Many of the companies in the utilities sector have so far failed to implement a comprehensive decarbonisation strategy.

Utilities sector: assessment & engagement

According to the analysis by our partner MSCI, less than half of the companies in this sector[1] have set themselves goals such as the ones required for the containment of climate warming at 1.5 or 2 degrees (“not Paris-aligned”).

In addition, the goodwill <ich weiss nicht ganz genau, was mit “Unternehmenswerten” hier gemeint ist, komme aber nur auf den buchhalterischen Goodwill, da saemtliche andere Konzepte des Unternehmenwerts ja keine zeitliche Beschraenkung aufweisen> of utilities has a long life; that and the high capital intensity make a transitional period of at least a decade seem realistic.

The results also show that, on the basis of a global carbon budget, i.e. the total amount of emissions that may be produced for global warming to still remain within the 2-degree confines, the utilities sector would have to facilitate the lion’s share of these reductions, given that this sector has already developed low-emission technologies that are also competitive. The sector is therefore in a better situation than others.

Investments in networks and energy storage necessary

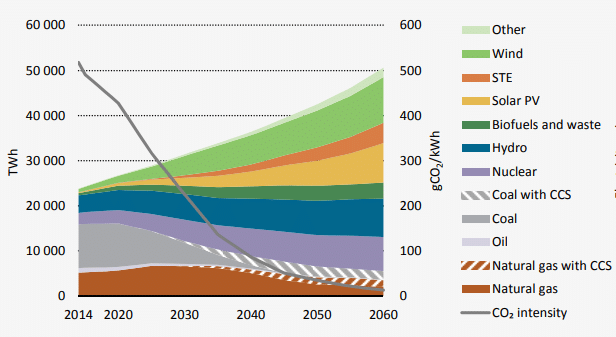

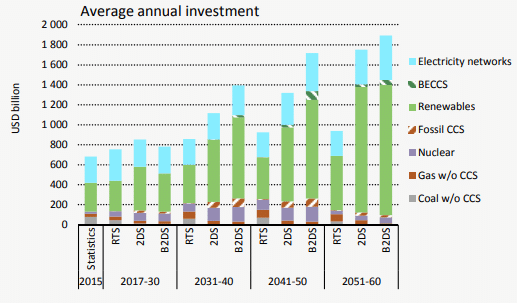

In order to allow for a comprehensive transformation of the global utilities sector by 2060 towards less CO2-intense forms of energy (and to achieve a CO2 intensity of zero), global investments are particularly needed in networks and renewable energy. This is in line with the models of the International Energy Agency in scenarios that follow the 2-degrees target. The funds required by 2060 may amount to more than USD 50,000bn, with USD 1,200bn earmarked for energy storage in the field of renewable energies until 2050.

[1] Based on the MSCI ACWI IMI index, constituents of the utilities sector as of July 2019

Chart: Global electricity production in the utilities sector, 2-degrees scenario

Chart: Investments required in the utilities sector

Smart networks

At 50 million kilometres of worldwide installed capacity (N.B. that is roughly the distance from Earth to Mars), the global electricity network is one of the most complex infrastructure systems around. Whereas originally the networks were generally set up as a one-way system (large-scale power plants produce electricity for consumers), the adjustment to changes in conditions such as input from the demand side constitutes an essential challenge for the sector.

Technological progress, the doubling of the flow of data that we have seen every two years, and the strong decrease in prices in the field of data processing allow for the implementation of the required solutions to a larger extent nowadays. However, further progress in the area of the already existing and still-to-be-developed smart-grid solutions is necessary to support long-term decarbonisation; on the one hand to integrate new technologies, and on the other hand to better handle the demand side.

Engagement with network operators

In order to address the aforementioned issues, we have approached various network operators and asked them for their input. We have initiated a positive dialogue and been in frequent contact with the network operator Fluvius System Operator. In our discussions, we addressed the problem of a lack of definition, given that for example it is still not fully clear which forms of energy are considered renewable or green.

The EU Taxonomy, which is being worked out as we speak, may provide guidance in this context. The identification of the feeding sources of energy for the purpose of tracking their point of origin is mainly possible for those agents who hold information on connecting points; after feeding into the general network, it is very difficult to trace the feeder.

Test of blockchain technology in Austria

As part of the national specification of the goal to transform the domestic generation of power to renewable sources by 2030, Austria launched a pilot project at the beginning of 2020 to regulate the network with small renewable plants on the basis of blockchain technology.

The goal of APG (Austrian Power Grid) and EWF (Energy Web Foundation) in this project is to prove that a network that consists of smaller, decentralised units of power production can be regulated. Here, the idea is to apply blockchain technology in order to register and quantify the production plants involved and to implement the financial settlement of the transactions.

The connection of decentralised renewable energy plants to wholesale electricity markets will also be tested via EWF facilities within the framework of the project.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.