The decline in crude oil prices has led to a trend reversal in the energy market this year: while many power companies have recently raised their profit forecasts, the major oil companies suffered massively from the recent drop in crude oil prices. Meanwhile, in the effort to reach climate targets, the trend toward renewable energies continues unabated.

The dramatic oil price increases following Russia’s invasion of Ukraine brought massive profits to the major oil companies in 2022. Immediately following the start of the war in Ukraine, the price of key oil benchmark Brent crude soared to around 130 USD per barrel (159 liters). This year, however, the price of oil intermittently fell back below 80 USD.

As a result, the five largest Western oil companies reported massive drops in profits in Q2. BP’s profit saw a particularly steep drop of around 69 per cent to USD 2.6bn. Shell and France’s TotalEnergies both reported a halving of quarterly profits to around USD 5bn each. US oil giant Chevron also saw its quarterly profit roughly halved to around USD 6bn.

Major European Power Companies Optimistic After Good Half-Year Results

Meanwhile, many power companies are much more optimistic about the future after a successful first half-year. After reporting surprisingly good quarterly figures, German power company RWE raised its net profit forecast for the entire year from previously EUR 2.2bn–2.7bn to USD 3.3bn–3.8bn. Spanish power company Iberdrola also recently raised its profit outlook after having increased its net profit in the first half-year by more than 20 per cent to over EUR 2.5bn. Italy’s Enel increased its net profit by as much as 52 percent to EUR 3.3bn. The utilities benefited from the normalisation on the energy market as well as good business in the hydroelectric, biomass and gas sectors.

Investments in Gas-Fired Power Plants That Can be Converted to Hydroelectric Plants

These sectors in particular are likely going to continue to benefit from the decarbonisation and energy transition efforts to reach climate targets, including the gas sector, which is also experiencing a small boom. Countries like Germany are hoping to achieve climate transition by building new gas-fired power plants that can be converted to hydroelectric plants in the future. Germany is planning massive subsidies for such power plants so that the phase-out of coal-fired power targeted for 2030 can be achieved.

Hydrogen power plants complement wind and solar energy: They are intended to compensate for the “dunkelflauten” called wind and solar doldrums. However, the production of hydrogen by electrolysis also requires electricity. If the technology is to be environmentally friendly, green electricity from other sources is therefore also required.

Some companies have already jumped on this bandwagon. Germany’s RWE, for example, recently announced the construction of a gas-fired power plant that can also run on hydrogen. Other major economies are also planning major investments in this area; the USA, for example, has created attractive framework conditions for investors.

Another important pillar of the energy transition is the move in the transportation sector from internal combustion to electric vehicle (EV) engines. In view of the EV boom, this means that electric power companies will have an even more important role to play. In turn, the increased adoption of sustainable aviation fuels (SAF) is crucial for the decarbonisation of air traffic. According to EU plans, their share should be down to 2 per cent by 2024. Many companies are already investing in the production of such fuels, based on food crops, biomass or in the form of synthetic fuels.

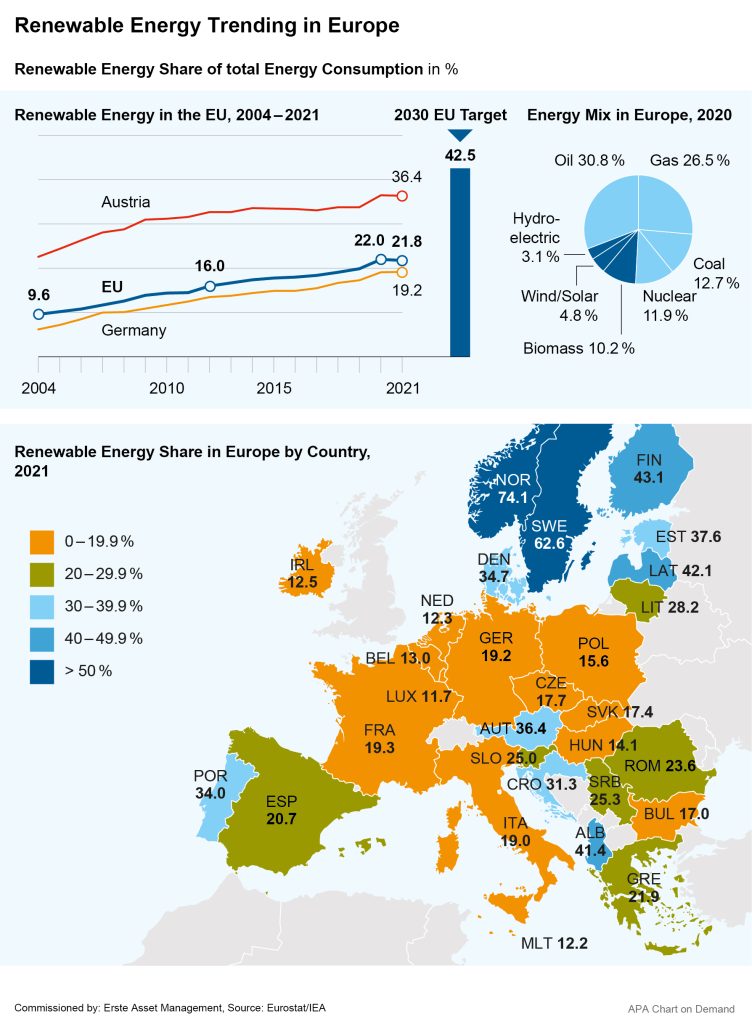

EU Target Calls for 42.5 Per Cent Renewable Energies by 2030

With all these measures, the EU hopes to achieve its adopted climate targets. These include reducing energy consumption across the EU by 11.7 per cent and increasing the share of renewable energies in the energy mix to 42.5 per cent by 2030. The G20 countries, meanwhile, were unable to agree on common targets for renewable energies at their last meeting in July. In particular, individual countries with high production or consumption of fossil fuels tended to object to stricter goals. There was, however, a joint commitment to decarbonise industries with high energy consumption for the first time.

As it is, gas and oil are likely to remain in demand for the time being until the complete transition to sustainable energies is achieved. The USA, for example, has recently ramped up its liquefied natural gas production again. Europe remains the main destination for gas exports. And oil companies have also recently increased their investments in exploration and production. According to experts, demand for oil has not yet been peaked and won’t do so for another few years.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

The companies listed here have been selected as examples and do not constitute an investment recommendation.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.