What happened?

Last Friday evening, a fraction of the Army mostly medium rank officers, had undertaken a coup attempt and seized airports, bridges, TV stations and military headquarters, before attacking the Turkish parliament, leaving the building charred and damaged, and have reasoned to seize power to protect the democracy from the Government.

A number of government officials, including President Erdogan and Prime Minister Yildirim, spoke to the media through FaceTime, saying the coup attempt was staged by military officers that are affiliated with Gulen movement. Prime Minister Binali Yildirim and Erdogan named the attempt as ‘uprising’ and perceived it as an attack to democracy.

Erdogan and the mosques called people to take to the streets and stand against the coup. People reacted strongly and took over the streets. Within a couple hours police forces took control and restored the order in most places. People walked on top of tanks and chanted against the coup. Also, several high rank military officers from different parts of Turkey strongly expressed their opposition against the coup and sided with the government.

The government and Erdogan claimed that Gulen movement to be responsible from the failed coup attempt, while Gulen movement rejects this claim and indicates they don’t even know the army forces who had undertaken the attempt, while also condemned the coup. The claim is that there will be High Military Council meeting during August 1-4, in which President Erdogan is expected to expel a group Gulen supporters from the Army.

On Saturday, the Parliament convened with an extraordinary meeting and all the members of parliament from the secular/social-democrat CHP (Cumhuriyet Halk Partisi), nationalist MHP (Milliyetci Hareket Partisi) and left-wing HDP (Halklarin Demokratik Partisi) opposed the coup attempt, and there were no one who supported.

Sadly, 200 people were dead and more than 1,500 wounded in the aftermath of the failed coup attempt and another crackdown on the group’s supporters has begun. More than 2.800 military personnel were arrested and more than 2.600 judges are laid-off and arrest orders for 140 Council of State members, more than 48 High Court of Appeals members and five HSYK (High Council of Judges and Prosecutors) members are released.

As expected, President Erdogan calls US to extradite Fethullah Gulen again while US officials requested for solid evidence that Gulen is involved in the coup attempt.

What could be the consequences?

The unsuccessful coup attempt will make President Erdogan more powerful now and Turkey is closer to presidential system. There are still question marks whether there will be early elections but the possibility increased significantly. AKP (Adalet ve Kalkinma Partisi – Party for Justice and Development) supporters were on streets throughout the weekend and it looks like the unsuccessful coup attempt would increase AKP’s popular support, which may also trigger the early election possibilities.

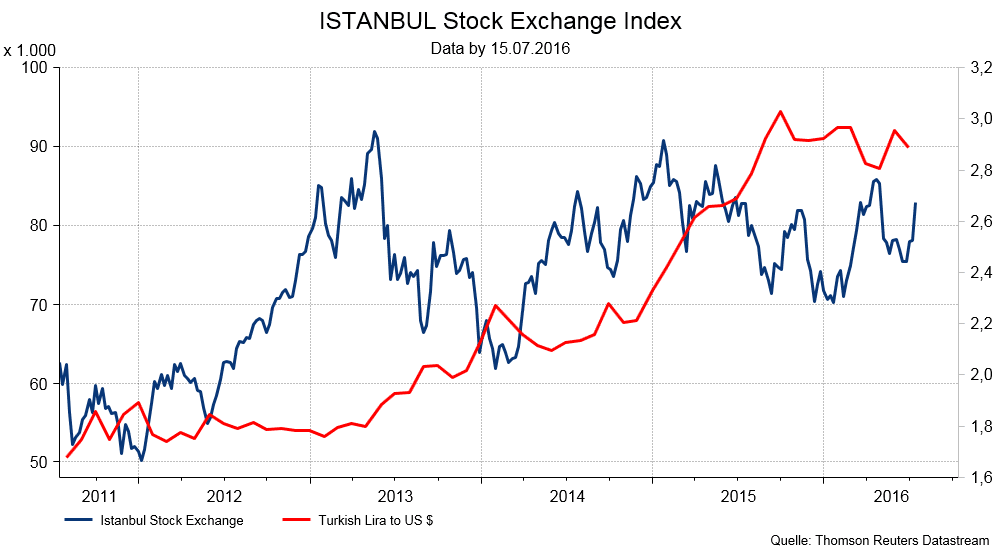

On the macro side, the failed coup attempt may have negative impacts on consumption and investment appetite and the struggling tourism sector probably will take another hit. After hitting above 3.0 levels against US Dollar, the Turkish Lira recovered of some of its losses during the weekend.

Deputy Prime Minister Simsek and the CBT (Central Bank of Turkey) Governor Murat Cetinkaya made conference call with the investors on Sunday evening and indicated that the Government has room in the budget and they don’t think there will be permanent negative consequences on the growth of the economy. The CBT also provided some measures to be taken to minimize the market impact. Accordingly, it was announced that the Central Bank will provide banks with needed liquidity without limits and the commission rate for the intraday liquidity facility will be zero. The bank further announced that market depth and prices will be closely monitored and all measures will be taken to ensure financial stability, if deemed necessary. The central bank is scheduled to hold a policy meeting Tuesday, where the market expects no change in the policy rate.

Erdogan’s full stance and response when all the dust settles down will be more crucial than ever this time for the economy. In addition, the failed coup attempt showed that there cannot be a coup in Turkey anymore and paves away the concerns over any military intervention going forward.

Equity market impact looks inevitable at this stage with the political turmoil. Although the Deputy PM & CBT Governor made efforts to sustain confidence for the foreign investor community and the recovery in the TRY, equity market is likely to seen off to a negative opening. Please note that Turkish Lira is still trading 2.5% weaker compared to Friday’s market close.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.