After a positive start to the year, the arrest warrant against Istanbul mayor Ekrem Imamoglu triggered major fluctuations on the Turkish financial markets last week. On the Istanbul stock exchange, the leading index Borsa Istanbul 100 fell by almost 7 per cent at times, but then recovered again. The national currency, the lira, fell to a record low against the US dollar, and prices on the bond market also plummeted.

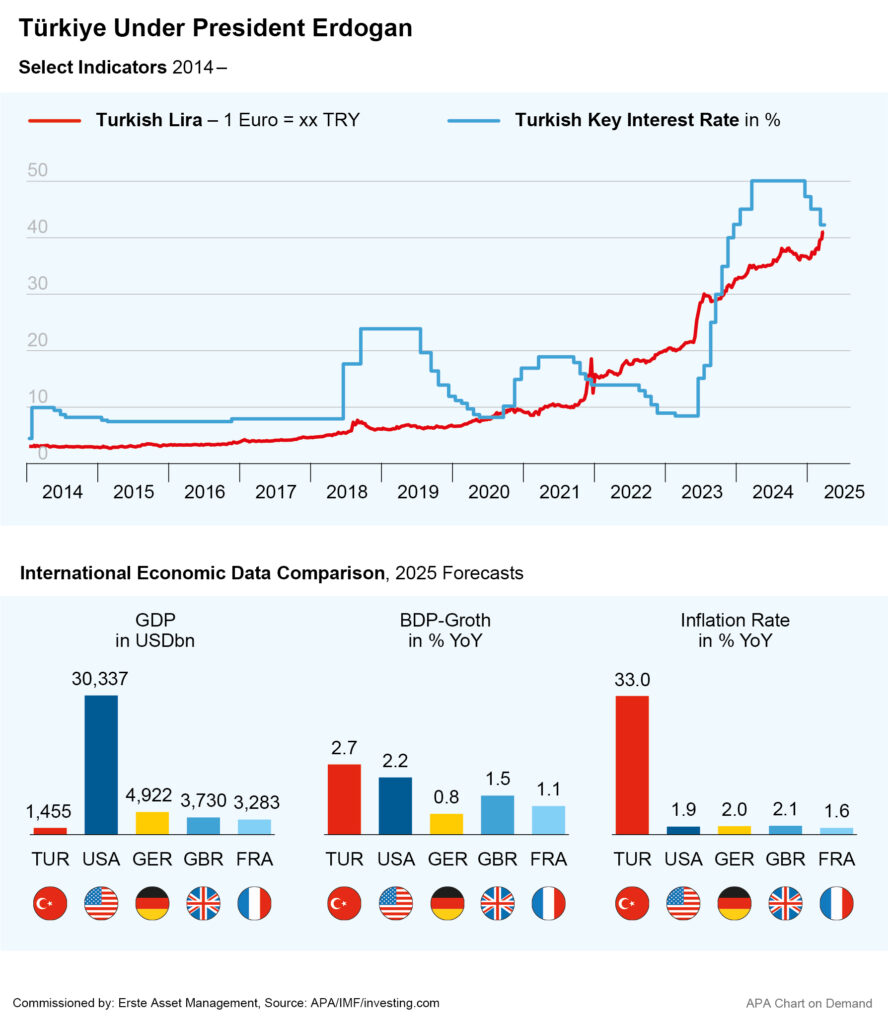

The Turkish central bank responded to the lira’s drop after the arrest of Imamoglu with support purchases of lira and an impromptu interest rate hike. The interest rate for short-term loans was raised from 44 to 46 per cent, while the key interest rate remained at 42.5 per cent. The central bank has not ruled out further steps.

Imamoglu, the most prominent political rival of head of state Recep Tayyip Erdogan, was unexpectedly arrested last Wednesday a few days before his planned nomination as presidential candidate. He is accused of membership of a criminal organisation and corruption, the state news agency Anadolu reported, citing the public prosecutor’s office. Imamoglu himself rejects the accusations.

The opposition accuses Erdogan of wanting to bolster his chances of re-election with the arrest. According to the Turkish constitution, a person may serve as president for a maximum of two terms. In order for Erdogan to be able to run for a third term in 2028, he would need a constitutional amendment and cooperation with previously hostile parties.

Lira recovers from record low after Central Bank intervention

Investors sold Turkish investments off of their portfolios due to the previous week’s political turbulence. As a result, the lira temporarily fell to a record low of 42 lira against the dollar. Following the central bank’s interest rate hike, the price recovered and rose to 37.99 lira per dollar. Some of the losses were also recovered on the stock market.

In the fight against the country’s high inflation, the Turkish central bank has been raising its key interest rate in several steps from 10 per cent to up to 50 per cent since 2023, maintaining this rate for eight months. Another problem is the lira’s weakness, which is causing prices for foreign products in the country to rise. While Turkey is rich in raw materials, it also relies heavily on imports.

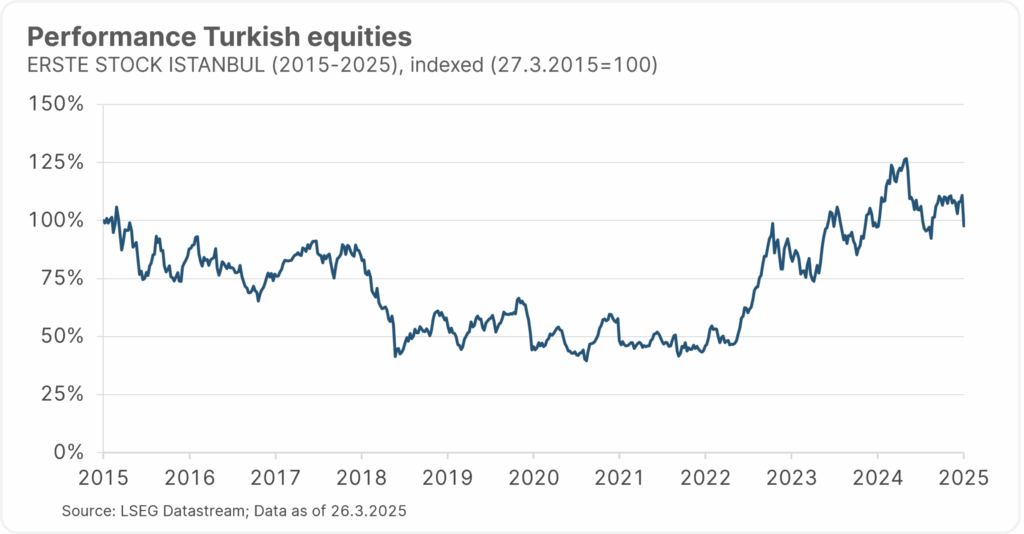

Note: Past performance is not a reliable indicator of future performance. Data as of 25.3.2025

Easing price pressure pecently allowed key interest rate drop

In December, the central bank was able to loosen its monetary policy reins somewhat thanks to abating inflationary pressure and has cut the key interest rate three times since then. In February, the annual inflation rate fell to 39.05 per cent from 42.12 per cent in January, marking the ninth consecutive month of falling inflation. Although the upward pressure on prices is still massive, it has already dropped significantly compared to the inflation rate of over 75 per cent in May 2024. According to the central bank, this is a sustained downward trend towards a target of 5 per cent over the next few years.

The easing inflation and the interest rate cut also contributed to the positive stock market sentiment in Turkey at the beginning of the year. The Turkish stock index initially recovered considerably, but the most recent correction wiped out the gains made at the start of the year. In previous years, the Turkish stock index ISE 100 had continuously made strong gains, increasing by around 30 per cent in 2023 and 2024 alone.

Turkish economy benefits from its role as a hub between Europe and Asia

In addition to the alleviated massive price pressure, growth data also supported the positive stock market sentiment at the start of the year. Despite opposing factors, the Turkish economy grew noticeably last year. Gross domestic product (GDP) rose by 3.2 per cent in 2024. At 3.0 per cent, growth in Q4 exceeded the 2.6 per cent expected by experts. Finance Minister Mehmet Simsek spoke of balanced growth in domestic economy as well as foreign demand.

With its traditional role as a hub between Europe, Asia and Africa, Turkey is a popular target for foreign investment and also benefits from its intensive trade relations with many major economies. The country’s most important trading partner is the EU, and, among the EU member states, Germany in particular. In addition, Turkey is in a customs union with the EU and has major export partners with US and the UK.

Turkey has recently greatly expanded its economic relations with China. According to a report by the Anadolu news agency, Chinese electric car manufacturer BYD plans to build a plant in Turkey for USD 1bn, having signed a contract to that effect with the Turkish government. The plant is expected to have an annual capacity of 150,000 vehicles. Massive investments are also planned in the energy sector, with Turkey planning to quadruple its wind and solar energy capacities to 120,000 MW by 2035, Energy Minister Alparslan Bayraktar announced. However, the country will need over USD 100bn in public and private investment to achieve this.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation.

After President Erdogan’s election victory in 2023, it was assumed that some calm would return, at least on the political level. There was hope that the focus would be on economic development and the country’s recovery. This has worked so far. “The central bank has returned to a more orthodox monetary policy and is focusing on combating inflation,” says Alexandre Dimitrov, fund manager of the ERSTE STOCK ISTANBUL equity fund, analyzing the situation.

International investors return

Credit default swaps (CDS, a measure of bond default risk, ed.) have fallen from around 500 basis points (100 basis points = 1 percent) in 2023 to below 260 at the end of 2024. Inflation has also recently fallen below 40 percent. This allowed the central bank to cut interest rates from 50 percent to 42.5 percent. “Interest rates are still high, but the direction is right,” said Dimitrov. Since the beginning of the year, there have been signs that international investors are returning to the country. Portfolio investments in equities recorded an inflow of €919 million, and approximately €3.49 billion flowed into bonds since the beginning of the year.

Erste AM Fund Manager Dimitrov: broad consensus for economic reforms

The real “vent” for political uncertainty is and remains the Turkish currency, the lira. On March 19, the currency temporarily lost approximately 6 percent against the euro, then closed down approximately 2.5 percent. In the short term, this political shock could lead to lower consumption. Higher inflation and thus higher (than expected) interest rates would weigh on real economic output.

Fund manager Dimitrov remains optimistic, however: “We do not believe that the country’s economic policy will change. Turkey is an open economy, export-oriented, and essentially competitive.” There is a broad consensus in society and the administration to continue the necessary economic reforms and ensure stability. The central bank can use liquidity and interest rates to calm the market and return to a disinflationary trend.

Volatility on the stock market

The Turkish stock market is and remain ns volatile. The last episode cost the market approximately 10 percent in March alone, and since the beginning of the year, price losses have amounted to approximately 15 percent (source: Bloomberg, March 26, 2025). Turkish stocks are trading at a significant discount relative to other markets. The price-earnings ratio (P/E) for 2025 is between 6 and 7. Dimitrov believes that industrial and export companies with strong balance sheets, as well as some banks and consumer stocks, should perform well in this environment. Those who are aware of the opportunities and risks can invest broadly in shares of Turkey’s most important financial and industrial companies with ERSTE STOCK ISTANBUL.

Note: Past performance is not a reliable indicator of future performance. The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation.

Risk notes according to 2011 Austrian Investment Fund Act

ERSTE STOCK ISTANBUL may exhibit increased volatility due to the composition of its portfolio: i.e. the unit value can be subject to significant fluctuations both upwards and downwards within short periods of time.

Risk notes ERSTE STOCK ISTANBUL

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.