Tariff conflicts, geopolitical turbulence and surprisingly robust stock markets in Europe – the first half of 2025 had a lot in store for investors. In this interview, Chief Investment Officer Gerold Permoser draws an initial conclusion and gives his assessment of the most important topics on the market at the moment.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

The first half of the year was largely volatile on the stock markets. Where does the rather negative mood on the markets come from?

Sentiment is generally not as good as the facts would suggest. But anyone who knows the markets knows that sentiment influences the markets – and sometimes even creates facts itself. Overall, the year to date has not been so bad. Most asset classes and sectors are up for the first six months of 2025. Market expectations for economic growth also continue to point upwards. None of the G20 countries, for example, are expected to see a decline in the current year. Global growth expectations amount to 2.7% for the current year and 2.8% for 2026.

One major event was the “Liberation Day” proclaimed by US President Donald Trump, on which far-reaching tariffs were announced. How do you assess the rapid recovery afterwards?

The manner of this recovery was indeed very remarkable. We looked at how the S&P-500, the most important US stock market index, has performed in the past after such events. In the two months following a sharp rise in volatility, the S&P-500 has usually performed negatively over the past 75 years – sometimes very significantly. This time it was exactly the opposite: since the Second World War, losses have never been recovered as quickly as now.

What were the reasons for this rapid recovery?

There are basically three theories on the market as to why this rapid recovery was possible: the first is that events such as Liberation Day have no fundamental impact on the markets and that they still rise in the long term. In specialist circles, this is also referred to as “nothing ever happens”. The second is that the fundamental environment for equities is basically still positive: the economy is still growing and the central banks are in a cycle of interest rate cuts. The third theory has a very catchy name and something to do with Donald Trump: TACO, which means Trump Always Chickens Out. What the markets mean by this is that Donald Trump also has a certain pain threshold and ultimately always backs down on his plans as soon as the markets react too strongly.

With regard to Liberation Day, how likely is it that the USA will soon create facts here?

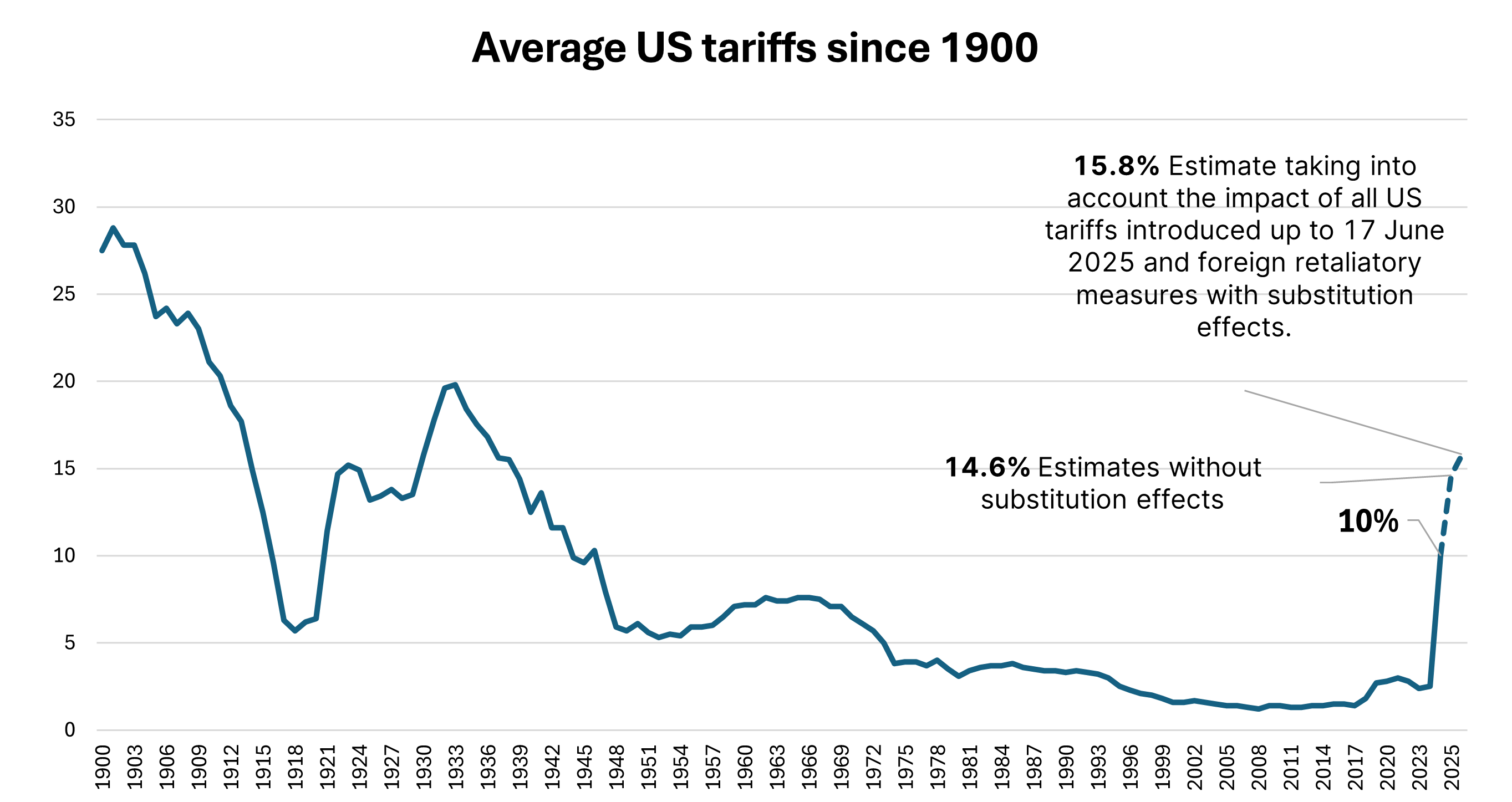

If the tariffs are imposed as announced, the average US tariff level would be around 15-16%, the highest since 1930. Whether and in what form the tariffs will actually be enforced is of course difficult to predict – only the day before yesterday the tariffs were suspended again until August 1.

In my view, there are several scenarios. I think it is very unlikely that there will be really high punitive tariffs against all the countries announced. It is equally unlikely that it will be possible to conclude trade deals en masse in such a short space of time. It usually takes several years. So that would be a very unexpected feat. What is more likely is either a further postponement or individual deals combined with punitive tariffs for less cooperative countries. The market is currently pricing in a positive outcome to the tariff issue, which also harbors a certain risk should things turn out differently. Of course, there is a risk that the TACO theory will no longer work at some point and Donald Trump will not back down in order to avoid losing his credibility.

Source: Yale Budget Lab, Tax Foundation, URL: Trump Tariffs: The Economic Impact of the Trump Trade War, data as of 2.7.2025

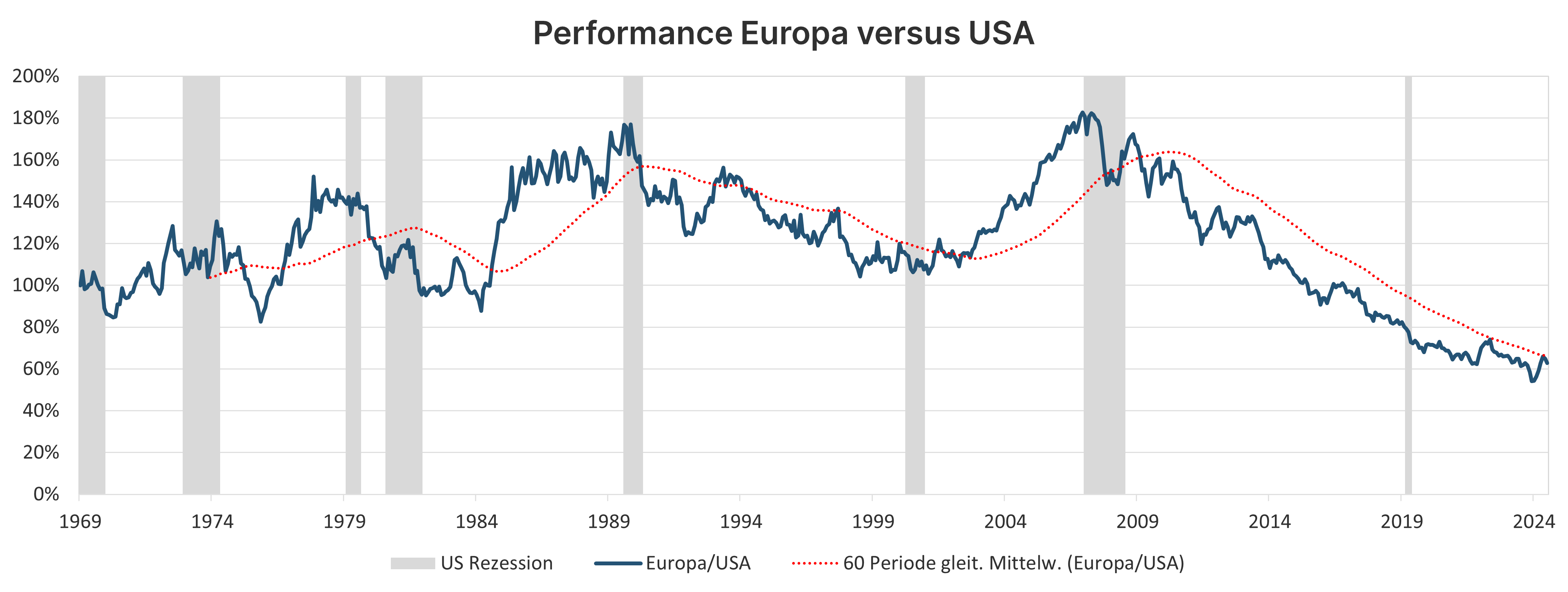

One of the big themes of the year so far has been the outperformance of the European equity markets compared to the US. Do you think this trend will continue?

It is often overlooked that the European and US markets are very different in terms of the dominant sectors. In general, the European market has benefited from its market structure this year. Market developments and general trends have recently tended to help European companies, with interest rate cuts in the eurozone and the infrastructure package in Germany. We expect the issues to continue to support the European markets in the second half of the year. However, there should no longer be such a wide spread in the development of stock markets on both sides of the Atlantic.

So it’s more short-term factors that speak in favor of Europe?

On the one hand, it is the short-term trends that are currently supporting the European markets. Europe is underweighted in the sectors that are among the growth themes of the future: Technology, IT, communication services. Europe needs to catch up here in order to remain competitive in the long term.

Since the financial crisis, European markets have systematically underperformed the US. There are several reasons for this. Among other things, the greater pressure to cut costs in Europe following the euro crisis and lower productivity compared to the USA. Something has changed here in the meantime. European countries have a better grip on their budgetary situation. Even if they have to tighten their belts, this is a clear difference to the USA with a budget deficit of over 7%. The European banking sector is also in a much sounder position than overseas. On the other hand, there are also factors that could benefit the European markets in the longer term.

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg, own calculation, data as of 02.07.2025

In the USA, the weak US dollar and rising yields on US government bonds have recently attracted attention. How do you classify these developments?

The weak performance of the US dollar is probably one of the biggest surprises this year. First and foremost, this has to do with the US government’s policies. The measures taken recently – tariffs, etc. – have unsettled many international investors. However, inflation expectations in the US are also higher than in the eurozone, which is negative for the dollar. Turning to the development of US government bonds: Several factors are currently driving yields higher here. Rising government debt, high budget deficits and current account deficits are causing investors to take a very close look at the risk associated with US Treasuries. Europe is currently in a better position here, which is why we also prefer the European bond markets in our positioning.

Geopolitically, the first six months of the year were just as turbulent at times. However, the swings in the oil price were largely limited.

The development of the oil price has been a topic of discussion in recent weeks, particularly in connection with the Israel-Iran conflict. If you look at the past five years, the oil price has been trending downwards since then and we believe that the current level will continue. There are currently factors from above and below that are preventing the price level from breaking out. On the downside, these are production costs. Many producers, especially in the USA, can still produce profitably at the current price level, but the price is unlikely to fall much lower. On the upside, the oil reserves are a cap. OPEC alone has significant reserve capacities of 5.5 million barrels per day. By comparison, the global economy requires around 103 million barrels.

The price of gold is usually a good indicator of geopolitical uncertainty. Is there still upside potential here after the past three “golden” years?

We remain overweight in gold in our positioning. On the one hand, central bank purchases are providing support here and, on the other, many momentum investors are focusing on gold, which is also favoring the price trend. Last but not least, the increased uncertainty mentioned above and gold’s role as a safe haven naturally also speak in favor of continued positive development.

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Investment opportunities for the second half of the year

Even if the uncertainty surrounding tariffs etc. is unlikely to disappear in the second half of the year, the fundamental environment on the stock markets remains positive. Interesting opportunities could therefore also open up for investors in the second half of 2025, for example with the ERSTE EQUITY RESEARCH equity fund (ISIN: AT0000A09VB0), which is based on the equity recommendations of Erste Group Research. The fund invests in a very concentrated portfolio of companies with relatively stable earnings growth, above-average profitability and good momentum.

On the bond side, ERSTE BOND CORPORATE BB (ISIN: AT0000A09HC7) could be worth a look. The fund invests primarily in corporate bonds on the cusp of the high-yield segment, whereby currency risks are largely hedged in the fund.

The ERSTE REAL ASSETS mixed fund (ISIN: AT0000A1PKM0) offers investors who want to invest in several asset classes with as broad a product base as possible the opportunity to invest in equities, commodities and precious metals (e.g. gold).

Risk notes ERSTE EQUITY RESEARCH

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

Risk notes ERSTE BOND CORPORATE BB

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE BOND CORPORATE BB as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE BOND CORPORATE BB, consideration should be given to any characteristics or objectives of the ERSTE BOND CORPORATE BB as described in the Fund Documents.

Risk notes ERSTE REAL ASSETS

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.