The corona pandemic in 2020 represented a major challenge to the global economy. Sales at many companies almost completely collapsed over a period of months, causing significant financial losses.

The rating agencies increasingly reacted to this situation in spring 2020 and lowered the credit rating of the affected companies. In the process, more companies than ever before fell from investment grade to the high-yield segment. However, many of these so-called “fallen angels” have been able to deleverage in the past three years and have now either been upgraded to investment grade again or are on the verge of doing so. With yesterday’s upgrade to BBB- from S&P, Ford, the biggest Fallen Angel, has now also made the return.

Rating agencies and credit ratings

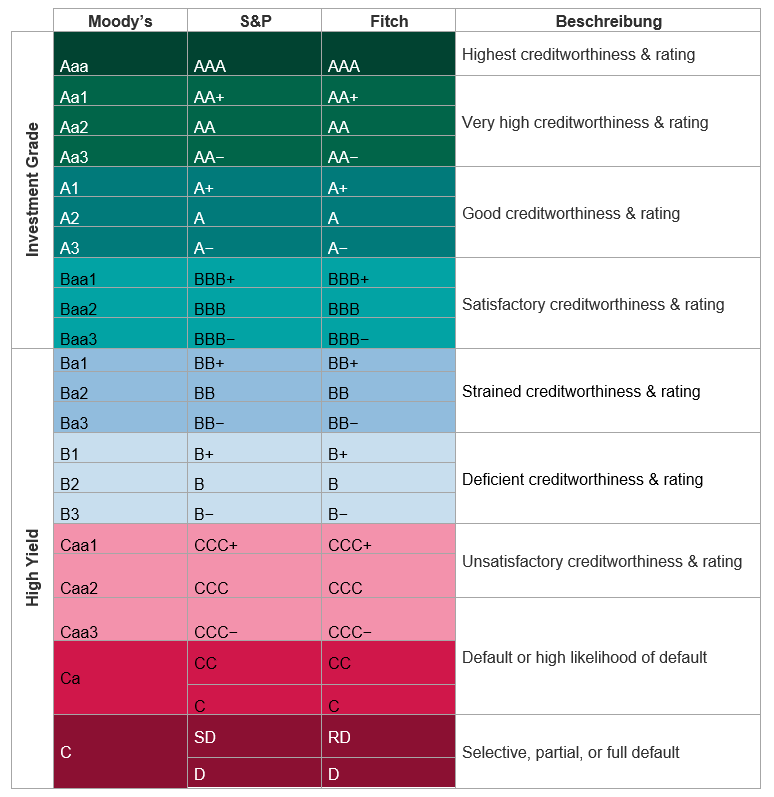

Credit ratings are assessments given by rating agencies such as Moody’s, Standard & Poor’s (S&P), or Fitch that evaluate the risk of default associated with a particular company or bond. These ratings are based on a variety of factors such as a company’s financial stability, level of debt, and business operations.

An important distinction in credit ratings has to be drawn between investment grade (IG) and high-yield (HY). Investment grade refers to companies or bonds that credit rating agencies consider relatively safe and stable. These companies have a high credit rating and therefore a low risk of default. Investment grade typically includes ratings from AAA to BBB- at Standard & Poor’s and Fitch or Aaa to Baa3 at Moody’s.

High-yield describes companies or bonds that rating agencies consider riskier and less stable. These companies often have a lower credit rating and their bonds are bought by investors who are willing to take on more risk in order to achieve higher returns. High-yield ratings are typically BB+ or below at Standard & Poor’s and Fitch or Ba1 or below at Moody’s.

The outlook in the credit assessment refers to the expected development of a borrower’s credit rating in the near future. The outlook can be positive, negative, or stable, and usually gives an indication of future changes in credit ratings. If a rating agency issues a positive or negative credit watch, this indicates at least a 50% probability of an upgrade or downgrade over the coming 90 days.

Fallen angels, rising stars…

A fallen angel is a bond that has been downgraded from investment grade to high-yield, typically from Baa3/BBB- to Ba1/BB+. A rising star, on the other hand, moves exactly the opposite way from the high-yield to the investment grade segment.

The IG or HY status of a company has a variety of implications for its debt: IG companies usually have greater access to capital markets and can issue bonds at lower interest rates as they are considered a safer investment. The investor base for HY companies, on the other hand, tends to be smaller, which results in lower liquidity and therefore often in a higher liquidity premium in addition to the higher credit risk premium (i.e. spread).

IG companies can usually issue bonds more straightforwardly because they are well-known and stable, whereas HY companies often have to hold investor presentations (so-called roadshows) to attract investors.

The higher level of migration within the rating matrix also reflects the higher risk in the HY segment. The high-yield segment is in a constant state of flux. Companies either migrate back to the IG segment in the positive case or, if the situation deteriorates, they incur a default or restructuring. The credit covenants in the bond prospectus are therefore usually stricter for bonds from the high-yield segment.

A look back at the Corona year 2020

In the press release on the rating downgrade of Lufthansa to Ba1 on 17 March 2020, Moody’s writes, “The rapid and widening spread of the coronavirus outbreak, deteriorating global economic outlook, falling oil prices, and asset price declines are creating a severe and extensive credit shock across many sectors, regions and markets. The combined credit effects of these developments are unprecedented.”

In this paragraph, Moody’s sums up very well what the state of the global economy was in 2020. A poor economy and even poorer balance sheet metrics and company outlooks inevitably led to ratings downgrades by credit rating agencies. By April 2020, S&P alone had already downgraded 301 US companies. The 90% downgrades compared to only 10% upgrades constituted a new high since 2009.

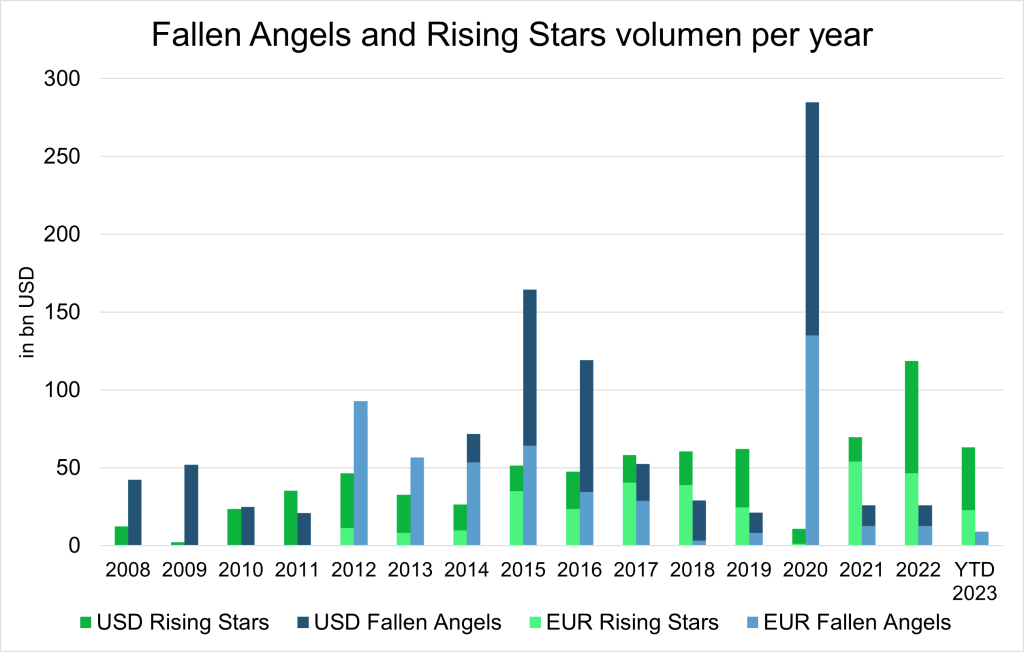

The volume of bonds downgraded from investment grade to high-yield status was also record-breaking. According to a report by Credit Sights, the volume amounted to EUR 64bn, i.e. more than ever before. New additions of fallen angels in the euro HY segment still accounted for 15.4% in January 2021.

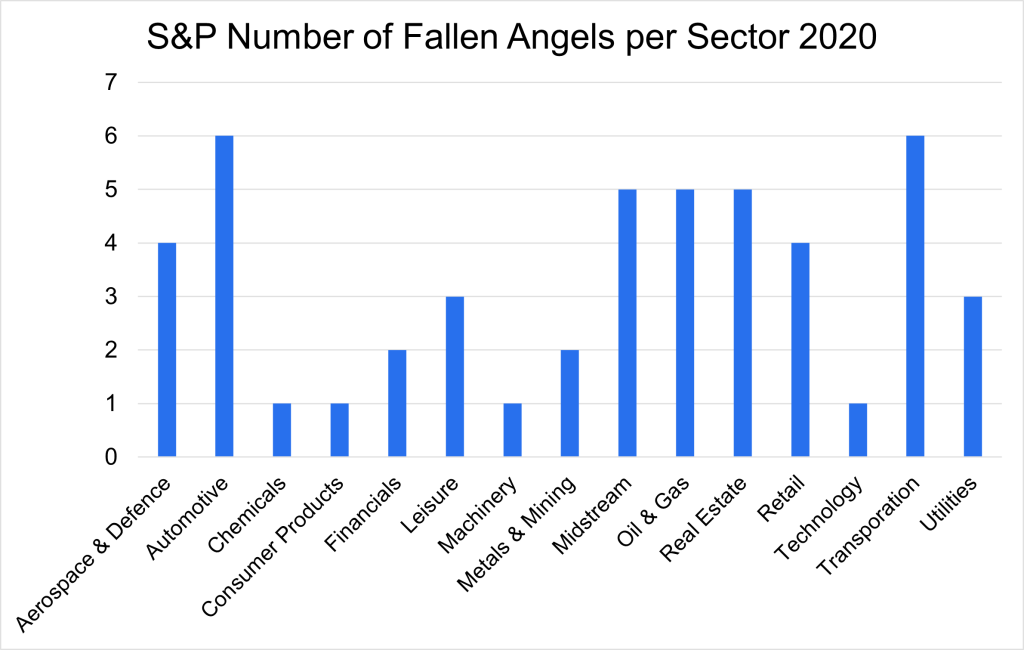

In US dollars terms, the picture was similar. USD 222bn worth of bonds and 60 issuers lost investment grade status here. Companies from the automotive industry, the energy sector, the travel and service industry, but also retailers were particularly hard hit.

Source: Own calculations, Standard & Poor’s Financial Services LLC

An example of a company that became a fallen angel in 2020 is Ford. In March 2020, S&P downgraded Ford’s credit rating from investment grade to junk status due to poor(er) company figures. As much as $78 billion in outstanding bonds were affected.

But the same fate befell many other companies. Soon after, carmaker Renault and German suppliers ZF Friedrichshafen and Schaeffler were downgraded. Among the airlines, the German Lufthansa, the American Delta Airline and the British IAG were hit. In the travel industry, for example, the hotel chain Accor and the cruise operators Carnival and Royal Caribbean Cruises were downgraded. In the retail sector, the Italian Esselunga, American Macy’s, and British Marks & Spencer failed to maintain their investment grade status. In the energy sector, Occidental Petroleum and Western Midstream were among the companies that slipped into the HY range. In total, there were so many companies that slipped into the lower rating segment that the index provider ICE even suspended the rebalancing of its fixed income indices in March 2020 and postponed it until April to give market participants more time to adjust.

Fallen angels are becoming rising stars

A lot has happened since 2020. The pandemic has been overcome and many companies were able to deleverage thanks to numerous fiscal aid packages and a rapid economic recovery, especially in 2021 and 2022. After the strong wave of fallen angels in 2020, we have largely seen rising stars in the past three years.

Source: Credit Sights, As of 14.09.2023 – Ford upgrade ($65 billion) not yet included (data for EUR first available as of 2012).

Even this year, the trend is looking quite positive and among the rising stars are also many names that were downgraded in 2020. Accor, for example, was reinstated to the IG segment by S&P in September after good business performance and declining debt. Occidental Petroleum and Western Midstream have also been upgraded again this year.

While S&P has already upgraded the IAG Group to BBB- in October, analysts also expect an upgrade soon for Lufthansa (S&P BB+, positive outlook). Delta Airline also still needs an upgrade from S&P (BB+, positive outlook) or Fitch (BB+, stable outlook) to return to the investment grade segment.

Retailers and cruise ships, on the other hand, are struggling more. Carnival and Royal Caribbean Cruises are even further away from returning to investment grade, mainly due to their capital-intensive business model. Macy’s and Marks & Spencer have retained their Ba1 (stable) rating, and Nordstrom even has a negative outlook at Ba1/BB+. Schaeffler (Baa3/BB+/BB+), ZF Friedrichshafen (Ba1/BB+), and Renault (Ba1/BB+/BB+) remain in the HY segment for the time being.

Since yesterday, Ford has also made it. After Fitch had already given the long-awaited upgrade in September, S&P has now followed suit, having had a positive outlook on the issuer for quite some time. The upgrade was triggered primarily by high profitability and gradual cost savings. At Moody’s, Ford remains at Ba1 (stable), but most analysts also expect an upgrade in 204.

What’s next?

Many companies have now overcome the difficulties of the Corona crisis and have either already joined the investment grade segment again or are well on the way to doing so. Analysts at JP Morgan expect a total of USD 85bn in rising stars and only USD 30bn in fallen angels in 2023, which confirms that the positive trend is currently ongoing.

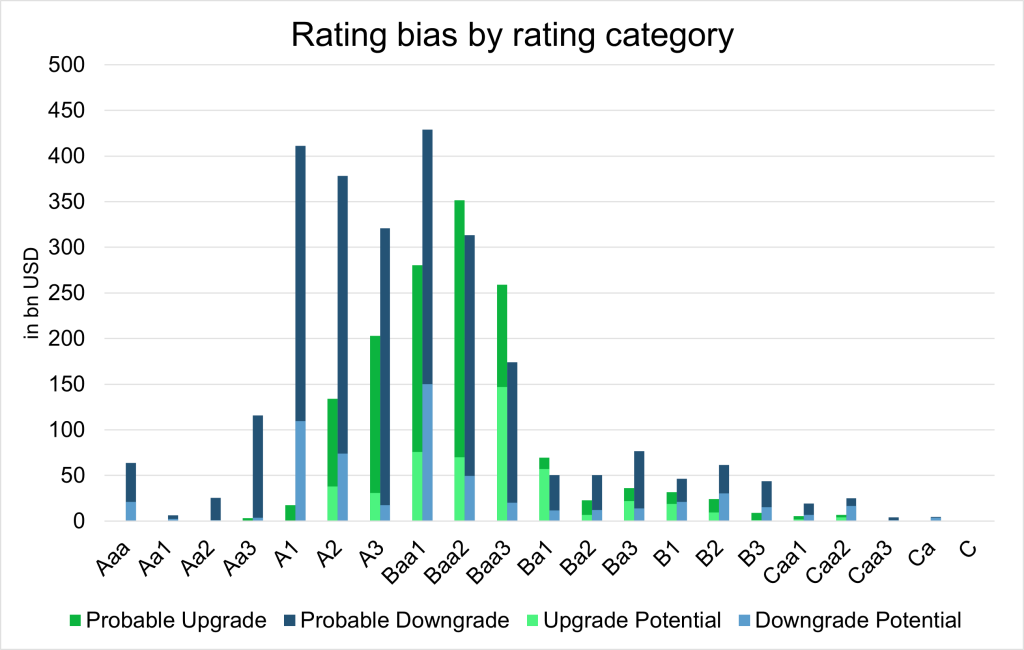

Bloomberg’s rating expectations across the different rating classes suggest that especially in the Baa2 to Ba1 segment, i.e. precisely the transition from investment grade to high-yield or the other way around, more bonds remain potential upgrade candidates. However, we can already see a slowdown in the trend, and for the very well rated companies (Baa1 and above) and lower rating categories (Ba2 and below), the probability of there being more downgrades than upgrades is increasing.

Source: Bloomberg, As of 17.10.2023 (N.B. the methodology takes into account rating differentials between the rating agencies as well as the rating outlook and the credit watch.)

Fundamentally speaking, the companies are still in a solid position, even if the key ratios are currently weakening somewhat. According to Credit Sights, BB issuer debt has risen minimally to 2.8x (+0.04 vs. the previous quarter) while interest coverage has fallen from 6.5x to 6.0x. That being said, it does remain above the historical average of 4.1x.

On the cost front, there is still pressure, but the majority of companies manage to pass it on to the customers. Margins, however, are on a slight decline; but as long as consumption remains strong and unemployment stays low, corporate bonds remain supported.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.