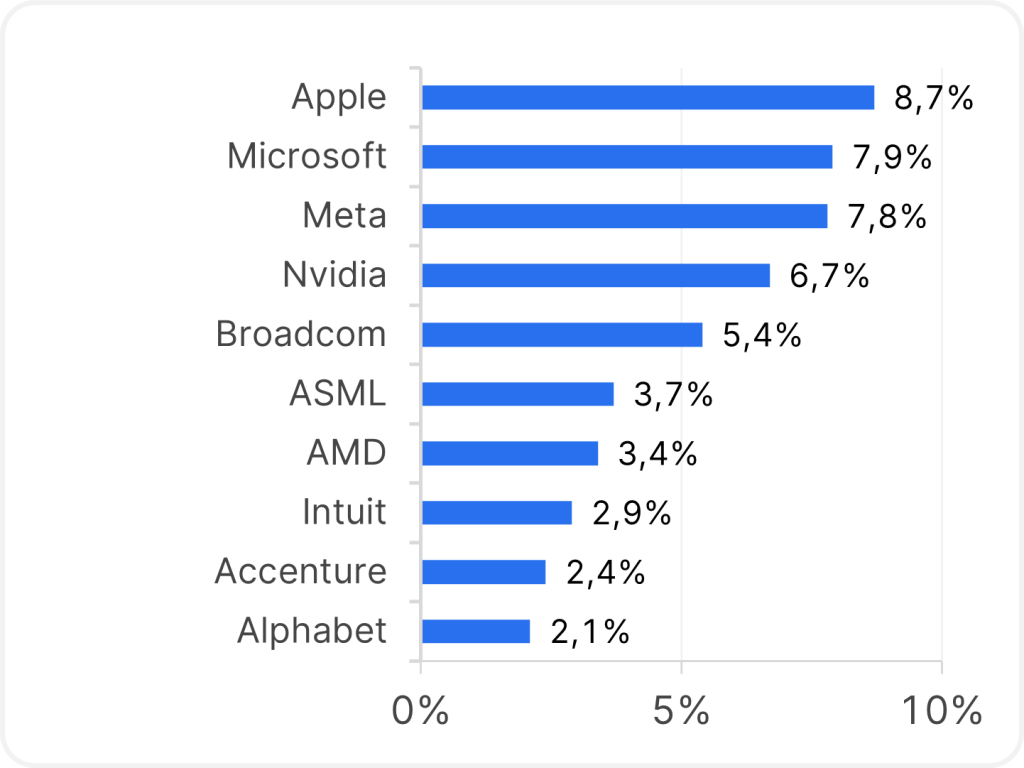

You can invest in promising future technologies such as AI and cybersecurity with ERSTE STOCK TECHNO. The equity fund’s portfolio includes well-known tech stocks such as Nvidia, Microsoft, Meta and Apple.

Note: Please note that an investment in securities involves risks as well as opportunities. The companies listed here have been selected as examples and do not constitute an investment recommendation. The portfolio positions listed may change at any time as part of active management. There is no guarantee that securities will be permanently included in the portfolio. Past performance is not a reliable indicator of future performance.

How has the fund performed?

Development over the past 10 years

What’s inside?

Top 10 Positions of the funds

Note: Chart is indexed (6.8.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Risks and opportunities at a glance

Advantages for the investor

- Broad diversification in technology companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE STOCK TECHNO

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.