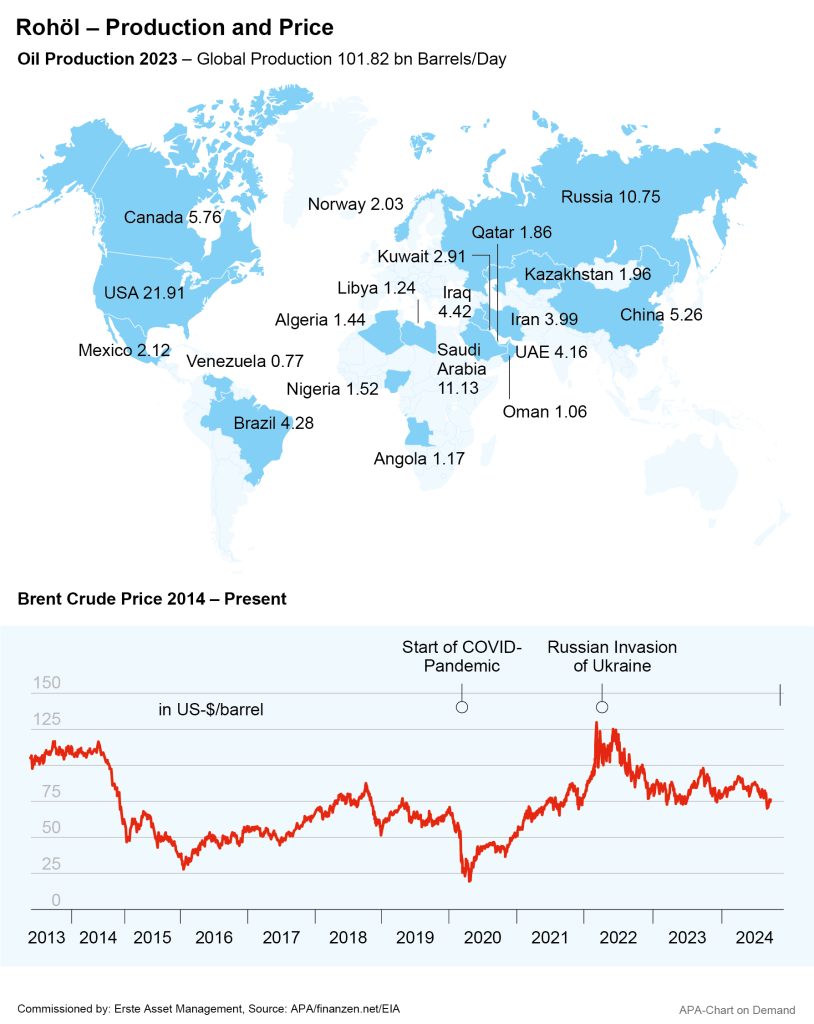

Crude oil prices have recently fallen for the second quarter in a row – in the current year, the price of the important benchmark Brent crude has fallen by almost 20% (Source: LSEG Datastream). However, with the recent escalation and tense situation in the Middle East, prices could rise again. In the current week alone, the Brent price rose again by over 3% after Iran launched a missile attack on Israel last Tuesday. Does this mean the oil price slump is over?

Lower oil prices depress inflation

So far, oil prices have been weighed down by economic data from China and the US, some of which was weak, and thus by fears of weaker demand for oil from the world’s two largest economies.

Logically, the fall in crude oil prices also had a significant impact on fuel and energy prices, which in turn led to a further fall in inflation. According to the flash estimate by Statistics Austria, the inflation rate in Austria was 1.8% in September. According to the Federal Statistical Office, consumer prices in Germany were 1.6% higher than in the previous year, meaning that inflation in the previous month fell to its lowest level in around three and a half years.

Economic slowdown in China a burden

According to the International Energy Agency (IEA), demand for oil on the global market is chiefly suffering from China’s struggling economy. According to the IEA’s monthly report published in September, this has “significantly slowed” growth in demand. In the first half of the year, demand for crude oil rose by an average of 0.8 million barrels per day, significantly less than in the previous year. For the total year, the IEA expects demand to increase slightly by 0.9 million barrels to a total of not quite 103 million barrels per day.

According to the IEA, demand in the first half of the year has shown the weakest growth since 2020. At the time, the coronavirus pandemic sent the demand for oil plummeting. “China’s economic growth is slowing, and the penetration of electric cars in the transport system is progressing at a very fast pace,” IEA chief Fatih Birol told the Bloomberg news agency.

Chinese central bank package to support the economy

However, the measures announced by China’s central bank and the government in Beijing to support the economy have recently raised hopes of a recovery in Chinese demand. With its most comprehensive package of measures to date since the pandemic, China’s central bank wants to help the economy of the People’s Republic to regain momentum. The reserve requirement ratio (RRR) for banks is to be lowered by 0.5 percentage points, which will give financial institutions the equivalent of around 1 trillion yuan, just under EUR 130bn, in additional volume for lending.

The central bank also held out the prospect of lowering the rate by a further 0.25 to 0.50 percentage points over the course of the year, as well as lowering mortgage interest rates. In response, China’s stock exchanges saw intermittently soaring prices.

Government also plans economic stimulus measures

China’s government has also announced decisive measures to stimulate the economy, not wanting to allow the world’s second largest economy to lose steam, and pledged on Thursday to achieve the economic target growth rate for this year as well as to stop the crisis on the property market, state media reported, citing a Politburo meeting. According to insiders, the measures will be financed by issuing government bonds totalling around CNY 2tn, around EUR 256bn, sources familiar with the plans recently told the Reuters news agency.

Oil prices reacted to the announcements in China with temporary gains, but pulled back again somewhat. Some doubts arose on the markets as to whether the measures announced would be sufficient to increase demand for oil. Prices are also under pressure from Libyan oil possibly returning to the market after delegates from eastern and western Libya agreed on criteria and timetables for the appointment of a governor and a board of directors for the country’s central bank. This move could help resolve the struggle around the control of oil revenue, which has led to drastic losses in Libya’s oil production and exports.

OPEC policy and the situation in the Middle East remain a central concern

On the market, the falling oil prices were also explained by a media report in the Financial Times on the future production policy in the leading OPEC member state Saudi Arabia, stating that Saudi Arabia is prepared to abandon its unofficial oil price target of USD 100 per barrel in order to regain market share. The newspaper referred to informed circles. According to other media reports, OPEC could extend its production restrictions to stabilise oil prices by two months, contrary to the original plans. According to the IEA, however, a surplus of crude oil can be expected on the global market in 2025 even if the oil alliance does not abandon its current production limits. OPEC itself recently only made insignificant changes to its forecasts for global oil demand in 2024, expecting global consumption of crude oil to increase by 2 million barrels to 104.2 barrels per day.

Developments in the Middle East also remain a determining factor for oil prices. In recent weeks, concerns about a geopolitical escalation drove oil prices up several times, with signs of a potential diplomatic solution driving them down repeatedly. Most recently, Israeli Prime Minister Benjamin Netanyahu announced retaliation following the Iranian attack on his country. At the same time, the Israeli ground offensive in Lebanon is continuing. It remains to be seen whether a further escalation of the situation can be prevented, which could also have a significant impact on the oil price.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.