In May 2019, the blockbuster ‘Rocketman’ celebrated its premiere at the Cannes Film Festival. The biopic pays tribute to Elton John and one of his greatest hits from the 1970s, ‘The Rocket Man’. The song was inspired by Ray Bradbury’s short story ‘The Rocket Man’ from ‘The Illustrated Man’. It is about a professional astronaut whose work keeps him away from his family for months at a time. Furthermore, the song captured the spirit of the early 1970s, when David Bowie had recorded the song ‘Space Oddity’ in 1969.

A lot has changed on Earth since May 2019. In the meantime, several wars and conflicts have broken out and a pandemic has dominated our everyday lives for several years. Between then and now, there have been four years of Joe Biden‘s presidency in the White House – and yet it seems as if nothing has changed since 2019. Because in May 2019, Donald Trump was still sitting in the White House and, just like this week, he announced extensive punitive tariffs.

If Elton John were to sing about the current zeitgeist instead of that of the 70s, the song would probably be titled ‘The Tariff Man’ and have the following lyrics:

And all these deals, they take too long

Can’ t trust the EU, man, they do us wrong

Mexico, they better pay

Or I’ ll tax them more today

[Chorus]

And I’ m the Tariff Man

Slappin’ taxes where I can, all night (all night)

Trade wars ain’ t as bad as they say

I’ ll just tweet it all away

I’ m the Tariff Man

Making China bend to my great might

They’ ll cave any day

Or I’ ll tax their savings away

What has happened in the last few days?

But back to the stock markets: on Sunday, Donald Trump made good on his threat from the US election campaign and the US government announced new tariffs on goods from Canada, Mexico and China. After the uncertainty caused by this sent stock markets tumbling, Trump announced a 30-day suspension of the 25% tariffs on imports from Canada and Mexico on Monday. This came after talks with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau.

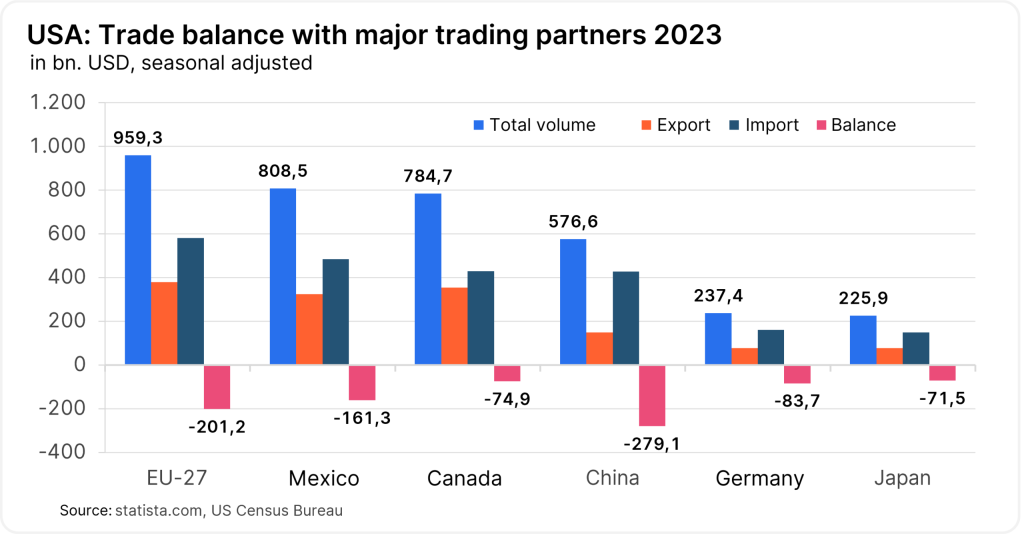

Both countries agreed to tighten their border controls to curb illegal immigration and drug trafficking, particularly fentanyl, into the US. This pause will give the three countries time to negotiate a broader economic agreement. Besides the EU, the United States’ most important trading partners are its immediate neighbours, Mexico and Canada. However, Trump has long been concerned about the trade deficit with these countries.

With China, on the other hand, the US remains on a confrontational course. While Mexico and Canada have been spared from tariffs for the time being, the US government has imposed a new 10% round of tariffs on Chinese imports. The Chinese government, for its part, has already announced retaliatory measures.

China’s response to the US tariffs:

- introduction of new 15% tariffs on US coal and liquefied natural gas (LNG)

- 10% tariffs on US crude oil, large vehicles and agricultural machinery

- initiation of an antitrust investigation against Google

- export restrictions on critical minerals important for semiconductor and battery production

What do we expect for the financial markets?

We were not surprised by the events of the past few days and the volatility that has arisen in the markets, and we have already pointed this out in this and other places in advance 👉

No Posts Found

Donald Trump is implementing what he announced during the election campaign and in his inauguration speech. The financial markets, on the other hand, reacted nervously. The US leading index S&P-500 lost almost 2% in intraday trading on Monday, but was able to recover some of these losses after the temporary suspension of tariffs on Mexican and Canadian imports was announced. The index closed the day down 0.8%. European equities followed a similar pattern, ending Monday’s trading session down 0.9% (interim losses of 1.5%).

US government bond yields were also subject to greater fluctuations at the start of the week, as was the price of gold. The US dollar appreciated noticeably against the euro during the day, but then gave up these gains. This reflected market participants’ expectation that tariffs could lead to a further widening of the interest rate gap between the US and the euro area.

Markets could wait and see for the time being

However, we were surprised by the fact that for the third time (Colombia before, now Canada and Mexico), the countries threatened with tariffs were able to reach a quick (provisional) agreement with the USA. This suggests that governments have already prepared for such measures.

The implication of this for the markets could be that when further tariffs are announced, market participants may initially adopt a wait-and-see attitude. This would reduce the selling pressure in the event of new tariffs, for example on the EU, and dampen volatility. From an investor’s point of view, it will be interesting to see whether an EU verse of Tariff Man will be added soon.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.